Tax Documents

Tax1099K

FDX / Data Structures / Tax1099K

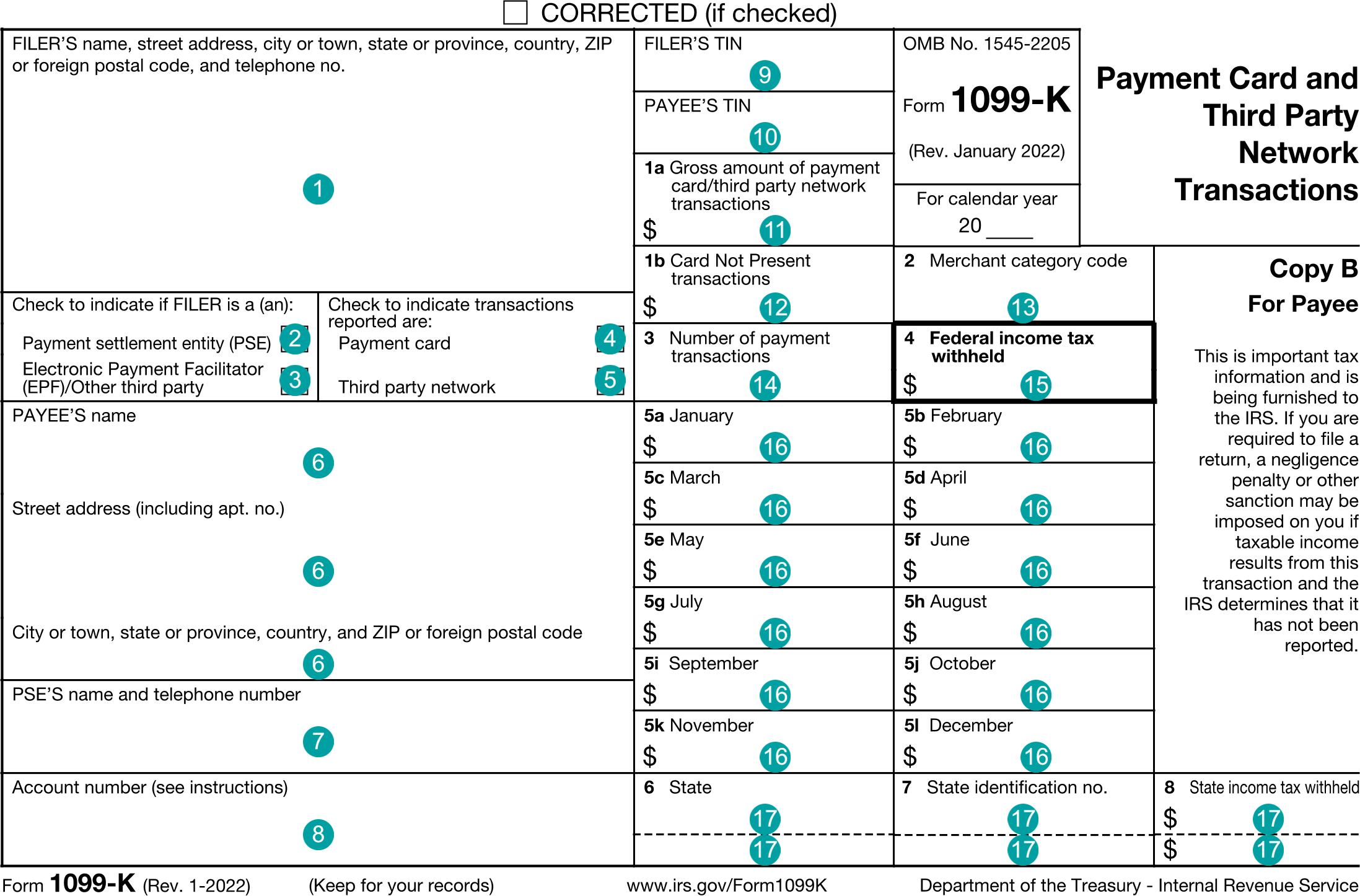

Form 1099-K, Merchant Card and Third-Party Network Payments

Extends and inherits all fields from Tax

Tax1099K Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | filerNameAddress | NameAddressPhone | Filer's name, address, and phone |

| 2 | paymentSettlementEntity | boolean | Check to indicate if FILER is a Payment Settlement Entity (PSE) |

| 3 | electronicPaymentFacilitator | boolean | Check to indicate if FILER is an Electronic Payment Facilitator (EPF) / Other third party |

| 4 | paymentCard | boolean | Check to indicate transactions reported are: Payment card |

| 5 | thirdPartyNetwork | boolean | Check to indicate transactions reported are: Third party network |

| 6 | payeeNameAddress | NameAddress | Payee's name and address |

| 7 | pseName | string | PSE's name |

| 8 | accountNumber | string | Account number |

| 9 | filerTin | string | FILER'S TIN |

| 10 | payeeTin | string | PAYEE'S TIN |

| 11 | grossAmount | number (double) | Box 1a, Gross amount of payment card/third party network transactions |

