Tax Documents

TaxW2G

FDX / Data Structures / TaxW2G

Form W-2G, Certain Gambling Winnings

Extends and inherits all fields from Tax

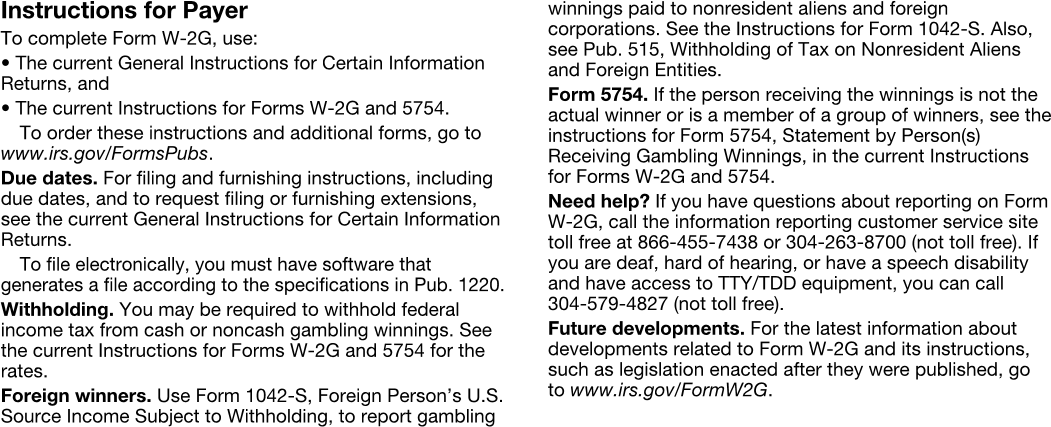

TaxW2G Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | payerNameAddress | NameAddressPhone | Payer's name, address and phone |

| 2 | payerTin | string | PAYER'S federal identification number |

| 3 | winnerNameAddress | NameAddress | Winner's name and address |

| 4 | winnings | number (double) | Box 1, Reportable winnings |

| 5 | dateWon | DateString | Box 2, Date won |

| 6 | typeOfWager | string | Box 3, Type of wager |

| 7 | federalTaxWithheld | number (double) | Box 4, Federal income tax withheld |

| 8 | transaction | string | Box 5, Transaction |

| 9 | race | string | Box 6, Race |

| 10 | identicalWinnings | number (double) | Box 7, Winnings from identical wagers |

| 11 | cashier | string | Box 8, Cashier |

| 12 | winnerTin | string | Box 9, Winner's taxpayer identification no. |

| 13 | window | string | Box 10, Window |

| 14 | firstId | string | Box 11, First I.D. |

| 15 | secondId | string | Box 12, Second I.D. |

| 16 | payerState | string | Box 13, State |

| 17 | stateWinnings | number (double) | Box 14, State winnings |

| 18 | stateTaxWithheld | number (double) | Box 15, State income tax withheld |

| 19 | localWinnings | number (double) | Box 16, Local winnings |

| 20 | localTaxWithheld | number (double) | Box 17, Local income tax withheld |

| 21 | localityName | string | Box 18, Name of locality |

| 22 | payerStateId | string | Box 13, Payer's state identification no. |

TaxW2G Usage:

- TaxData taxW2G

FDX Data Structure as JSON

{

"taxW2G" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"payerNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"phone" : {

"type" : "HOME",

"country" : "string",

"number" : "string",

"extension" : "string"

}

},

"payerTin" : "string",

"winnerNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"winnings" : 0.0,

"dateWon" : "2020-07-01",

"typeOfWager" : "string",

"federalTaxWithheld" : 0.0,

"transaction" : "string",

"race" : "string",

"identicalWinnings" : 0.0,

"cashier" : "string",

"winnerTin" : "string",

"window" : "string",

"firstId" : "string",

"secondId" : "string",

"payerState" : "string",

"stateWinnings" : 0.0,

"stateTaxWithheld" : 0.0,

"localWinnings" : 0.0,

"localTaxWithheld" : 0.0,

"localityName" : "string",

"payerStateId" : "string"

