Tax Documents

Tax1099Patr

FDX / Data Structures / Tax1099Patr

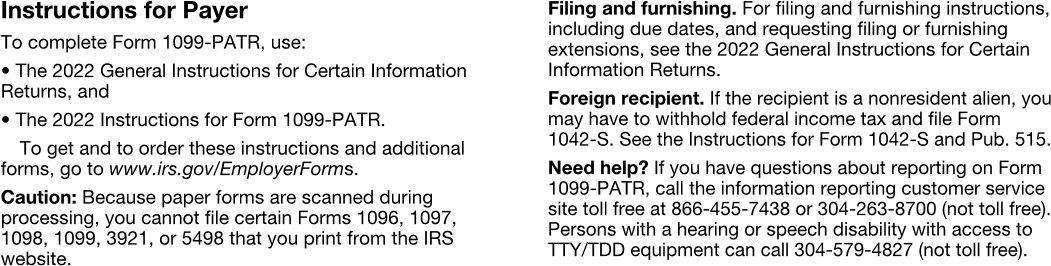

Form 1099-PATR, Taxable Distributions Received From Cooperatives

Extends and inherits all fields from Tax

Tax1099Patr Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | payerNameAddress | NameAddressPhone | Payer's name, address, and phone |

| 2 | payerTin | string | PAYER'S TIN |

| 3 | recipientTin | string | RECIPIENT'S TIN |

| 4 | recipientNameAddress | NameAddress | Recipient's name and address |

| 5 | accountNumber | string | Account number |

| 6 | patronageDividends | number (double) | Box 1, Patronage dividends |

| 7 | nonpatronageDistributions | number (double) | Box 2, Nonpatronage distributions |

| 8 | perUnitRetainAllocations | number (double) | Box 3, Per-unit retain allocations |

| 9 | federalTaxWithheld | number (double) | Box 4, Federal income tax withheld |

| 10 | redemption | number (double) | Box 5, Redemption of nonqualified notices and retain allocations |

| 11 | dpaDeduction | number (double) | 2019 Box 6, Domestic production activities deduction (IRS removed 2020) |

| 12 | section199Deduction | number (double) | Box 6, Section 199A(g) deduction |

| 13 | qualifiedPayments | number (double) | Box 7, Qualified payments |

| 14 | section199QualifiedItems | number (double) | Box 8, Section 199A(a) qualified items |

| 15 | section199SstbItems | number (double) | Box 9, Section 199A(a) SSTB (Specified Service Trade or Business) items |

| 16 | investmentCredit | number (double) | Box 10, Investment credit |

| 17 | workOpportunityCredit | number (double) | Box 11, Work opportunity credit |

| 18 | patronsAmtAdjustment | number (double) | 2019 Box 10, Patron's AMT adjustment (IRS removed 2020) |

| 19 | otherCreditsAndDeductions | number (double) | Box 12, Other credits and deductions |

| 20 | specifiedCoop | boolean | Box 13, Specified Cooperative |

| 21 | secondTinNotice | boolean | Second TIN Notice |

Tax1099Patr Usage:

- TaxData tax1099Patr

FDX Data Structure as JSON

{

"tax1099Patr" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"payerNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"phone" : {

"type" : "HOME",

"country" : "string",

"number" : "string",

"extension" : "string"

}

},

"payerTin" : "string",

"recipientTin" : "string",

"recipientNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"accountNumber" : "string",