| 12 | cardNotPresent | number (double) | Box 1b, Card Not Present Transactions |

| 13 | merchantCategoryCode | string | Box 2, Merchant category code |

| 14 | numberOfTransactions | number (double) | Box 3, Number of purchase transactions |

| 15 | federalTaxWithheld | number (double) | Box 4, Federal income tax withheld |

| 16 | monthAmounts | Array of MonthAmount | Box 5, Monthly amounts |

| 17 | stateTaxWithholding | Array of StateTaxWithholding | Boxes 6-8, State tax withholding |

| 18 | psePhone | TelephoneNumberPlusExtension | PSE's phone number |

| 19 | secondTinNotice | boolean | Second TIN Notice |

Tax1099K Usage:

- TaxData tax1099K

FDX Data Structure as JSON

{

"tax1099K" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"filerNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"phone" : {

"type" : "HOME",

"country" : "string",

"number" : "string",

"extension" : "string"

}

},

"paymentSettlementEntity" : true,

"electronicPaymentFacilitator" : true,

"paymentCard" : true,

"thirdPartyNetwork" : true,

"payeeNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"pseName" : "string",

"accountNumber" : "string",

"filerTin" : "string",

"payeeFederalId" : "string",

"grossAmount" : 0.0,

"cardNotPresent" : 0.0,

"merchantCategoryCode" : "string",

"numberOfTransactions" : 0.0,

"federalTaxWithheld" : 0.0,

"monthAmounts" : [ {

"month" : "JAN",

"amount" : 0.0

} ],

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 0.0,

"state" : "string",

"stateTaxId" : "string",

"stateIncome" : 0.0

} ],

"psePhone" : {

"type" : "HOME",

"country" : "string",

"number" : "string",

"extension" : "string"

},

"secondTinNotice" : true

}

}

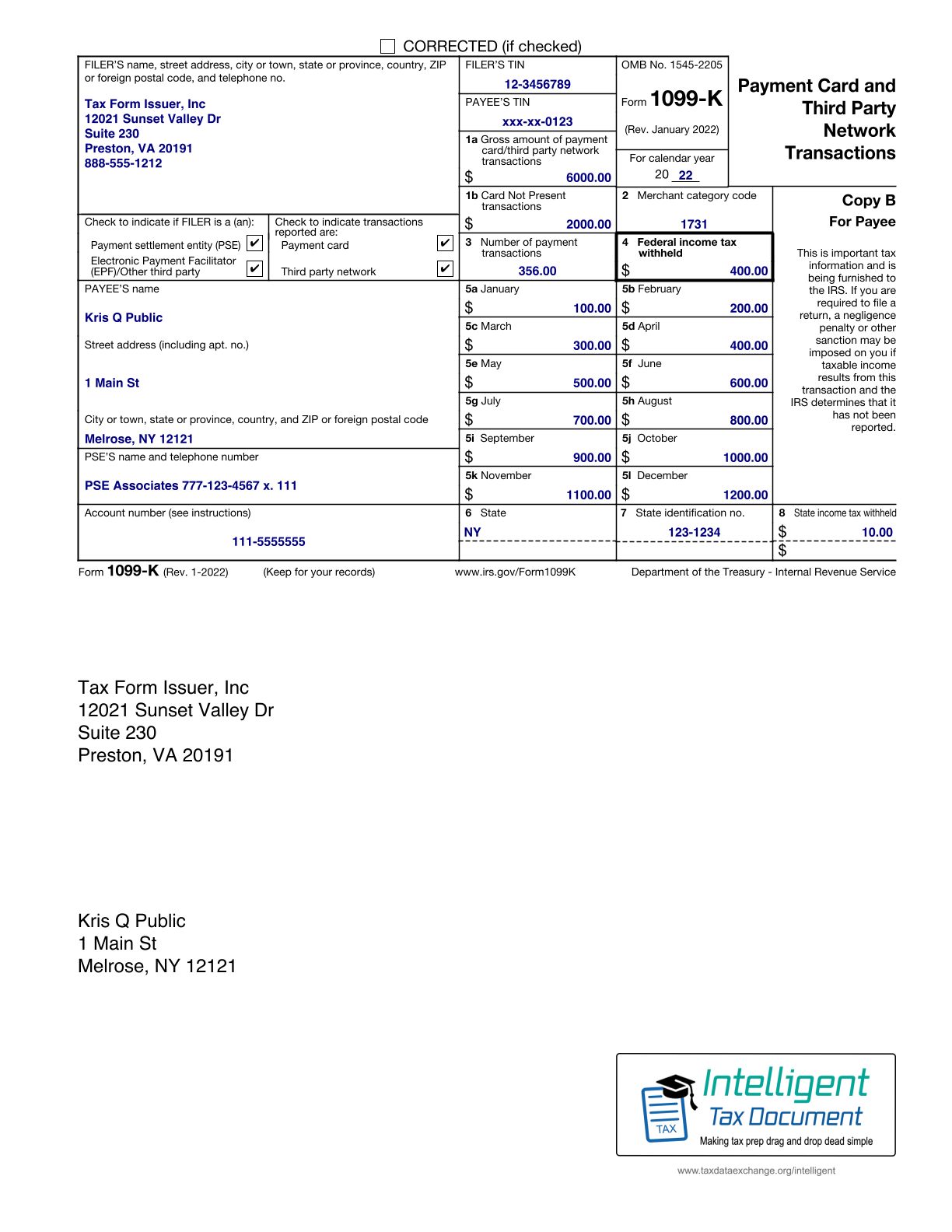

Example Form PDF

Example Form JSON

{

"tax1099K" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1099K",

"filerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"paymentSettlementEntity" : true,

