Tax Documents

Tax1099Oid

FDX / Data Structures / Tax1099Oid

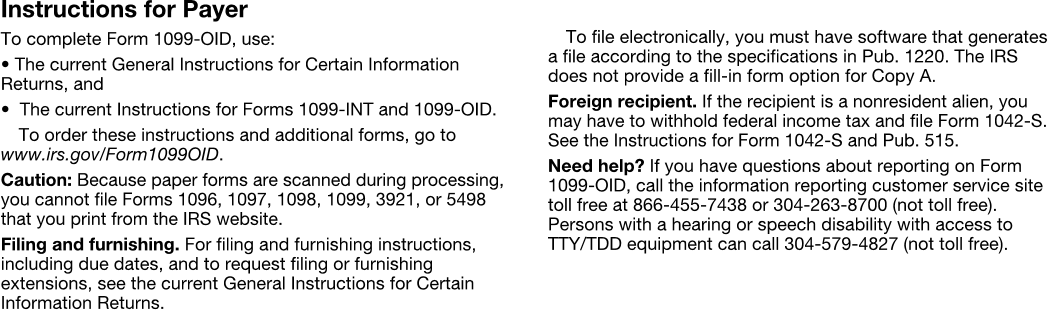

Form 1099-OID, Original Issue Discount

Extends and inherits all fields from Tax

Tax1099Oid Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | payerNameAddress | NameAddressPhone | Payer's name, address, and phone |

| 2 | payerTin | string | Payer's TIN |

| 3 | recipientTin | string | Recipient's TIN |

| 4 | recipientNameAddress | NameAddress | Recipient's name and address |

| 5 | foreignAccountTaxCompliance | boolean | FATCA filing requirement |

| 6 | accountNumber | string | Account number |

| 7 | originalIssueDiscount | number (double) | Box 1, Original issue discount |

| 8 | otherPeriodicInterest | number (double) | Box 2, Other periodic interest |

| 9 | earlyWithdrawalPenalty | number (double) | Box 3, Early withdrawal penalty |

| 10 | federalTaxWithheld | number (double) | Box 4, Federal income tax withheld |

| 11 | marketDiscount | number (double) | Box 5, Market discount |

| 12 | acquisitionPremium | number (double) | Box 6, Acquisition premium |

| 13 | oidDescription | string | Box 7, Description |

| 14 | discountOnTreasuryObligations | number (double) | Box 8, Original issue discount on U.S. Treasury obligations |

| 15 | investmentExpenses | number (double) | Box 9, Investment expenses |

| 16 | bondPremium | number (double) | Box 10, Bond premium |

| 17 | taxExemptOid | number (double) | Box 11, Tax-exempt OID |

| 18 | stateTaxWithholding | Array of StateTaxWithholding | Boxes 12-14, State tax withheld |

| 19 | stateExemptOid | Array of DescriptionAmount | Supplemental: State name and tax-exempt OID by state |

| 20 | secondTinNotice | boolean | Second TIN Notice |

Tax1099Oid Usage:

- TaxData tax1099Oid

FDX Data Structure as JSON

{

"tax1099Oid" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"payerNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"phone" : {

"type" : "HOME",

"country" : "string",

"number" : "string",

"extension" : "string"

}

},

"payerTin" : "string",

"recipientTin" : "string",

"recipientNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"foreignAccountTaxCompliance" : true,

