Tax Documents

Tax1099R

FDX / Data Structures / Tax1099R

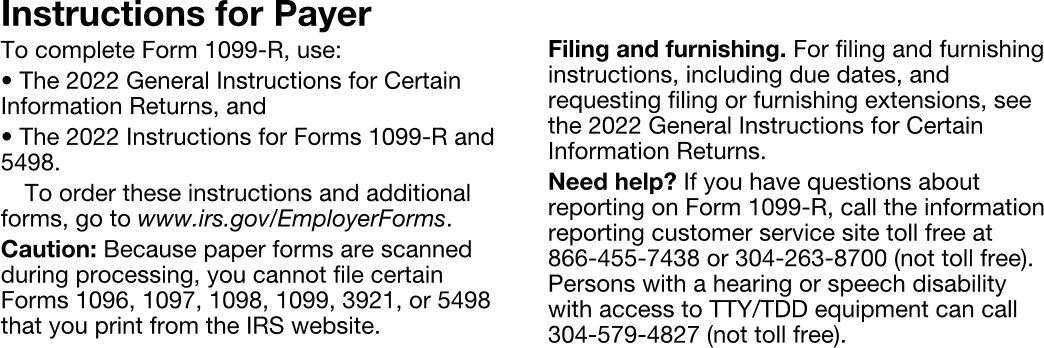

Form 1099-R, Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Extends and inherits all fields from Tax

Tax1099R Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | payerNameAddress | NameAddressPhone | Payer's name, address, and phone |

| 2 | payerTin | string | PAYER'S TIN |

| 3 | recipientTin | string | RECIPIENT'S TIN |

| 4 | recipientNameAddress | NameAddress | Recipient's name and address |

| 5 | allocableToIRR | number (double) | Box 10, Amount allocable to IRR within 5 years |

| 6 | firstYearOfRoth | integer | Box 11, First year of designated Roth |

| 7 | foreignAccountTaxCompliance | boolean | FATCA filing requirement |

| 8 | recipientAccountNumber | string | Account number |

| 9 | dateOfPayment | DateString | Date of payment |

| 10 | grossDistribution | number (double) | Box 1, Gross distribution |

| 11 | taxableAmount | number (double) | Box 2a, Taxable amount |

| 12 | taxableAmountNotDetermined | boolean | Box 2b, Taxable amount not determined |

| 13 | totalDistribution | boolean | Box 2c, Total distribution |

| 14 | capitalGain | number (double) | Box 3, Capital gain |

| 15 | federalTaxWithheld | number (double) | Box 4, Federal income tax withheld |

| 16 | employeeContributions | number (double) | Box 5, Employee contributions |

| 17 | netUnrealizedAppreciation | number (double) | Box 6, Net unrealized appreciation |

| 18 | distributionCodes | Array of string | Box 7, Distribution codes |

| 19 | iraSepSimple | boolean | Box 7b, IRA/SEP/SIMPLE |

| 20 | otherAmount | number (double) | Box 8, Other |

| 21 | otherPercent | number (double) | Box 8, Other percent |

| 22 | yourPercentOfTotal | number (double) | Box 9a, Your percent of total distribution |

| 23 | totalEmployeeContributions | number (double) | Box 9b, Total employee contributions |

| 24 | stateTaxWithholding | Array of StateTaxWithholding | Boxes 12-14, State tax withholding |

| 25 | localTaxWithholding | Array of LocalTaxWithholding | Boxes 15-17, Local tax withholding |

Tax1099R Usage:

- TaxData tax1099R

FDX Data Structure as JSON

{

"tax1099R" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"payerNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"phone" : {

"type" : "HOME",

"country" : "string",

"number" : "string",

"extension" : "string"

}

},

"payerTin" : "string",

"recipientTin" : "string",

"recipientNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"allocableToIRR" : 0.0,

"firstYearOfRoth" : 0,

"foreignAccountTaxCompliance" : true,

"recipientAccountNumber" : "string",

"dateOfPayment" : "2020-07-01",

"grossDistribution" : 0.0,

"taxableAmount" : 0.0,

"taxableAmountNotDetermined" : true,

"totalDistribution" : true,

"capitalGain" : 0.0,

"federalTaxWithheld" : 0.0,

"employeeContributions" : 0.0,

"netUnrealizedAppreciation" : 0.0,

"distributionCodes" : [ "A" ],

"iraSepSimple" : true,

"otherAmount" : 0.0,

"otherPercent" : 0.0,

"yourPercentOfTotal" : 0.0,

"totalEmployeeContributions" : 0.0,

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 0.0,

"state" : "string",

"stateTaxId" : "string",

"stateIncome" : 0.0

} ],

"localTaxWithholding" : [ {

"localTaxWithheld" : 0.0,

"localityName" : "string",

"state" : "string",

"localIncome" : 0.0

} ]

