Tax Documents

TaxW2C

FDX / Data Structures / TaxW2C

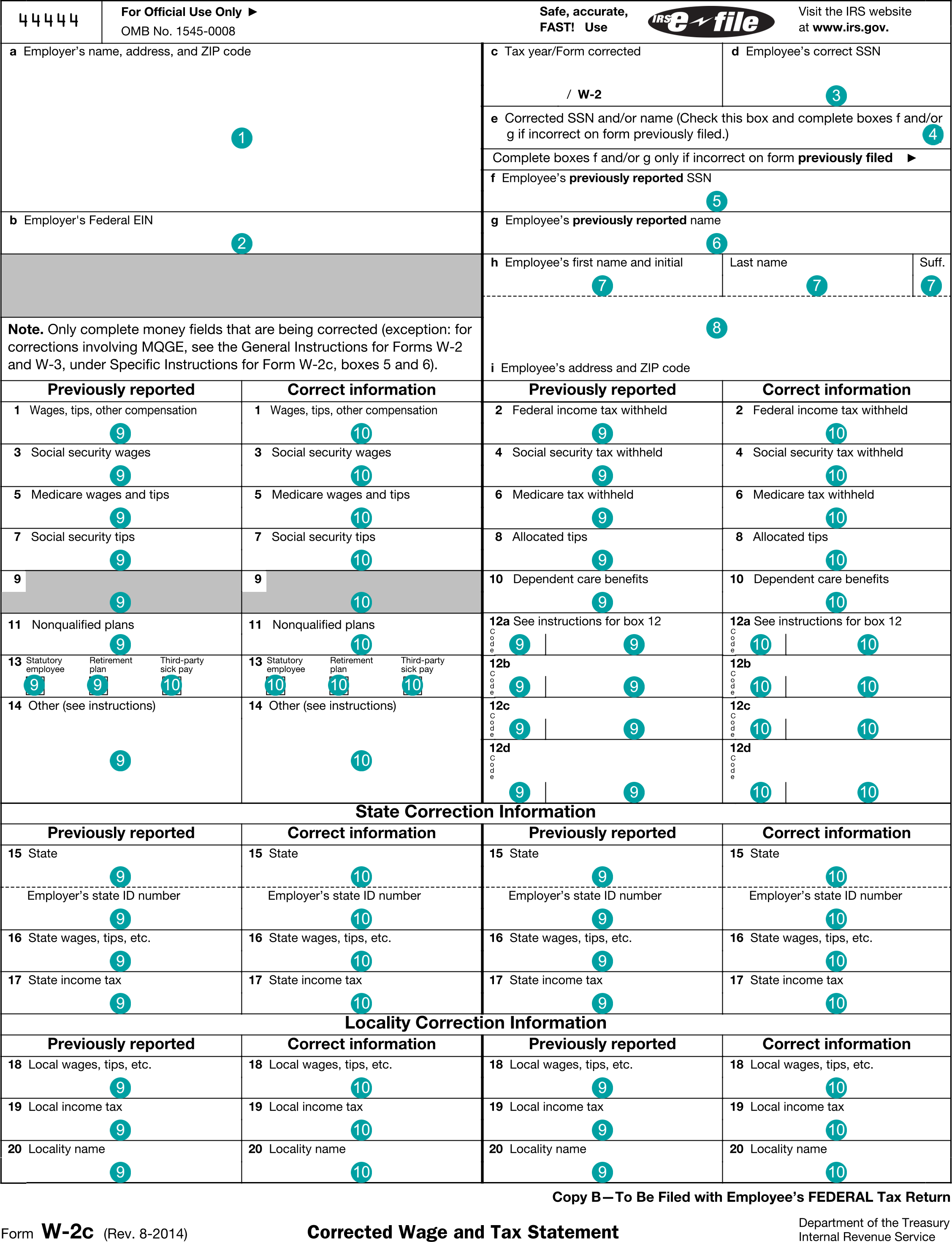

Form W-2c, IRS form W-2c, Corrected Wage and Tax Statement

Extends and inherits all fields from Tax

TaxW2C Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | employerNameAddress | NameAddress | Box a, Employer's name, address, and ZIP code |

| 2 | employerTin | string | Box b, Employer's Federal EIN |

| 3 | employeeTin | string | Box d, Employee's correct SSN |

| 4 | correctedTinOrName | boolean | Box e, Corrected SSN and/or name |

| 5 | previousEmployeeTin | string | Box f, Employee's previously reported SSN |

| 6 | previousEmployeeName | IndividualName | Box g, Employee's previously reported name |

| 7 | employeeName | IndividualName | Box h, Employee's name |

| 8 | employeeAddress | Address | Box I, Employee's address and ZIP code |

| 9 | originalW2 | TaxW2 | Boxes 1-20 of Previously reported Wage and Tax Statement |

| 10 | correctedW2 | TaxW2 | Boxes 1-20 of Correct information Wage and Tax Statement |

TaxW2C Usage:

