Tax Documents

Tax1095A

FDX / Data Structures / Tax1095A

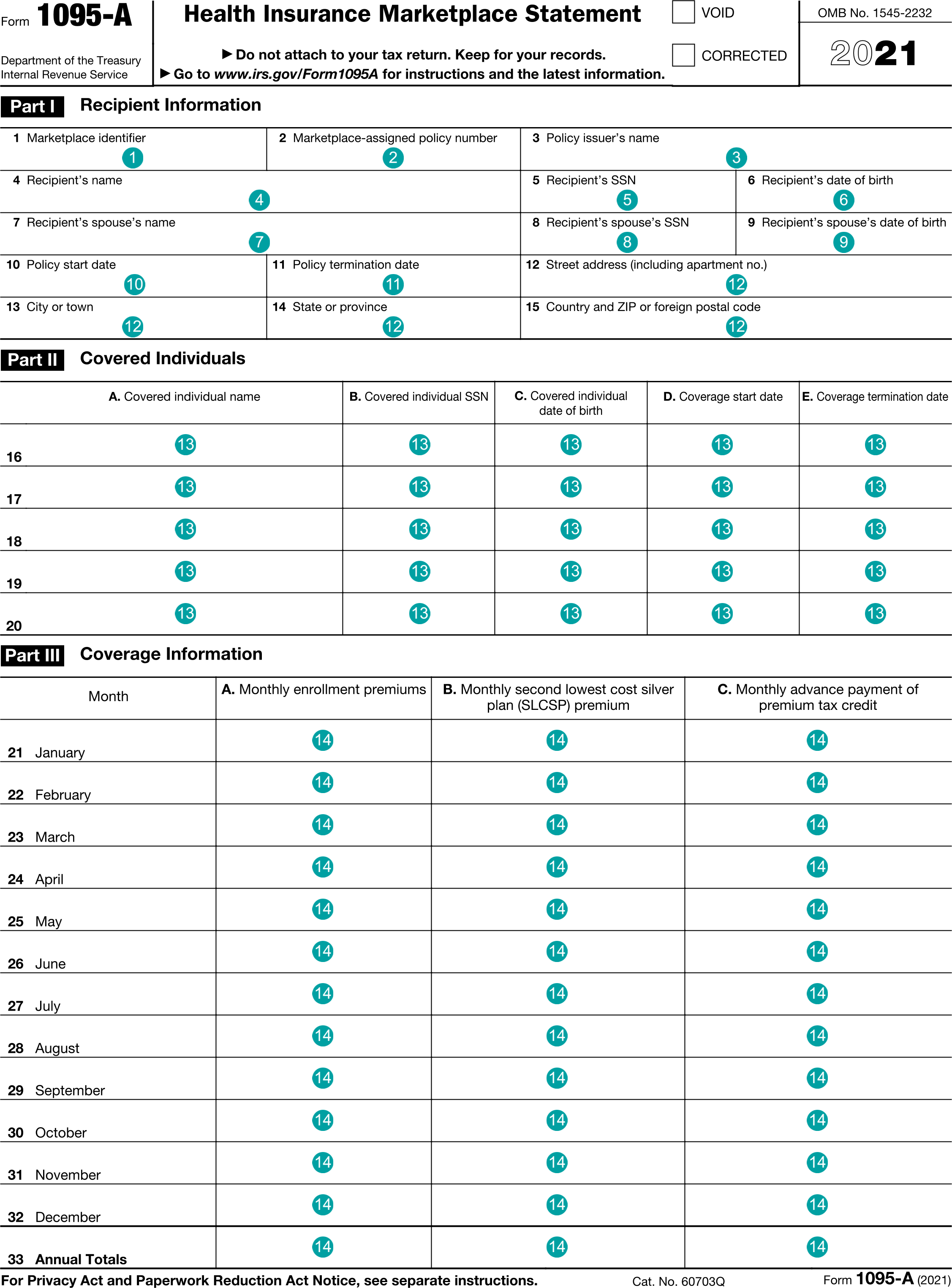

Form 1095-A, Health Insurance Marketplace Statement

Extends and inherits all fields from Tax

Tax1095A Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | marketplaceId | string | Box 1, Marketplace identifier |

| 2 | marketplacePolicyNumber | string | Box 2, Marketplace-assigned policy number |

| 3 | policyIssuerName | string | Box 3, Policy issuer's name |

| 4 | recipientName | string | Box 4, Recipient's name |

| 5 | recipientTin | string | Box 5, Recipient's SSN |

| 6 | recipientDateOfBirth | DateString | Box 6, Recipient's date of birth |

| 7 | spouseName | string | Box 7, Recipient's spouse's name |

| 8 | spouseTin | string | Box 8, Recipient's spouse's SSN |

| 9 | spouseDateOfBirth | DateString | Box 9, Recipient's spouse's date of birth |

