Tax Documents

Tax1099Sa

FDX / Data Structures / Tax1099Sa

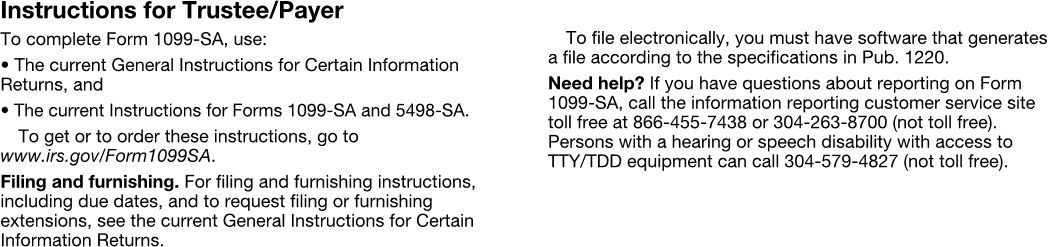

Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA

Extends and inherits all fields from Tax

Tax1099Sa Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | payerNameAddress | NameAddressPhone | Payer's name, address, and phone |

| 2 | payerTin | string | PAYER'S TIN |

| 3 | recipientTin | string | RECIPIENT'S TIN |

| 4 | recipientNameAddress | NameAddress | Recipient's name and address |

| 5 | accountNumber | string | Account number |

| 6 | grossDistribution | number (double) | Box 1, Gross distribution |

| 7 | earnings | number (double) | Box 2, Earnings on excess contributions |

| 8 | distributionCode | string | Box 3, Distribution code |

| 9 | fairMarketValue | number (double) | Box 4, FMV on date of death |

| 10 | hsa | boolean | Box 5a, HSA |

| 11 | archerAccount | boolean | Box 5b, Archer MSA |

| 12 | medicalSavingsAccount | boolean | Box 5c, Medicare Advantage (MA) MSA |

Tax1099Sa Usage:

- TaxData tax1099Sa

FDX Data Structure as JSON

{

"tax1099Sa" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"payerNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"phone" : {

"type" : "HOME",

"country" : "string",

"number" : "string",

"extension" : "string"

}

},

"payerTin" : "string",

"recipientTin" : "string",

"recipientNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"accountNumber" : "string",

"grossDistribution" : 0.0,

"earnings" : 0.0,

"distributionCode" : "string",

"fairMarketValue" : 0.0,

"hsa" : true,

"archerAccount" : true,

"medicalSavingsAccount" : true

}

}

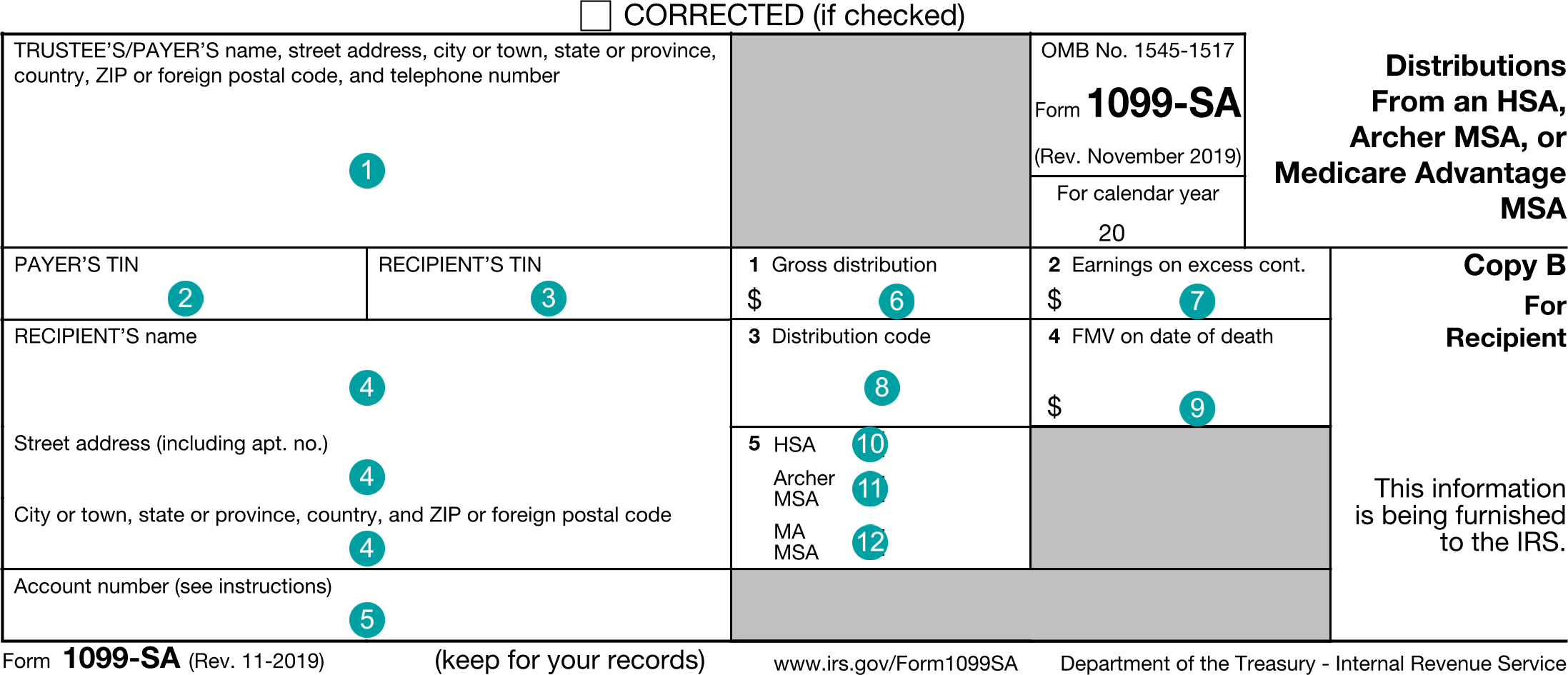

Example Form PDF

Example Form JSON

{

"tax1099Sa" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1099Sa",

"payerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"payerTin" : "12-3456789",

