Tax Documents

TaxW2

FDX / Data Structures / TaxW2

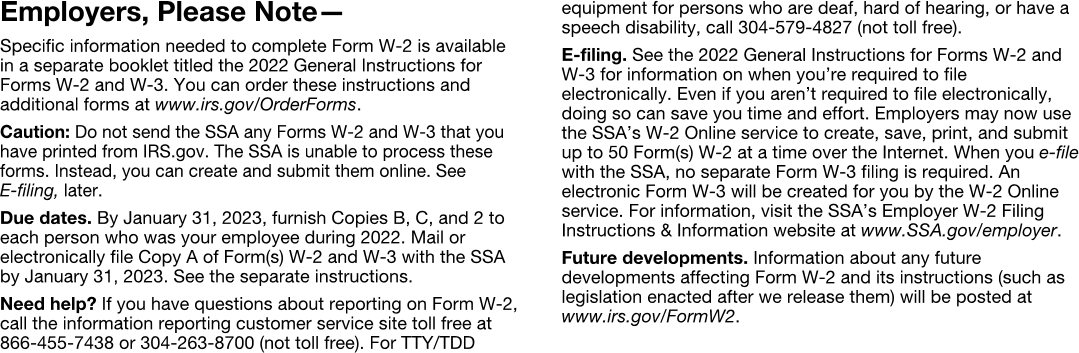

Form W-2, Wage and Tax Statement

Extends and inherits all fields from Tax

TaxW2 Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | employeeTin | string | Employee's social security number |

| 2 | employerTin | string | Employer identification number (EIN) |

| 3 | employerNameAddress | NameAddress | Employer's name and address |

| 4 | controlNumber | string | Control number |

| 5 | employeeName | IndividualName | Employee name |

| 6 | employeeAddress | Address | Employee's address |

| 7 | wages | number (double) | Box 1, Wages, tips, other compensation |

| 8 | federalTaxWithheld | number (double) | Box 2, Federal income tax withheld |

| 9 | socialSecurityWages | number (double) | Box 3, Social security wages |

| 10 | socialSecurityTaxWithheld | number (double) | Box 4, Social security tax withheld |

| 11 | medicareWages | number (double) | Box 5, Medicare wages and tips |

| 12 | medicareTaxWithheld | number (double) | Box 6, Medicare tax withheld |

| 13 | socialSecurityTips | number (double) | Box 7, Social security tips |

| 14 | allocatedTips | number (double) | Box 8, Allocated tips |

| 15 | dependentCareBenefit | number (double) | Box 10, Dependent care benefits |

| 16 | nonQualifiedPlan | number (double) | Box 11, Nonqualified plans |

| 17 | codes | Array of CodeAmount | Box 12, Codes and amounts |

| 18 | statutory | boolean | Box 13, Statutory employee |

| 19 | retirementPlan | boolean | Box 13, Retirement plan |

| 20 | thirdPartySickPay | boolean | Box 13, Third-party sick pay |

| 21 | esppQualified | number (double) | Employee Stock Purchase Plan Qualified Disposition amount |

| 22 | esppNonQualified | number (double) | Employee Stock Purchase Plan Nonqualified Disposition amount |

| 23 | other | Array of DescriptionAmount | Box 14, Other descriptions and amounts |

| 24 | stateTaxWithholding | Array of StateTaxWithholding | Boxes 15-17, State tax withholding |

| 25 | localTaxWithholding | Array of LocalTaxWithholding | Boxes 18-20, Local tax withholding |

TaxW2 Usage:

FDX Data Structure as JSON

{

"taxW2" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"employeeTin" : "string",

"employerTin" : "string",

"employerNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"controlNumber" : "string",

"employeeName" : {

"first" : "string",

"middle" : "string",

"last" : "string",

"suffix" : "string"

},

"employeeAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD"

