Tax Documents

Tax1042S

FDX / Data Structures / Tax1042S

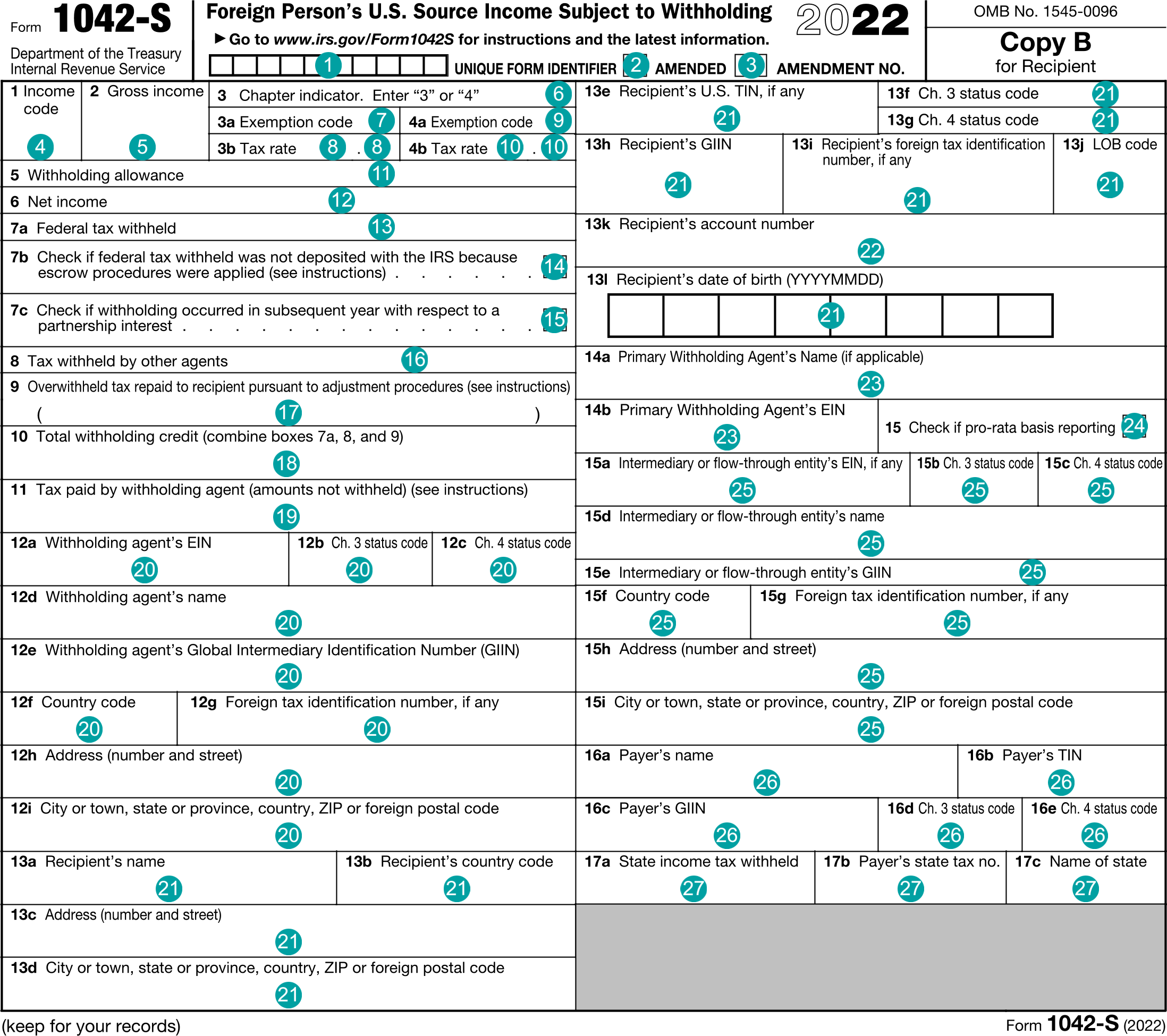

Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding

Extends and inherits all fields from Tax

Tax1042S Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | formId | string | Unique form identifier |