| 10 | policyStartDate | DateString | Box 10, Policy start date |

| 11 | policyTerminationDate | DateString | Box 11, Policy termination date |

| 12 | recipientAddress | Address | Boxes 12-15, Recipient address |

| 13 | coveredIndividuals | Array of HealthInsuranceMarketplaceCoveredIndividual | Boxes 16+, Covered Individuals |

| 14 | coverages | Array of HealthInsuranceCoverage | Boxes 21-33, Coverage Information |

Tax1095A Usage:

- TaxData tax1095A

FDX Data Structure as JSON

{

"tax1095A" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"marketplaceId" : "string",

"marketplacePolicyNumber" : "string",

"policyIssuerName" : "string",

"recipientName" : "string",

"recipientTin" : "string",

"recipientDateOfBirth" : "2020-07-01",

"spouseName" : "string",

"spouseTin" : "string",

"spouseDateOfBirth" : "2020-07-01",

"policyStartDate" : "2020-07-01",

"policyTerminationDate" : "2020-07-01",

"recipientAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD"

},

"coveredIndividuals" : [ {

"name" : "string",

"tin" : "string",

"dateOfBirth" : "2020-07-01",

"policyStartDate" : "2020-07-01",

"policyTerminationDate" : "2020-07-01"

} ],

"coverages" : [ {

"enrollmentPremium" : 0.0,

"slcspPremium" : 0.0,

"advancePremiumTaxCreditPayment" : 0.0,

"month" : "ANNUAL"

} ]