}

}

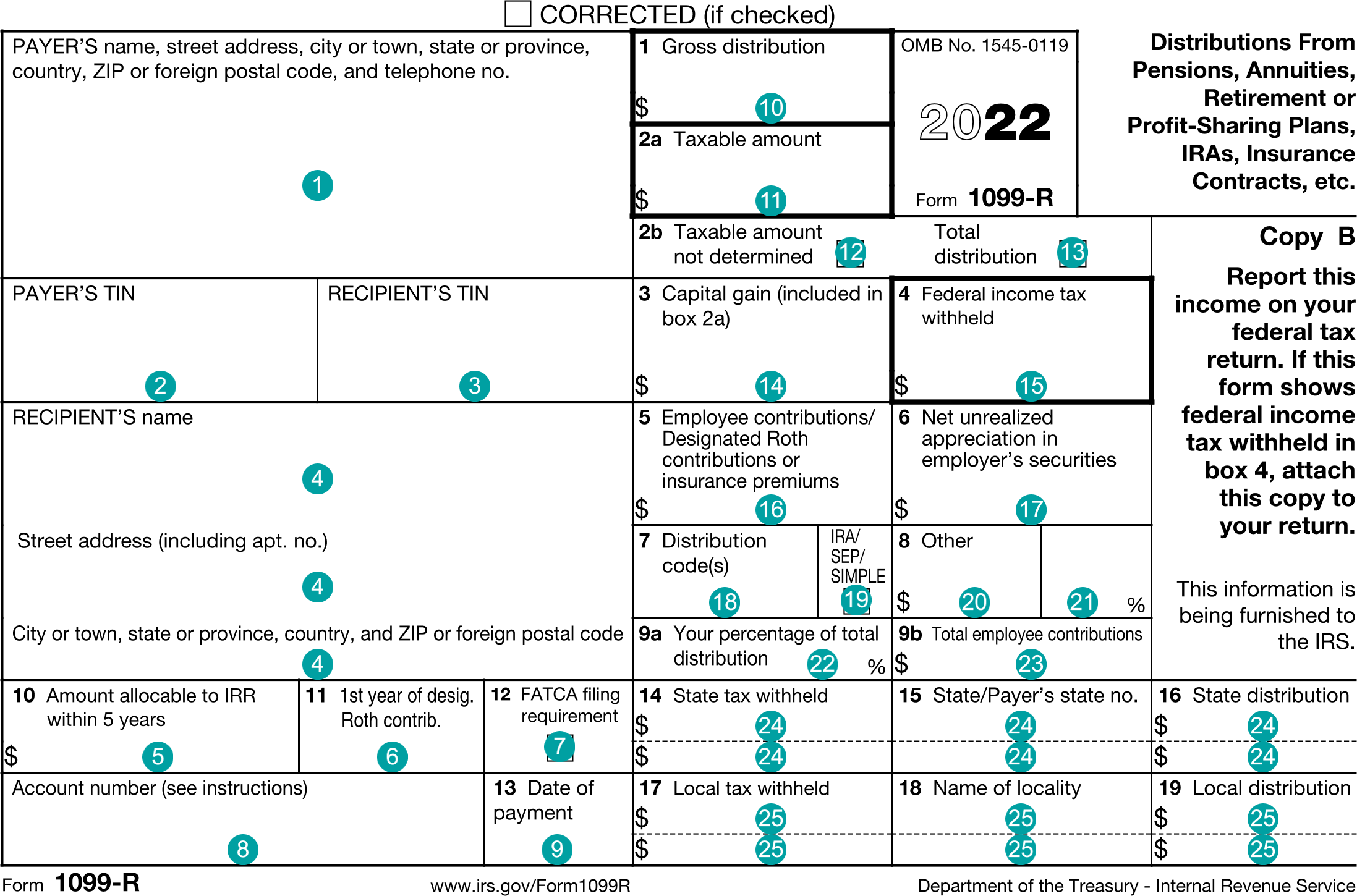

Example Form PDF

Example Form JSON

{

"tax1099R" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1099R",

"payerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"payerTin" : "12-3456789",

"recipientTin" : "xxx-xx-1234",

"recipientNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q Public"