"accountNumber" : "string",

"originalIssueDiscount" : 0.0,

"otherPeriodicInterest" : 0.0,

"earlyWithdrawalPenalty" : 0.0,

"federalTaxWithheld" : 0.0,

"marketDiscount" : 0.0,

"acquisitionPremium" : 0.0,

"oidDescription" : "string",

"discountOnTreasuryObligations" : 0.0,

"investmentExpenses" : 0.0,

"bondPremium" : 0.0,

"taxExemptOid" : 0.0,

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 0.0,

"state" : "string",

"stateTaxId" : "string",

"stateIncome" : 0.0

} ],

"stateExemptOid" : [ {

"description" : "string",

"amount" : 0.0

} ],

"secondTinNotice" : true

}

}

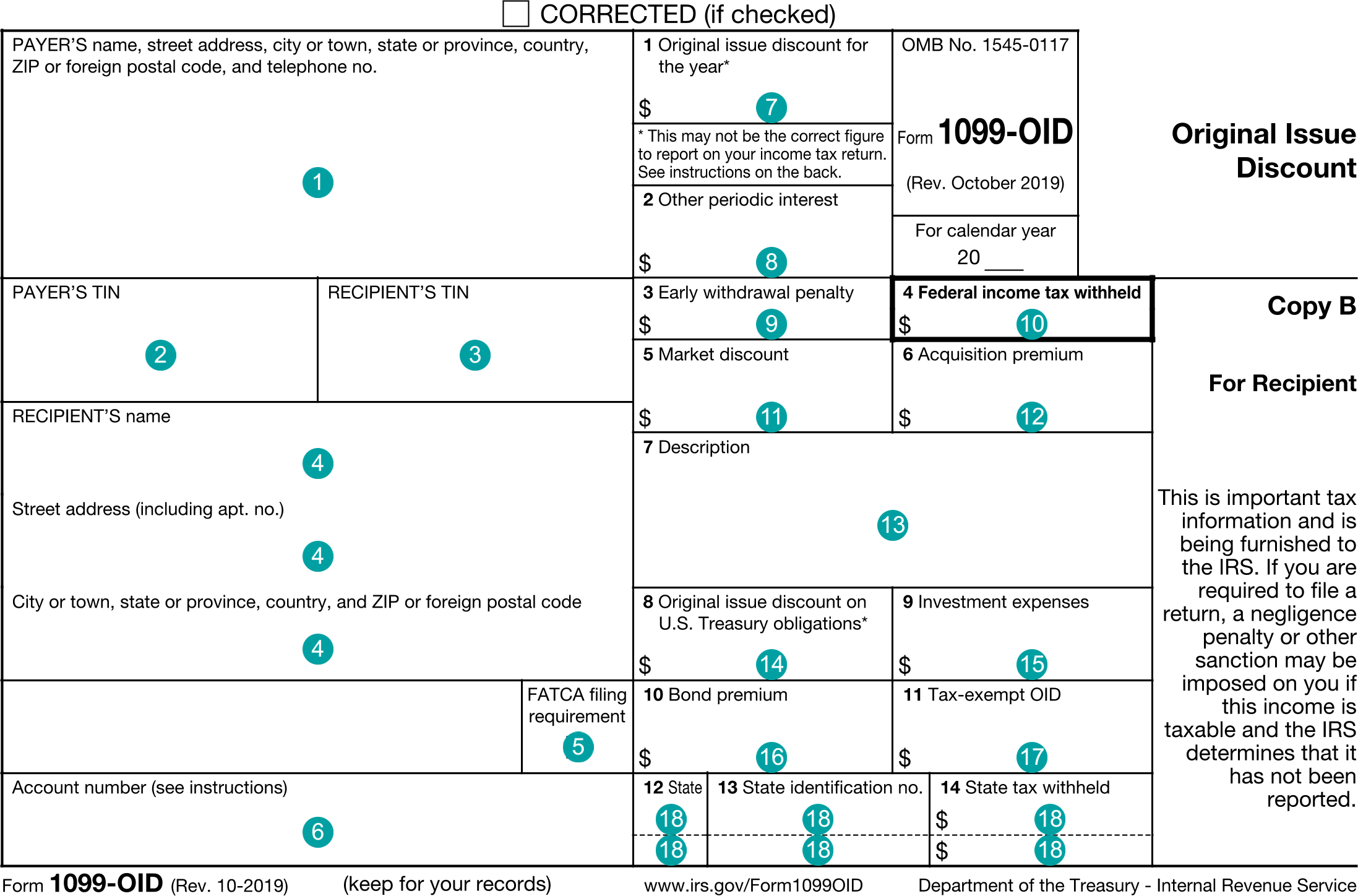

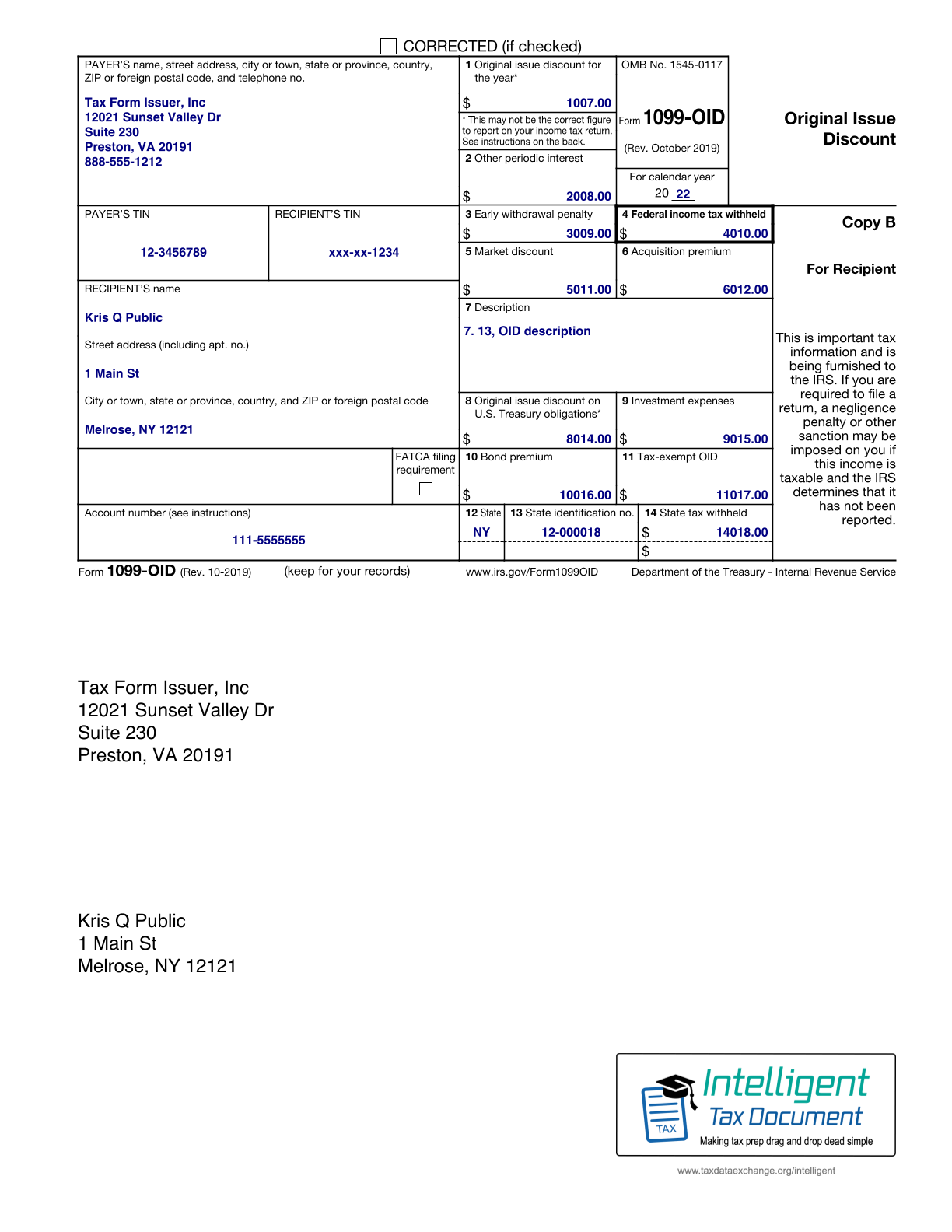

Example Form PDF

Example Form JSON

{

"tax1099Oid" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1099Oid",

"payerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"payerTin" : "12-3456789",

"recipientTin" : "xxx-xx-1234",

"recipientNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q Public"

},

"foreignAccountTaxCompliance" : false,

"accountNumber" : "111-5555555",

"originalIssueDiscount" : 1007.0,

"otherPeriodicInterest" : 2008.0,

"earlyWithdrawalPenalty" : 3009.0,

"federalTaxWithheld" : 4010.0,

"marketDiscount" : 5011.0,

"acquisitionPremium" : 6012.0,

"oidDescription" : "7. 13, OID description",

"discountOnTreasuryObligations" : 8014.0,

"investmentExpenses" : 9015.0,

"bondPremium" : 10016.0,

"taxExemptOid" : 11017.0,

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 14018.0,