- TaxData taxW2C

FDX Data Structure as JSON

{

"taxW2C" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"employerNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"employerTin" : "string",

"employeeTin" : "string",

"correctedTinOrName" : true,

"previousEmployeeTin" : "string",

"previousEmployeeName" : {

"first" : "string",

"middle" : "string",

"last" : "string",

"suffix" : "string"

},

"employeeName" : {

"first" : "string",

"middle" : "string",

"last" : "string",

"suffix" : "string"

},

"employeeAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD"

},

"originalW2" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"employeeTin" : "string",

"employerTin" : "string",

"employerNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"controlNumber" : "string",

"employeeName" : {

"first" : "string",

"middle" : "string",

"last" : "string",

"suffix" : "string"

},

"employeeAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD"

},

"wages" : 0.0,

"federalTaxWithheld" : 0.0,

"socialSecurityWages" : 0.0,

"socialSecurityTaxWithheld" : 0.0,

"medicareWages" : 0.0,

"medicareTaxWithheld" : 0.0,

"socialSecurityTips" : 0.0,

"allocatedTips" : 0.0,

"dependentCareBenefit" : 0.0,

"nonQualifiedPlan" : 0.0,

"codes" : [ {

"code" : "string",

"amount" : 0.0

} ],

"statutory" : true,

"retirementPlan" : true,

"thirdPartySickPay" : true,

"esppQualified" : 0.0,

"esppNonQualified" : 0.0,

"other" : [ {

"description" : "string",

"amount" : 0.0

} ],

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 0.0,

"state" : "string",

"stateTaxId" : "string",

"stateIncome" : 0.0

} ],

"localTaxWithholding" : [ {

"localTaxWithheld" : 0.0,

"localityName" : "string",

"state" : "string",

"localIncome" : 0.0

} ]

},

"correctedW2" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"employeeTin" : "string",

"employerTin" : "string",

"employerNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"controlNumber" : "string",

"employeeName" : {

"first" : "string",

"middle" : "string",

"last" : "string",

"suffix" : "string"

},

"employeeAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD"

},

"wages" : 0.0,

"federalTaxWithheld" : 0.0,

"socialSecurityWages" : 0.0,

"socialSecurityTaxWithheld" : 0.0,

"medicareWages" : 0.0,

"medicareTaxWithheld" : 0.0,

"socialSecurityTips" : 0.0,

"allocatedTips" : 0.0,

"dependentCareBenefit" : 0.0,

"nonQualifiedPlan" : 0.0,

"codes" : [ {

"code" : "string",

"amount" : 0.0

} ],

"statutory" : true,

"retirementPlan" : true,

"thirdPartySickPay" : true,

"esppQualified" : 0.0,

"esppNonQualified" : 0.0,

"other" : [ {

"description" : "string",

"amount" : 0.0

} ],

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 0.0,

"state" : "string",

"stateTaxId" : "string",

"stateIncome" : 0.0

} ],

"localTaxWithholding" : [ {

"localTaxWithheld" : 0.0,

"localityName" : "string",

"state" : "string",

"localIncome" : 0.0

} ]

