Tax Exchange Format (TXF)

Introduction

The TXF standard was established in approximately 1991. The ability to import files in the TXF format has been a feature of desktop tax preparation software such as Intuit TurboTax and Block Tax Cut for many years.

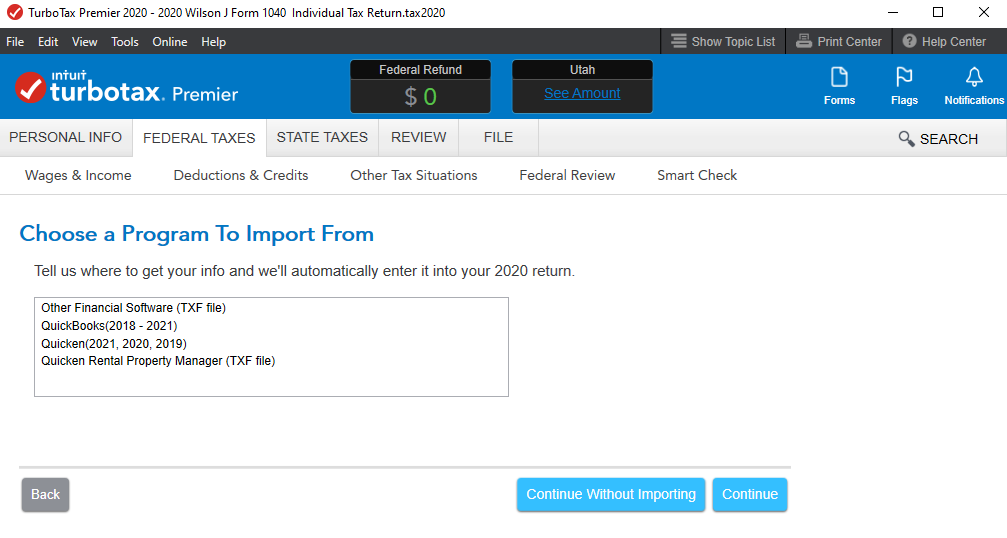

For example, to import a TXF file in TurboTax, you select 'File' then 'Import' and are presented with the below screen.

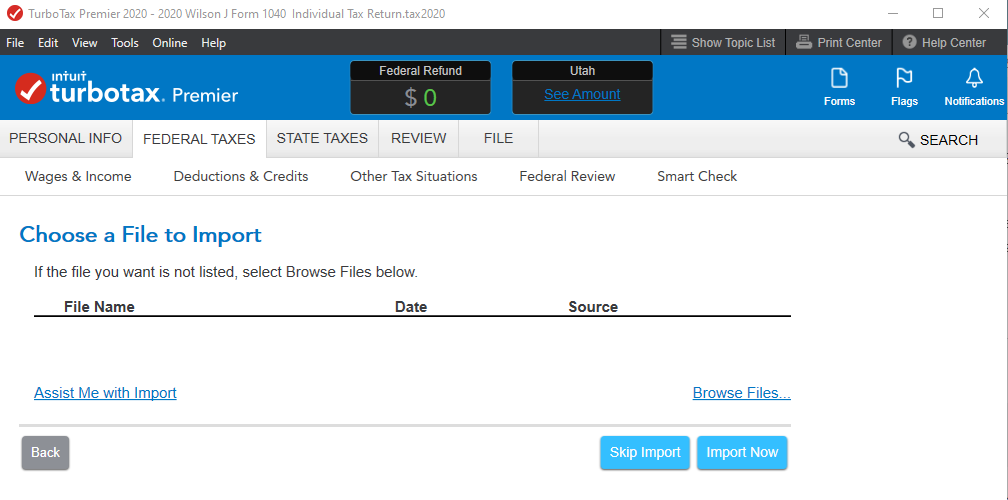

You select "Other Financial Software (TXF File)", and then browse to the file as shown here.

Usage

TXF has been used extensively for:

- Form 1099-B broker transaction data import. Brokers such as TD Ameritrade and Interactive Brokers supply TXF files.

- Form 1065 Schedule K-1 data import. Sites such as www.taxpackagesupport.com supply data files in the TXF format.

Recent History

With the advent of online tax software, unfortunately, the use of TXF import declined in favor of OFX import.

We say unfortunately because:

- OFX does not support all of the data that TXF supports

- It is not practical for all issuers of tax forms to operate an OFX server and interface with all tax software programs

- We are not aware of any web-based tax software that imports TXF files

The TXF specification document has not been updated in many years. Futher, it has not been publicly available for some time. The last known web address for the documentation file, https://turbotax.intuit.com/txf, is no longer reachable. See a copy of the document here.

For the above reasons, to better serve taxpayers, the industry should migrate away from TXF and towards the FDX JSON format for file import.

