Tax Documents

Tax1097Btc

FDX / Data Structures / Tax1097Btc

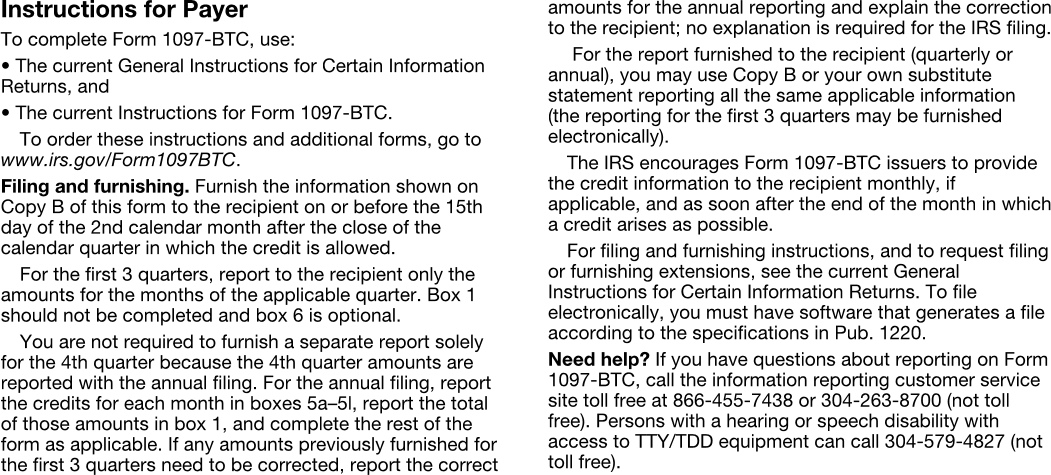

Form 1097-BTC, Bond Tax Credit

Extends and inherits all fields from Tax

Tax1097Btc Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | issuerNameAddress | NameAddressPhone | Issuer's name, address, and phone |

| 2 | issuerTin | string | FORM 1097-BTC ISSUER'S TIN |

| 3 | recipientTin | string | RECIPIENT'S TIN |

| 4 | recipientNameAddress | NameAddress | Recipient's name and address |

| 5 | filingForCredit | boolean | Form 1097-BTC issuer is: Issuer of bond or its agent filing current year Form 1097-BTC for credit being reported |

| 6 | asNominee | boolean | Form 1097-BTC issuer is: An entity or a person that received or should have received a current year Form 1097-BTC and is distributing part or all of that credit to others |

| 7 | total | number (double) | Box 1, Total |

| 8 | bondCode | string | Box 2a, Code |

| 9 | uniqueId | string | Box 2b, Unique Identifier |

| 10 | bondType | string | Box 3, Bond type |

| 11 | amounts | Array of MonthAmount | Box 5, Amounts by month |

| 12 | comments | string | Box 6, Comments |

Tax1097Btc Usage:

- TaxData tax1097Btc

FDX Data Structure as JSON

{

"tax1097Btc" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"issuerNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"phone" : {

"type" : "HOME",

"country" : "string",

"number" : "string",

"extension" : "string"

}

},

"issuerTin" : "string",

"recipientTin" : "string",

"recipientNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"filingForCredit" : true,

"asNominee" : true,

"total" : 0.0,

"bondCode" : "string",

"uniqueId" : "string",

"bondType" : "string",

"amounts" : [ {

"month" : "JAN",

"amount" : 0.0

} ],

"comments" : "string"

