Tax Data Exchange Resources and Services

Does your company produce and issue

Forms W-2, 1099, 1098, 1042, 2439, 3921, 5498, or Schedules K-1?

If so, for a relatively small incremental investment of time and money,

- You can produce tax documents that are "intelligent" to begin with and do not require artificial intelligence to decipher

- You can simplify and streamline recipients tax prep experience

- You can send the message that you value recipients time

- You can convert "tax time" into "tech time" for recipients of your tax documents

Instead of enduring the tedium of manually entering the data from your tax documents into tax software, recipients

- Use a smartphone app to simply snap a QR code shown in the lower half of the form or

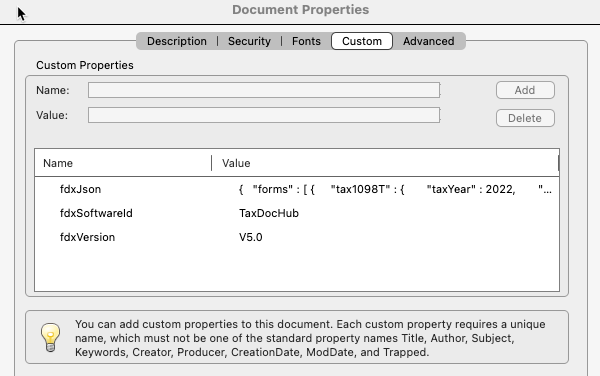

- Download the form as PDF and drag and drop the PDF into tax software

Add QR Codes to Your Tax Documents

More information on this technology.

Embed Industry-Standard JSON in Your Tax Documents

More information on this technology.

Get the Resources You Need

You are already doing most of the work.

- You are collecting the data you need

- You are creating the tax form as PDF

- You are placing the data on the form

You just need to do these additional steps

- Take the data you already have and place it in an industry-standard data structure

- Serialize the data to JSON

- Convert the JSON to a QR code

- Place the QR code on the PDF

- Embed the JSON in the PDF custom properties

The information and resources you need to do this are included in our new "Tax Data Exchange Services" app.

Get more information, check out the app at https://www.taxdataexchange.org/services/