"electronicPaymentFacilitator" : true,

"paymentCard" : true,

"thirdPartyNetwork" : true,

"payeeNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q Public"

},

"pseName" : "PSE Associates",

"accountNumber" : "111-5555555",

"filerTin" : "12-3456789",

"payeeTin" : "xxx-xx-0123",

"grossAmount" : 6000.0,

"cardNotPresent" : 2000.0,

"merchantCategoryCode" : "1731",

"numberOfTransactions" : 356.0,

"federalTaxWithheld" : 400.0,

"monthAmounts" : [ {

"month" : "JAN",

"amount" : 100.0

}, {

"month" : "FEB",

"amount" : 200.0

}, {

"month" : "MAR",

"amount" : 300.0

}, {

"month" : "APR",

"amount" : 400.0

}, {

"month" : "MAY",

"amount" : 500.0

}, {

"month" : "JUN",

"amount" : 600.0

}, {

"month" : "JUL",

"amount" : 700.0

}, {

"month" : "AUG",

"amount" : 800.0

}, {

"month" : "SEP",

"amount" : 900.0

}, {

"month" : "OCT",

"amount" : 1000.0

}, {

"month" : "NOV",

"amount" : 1100.0

}, {

"month" : "DEC",

"amount" : 1200.0

} ],

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 10.0,

"state" : "NY",

"stateTaxId" : "123-1234",

"stateIncome" : 100.0

} ],

"psePhone" : {

"number" : "7771234567",

"extension" : "111"

}

}

}

Example Form JSON for QR Code Purposes

Example Form PDF with QR Code

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"taxFormDate": "2021-03-30",

"taxFormType": "Tax1099K",

"filerNameAddress.line1": "12021 Sunset Valley Dr",

"filerNameAddress.line2": "Suite 230",

"filerNameAddress.city": "Preston",

"filerNameAddress.state": "VA",

"filerNameAddress.postalCode": "20191",

"filerNameAddress.country": "US",

"filerNameAddress.name1": "Tax Form Issuer, Inc",

"filerNameAddress.phone.number": "8885551212",

"paymentSettlementEntity": "true",

"electronicPaymentFacilitator": "true",

"paymentCard": "true",

"thirdPartyNetwork": "true",

"payeeNameAddress.line1": "1 Main St",

"payeeNameAddress.city": "Melrose",

"payeeNameAddress.state": "NY",

"payeeNameAddress.postalCode": "12121",

"payeeNameAddress.country": "US",

"payeeNameAddress.name1": "Kris Q Public",

"pseName": "PSE Associates",

"accountNumber": "111-5555555",

"filerTin": "12-3456789",

"payeeTin": "xxx-xx-0123",

"grossAmount": "6000.0",

"cardNotPresent": "2000.0",

"merchantCategoryCode": "1731",

"numberOfTransactions": "356.0",

"federalTaxWithheld": "400.0",

"monthAmounts-1.month": "JAN",

"monthAmounts-1.amount": "100.0",

"monthAmounts-2.month": "FEB",

"monthAmounts-2.amount": "200.0",

"monthAmounts-3.month": "MAR",

"monthAmounts-3.amount": "300.0",

"monthAmounts-4.month": "APR",

"monthAmounts-4.amount": "400.0",

"monthAmounts-5.month": "MAY",

"monthAmounts-5.amount": "500.0",

"monthAmounts-6.month": "JUN",

"monthAmounts-6.amount": "600.0",

"monthAmounts-7.month": "JUL",

"monthAmounts-7.amount": "700.0",

"monthAmounts-8.month": "AUG",

"monthAmounts-8.amount": "800.0",

"monthAmounts-9.month": "SEP",

"monthAmounts-9.amount": "900.0",

"monthAmounts-10.month": "OCT",

"monthAmounts-10.amount": "1000.0",

"monthAmounts-11.month": "NOV",

"monthAmounts-11.amount": "1100.0",

"monthAmounts-12.month": "DEC",

"monthAmounts-12.amount": "1200.0",

"stateTaxWithholding-1.stateTaxWithheld": "10.0",

"stateTaxWithholding-1.state": "NY",

"stateTaxWithholding-1.stateTaxId": "123-1234",

"stateTaxWithholding-1.stateIncome": "100.0",

"psePhone.number": "7771234567",

"psePhone.extension": "111"

}

Issuer Instructions