Tax Documents

Tax1099C

FDX / Data Structures / Tax1099C

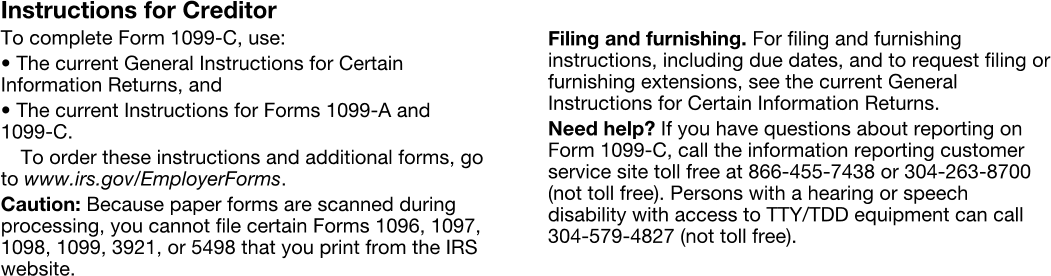

Form 1099-C, Cancellation of Debt

Extends and inherits all fields from Tax

Tax1099C Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | creditorNameAddress | NameAddressPhone | Creditor's name, address, and phone |

| 2 | creditorTin | string | CREDITOR'S TIN |

| 3 | debtorTin | string | DEBTOR'S TIN |

| 4 | debtorNameAddress | NameAddress | Debtor's name and address |

| 5 | accountNumber | string | Account number |

| 6 | dateOfEvent | DateString | Box 1, Date of identifiable event |

| 7 | amountDischarged | number (double) | Box 2, Amount of debt discharged |

| 8 | interestIncluded | number (double) | Box 3, Interest if included in box 2 |

| 9 | debtDescription | string | Box 4, Debt description |

| 10 | personallyLiable | boolean | Box 5, If checked, the debtor was personally liable for repayment of the debt |

| 11 | debtCode | string | Box 6, Identifiable debt code |

| 12 | fairMarketValue | number (double) | Box 7, Fair market value of property |

Tax1099C Usage:

- TaxData tax1099C

FDX Data Structure as JSON

{

"tax1099C" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"creditorNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"phone" : {

"type" : "HOME",

"country" : "string",

"number" : "string",

"extension" : "string"

}

},

"creditorTin" : "string",

"debtorTin" : "string",

"debtorNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"accountNumber" : "string",