}

}

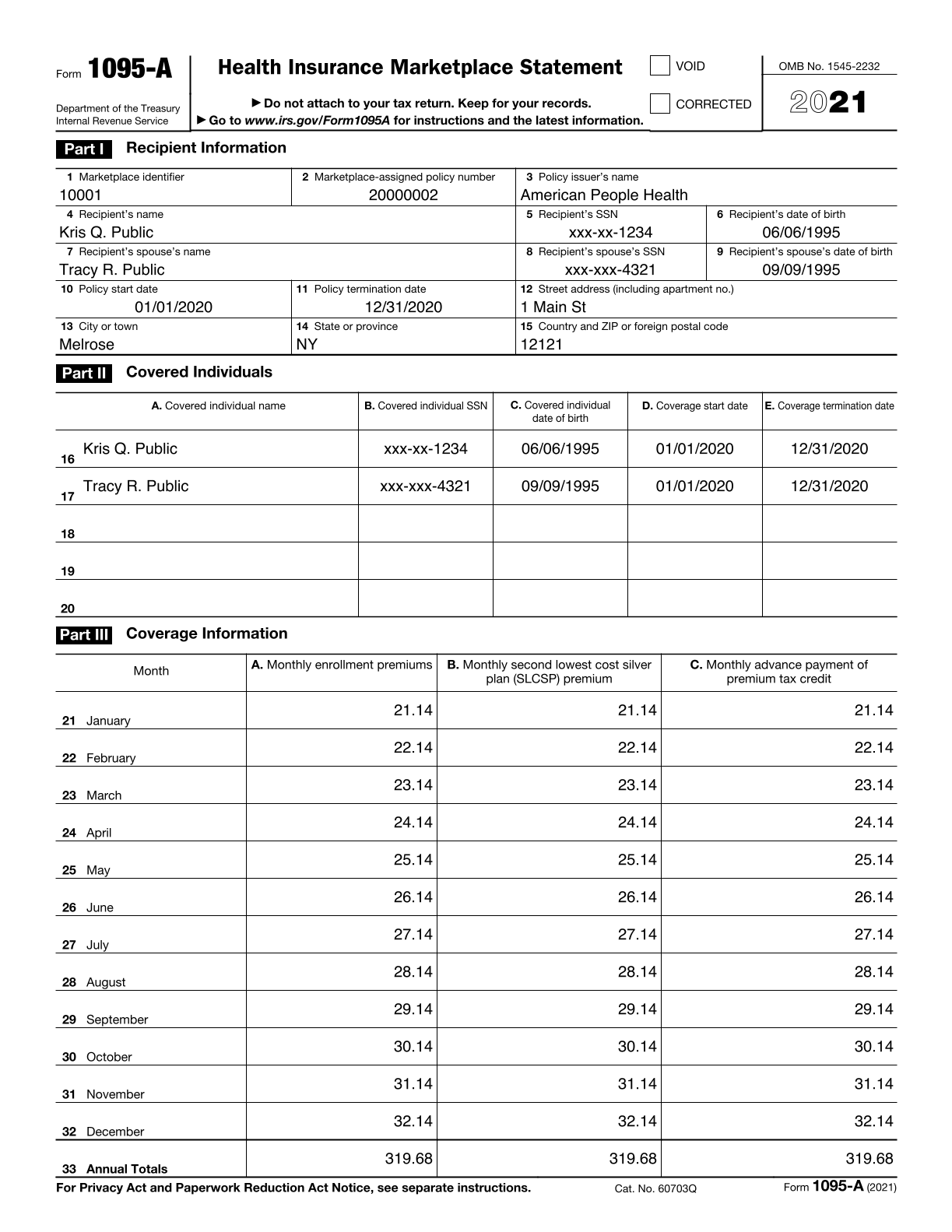

Example Form PDF

Example Form JSON

{

"tax1095A" : {

"taxYear" : 2022,

"taxFormId" : "e5d4ee73bd1-9295-480f-a426-1095-A",

"taxFormDate" : "2021-02-01",

"taxFormType" : "Tax1095A",

"marketplaceId" : "10001",

"marketplacePolicyNumber" : "20000002",

"policyIssuerName" : "American People Health",

"recipientName" : "Kris Q. Public",

"recipientTin" : "xxx-xx-1234",

"recipientDateOfBirth" : "1995-06-06",

"spouseName" : "Tracy R. Public",

"spouseTin" : "xxx-xxx-4321",

"spouseDateOfBirth" : "1995-09-09",

"policyStartDate" : "2020-01-01",

"policyTerminationDate" : "2020-12-31",

"recipientAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121"

},

"coveredIndividuals" : [ {

"name" : "Kris Q. Public",

"tin" : "xxx-xx-1234",

"dateOfBirth" : "1995-06-06",

"policyStartDate" : "2020-01-01",

"policyTerminationDate" : "2020-12-31"

}, {

"name" : "Tracy R. Public",

"tin" : "xxx-xxx-4321",

"dateOfBirth" : "1995-09-09",

"policyStartDate" : "2020-01-01",

"policyTerminationDate" : "2020-12-31"

} ],

"coverages" : [ {

"enrollmentPremium" : 21.14,

"slcspPremium" : 21.14,

"advancePremiumTaxCreditPayment" : 21.14,

"month" : "JANUARY"

}, {

"enrollmentPremium" : 22.14,

"slcspPremium" : 22.14,

"advancePremiumTaxCreditPayment" : 22.14,

"month" : "FEBRUARY"

}, {

"enrollmentPremium" : 23.14,

"slcspPremium" : 23.14,

"advancePremiumTaxCreditPayment" : 23.14,

"month" : "MARCH"

}, {

"enrollmentPremium" : 24.14,

"slcspPremium" : 24.14,

"advancePremiumTaxCreditPayment" : 24.14,

"month" : "APRIL"

}, {

"enrollmentPremium" : 25.14,

"slcspPremium" : 25.14,

"advancePremiumTaxCreditPayment" : 25.14,

"month" : "MAY"

}, {

"enrollmentPremium" : 26.14,

"slcspPremium" : 26.14,

"advancePremiumTaxCreditPayment" : 26.14,

"month" : "JUNE"

}, {

"enrollmentPremium" : 27.14,

"slcspPremium" : 27.14,

"advancePremiumTaxCreditPayment" : 27.14,

"month" : "JULY"

}, {

"enrollmentPremium" : 28.14,

"slcspPremium" : 28.14,

"advancePremiumTaxCreditPayment" : 28.14,

"month" : "AUGUST"

}, {

"enrollmentPremium" : 29.14,

"slcspPremium" : 29.14,

"advancePremiumTaxCreditPayment" : 29.14,

"month" : "SEPTEMBER"

}, {

"enrollmentPremium" : 30.14,

"slcspPremium" : 30.14,

"advancePremiumTaxCreditPayment" : 30.14,

"month" : "OCTOBER"

}, {

"enrollmentPremium" : 31.14,

"slcspPremium" : 31.14,

"advancePremiumTaxCreditPayment" : 31.14,

"month" : "NOVEMBER"

}, {

"enrollmentPremium" : 32.14,

"slcspPremium" : 32.14,

"advancePremiumTaxCreditPayment" : 32.14,

"month" : "DECEMBER"

}, {

"enrollmentPremium" : 319.68,

"slcspPremium" : 319.68,

"advancePremiumTaxCreditPayment" : 319.68,

"month" : "ANNUAL"