},

"wages" : 0.0,

"federalTaxWithheld" : 0.0,

"socialSecurityWages" : 0.0,

"socialSecurityTaxWithheld" : 0.0,

"medicareWages" : 0.0,

"medicareTaxWithheld" : 0.0,

"socialSecurityTips" : 0.0,

"allocatedTips" : 0.0,

"dependentCareBenefit" : 0.0,

"nonQualifiedPlan" : 0.0,

"codes" : [ {

"code" : "string",

"amount" : 0.0

} ],

"statutory" : true,

"retirementPlan" : true,

"thirdPartySickPay" : true,

"esppQualified" : 0.0,

"esppNonQualified" : 0.0,

"other" : [ {

"description" : "string",

"amount" : 0.0

} ],

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 0.0,

"state" : "string",

"stateTaxId" : "string",

"stateIncome" : 0.0

} ],

"localTaxWithholding" : [ {

"localTaxWithheld" : 0.0,

"localityName" : "string",

"state" : "string",

"localIncome" : 0.0

} ]

}

}

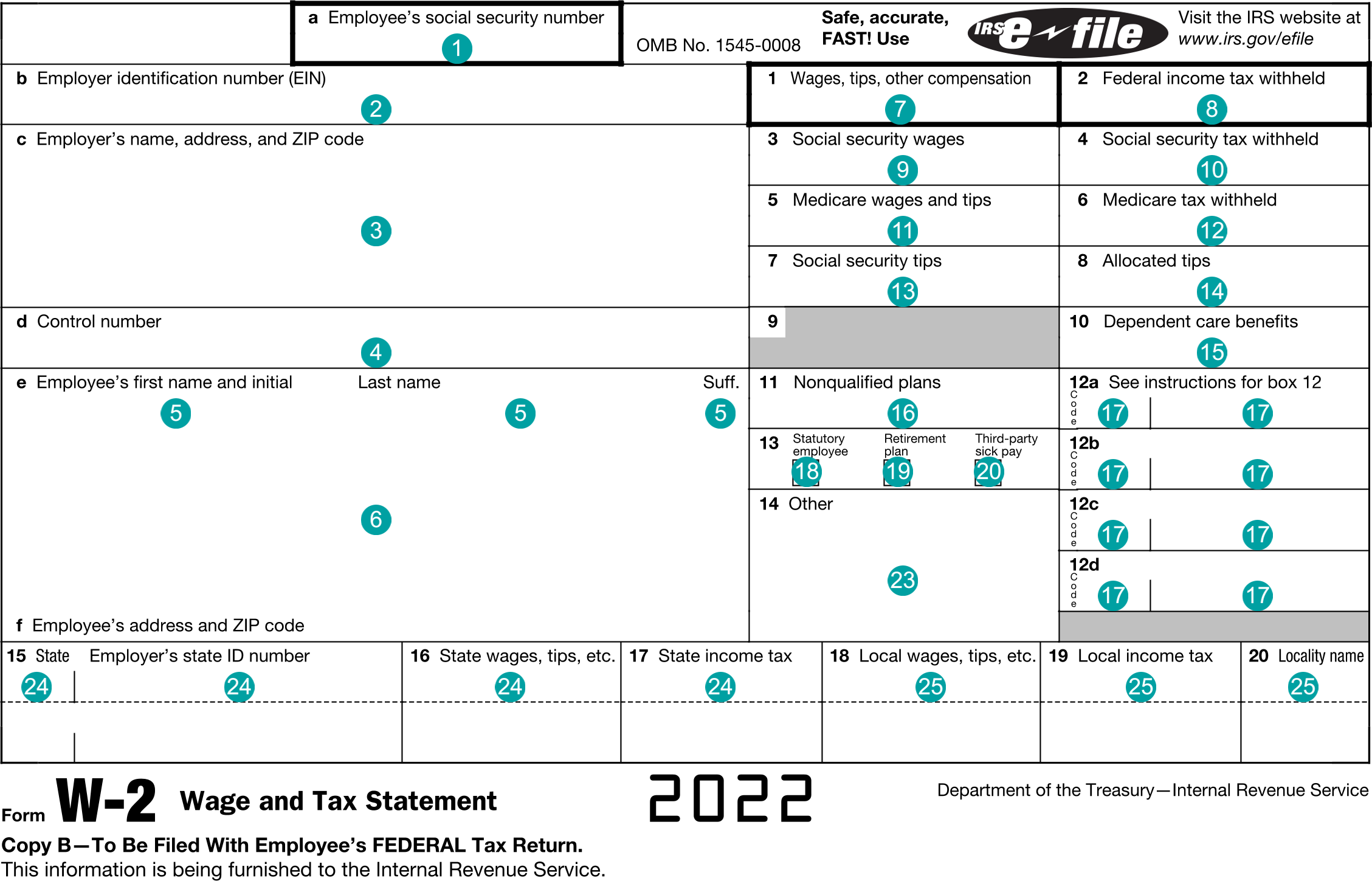

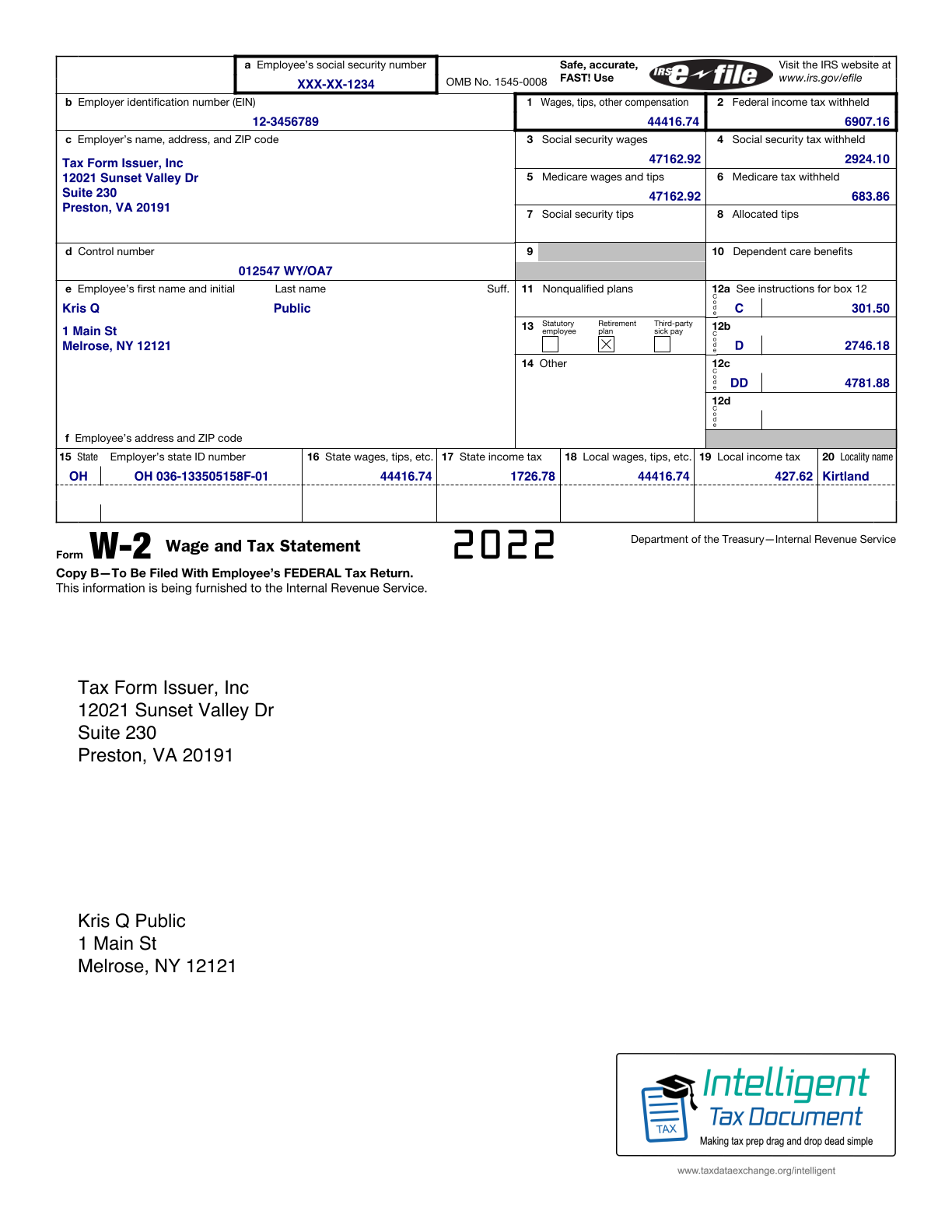

Example Form PDF

Example Form JSON

{

"taxW2" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "TaxW2",

"employeeTin" : "XXX-XX-1234",

"employerTin" : "12-3456789",

"employerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"name1" : "Tax Form Issuer, Inc"

},

"controlNumber" : "012547 WY/OA7",

"employeeName" : {

"first" : "Kris",

"middle" : "Q",

"last" : "Public"

},

"employeeAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121"

},

"wages" : 44416.74,

"federalTaxWithheld" : 6907.16,

"socialSecurityWages" : 47162.92,

"socialSecurityTaxWithheld" : 2924.1,

"medicareWages" : 47162.92,

"medicareTaxWithheld" : 683.86,

"codes" : [ {

"code" : "C",

"amount" : 301.5

}, {

"code" : "D",

"amount" : 2746.18

}, {

"code" : "DD",

"amount" : 4781.88

} ],

"retirementPlan" : true,

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 1726.78,

"state" : "OH",

"stateTaxId" : "OH 036-133505158F-01",

"stateIncome" : 44416.74

} ],

"localTaxWithholding" : [ {

"localTaxWithheld" : 427.62,

"localityName" : "Kirtland",

"state" : "OH",

"localIncome" : 44416.74

} ]

