Tax Software

The Five Import Technologies Every Tax Software Program Should Add

Background

- Manual entry of data into tax software is tedious and error-prone.

- Data import should be maximized and manual data entry should be minimized.

- One of the goals of the tax data exchange website is to "Support democratization of tax document data so that all tax software companies can offer data import features".

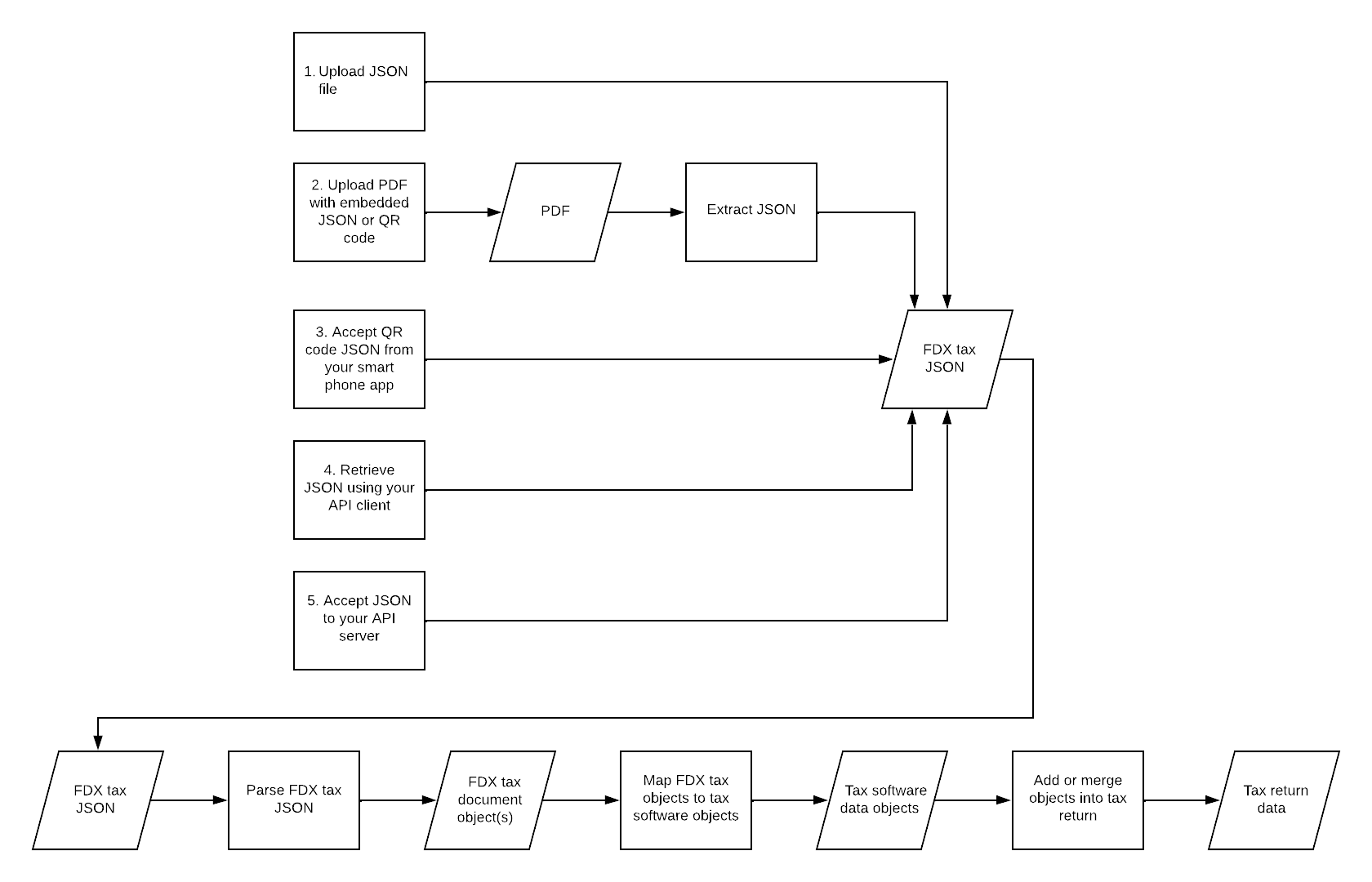

- We encourage and provide technical information and resources to support the import of over 50 tax documents through 5 import technologies.

Premise

We believe that every tax software company should have a road map

that includes the addition of each of the 5 import technologies listed below

for most or all of the tax documents for which standards have been defined.

- File Import - Industry-Standard Files

- File Import - Intelligent Tax Documents®

- QR Code

- API Client

- API Server

1. File Import - Industry-Standard File

Provide FDX Tax JSON or OFX Tax XML file import in your application.

File import capabilities were a staple of desktop tax applications. Using the Tax Exchange Format (TXF), any tax data provider could export a TXF file and tax software could import the file. Unfortunately, when online tax applications began, they did not include this feature. This was a huge mistake.

The assertion that TXF was replaced by Open Financial Exchange (OFX) is patently false. TXF covered a broader set of data than OFX. But, most importantly, with few exceptions, OFX-formatted data is only delivered via API. Setting up API relationships with hundreds of tax data providers is impractical or impossible. Too many brokers, for example, take the position that setting up an API with one or two software companies is sufficient.

The TXF standard is no longer published or maintained. The Financial Data Exchange (FDX) standard-setting organization has created a replacement for TXF using the ubiquitous JSON format. The data structures for over 50 tax documents are defined. And they are documented on this website.

2. File Import - Intelligent Tax Documents® (PDF with Embedded JSON and/or QR Code)

Provide Intelligent Tax Document® file import in your application

In recent years, instead of mailing tax documents, most providers deliver them via website download in portable document format (PDF). As described on this website, PDF tax documents can contain embedded tax data in industry-standard format that can be simply and accurately extracted from the documents.

3. QR Code

Add scanning of QR Codes to your smartphone app.

Many tax software applications already take pictures of tax documents and upload the image to tax software servers for optical character recognition (OCR) processing. Adding QR code scanning and uploading the scanned data to servers is a relatively small incremental effort.

QR processing of industry-standard QR codes is completely accurate. Whereas, OCR processing often fails to accurately extract tax data.

4. API Client

Include FDX Tax and OFX Tax 2.2 API clients in your application.

Many tax document issuers make tax data retrievable from their servers via API. While tax software applications may not be able to establish data sharing agreements will all of them, connecting with as many as possible is a worthy goal.

5. API Server

Allow trusted third party applications to push tax data to your program via API.

There are now many applications assisting taxpayers and tax preparers to collect and assemble annual tax documents. Many of these extract tax data from the documents and are positioned to push that data into tax software applications. However, not enough tax software applications provide API server technologies at this time.

Additionally, many taxpayers would be willing to give permission to tax document issuers to securely forward their annual tax document data to a trusted application as soon as the data is available.

Recommended Implementation

We recommend that you implement tax data import such that the five import technologies share the same data ingestion process.