} ]

}

}

Example Form JSON for QR Code Purposes

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"taxFormId": "e5d4ee73bd1-9295-480f-a426-1095-A",

"taxFormDate": "2021-02-01",

"taxFormType": "Tax1095A",

"marketplaceId": "10001",

"marketplacePolicyNumber": "20000002",

"policyIssuerName": "American People Health",

"recipientName": "Kris Q. Public",

"recipientTin": "xxx-xx-1234",

"recipientDateOfBirth": "1995-06-06",

"spouseName": "Tracy R. Public",

"spouseTin": "xxx-xxx-4321",

"spouseDateOfBirth": "1995-09-09",

"policyStartDate": "2020-01-01",

"policyTerminationDate": "2020-12-31",

"recipientAddress.line1": "1 Main St",

"recipientAddress.city": "Melrose",

"recipientAddress.state": "NY",

"recipientAddress.postalCode": "12121",

"coveredIndividuals-1.name": "Kris Q. Public",

"coveredIndividuals-1.tin": "xxx-xx-1234",

"coveredIndividuals-1.dateOfBirth": "1995-06-06",

"coveredIndividuals-1.policyStartDate": "2020-01-01",

"coveredIndividuals-1.policyTerminationDate": "2020-12-31",

"coveredIndividuals-2.name": "Tracy R. Public",

"coveredIndividuals-2.tin": "xxx-xxx-4321",

"coveredIndividuals-2.dateOfBirth": "1995-09-09",

"coveredIndividuals-2.policyStartDate": "2020-01-01",

"coveredIndividuals-2.policyTerminationDate": "2020-12-31",

"coverages-1.enrollmentPremium": "21.14",

"coverages-1.slcspPremium": "21.14",

"coverages-1.advancePremiumTaxCreditPayment": "21.14",

"coverages-1.month": "JANUARY",

"coverages-2.enrollmentPremium": "22.14",

"coverages-2.slcspPremium": "22.14",

"coverages-2.advancePremiumTaxCreditPayment": "22.14",

"coverages-2.month": "FEBRUARY",

"coverages-3.enrollmentPremium": "23.14",

"coverages-3.slcspPremium": "23.14",

"coverages-3.advancePremiumTaxCreditPayment": "23.14",

"coverages-3.month": "MARCH",

"coverages-4.enrollmentPremium": "24.14",

"coverages-4.slcspPremium": "24.14",

"coverages-4.advancePremiumTaxCreditPayment": "24.14",

"coverages-4.month": "APRIL",

"coverages-5.enrollmentPremium": "25.14",

"coverages-5.slcspPremium": "25.14",

"coverages-5.advancePremiumTaxCreditPayment": "25.14",

"coverages-5.month": "MAY",

"coverages-6.enrollmentPremium": "26.14",

"coverages-6.slcspPremium": "26.14",

"coverages-6.advancePremiumTaxCreditPayment": "26.14",

"coverages-6.month": "JUNE",

"coverages-7.enrollmentPremium": "27.14",

"coverages-7.slcspPremium": "27.14",

"coverages-7.advancePremiumTaxCreditPayment": "27.14",

"coverages-7.month": "JULY",

"coverages-8.enrollmentPremium": "28.14",

"coverages-8.slcspPremium": "28.14",

"coverages-8.advancePremiumTaxCreditPayment": "28.14",

"coverages-8.month": "AUGUST",

"coverages-9.enrollmentPremium": "29.14",

"coverages-9.slcspPremium": "29.14",

"coverages-9.advancePremiumTaxCreditPayment": "29.14",

"coverages-9.month": "SEPTEMBER",

"coverages-10.enrollmentPremium": "30.14",

"coverages-10.slcspPremium": "30.14",

"coverages-10.advancePremiumTaxCreditPayment": "30.14",

"coverages-10.month": "OCTOBER",

"coverages-11.enrollmentPremium": "31.14",

"coverages-11.slcspPremium": "31.14",

"coverages-11.advancePremiumTaxCreditPayment": "31.14",

"coverages-11.month": "NOVEMBER",

"coverages-12.enrollmentPremium": "32.14",

"coverages-12.slcspPremium": "32.14",

"coverages-12.advancePremiumTaxCreditPayment": "32.14",

"coverages-12.month": "DECEMBER",

"coverages-13.enrollmentPremium": "319.68",

"coverages-13.slcspPremium": "319.68",

"coverages-13.advancePremiumTaxCreditPayment": "319.68",

"coverages-13.month": "ANNUAL"

}

Issuer Instructions