}

}

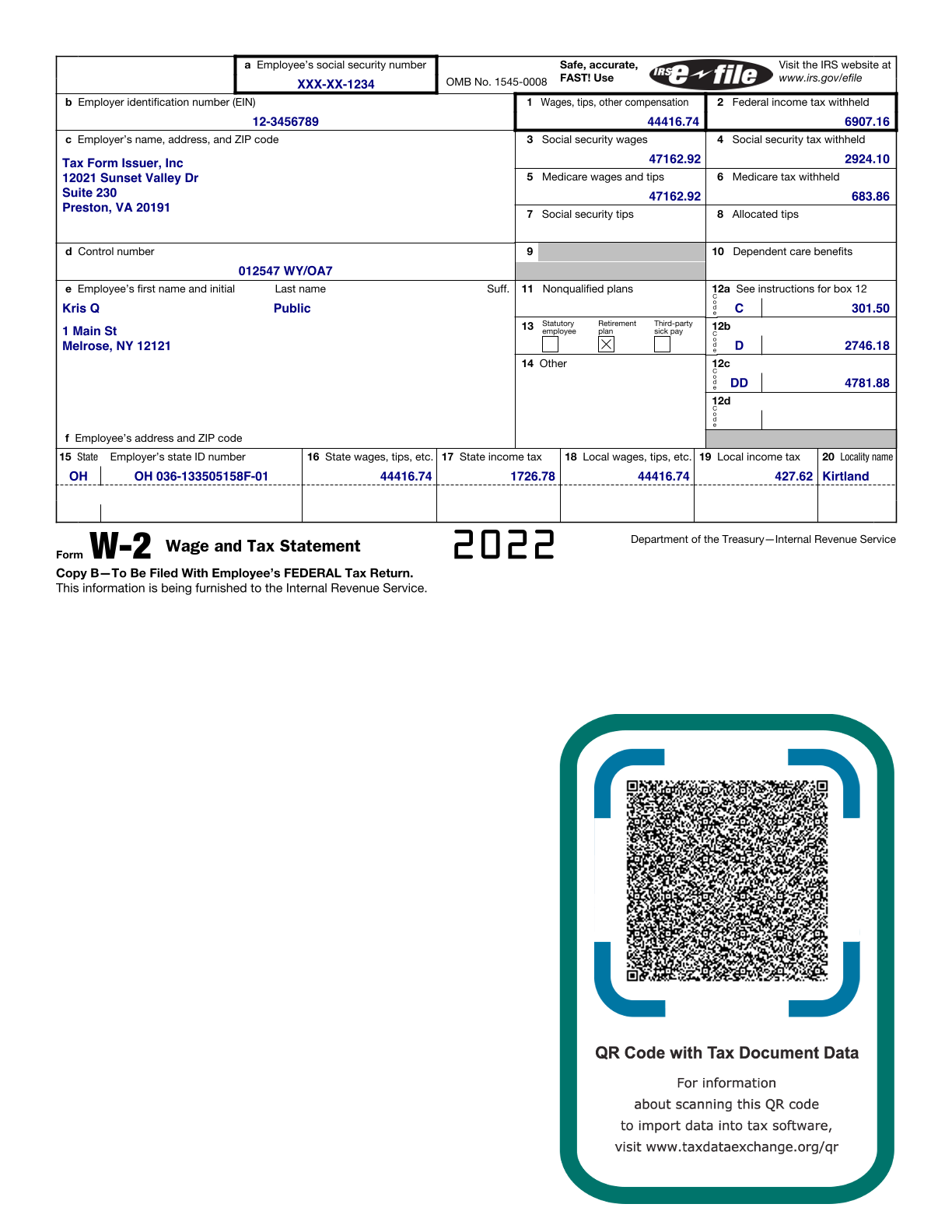

Example Form JSON for QR Code Purposes

Example Form PDF with QR Code

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"taxFormDate": "2021-03-30",

"taxFormType": "TaxW2",

"employeeTin": "XXX-XX-1234",

"employerTin": "12-3456789",

"employerNameAddress.line1": "12021 Sunset Valley Dr",

"employerNameAddress.line2": "Suite 230",

"employerNameAddress.city": "Preston",

"employerNameAddress.state": "VA",

"employerNameAddress.postalCode": "20191",

"employerNameAddress.name1": "Tax Form Issuer, Inc",

"controlNumber": "012547 WY/OA7",

"employeeName.first": "Kris",

"employeeName.middle": "Q",

"employeeName.last": "Public",

"employeeAddress.line1": "1 Main St",

"employeeAddress.city": "Melrose",

"employeeAddress.state": "NY",

"employeeAddress.postalCode": "12121",

"wages": "44416.74",

"federalTaxWithheld": "6907.16",

"socialSecurityWages": "47162.92",

"socialSecurityTaxWithheld": "2924.1",

"medicareWages": "47162.92",

"medicareTaxWithheld": "683.86",

"codes-1.code": "C",

"codes-1.amount": "301.5",

"codes-2.code": "D",

"codes-2.amount": "2746.18",

"codes-3.code": "DD",

"codes-3.amount": "4781.88",

"retirementPlan": "true",

"stateTaxWithholding-1.stateTaxWithheld": "1726.78",

"stateTaxWithholding-1.state": "OH",

"stateTaxWithholding-1.stateTaxId": "OH 036-133505158F-01",

"stateTaxWithholding-1.stateIncome": "44416.74",

"localTaxWithholding-1.localTaxWithheld": "427.62",

"localTaxWithholding-1.localityName": "Kirtland",

"localTaxWithholding-1.state": "OH",

"localTaxWithholding-1.localIncome": "44416.74"

}

Issuer Instructions