"dateOfEvent" : "2020-07-01",

"amountDischarged" : 0.0,

"interestIncluded" : 0.0,

"debtDescription" : "string",

"personallyLiable" : true,

"debtCode" : "string",

"fairMarketValue" : 0.0

}

}

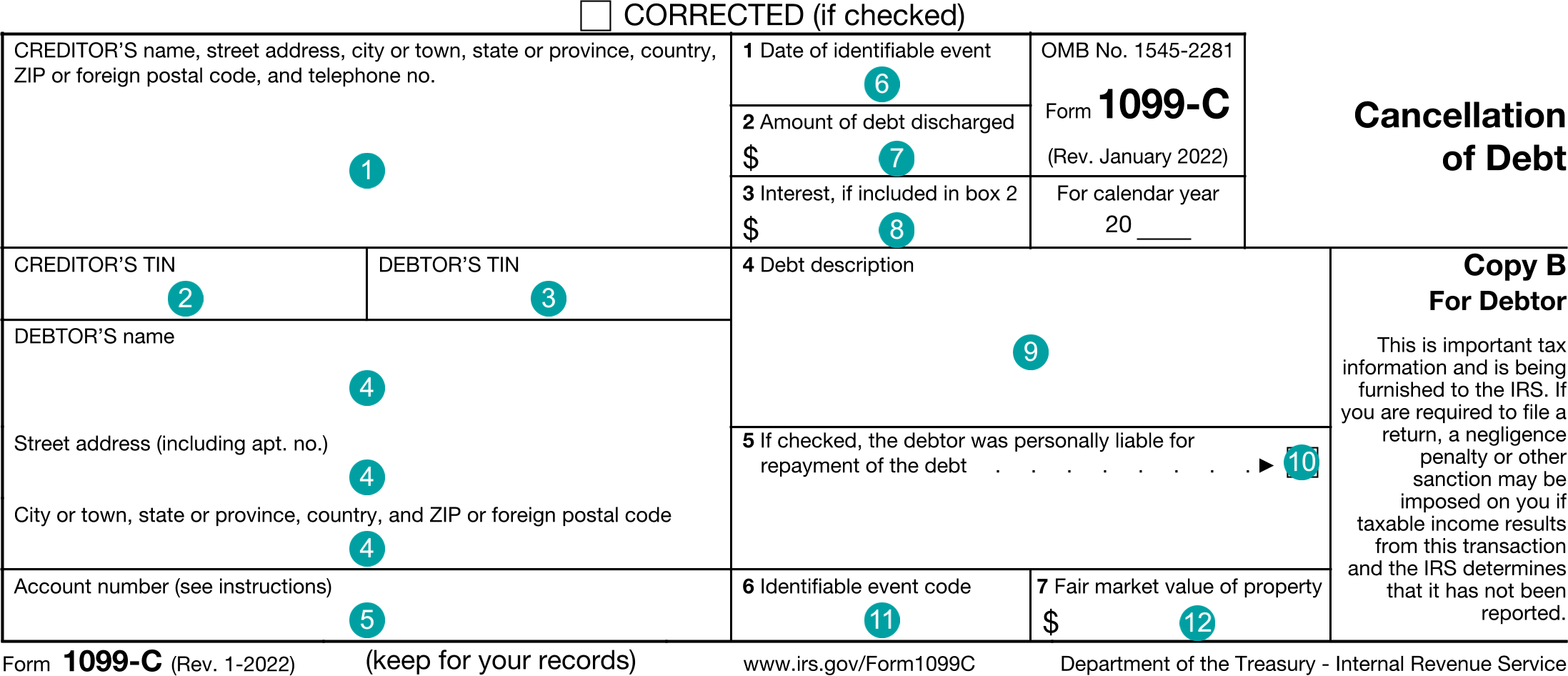

Example Form PDF

Example Form JSON

{

"tax1099C" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1099C",

"creditorNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"creditorTin" : "12-3456789",

"debtorTin" : "xxx-xx-1234",

"debtorNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q Public"