"recipientTin" : "xxx-xx-1234",

"recipientNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q Public"

},

"accountNumber" : "111-23456",

"grossDistribution" : 1000.0,

"earnings" : 200.0,

"distributionCode" : "A",

"fairMarketValue" : 400.0,

"hsa" : true

}

}

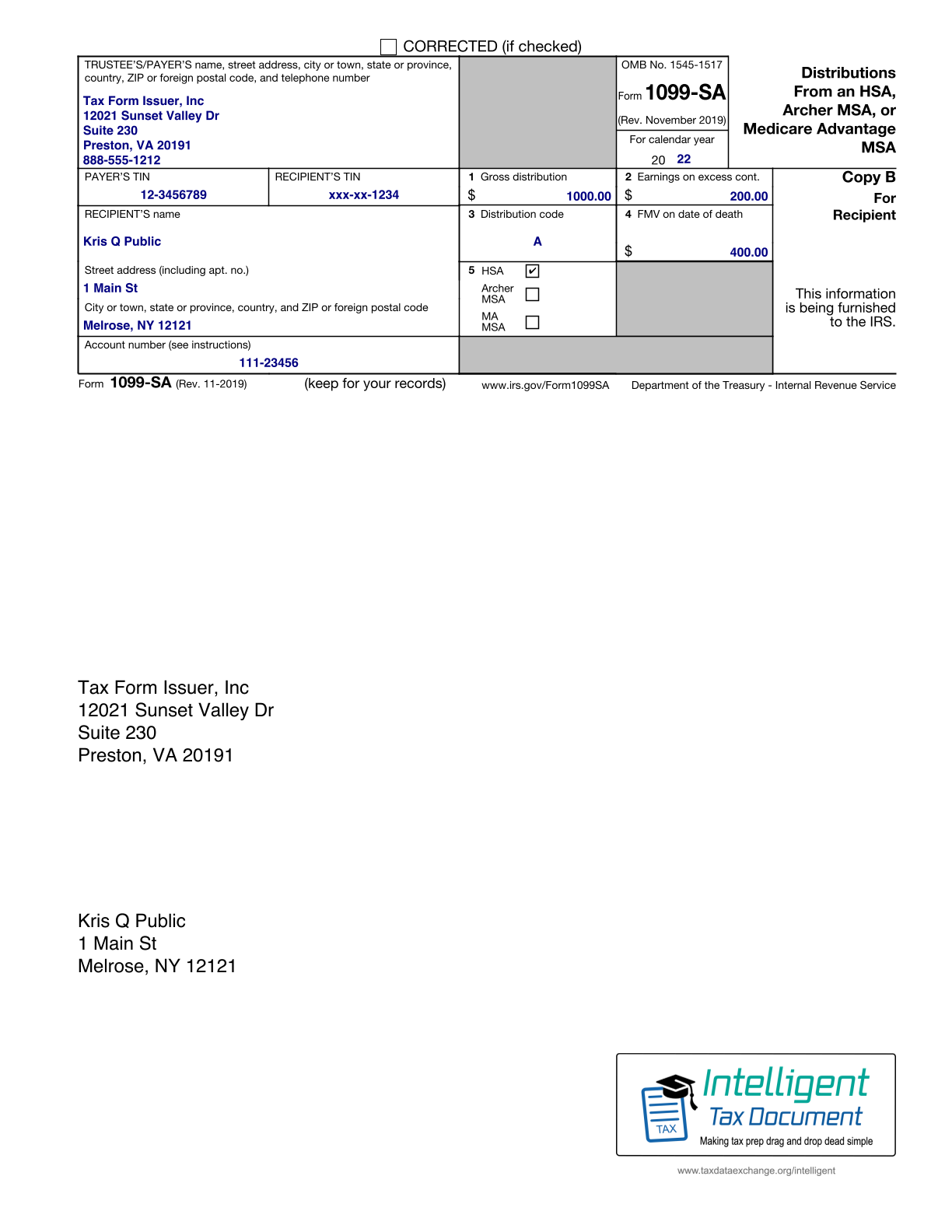

Example Form JSON for QR Code Purposes

Example Form PDF with QR Code

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"taxFormDate": "2021-03-30",

"taxFormType": "Tax1099Sa",

"payerNameAddress.line1": "12021 Sunset Valley Dr",

"payerNameAddress.line2": "Suite 230",

"payerNameAddress.city": "Preston",

"payerNameAddress.state": "VA",

"payerNameAddress.postalCode": "20191",

"payerNameAddress.country": "US",

"payerNameAddress.name1": "Tax Form Issuer, Inc",

"payerNameAddress.phone.number": "8885551212",

"payerTin": "12-3456789",

"recipientTin": "xxx-xx-1234",

"recipientNameAddress.line1": "1 Main St",

"recipientNameAddress.city": "Melrose",

"recipientNameAddress.state": "NY",

"recipientNameAddress.postalCode": "12121",

"recipientNameAddress.country": "US",

"recipientNameAddress.name1": "Kris Q Public",

"accountNumber": "111-23456",

"grossDistribution": "1000.0",

"earnings": "200.0",

"distributionCode": "A",

"fairMarketValue": "400.0",

"hsa": "true"

}

Issuer Instructions