Annual Tax Documents with QR Codes

TAX DOCUMENT RECIPIENTS

INTENTIONS

The concept of adding QR codes to annual tax documents has the following intentions:

- Eliminate data entry errors in the income tax return preparation process

- Reduce time spent in tax preparation

- Reduce programming costs associated with Optical Character Recognition (OCR) technology

- Increase success rate of tax document scanning over OCR

- Provide a simple mechanism for tax document issuers and tax software to integrate without having to build full-fledged API connections

THE TECHNOLOGY — DATA NOT URL

Two-dimensional bar codes, known as QR codes, store information as a series of pixels in a square-shaped grid that can be quickly retrieved using computer devices such as smartphones.

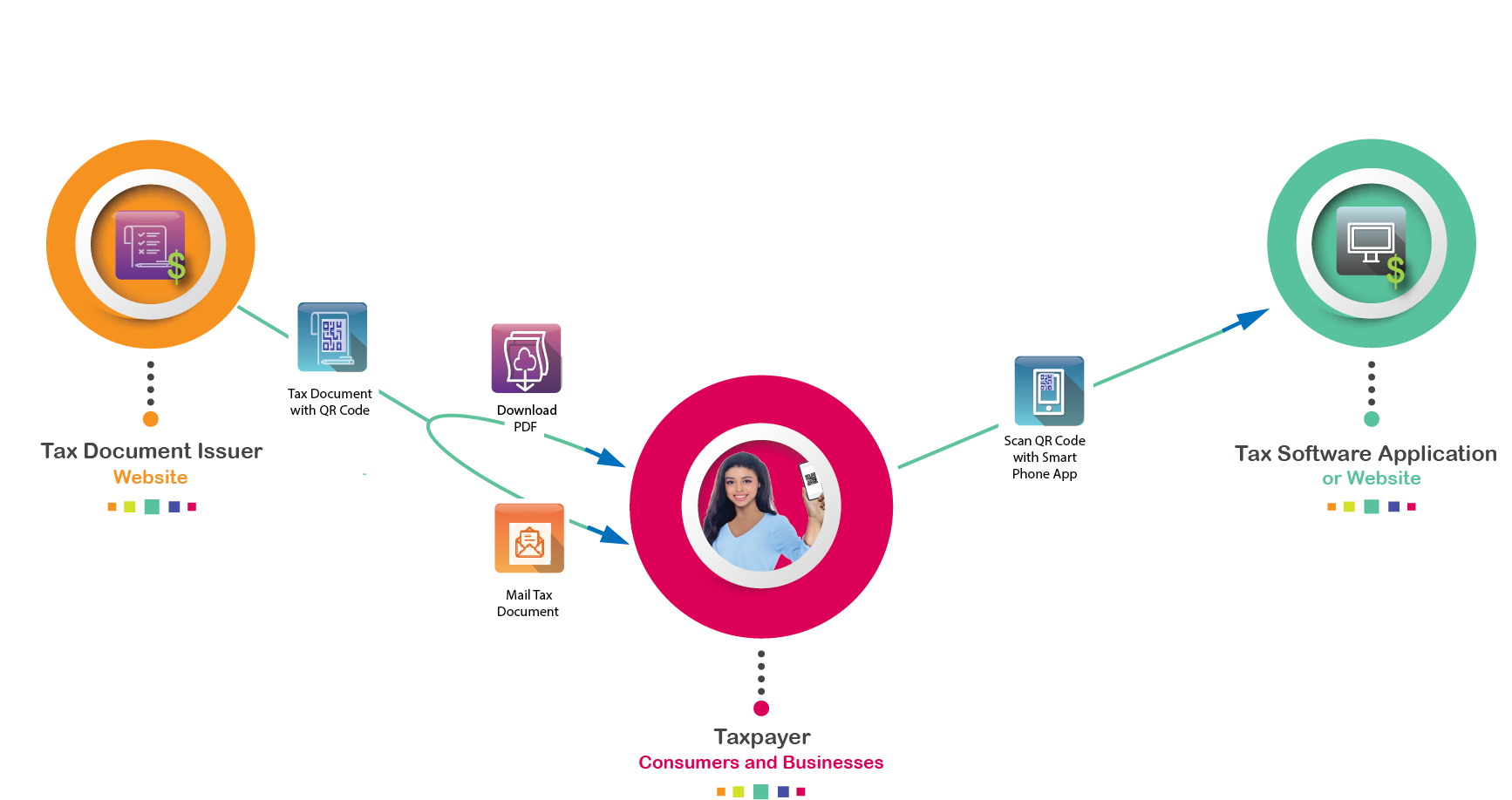

Issuers of annual tax documents can encode document data as QR codes. Tax software smartphone applications can scan the code for inclusion of the data in income tax returns of individuals and businesses. Scanning the code with a generic QR code reader app can display the data, but the app won't know what to do with it.

The diagram below illustrates the workflow.

TAX DOCUMENT ISSUERS

INFORMATION AND RESOURCES

Do you need help to create tax documents with QR codes? Here are some links to information and resources:

FREQUENTLY ASKED QUESTIONS

Question: Has the IRS approved the use of QR codes on tax forms?

Answer: The IRS has indicated that they have no problem with putting codes on recipient (also known as "for records") copies of tax forms.