"patronageDividends" : 0.0,

"nonpatronageDistributions" : 0.0,

"perUnitRetainAllocations" : 0.0,

"federalTaxWithheld" : 0.0,

"redemption" : 0.0,

"dpaDeduction" : 0.0,

"section199Deduction" : 0.0,

"qualifiedPayments" : 0.0,

"section199QualifiedItems" : 0.0,

"section199SstbItems" : 0.0,

"investmentCredit" : 0.0,

"workOpportunityCredit" : 0.0,

"patronsAmtAdjustment" : 0.0,

"otherCreditsAndDeductions" : 0.0,

"specifiedCoop" : true,

"secondTinNotice" : true

}

}

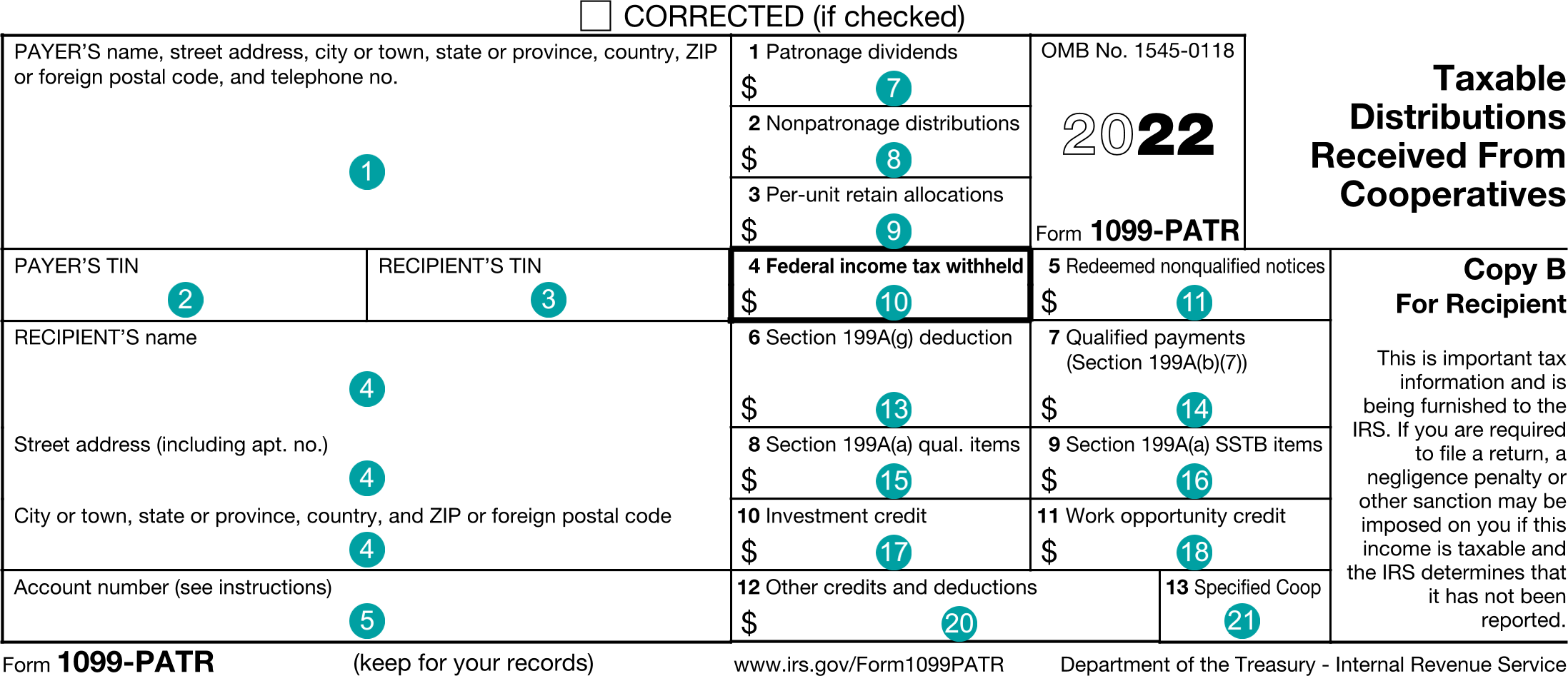

Example Form PDF

Example Form JSON

{

"tax1099Patr" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1099Patr",

"payerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"payerTin" : "12-3456789",

"recipientTin" : "xxx-xx-1234",

"recipientNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q Public"

