Tax Documents

Tax1099Misc

FDX / Data Structures / Tax1099Misc

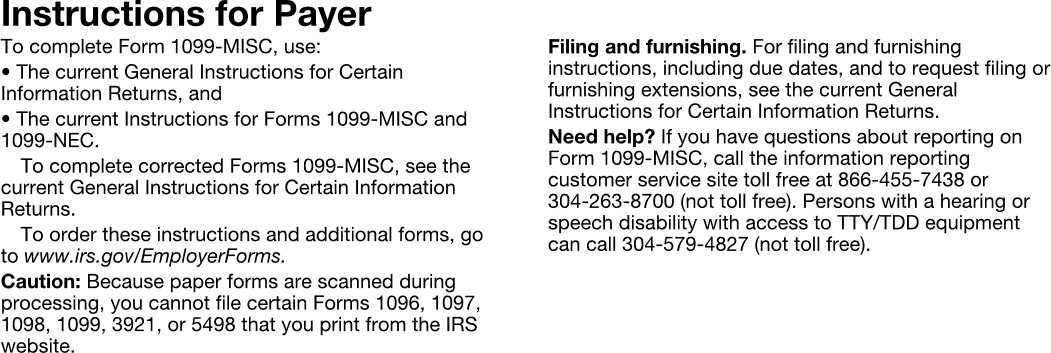

Form 1099-MISC, Miscellaneous Income

Extends and inherits all fields from Tax

Tax1099Misc Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | payerNameAddress | NameAddressPhone | PAYER'S name, address, and phone |

| 2 | payerTin | string | PAYER'S TIN |

| 3 | recipientTin | string | RECIPIENT'S TIN |

| 4 | recipientNameAddress | NameAddress | RECIPIENT'S name and address |

| 5 | accountNumber | string | Account number |

| 6 | foreignAccountTaxCompliance | boolean | FATCA filing requirement |

| 7 | rents | number (double) | Box 1, Rents |

| 8 | royalties | number (double) | Box 2, Royalties |

| 9 | otherIncome | number (double) | Box 3, Other income |

| 10 | federalTaxWithheld | number (double) | Box 4, Federal income tax withheld |

| 11 | fishingBoatProceeds | number (double) | Box 5, Fishing boat proceeds |

| 12 | medicalHealthPayment | number (double) | Box 6, Medical and health care payments |

| 13 | nonEmployeeCompensation | number (double) | 2019 Box 7, Nonemployee compensation (IRS removed 2020) |

| 14 | payerDirectSales | boolean | Box 7, Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale |

| 15 | substitutePayments | number (double) | Box 8, Substitute payments in lieu of dividends or interest |

| 16 | cropInsurance | number (double) | Box 9, Crop insurance proceeds |

| 17 | secondTinNotice | boolean | Second TIN Notice |

| 18 | grossAttorney | number (double) | Box 10, Gross proceeds paid to an attorney |

| 19 | fishPurchased | number (double) | Box 11, Fish purchased for resale |

| 20 | section409ADeferrals | number (double) | Box 12, Section 409A deferrals |

| 21 | section409AIncome | number (double) | 2019 Box 15b, Section 409A income (IRS removed 2020) |

| 22 | excessGolden | number (double) | Box 13, Excess golden parachute payments |

| 23 | nonQualifiedDeferredCompensation | number (double) | Box 14, Nonqualified Deferred Compensation |

| 24 | stateTaxWithholding | Array of StateTaxWithholding | Boxes 16-18, State tax withholding |

Tax1099Misc Usage:

- TaxData tax1099Misc

FDX Data Structure as JSON

{

"tax1099Misc" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"payerNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"phone" : {

"type" : "HOME",

"country" : "string",

"number" : "string",

"extension" : "string"

}

},

"payerTin" : "string",

"recipientTin" : "string",

"recipientNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"accountNumber" : "string",