}

}

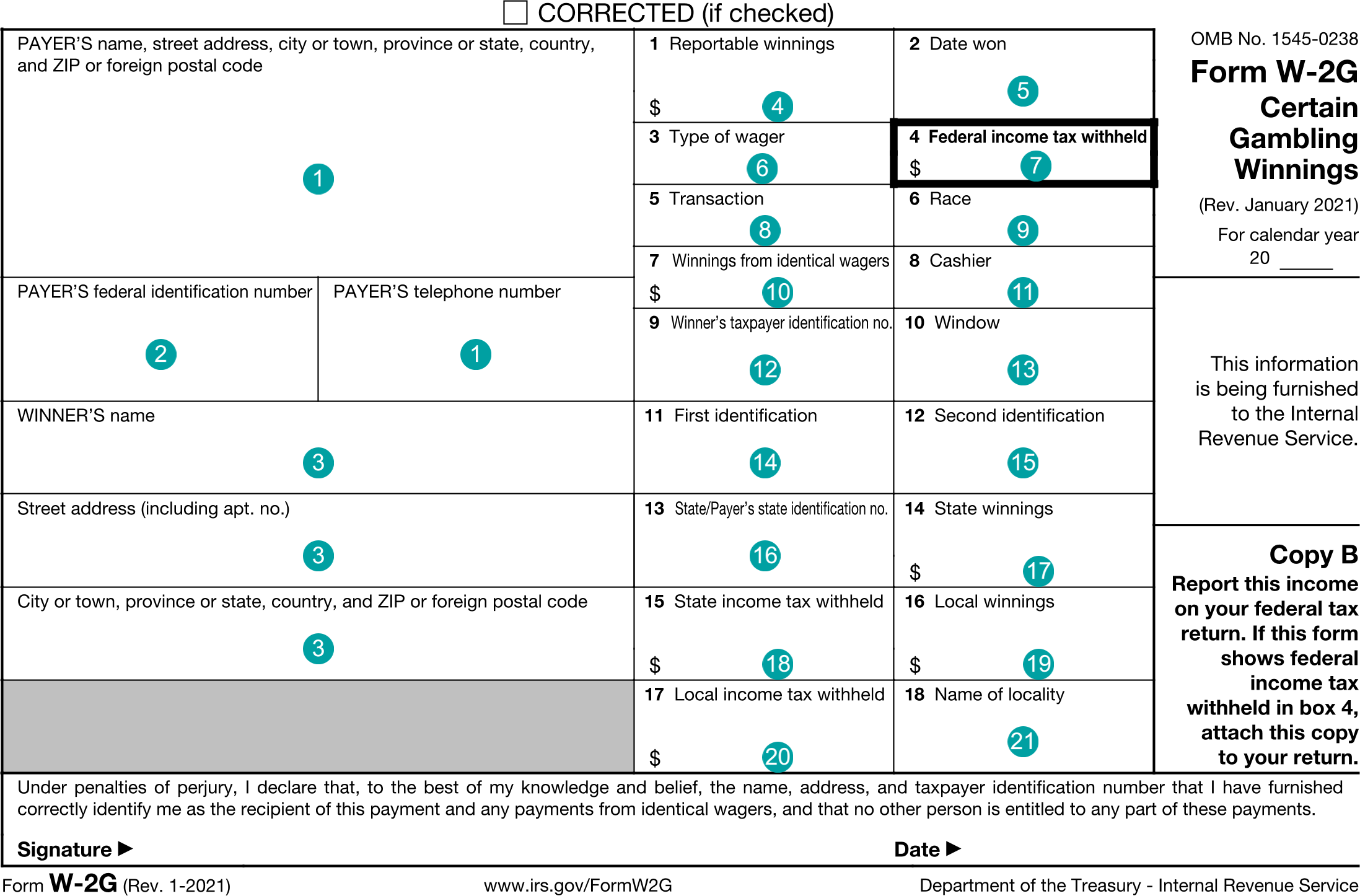

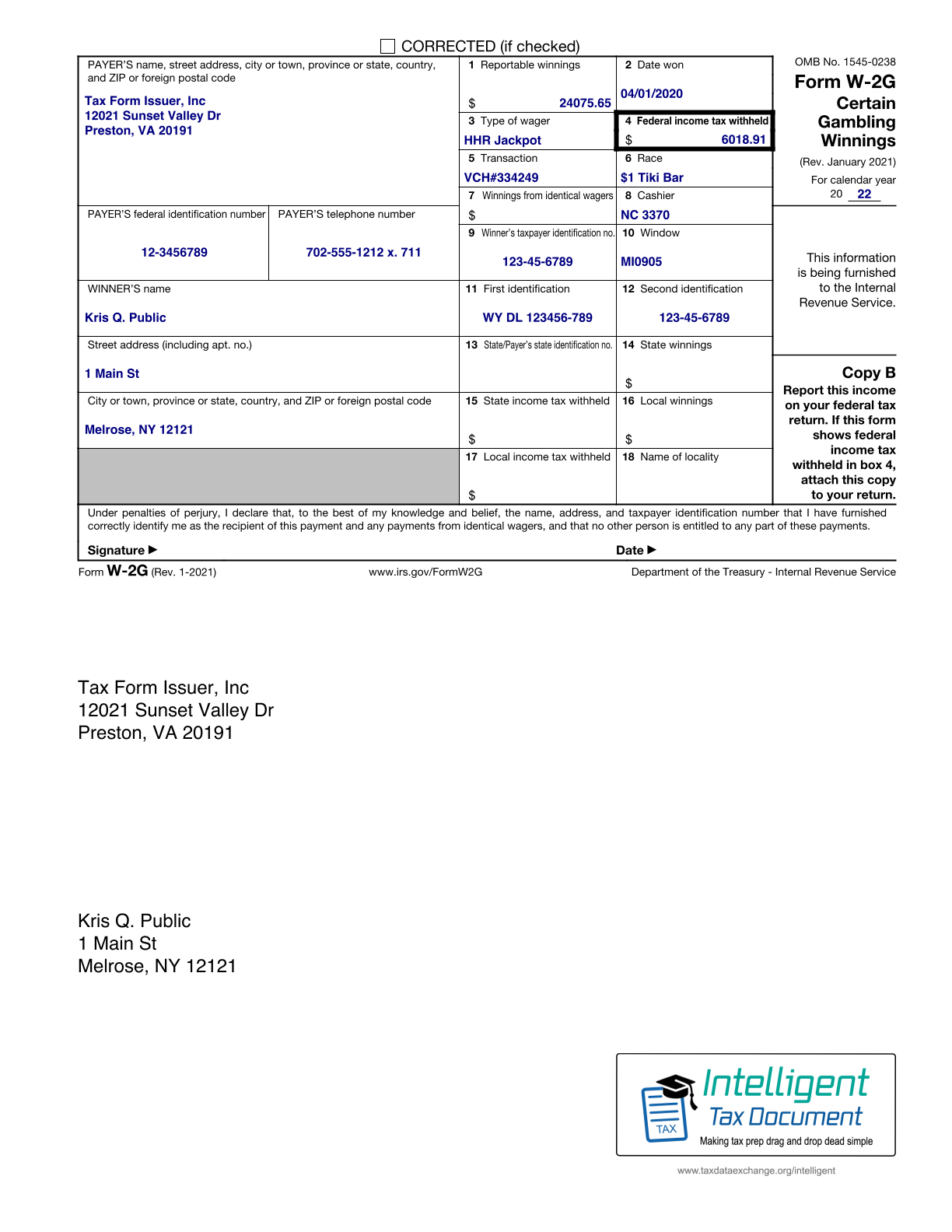

Example Form PDF

Example Form JSON

{

"taxW2G" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "TaxW2G",

"payerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "7025551212",

"extension" : "711"

}

},

"payerTin" : "12-3456789",

"winnerNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"name1" : "Kris Q. Public"

},

"winnings" : 24075.65,

"dateWon" : "2020-04-01",

"typeOfWager" : "HHR Jackpot",

"federalTaxWithheld" : 6018.91,

"transaction" : "VCH#334249",

"race" : "$1 Tiki Bar",

"cashier" : "NC 3370",

"winnerTin" : "123-45-6789",

"window" : "MI0905",

"firstId" : "WY DL 123456-789",

"secondId" : "123-45-6789"

}

}

Example Form JSON for QR Code Purposes

Example Form PDF with QR Code

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"taxFormDate": "2021-03-30",

"taxFormType": "TaxW2G",

"payerNameAddress.line1": "12021 Sunset Valley Dr",

"payerNameAddress.city": "Preston",

"payerNameAddress.state": "VA",

"payerNameAddress.postalCode": "20191",

"payerNameAddress.name1": "Tax Form Issuer, Inc",

"payerNameAddress.phone.number": "7025551212",

"payerNameAddress.phone.extension": "711",

"payerTin": "12-3456789",

"winnerNameAddress.line1": "1 Main St",

"winnerNameAddress.city": "Melrose",

"winnerNameAddress.state": "NY",

"winnerNameAddress.postalCode": "12121",

"winnerNameAddress.name1": "Kris Q. Public",

"winnings": "24075.65",

"dateWon": "2020-04-01",

"typeOfWager": "HHR Jackpot",

"federalTaxWithheld": "6018.91",

"transaction": "VCH#334249",

"race": "$1 Tiki Bar",

"cashier": "NC 3370",

"winnerTin": "123-45-6789",

"window": "MI0905",

"firstId": "WY DL 123456-789",

"secondId": "123-45-6789"

}

Issuer Instructions