TXF File Format

Sample File:

V042 AQuicken 2011 for Windows R1 D08/20/2011 ^ TS N280 C1 L1 $-625.00 ^ TD N280 C1 L1 $-125.00 X 2/24/2011 Our Checking 1012 Red Cross ^ TS N287 C1 L1 $120.00 POur Checking ^ TS N287 C1 L2 $220.00 PSavings 1 ^ TS N304 C1 L1 $-668.00 ^

TXF files are ASCII files consisting of a header record (see header record below) followed by a sequence of data records.

Fields

Sample Field:

$-668.00

Each field consists of one line. Use of Carriage Return (CR) and Line Feed (LF) to denote line ending is preferred.

Each field has a single character (see "Field Types" below) at the beginning that is followed immediately by the data for the field.

Records

Sample Record:

TS N304 C1 L1 $-668.00 ^

Each record consists of a sequence of fields.

Each record is terminated by a line which has one "^" (caret) character.

Header Record

Sample Header Record:

V042 ARealized Gains/Losses 2019 TLA R2 D01/21/2020 ^

All Tax Exchange Files should have a header record. The header record defines:

- The version of the specification used. ("V")

- The program used to create the file. ("A")

- The date the file was created. ("D")

Field Types

| Character | Title | Explanation |

|---|---|---|

| V | Version | The version of TXF standard used to create the file. |

| A | Program Name | The name of the program creating the TXF file. The version number should also be included. |

| D | Date | Field contains a date. Use mm/dd/yyyy format. "Various" is also allowed in some contexts. |

| T | Type | Either S for summary or D for detail. Default value is S. |

| N | Reference number | A 3 digit number used to map the data to the applicable line on the applicable form, schedule, or worksheet input field in the tax software. |

| C | Copy Number | The copy number for multi-copy forms (such as Schedule C). If there is only one copy, the value should be 1. If no "C" field is supplied, Copy 1 will be assumed. The maximum number is 255. |

| L | Line Number | The line number for multi-line items. If there is only one line item, the number should be 1. The default value is 1. |

| X | Detail |

Extra text that can be used by the tax software to populate a supporting statement.

If used, these detail records should place data in columns as shown here:

X identifier 1 char Position 0:0 Date 8 chars Position 1:8 Account 30 chars Position 10:39 Check Number 6 chars Position 41:46 Payee 40 chars Position 48:87 Memo 40 chars Position 89:128 Category 15 chars Position 130:144 |

| $ | Amount | The dollar amount for the item. Income, gains, and money received are positive numbers. Expenses, losses, and money spent (including tax payments) are negative numbers. |

| P | Description | A description or other such text value |

Data Records

Sample Data Record:

TS N304 C1 L1 $-668.00 ^

For each data record there are a set of common fields. In the recommended sequence, they are:

- T Type

- N Reference Number

- C Copy number

- L Line number

Data Record Formats

There are 7 data record formats. They are labeled 0 through 6. Each has various additional fields.

Record Format 0

Sample Format 0 Data Record:

TS N554 C1 L1 PX ^

Used for boolean records such as "spouse" indicator

Record Format 1

Sample Format 1 Data Record:

TS N678 C1 L1 $1213.54 ^

A dollar amount field. Cents are allowed but many some tax software programs will round the value to the nearest dollar. Commas in the allowed in the thousand position, but not recommended.

Record Format 2

Sample Format 2 Data Record:

TS N319 C1 L1 PPharmacy ^

A string value used for "description" fields. For example, Schedule C, Line A.

Record Format 3

Sample Format 3 Data Record:

TS N287 C1 L1 $123.45 PBank of Commerce ^

Used for fields requiring both a description and an amount. For example, interest income where bank name and dollar amount are required.

Record Format 4

Sample Format 4 Data Record:

TD N321 C1 L1 P200 Reebok D01/05/2011 D10/01/2011 $1000.00 $1100.00 ^

Used to report sales of stocks, etc. Values are:

- P Security description

- D Date acquired. Some programs allow "Various" here.

- D Date sold

- $ Cost basis

- $ Sales price, net of commission

Record Format 5

Sample Format 5 Data Record:

TD N713 C1 L1 P50 QCOM D01/02/2010 D01/15/2011 $1500.00 $1300.00 $200.00 ^

Sales of assets including stocks

- P Security description

- D Date acquired

- D Date sold

- $ Cost

- $ Sales, net of commissions

- $ Depreciation allowed OR Wash sale adjustment amount

Record Format 6

Sample Format 6 Data Record:

TS N522 C1 L1 D06/15/2020 $-800.00 PNY ^

Used for quarterly federal and state estimated tax payments. State code is ignored for federal estimated tax payments. Date paid, amount paid, and state abbreviation.