"foreignAccountTaxCompliance" : true,

"rents" : 0.0,

"royalties" : 0.0,

"otherIncome" : 0.0,

"federalTaxWithheld" : 0.0,

"fishingBoatProceeds" : 0.0,

"medicalHealthPayment" : 0.0,

"nonEmployeeCompensation" : 0.0,

"payerDirectSales" : true,

"substitutePayments" : 0.0,

"cropInsurance" : 0.0,

"grossAttorney" : 0.0,

"section409ADeferrals" : 0.0,

"section409AIncome" : 0.0,

"excessGolden" : 0.0,

"nonQualifiedDeferredCompensation" : 0.0,

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 0.0,

"state" : "string",

"stateTaxId" : "string",

"stateIncome" : 0.0

} ]

}

}

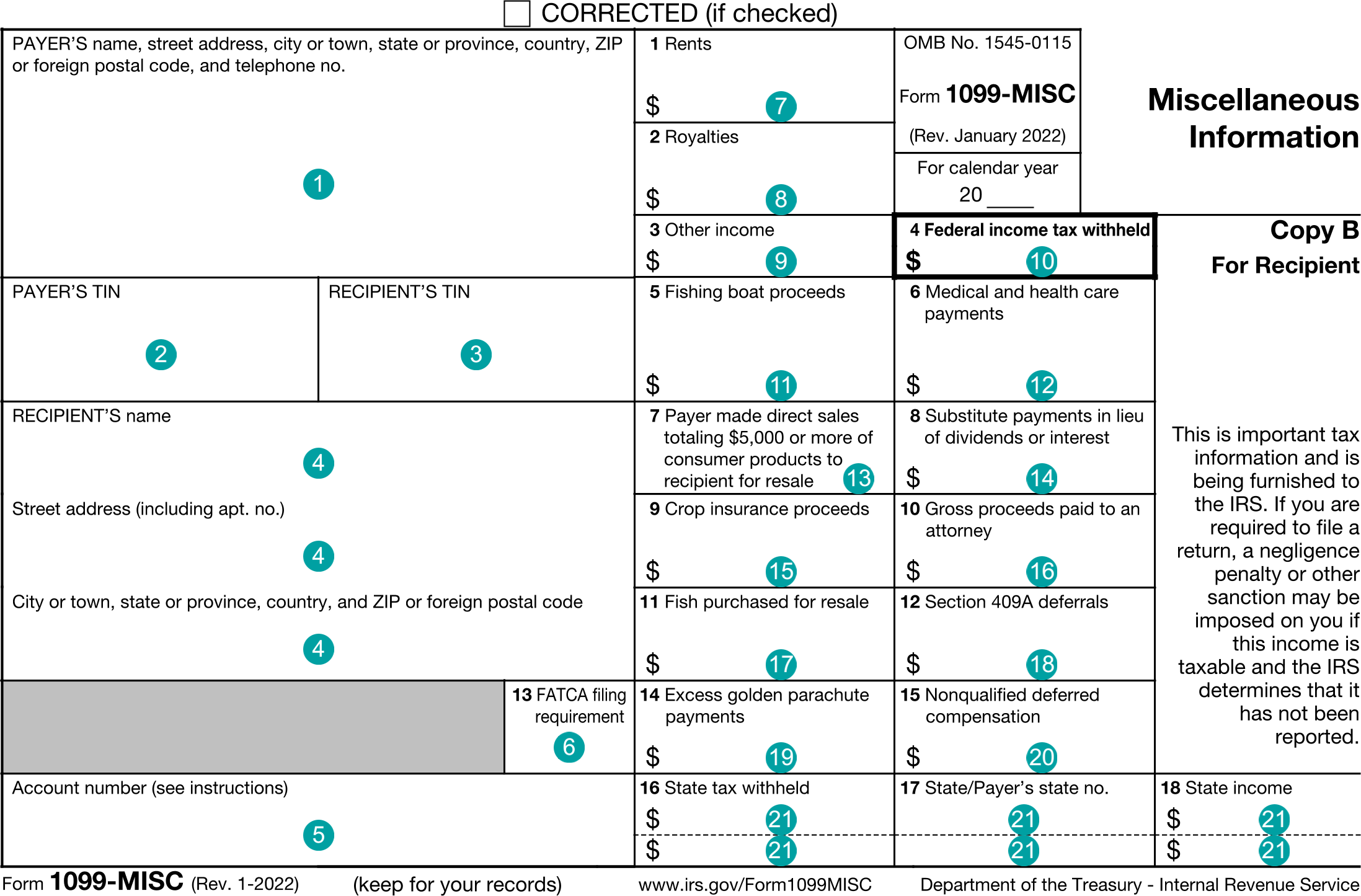

Example Form PDF

Example Form JSON

{

"tax1099Misc" : {

"taxYear" : 2021,

"taxFormDate" : "2022-02-01",

"additionalInformation" : "FDX v5.0",

"taxFormType" : "Tax1099Misc",

"payerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"payerTin" : "12-3456789",

"recipientTin" : "xxx-xx-1234",

"recipientNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q Public"

},

"accountNumber" : "111-5555555",

"foreignAccountTaxCompliance" : false,

"rents" : 1007.0,

"royalties" : 2008.0,

"otherIncome" : 3009.0,

"federalTaxWithheld" : 4010.0,

"fishingBoatProceeds" : 5011.0,

"medicalHealthPayment" : 6012.0,

"payerDirectSales" : true,

"substitutePayments" : 8015.0,

"cropInsurance" : 9016.0,

"secondTinNotice" : false,

"grossAttorney" : 10017.0,

"fishPurchased" : 11017.5,

"section409ADeferrals" : 12018.0,

"excessGolden" : 13020.0,

"nonQualifiedDeferredCompensation" : 14021.0,

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 15022.0,

"state" : "NY",

"stateTaxId" : "xxx-16022",

"stateIncome" : 17022.0

} ]