}

}

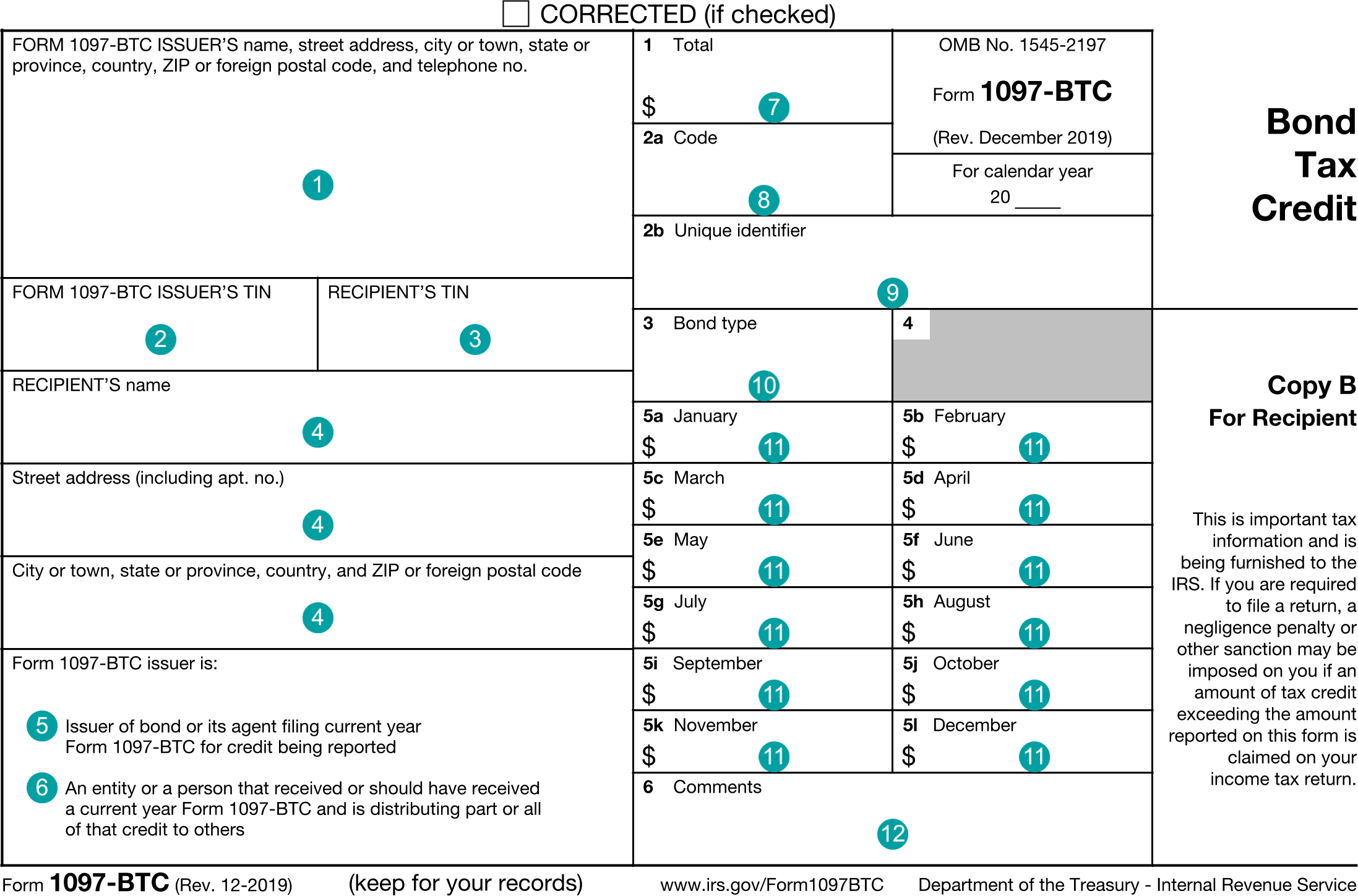

Example Form PDF

Example Form JSON

{

"tax1097Btc" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1097Btc",

"issuerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"issuerTin" : "12-3456789",

"recipientTin" : "xxx-xx-1234",

"recipientNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q Public"

},

"filingForCredit" : true,

"asNominee" : true,

"total" : 1007.0,

"bondCode" : "123-456-789",

"uniqueId" : "guid-54321",

"bondType" : "BondType",

"amounts" : [ {

"month" : "JAN",

"amount" : 511.0

}, {

"month" : "FEB",

"amount" : 496.0

} ],

"comments" : "6. Comments"