}

}

}

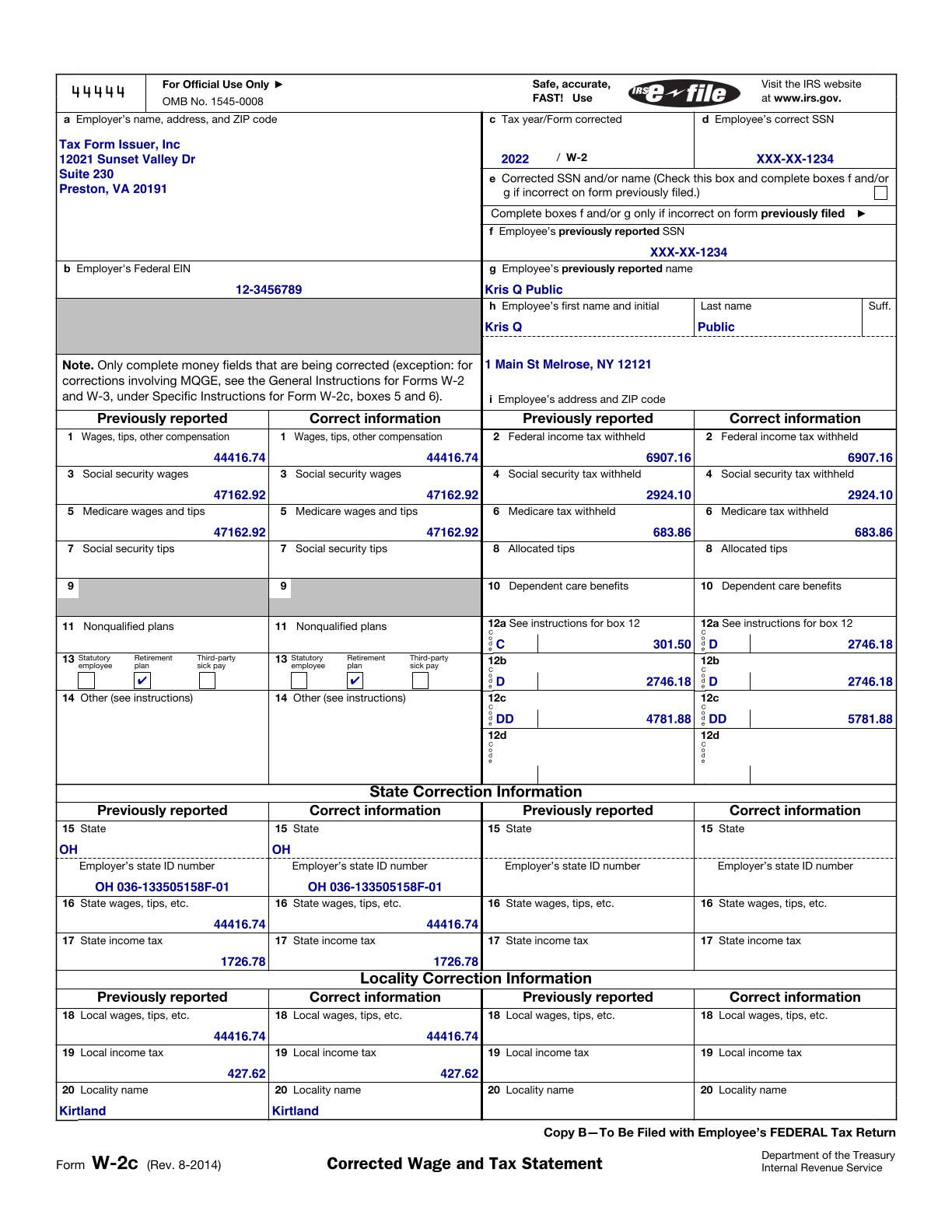

Example Form PDF

Example Form JSON

{

"taxW2C" : {

"taxYear" : 2022,

"taxFormDate" : "2020-12-31",

"taxFormType" : "TaxW2C",

"employerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"name1" : "Tax Form Issuer, Inc"

},

"employerTin" : "12-3456789",

"employeeTin" : "XXX-XX-1234",

"correctedTinOrName" : false,

"previousEmployeeTin" : "XXX-XX-1234",

"previousEmployeeName" : {

"first" : "Kris",

"middle" : "Q",

"last" : "Public"

},

"employeeName" : {

"first" : "Kris",

"middle" : "Q",

"last" : "Public"

},

"employeeAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121"

},

"originalW2" : {

"taxYear" : 2022,

"employeeTin" : "XXX-XX-1234",

"employerTin" : "12-3456789",

"employerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"name1" : "Tax Form Issuer, Inc"

},

"controlNumber" : "012547 WY/OA7",

"employeeName" : {

"first" : "Kris",

"middle" : "Q",

"last" : "Public"

},

"employeeAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121"

},

"wages" : 44416.74,

"federalTaxWithheld" : 6907.16,

"socialSecurityWages" : 47162.92,

"socialSecurityTaxWithheld" : 2924.1,

"medicareWages" : 47162.92,

"medicareTaxWithheld" : 683.86,

"codes" : [ {

"code" : "C",

"amount" : 301.5

}, {

"code" : "D",

"amount" : 2746.18

}, {

"code" : "DD",

"amount" : 4781.88

} ],

"retirementPlan" : true,

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 1726.78,

"state" : "OH",

"stateTaxId" : "OH 036-133505158F-01",

"stateIncome" : 44416.74

} ],

"localTaxWithholding" : [ {

"localTaxWithheld" : 427.62,

"localityName" : "Kirtland",

"state" : "OH",

"localIncome" : 44416.74

} ]

},

"correctedW2" : {

"taxYear" : 2022,

"employeeTin" : "XXX-XX-1234",

"employerTin" : "12-3456789",

"employerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"name1" : "Tax Form Issuer, Inc"

},

"controlNumber" : "012547 WY/OA7",

"employeeName" : {

"first" : "Kris",

"middle" : "Q",

"last" : "Public"

},

"employeeAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121"

},

"wages" : 44416.74,

"federalTaxWithheld" : 6907.16,

"socialSecurityWages" : 47162.92,

"socialSecurityTaxWithheld" : 2924.1,

"medicareWages" : 47162.92,

"medicareTaxWithheld" : 683.86,

"codes" : [ {

"code" : "C",

"amount" : 301.5

}, {

"code" : "D",

"amount" : 2746.18

}, {

"code" : "DD",

"amount" : 5781.88

} ],

"retirementPlan" : true,

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 1726.78,

"state" : "OH",

"stateTaxId" : "OH 036-133505158F-01",

"stateIncome" : 44416.74

} ],

"localTaxWithholding" : [ {

"localTaxWithheld" : 427.62,

"localityName" : "Kirtland",

"state" : "OH",

"localIncome" : 44416.74

} ]

}

}

}

Example Form JSON for QR Code Purposes

Example Data As Flattened Map (Key, Value Pairs)

{}