| 2 | amended | boolean | Amended |

| 3 | amendmentNumber | integer | Amendment number |

| 4 | incomeTypeCode | string | Box 1, Income code |

| 5 | grossIncome | number (double) | Box 2, Gross income |

| 6 | chapterIndicator | string | Box 3, Chapter indicator |

| 7 | ch3ExemptionCode | string | Box 3a, Exemption code |

| 8 | ch3TaxRate | number (double) | Box 3b, Tax rate |

| 9 | ch4ExemptionCode | string | Box 4a, Exemption code |

| 10 | ch4TaxRate | number (double) | Box 4b, Tax rate |

| 11 | withholdingAllowance | number (double) | Box 5, Withholding allowance |

| 12 | netIncome | number (double) | Box 6, Net income |

| 13 | federalTaxWithheld | number (double) | Box 7a, Federal tax withheld |

| 14 | escrowProceduresApplied | boolean | Box 7b, Check if federal tax withheld was not deposited with the IRS because escrow procedures were applied |

| 15 | subsequentYear | boolean | Box 7c, Check if withholding occurred in subsequent year with respect to a partnership interest |

| 16 | otherAgentsTaxWithheld | number (double) | Box 8, Tax withheld by other agents |

| 17 | recipientRepaidAmount | number (double) | Box 9, Overwithheld tax repaid to recipient pursuant to adjustment procedures |

| 18 | totalTaxWithholdingCredit | number (double) | Box 10, Total withholding credit |

| 19 | withholdingAgentTaxPaid | number (double) | Box 11, Tax paid by withholding agent (amounts not withheld) |

| 20 | withholdingAgent | Form1042Agent | Box 12, Withholding agent |

| 21 | recipient | Form1042Recipient | Box 13, Recipient |

| 22 | accountNumber | string | Box 13k, Recipient account number |

| 23 | primary | Form1042Agent | Box 14, Primary Withholding Agent |

| 24 | prorataBasisReporting | boolean | Box 15, Check if pro-rata basis reporting |

| 25 | intermediary | Form1042Agent | Box 15, Intermediary or flow thru entity |

| 26 | payer | Form1042Agent | Box 16, Payer |

| 27 | stateTaxWithholding | StateTaxWithholding | Box 17, State tax withholding |

Tax1042S Usage:

- TaxData tax1042S

FDX Data Structure as JSON

{

"tax1042S" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"formId" : "string",

"amended" : true,

"amendmentNumber" : 0,

"incomeTypeCode" : "string",

"grossIncome" : 0.0,

"chapterIndicator" : "string",

"ch3ExemptionCode" : "string",

"ch3TaxRate" : 0.0,

"ch4ExemptionCode" : "string",

"ch4TaxRate" : 0.0,

"withholdingAllowance" : 0.0,

"netIncome" : 0.0,

"federalTaxWithheld" : 0.0,

"escrowProceduresApplied" : true,

"subsequentYear" : true,

"otherAgentsTaxWithheld" : 0.0,

"recipientRepaidAmount" : 0.0,

"totalTaxWithholdingCredit" : 0.0,

"withholdingAgentTaxPaid" : 0.0,

"withholdingAgent" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"agentTin" : "string",

"ch3StatusCode" : "string",

"ch4StatusCode" : "string",

"giin" : "string",

"countryCode" : "string",

"foreignTin" : "string"

},

"recipient" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"agentTin" : "string",

"ch3StatusCode" : "string",

"ch4StatusCode" : "string",

"giin" : "string",

"countryCode" : "string",

"foreignTin" : "string",

"lobCode" : "string",

"dateOfBirth" : "2020-07-01"

},

"primary" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"agentTin" : "string",

"ch3StatusCode" : "string",

"ch4StatusCode" : "string",

"giin" : "string",

"countryCode" : "string",

"foreignTin" : "string"

},

"intermediary" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"agentTin" : "string",

"ch3StatusCode" : "string",

"ch4StatusCode" : "string",

"giin" : "string",

"countryCode" : "string",

"foreignTin" : "string"

},

"payer" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"agentTin" : "string",

"ch3StatusCode" : "string",

"ch4StatusCode" : "string",

"giin" : "string",

"countryCode" : "string",

"foreignTin" : "string"