},

"accountNumber" : "111-5555555",

"patronageDividends" : 10000.0,

"nonpatronageDistributions" : 2000.0,

"perUnitRetainAllocations" : 3000.0,

"federalTaxWithheld" : 400.0,

"redemption" : 500.0,

"dpaDeduction" : 600.0,

"qualifiedPayments" : 700.0,

"investmentCredit" : 800.0,

"workOpportunityCredit" : 900.0,

"patronsAmtAdjustment" : 1000.0,

"otherCreditsAndDeductions" : 110.0

}

}

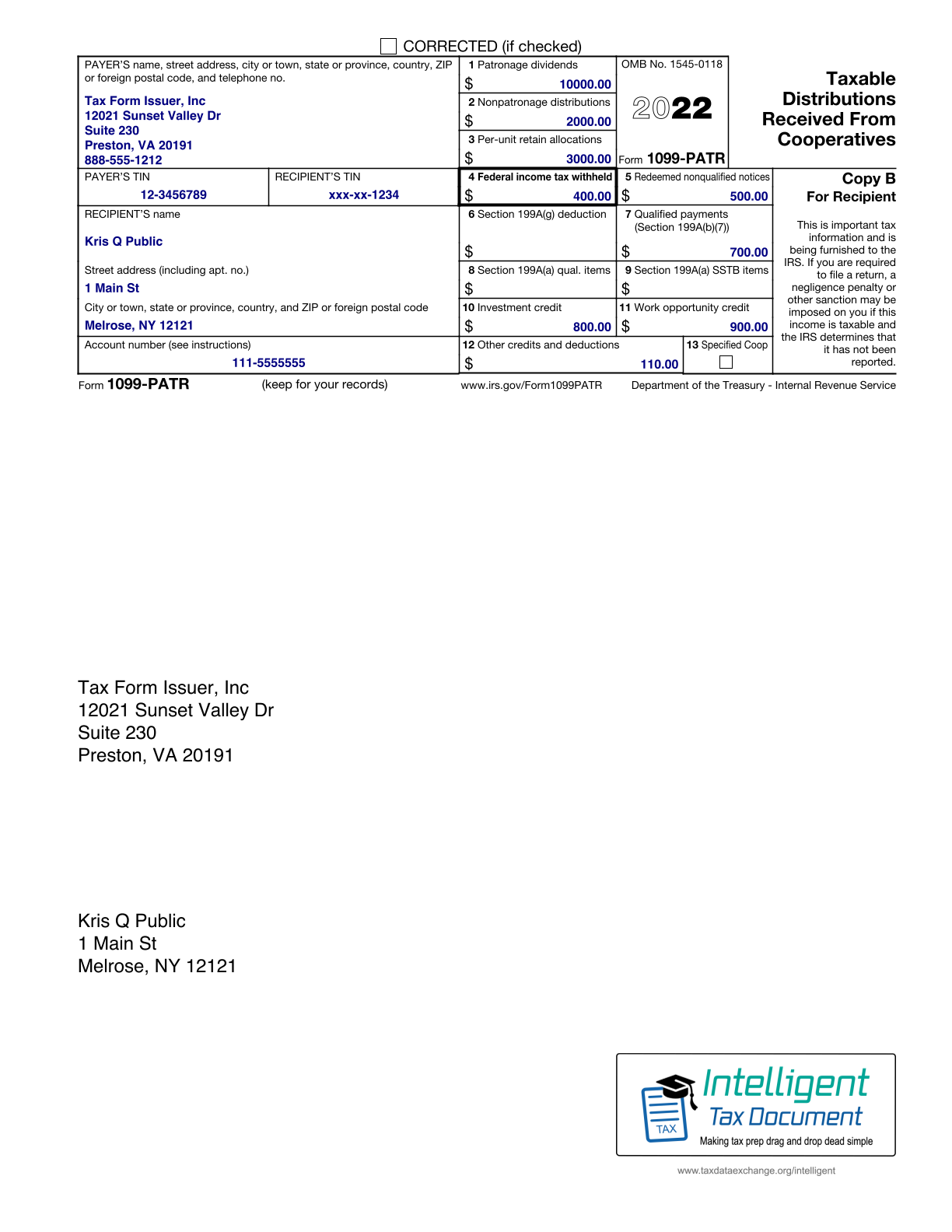

Example Form JSON for QR Code Purposes

Example Form PDF with QR Code

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"taxFormDate": "2021-03-30",

"taxFormType": "Tax1099Patr",

"payerNameAddress.line1": "12021 Sunset Valley Dr",

"payerNameAddress.line2": "Suite 230",

"payerNameAddress.city": "Preston",

"payerNameAddress.state": "VA",

"payerNameAddress.postalCode": "20191",

"payerNameAddress.country": "US",

"payerNameAddress.name1": "Tax Form Issuer, Inc",

"payerNameAddress.phone.number": "8885551212",

"payerTin": "12-3456789",

"recipientTin": "xxx-xx-1234",

"recipientNameAddress.line1": "1 Main St",

"recipientNameAddress.city": "Melrose",

"recipientNameAddress.state": "NY",

"recipientNameAddress.postalCode": "12121",

"recipientNameAddress.country": "US",

"recipientNameAddress.name1": "Kris Q Public",

"accountNumber": "111-5555555",

"patronageDividends": "10000.0",

"nonpatronageDistributions": "2000.0",

"perUnitRetainAllocations": "3000.0",

"federalTaxWithheld": "400.0",

"redemption": "500.0",

"dpaDeduction": "600.0",

"qualifiedPayments": "700.0",

"investmentCredit": "800.0",

"workOpportunityCredit": "900.0",

"patronsAmtAdjustment": "1000.0",

"otherCreditsAndDeductions": "110.0"

}

Issuer Instructions