}

}

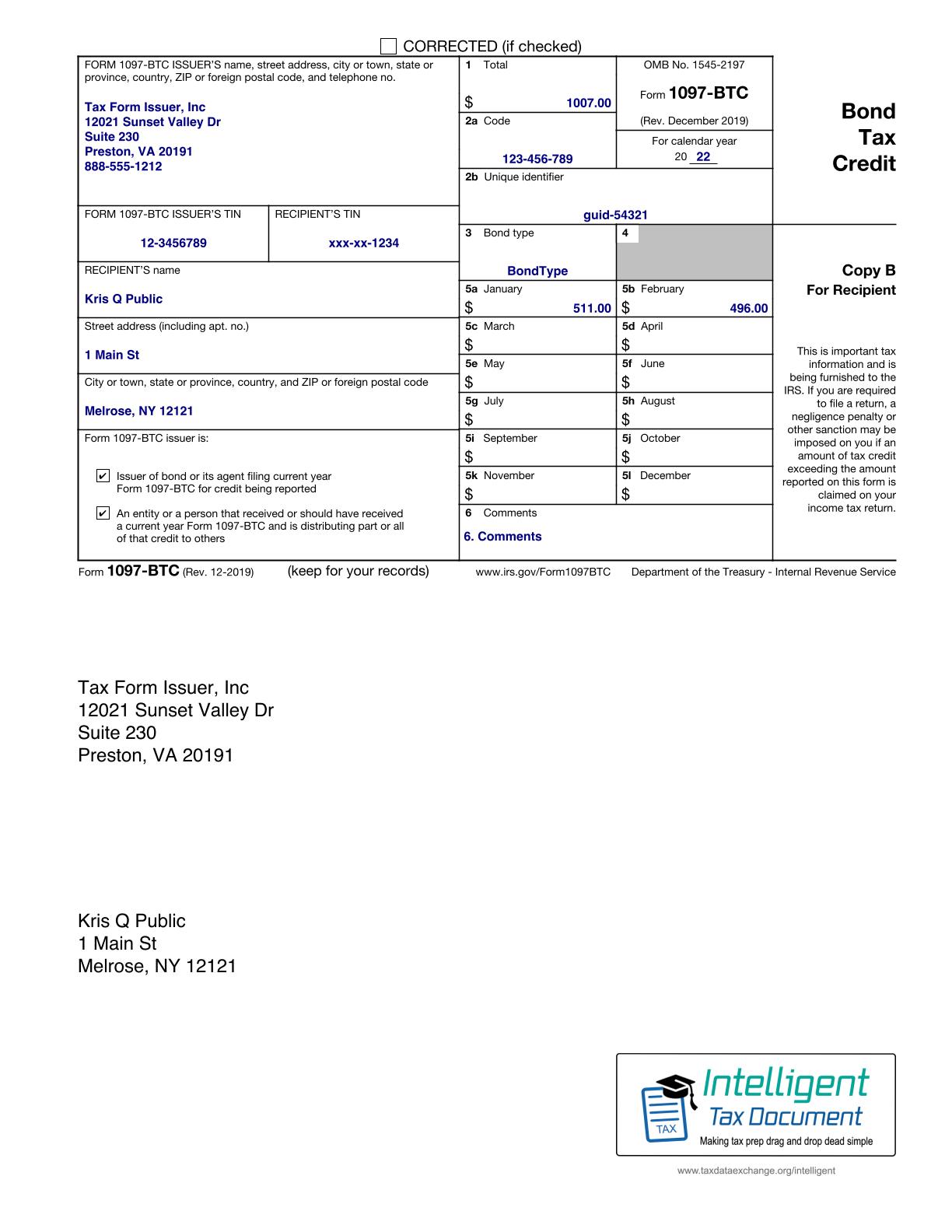

Example Form JSON for QR Code Purposes

Example Form PDF with QR Code

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"taxFormDate": "2021-03-30",

"taxFormType": "Tax1097Btc",

"issuerNameAddress.line1": "12021 Sunset Valley Dr",

"issuerNameAddress.line2": "Suite 230",

"issuerNameAddress.city": "Preston",

"issuerNameAddress.state": "VA",

"issuerNameAddress.postalCode": "20191",

"issuerNameAddress.country": "US",

"issuerNameAddress.name1": "Tax Form Issuer, Inc",

"issuerNameAddress.phone.number": "8885551212",

"issuerTin": "12-3456789",

"recipientTin": "xxx-xx-1234",

"recipientNameAddress.line1": "1 Main St",

"recipientNameAddress.city": "Melrose",

"recipientNameAddress.state": "NY",

"recipientNameAddress.postalCode": "12121",

"recipientNameAddress.country": "US",

"recipientNameAddress.name1": "Kris Q Public",

"filingForCredit": "true",

"asNominee": "true",

"total": "1007.0",

"bondCode": "123-456-789",

"uniqueId": "guid-54321",

"bondType": "BondType",

"amounts-1.month": "JAN",

"amounts-1.amount": "511.0",

"amounts-2.month": "FEB",

"amounts-2.amount": "496.0",

"comments": "6. Comments"

}

Issuer Instructions