},

"accountNumber" : "111-5555555",

"dateOfEvent" : "2020-04-01",

"amountDischarged" : 20000.0,

"interestIncluded" : 300.0,

"debtDescription" : "Signature loan",

"personallyLiable" : true,

"debtCode" : "F",

"fairMarketValue" : 7000.0

}

}

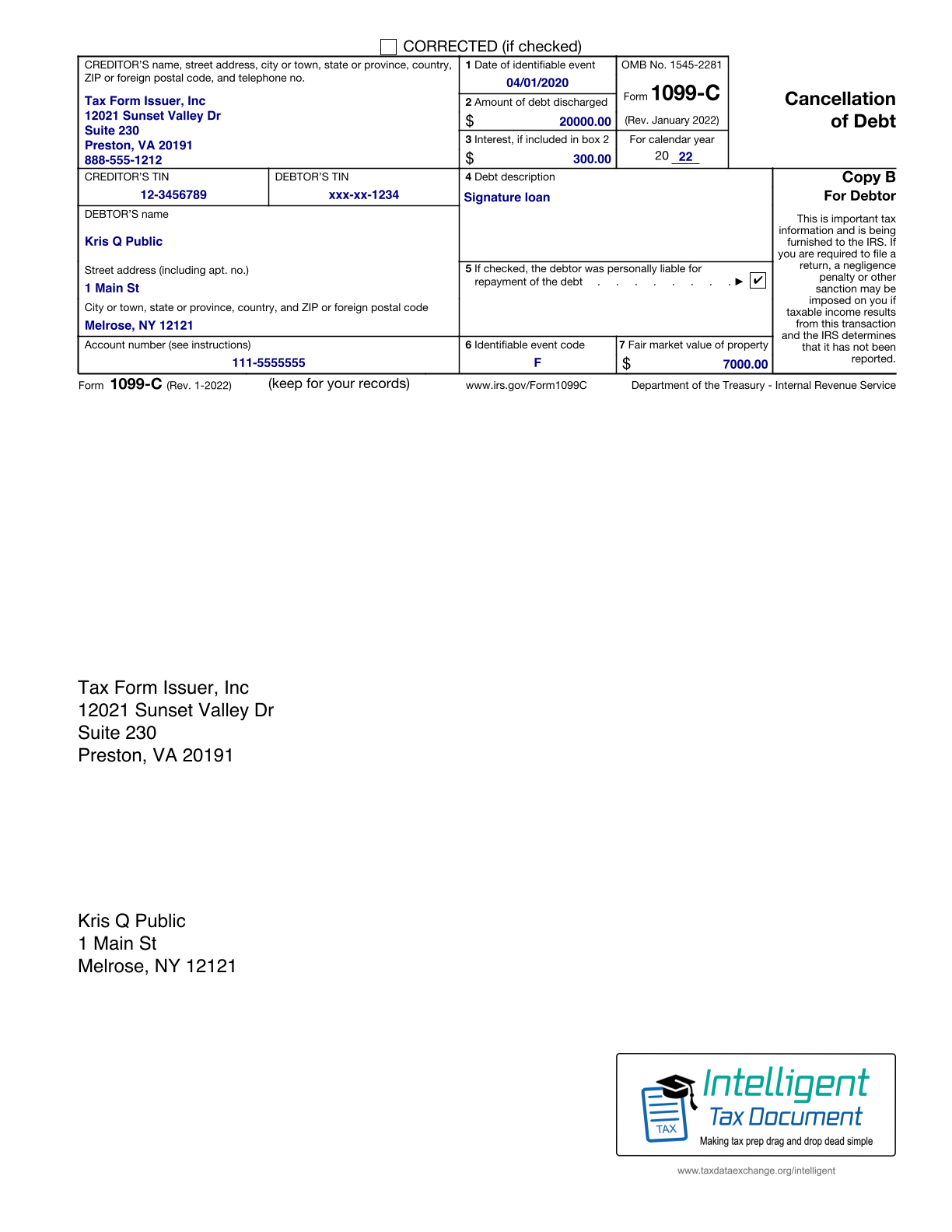

Example Form JSON for QR Code Purposes

Example Form PDF with QR Code

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"taxFormDate": "2021-03-30",

"taxFormType": "Tax1099C",

"creditorNameAddress.line1": "12021 Sunset Valley Dr",

"creditorNameAddress.line2": "Suite 230",

"creditorNameAddress.city": "Preston",

"creditorNameAddress.state": "VA",

"creditorNameAddress.postalCode": "20191",

"creditorNameAddress.country": "US",

"creditorNameAddress.name1": "Tax Form Issuer, Inc",

"creditorNameAddress.phone.number": "8885551212",

"creditorTin": "12-3456789",

"debtorTin": "xxx-xx-1234",

"debtorNameAddress.line1": "1 Main St",

"debtorNameAddress.city": "Melrose",

"debtorNameAddress.state": "NY",

"debtorNameAddress.postalCode": "12121",

"debtorNameAddress.country": "US",

"debtorNameAddress.name1": "Kris Q Public",

"accountNumber": "111-5555555",

"dateOfEvent": "2020-04-01",

"amountDischarged": "20000.0",

"interestIncluded": "300.0",

"debtDescription": "Signature loan",

"personallyLiable": "true",

"debtCode": "F",

"fairMarketValue": "7000.0"

}

Issuer Instructions