},

"stateTaxWithholding" : {

"stateTaxWithheld" : 0.0,

"state" : "string",

"stateTaxId" : "string",

"stateIncome" : 0.0

}

}

}

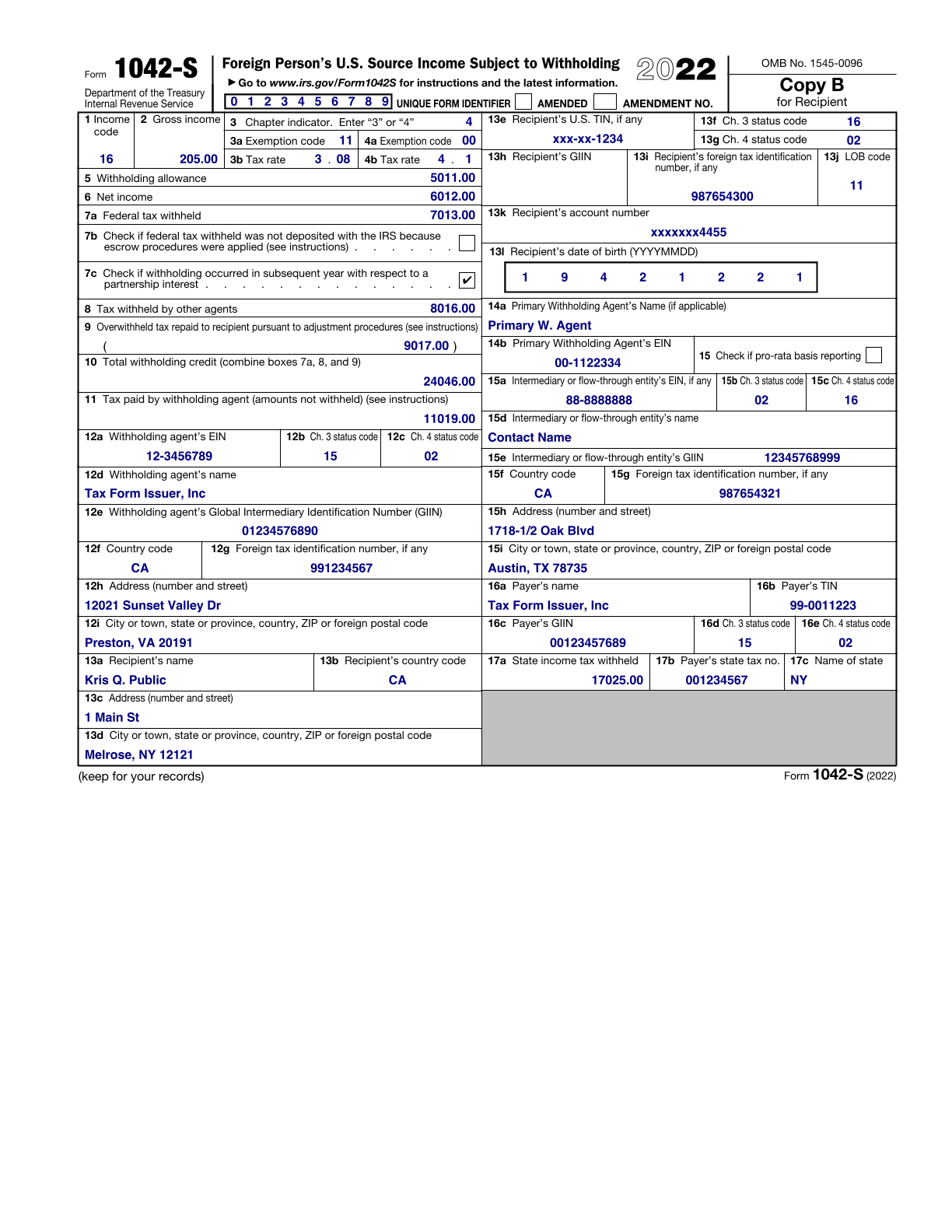

Example Form PDF

Example Form JSON

{

"tax1042S" : {

"taxYear" : 2022,

"accountId" : "xxxxxxxx4455",

"taxFormId" : "e5d4ee73bd1-9295-480f-a426-a260f771",

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1042S",

"formId" : "0123456789",

"incomeTypeCode" : "16",

"grossIncome" : 205.0,

"chapterIndicator" : "4",

"ch3ExemptionCode" : "11",

"ch3TaxRate" : 3.08,

"ch4ExemptionCode" : "00",

"ch4TaxRate" : 4.1,

"withholdingAllowance" : 5011.0,

"netIncome" : 6012.0,

"federalTaxWithheld" : 7013.0,

"subsequentYear" : true,

"otherAgentsTaxWithheld" : 8016.0,

"recipientRepaidAmount" : 9017.0,

"totalTaxWithholdingCredit" : 24046.0,

"withholdingAgentTaxPaid" : 11019.0,

"withholdingAgent" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"agentTin" : "12-3456789",

"ch3StatusCode" : "15",

"ch4StatusCode" : "02",

"giin" : "01234576890",

"countryCode" : "CA",

"foreignTin" : "991234567"