}

}

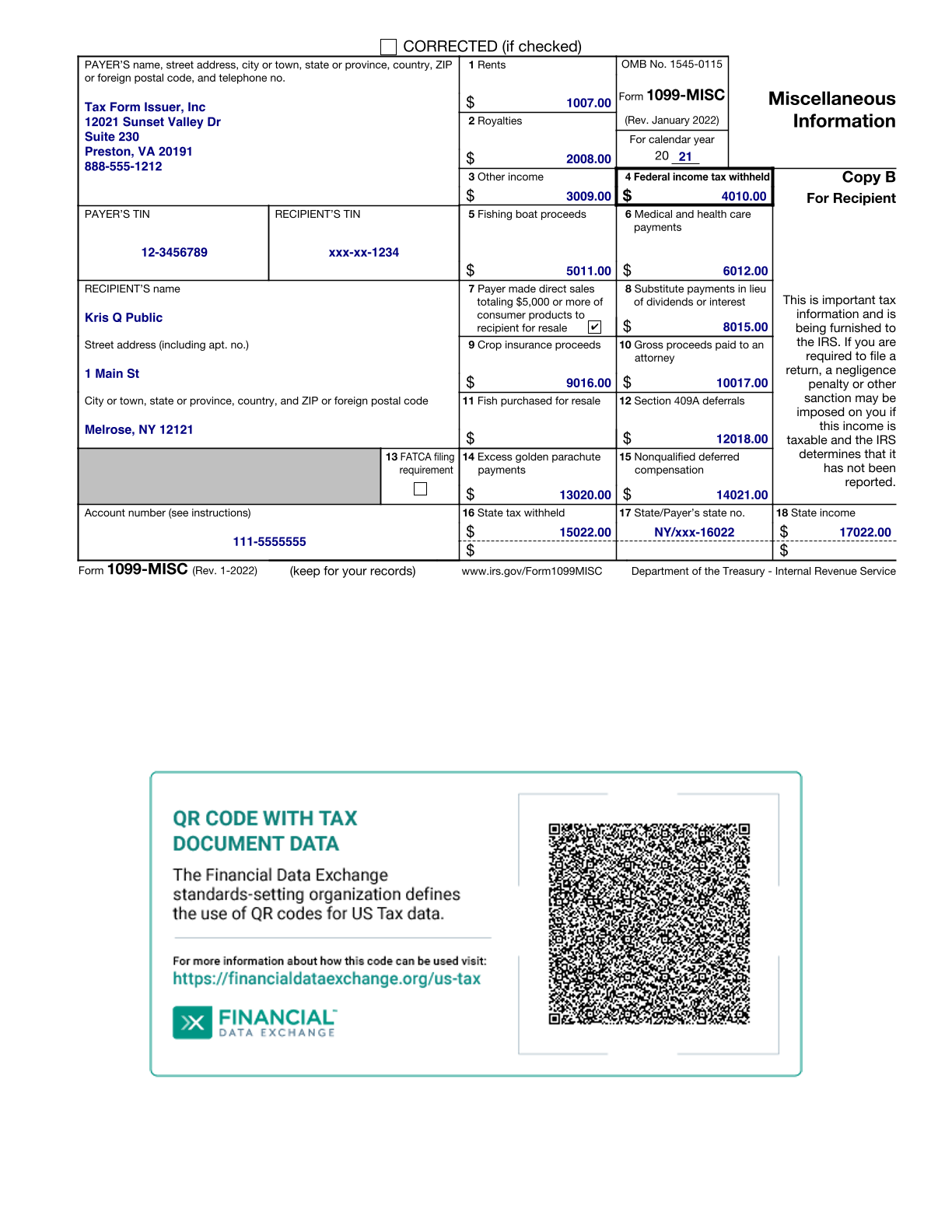

Example Form JSON for QR Code Purposes

Example Form PDF with QR Code

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2021",

"taxFormDate": "2022-02-01",

"additionalInformation": "FDX v5.0",

"taxFormType": "Tax1099Misc",

"payerNameAddress.line1": "12021 Sunset Valley Dr",

"payerNameAddress.line2": "Suite 230",

"payerNameAddress.city": "Preston",

"payerNameAddress.state": "VA",

"payerNameAddress.postalCode": "20191",

"payerNameAddress.country": "US",

"payerNameAddress.name1": "Tax Form Issuer, Inc",

"payerNameAddress.phone.number": "8885551212",

"payerTin": "12-3456789",

"recipientTin": "xxx-xx-1234",

"recipientNameAddress.line1": "1 Main St",

"recipientNameAddress.city": "Melrose",

"recipientNameAddress.state": "NY",

"recipientNameAddress.postalCode": "12121",

"recipientNameAddress.country": "US",

"recipientNameAddress.name1": "Kris Q Public",

"accountNumber": "111-5555555",

"foreignAccountTaxCompliance": "false",

"rents": "1007.0",

"royalties": "2008.0",

"otherIncome": "3009.0",

"federalTaxWithheld": "4010.0",

"fishingBoatProceeds": "5011.0",

"medicalHealthPayment": "6012.0",

"payerDirectSales": "true",

"substitutePayments": "8015.0",

"cropInsurance": "9016.0",

"secondTinNotice": "false",

"grossAttorney": "10017.0",

"fishPurchased": "11017.5",

"section409ADeferrals": "12018.0",

"excessGolden": "13020.0",

"nonQualifiedDeferredCompensation": "14021.0",

"stateTaxWithholding-1.stateTaxWithheld": "15022.0",

"stateTaxWithholding-1.state": "NY",

"stateTaxWithholding-1.stateTaxId": "xxx-16022",

"stateTaxWithholding-1.stateIncome": "17022.0"

}

Issuer Instructions