Tax Document Electronic Distribution - JSON File Export/Import

JSON File Export/Import Use Case

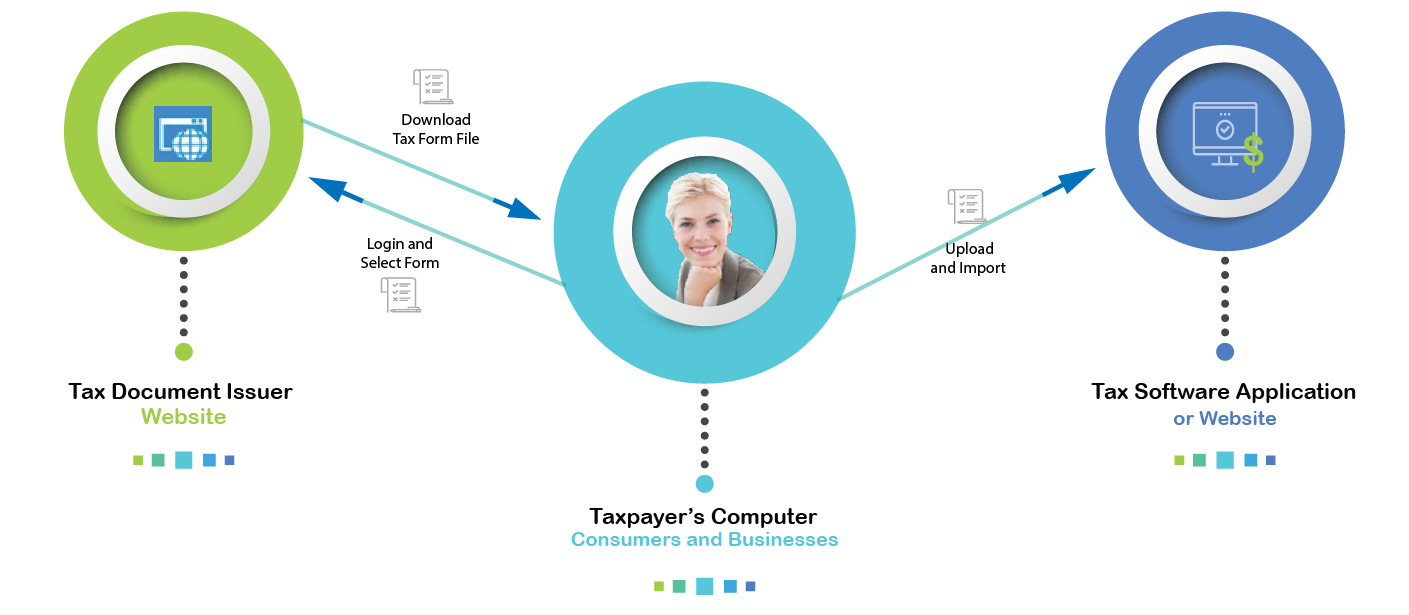

The JSON file export/import (or file download/upload) use case is depicted in the diagram below and in this short video.

It is a valid use case under the following circumstances:

- The issuer of the income tax document cannot justify the cost to develop, maintain, and operate an API server.

- The time and cost to establish data sharing agreements with all tax software companies is too great.

Issuers of Annual Tax Documents — JSON File Export (Download)

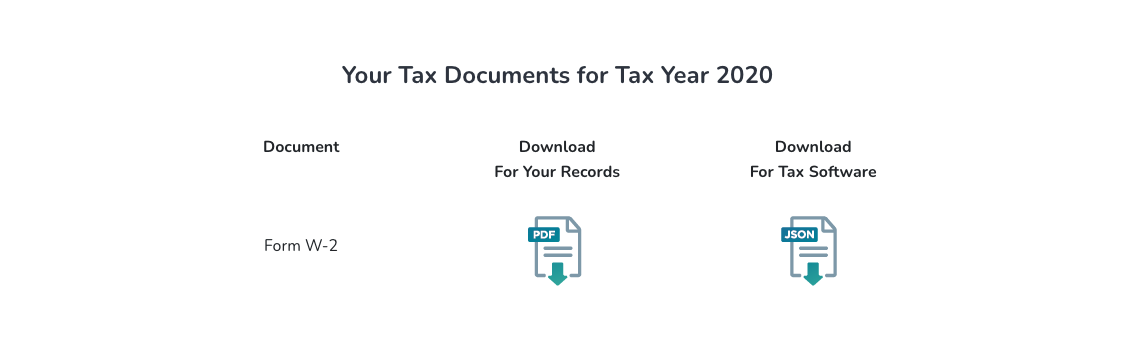

In addition to providing download of annual tax documents in human-readable form (PDF), add download of the tax document data as industry-standard FDX JSON that tax software can consume.