},

"recipient" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q. Public",

"agentTin" : "xxx-xx-1234",

"ch3StatusCode" : "16",

"ch4StatusCode" : "02",

"countryCode" : "CA",

"foreignTin" : "987654300",

"lobCode" : "11",

"dateOfBirth" : "1942-12-21"

},

"accountNumber" : "xxxxxxx4455",

"primary" : {

"name1" : "Primary W. Agent",

"agentTin" : "00-1122334"

},

"prorataBasisReporting" : false,

"intermediary" : {

"line1" : "1718-1/2 Oak Blvd",

"city" : "Austin",

"state" : "TX",

"postalCode" : "78735",

"country" : "US",

"name1" : "Contact Name",

"agentTin" : "88-8888888",

"ch3StatusCode" : "02",

"ch4StatusCode" : "16",

"giin" : "12345768999",

"countryCode" : "CA",

"foreignTin" : "987654321"

},

"payer" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"agentTin" : "99-0011223",

"ch3StatusCode" : "15",

"ch4StatusCode" : "02",

"giin" : "00123457689"

},

"stateTaxWithholding" : {

"stateTaxWithheld" : 17025.0,

"state" : "NY",

"stateTaxId" : "001234567"

}

}

}

Example Form JSON for QR Code Purposes

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"accountId": "xxxxxxxx4455",

"taxFormId": "e5d4ee73bd1-9295-480f-a426-a260f771",

"taxFormDate": "2021-03-30",

"taxFormType": "Tax1042S",

"formId": "0123456789",

"incomeTypeCode": "16",

"grossIncome": "205.0",

"chapterIndicator": "4",

"ch3ExemptionCode": "11",

"ch3TaxRate": "3.08",

"ch4ExemptionCode": "00",

"ch4TaxRate": "4.1",

"withholdingAllowance": "5011.0",

"netIncome": "6012.0",

"federalTaxWithheld": "7013.0",

"subsequentYear": "true",

"otherAgentsTaxWithheld": "8016.0",

"recipientRepaidAmount": "9017.0",

"totalTaxWithholdingCredit": "24046.0",

"withholdingAgentTaxPaid": "11019.0",

"withholdingAgent.line1": "12021 Sunset Valley Dr",

"withholdingAgent.line2": "Suite 230",

"withholdingAgent.city": "Preston",

"withholdingAgent.state": "VA",

"withholdingAgent.postalCode": "20191",

"withholdingAgent.country": "US",

"withholdingAgent.name1": "Tax Form Issuer, Inc",

"withholdingAgent.agentTin": "12-3456789",

"withholdingAgent.ch3StatusCode": "15",

"withholdingAgent.ch4StatusCode": "02",

"withholdingAgent.giin": "01234576890",

"withholdingAgent.countryCode": "CA",

"withholdingAgent.foreignTin": "991234567",

"recipient.line1": "1 Main St",

"recipient.city": "Melrose",

"recipient.state": "NY",

"recipient.postalCode": "12121",

"recipient.country": "US",

"recipient.name1": "Kris Q. Public",

"recipient.agentTin": "xxx-xx-1234",

"recipient.ch3StatusCode": "16",

"recipient.ch4StatusCode": "02",

"recipient.countryCode": "CA",

"recipient.foreignTin": "987654300",

"recipient.lobCode": "11",

"recipient.dateOfBirth": "1942-12-21",

"accountNumber": "xxxxxxx4455",

"primary.name1": "Primary W. Agent",

"primary.agentTin": "00-1122334",

"prorataBasisReporting": "false",

"intermediary.line1": "1718-1/2 Oak Blvd",

"intermediary.city": "Austin",

"intermediary.state": "TX",

"intermediary.postalCode": "78735",

"intermediary.country": "US",

"intermediary.name1": "Contact Name",

"intermediary.agentTin": "88-8888888",

"intermediary.ch3StatusCode": "02",

"intermediary.ch4StatusCode": "16",

"intermediary.giin": "12345768999",

"intermediary.countryCode": "CA",

"intermediary.foreignTin": "987654321",

"payer.line1": "12021 Sunset Valley Dr",

"payer.line2": "Suite 230",

"payer.city": "Preston",

"payer.state": "VA",

"payer.postalCode": "20191",

"payer.country": "US",

"payer.name1": "Tax Form Issuer, Inc",

"payer.agentTin": "99-0011223",

"payer.ch3StatusCode": "15",

"payer.ch4StatusCode": "02",

"payer.giin": "00123457689",

"stateTaxWithholding.stateTaxWithheld": "17025.0",

"stateTaxWithholding.state": "NY",

"stateTaxWithholding.stateTaxId": "001234567"

}