"state" : "NY",

"stateTaxId" : "12-000018"

} ]

}

}

Example Form JSON for QR Code Purposes

Example Form PDF with QR Code

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"taxFormDate": "2021-03-30",

"taxFormType": "Tax1099Oid",

"payerNameAddress.line1": "12021 Sunset Valley Dr",

"payerNameAddress.line2": "Suite 230",

"payerNameAddress.city": "Preston",

"payerNameAddress.state": "VA",

"payerNameAddress.postalCode": "20191",

"payerNameAddress.country": "US",

"payerNameAddress.name1": "Tax Form Issuer, Inc",

"payerNameAddress.phone.number": "8885551212",

"payerTin": "12-3456789",

"recipientTin": "xxx-xx-1234",

"recipientNameAddress.line1": "1 Main St",

"recipientNameAddress.city": "Melrose",

"recipientNameAddress.state": "NY",

"recipientNameAddress.postalCode": "12121",

"recipientNameAddress.country": "US",

"recipientNameAddress.name1": "Kris Q Public",

"foreignAccountTaxCompliance": "false",

"accountNumber": "111-5555555",

"originalIssueDiscount": "1007.0",

"otherPeriodicInterest": "2008.0",

"earlyWithdrawalPenalty": "3009.0",

"federalTaxWithheld": "4010.0",

"marketDiscount": "5011.0",

"acquisitionPremium": "6012.0",

"oidDescription": "7. 13, OID description",

"discountOnTreasuryObligations": "8014.0",

"investmentExpenses": "9015.0",

"bondPremium": "10016.0",

"taxExemptOid": "11017.0",

"stateTaxWithholding-1.stateTaxWithheld": "14018.0",

"stateTaxWithholding-1.state": "NY",

"stateTaxWithholding-1.stateTaxId": "12-000018"

}

Issuer Instructions