Your website might have a page that looks like this:

A taxpayer would download the FDX JSON file as seen in this video clip.

Income Tax Return Preparation Applications — File Import (Upload)

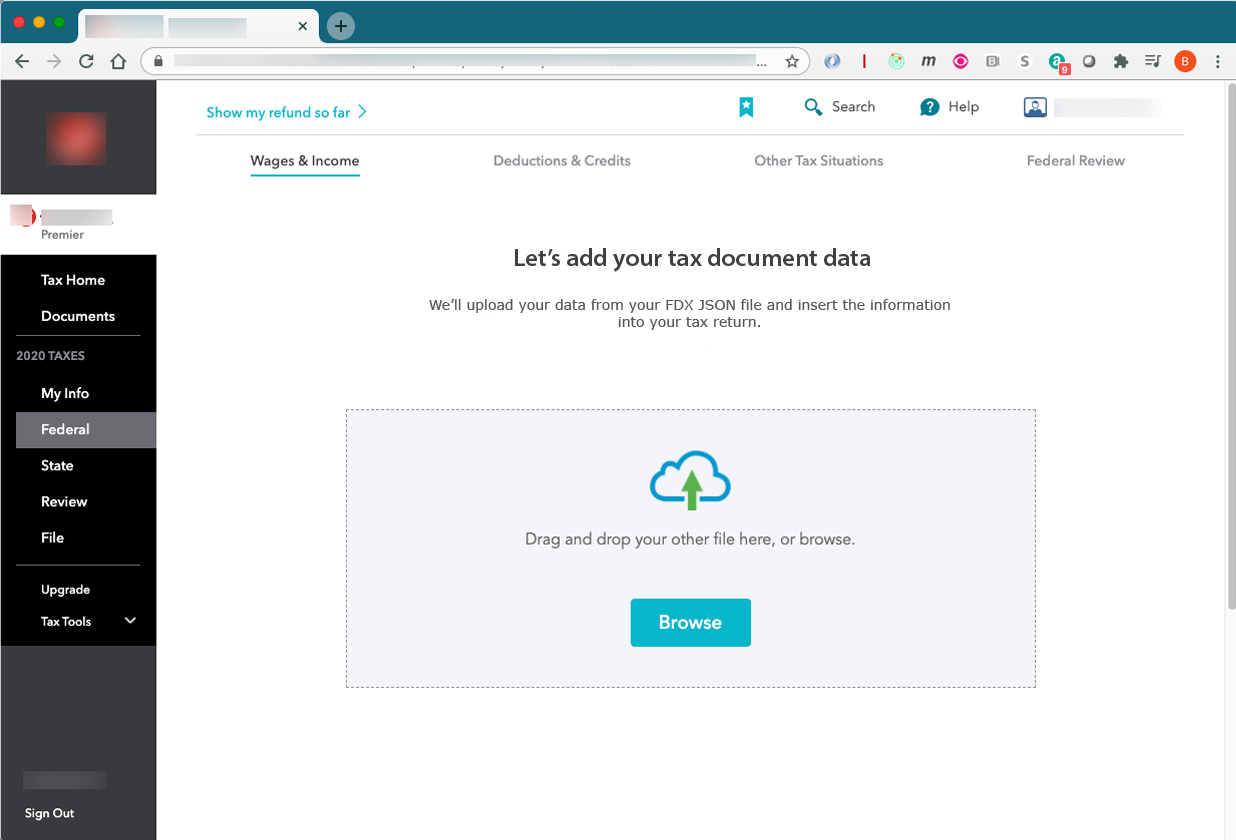

Tax software applications provide for upload of FDX JSON files.

Here is an example page from a tax software app.

Taxpayers drag and drop the downloaded FDX JSON file as seen in this video.