},

"allocableToIRR" : 1000.0,

"firstYearOfRoth" : 2012,

"recipientAccountNumber" : "111-23456",

"dateOfPayment" : "2020-04-01",

"grossDistribution" : 100000.0,

"taxableAmount" : 21000.0,

"totalDistribution" : true,

"capitalGain" : 3000.0,

"federalTaxWithheld" : 4000.0,

"employeeContributions" : 5000.0,

"netUnrealizedAppreciation" : 6000.0,

"distributionCodes" : [ "A" ],

"iraSepSimple" : true,

"totalEmployeeContributions" : 9200.0,

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 1400.0,

"state" : "NY",

"stateTaxId" : "State Id",

"stateIncome" : 16000.0

} ]

}

}

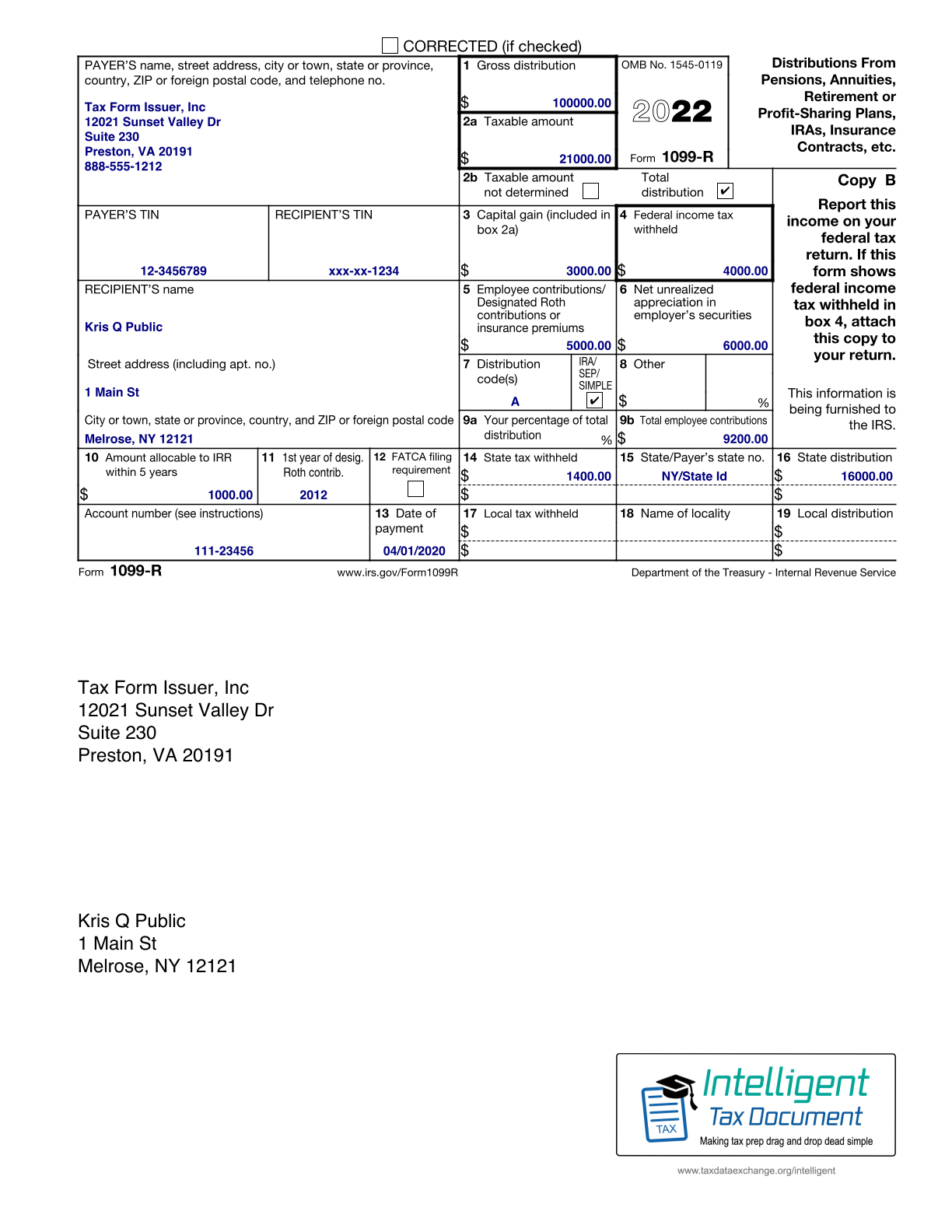

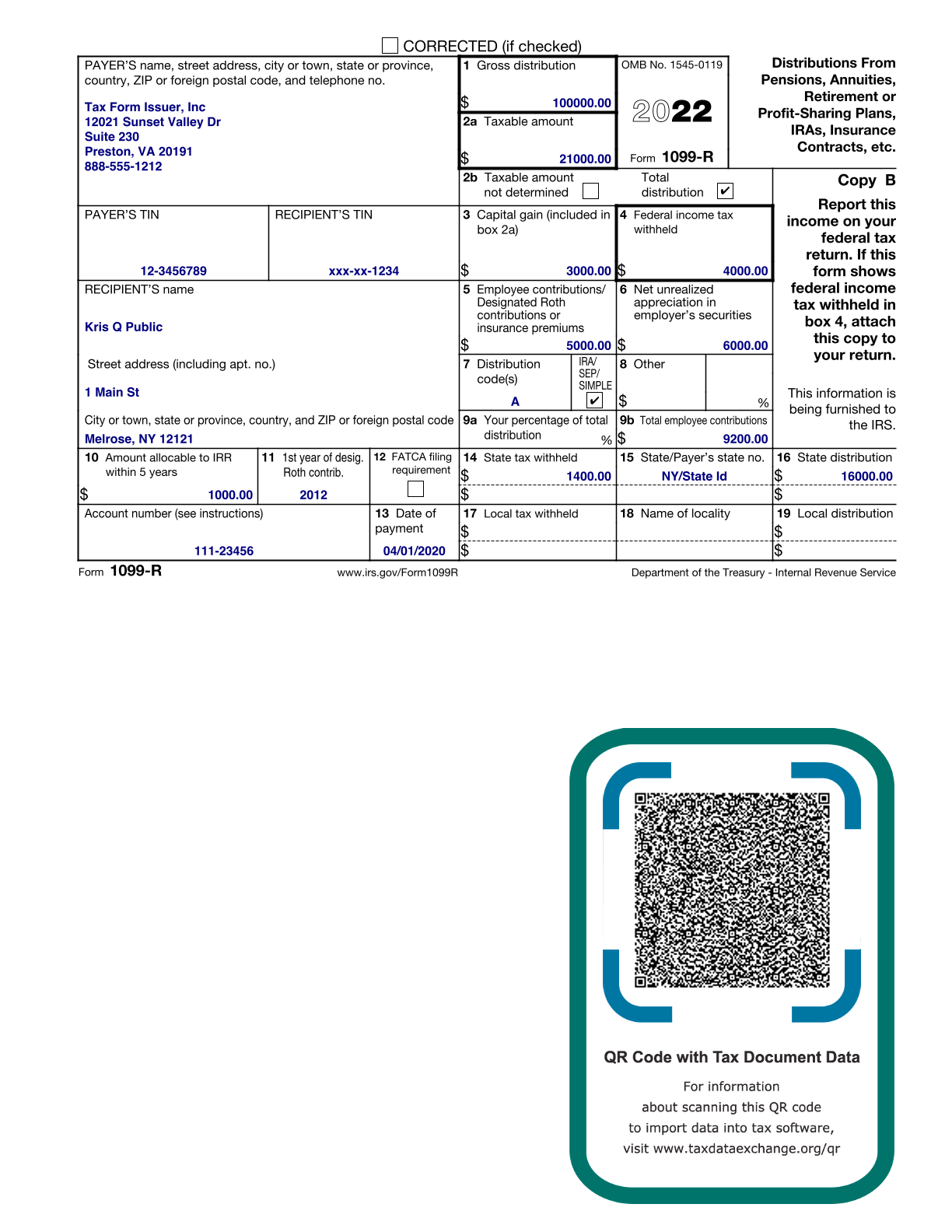

Example Form JSON for QR Code Purposes

Example Form PDF with QR Code

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"taxFormDate": "2021-03-30",

"taxFormType": "Tax1099R",

"payerNameAddress.line1": "12021 Sunset Valley Dr",

"payerNameAddress.line2": "Suite 230",

"payerNameAddress.city": "Preston",

"payerNameAddress.state": "VA",

"payerNameAddress.postalCode": "20191",

"payerNameAddress.country": "US",

"payerNameAddress.name1": "Tax Form Issuer, Inc",

"payerNameAddress.phone.number": "8885551212",

"payerTin": "12-3456789",

"recipientTin": "xxx-xx-1234",

"recipientNameAddress.line1": "1 Main St",

"recipientNameAddress.city": "Melrose",

"recipientNameAddress.state": "NY",

"recipientNameAddress.postalCode": "12121",

"recipientNameAddress.country": "US",

"recipientNameAddress.name1": "Kris Q Public",

"allocableToIRR": "1000.0",

"firstYearOfRoth": "2012",

"recipientAccountNumber": "111-23456",

"dateOfPayment": "2020-04-01",

"grossDistribution": "100000.0",

"taxableAmount": "21000.0",

"totalDistribution": "true",

"capitalGain": "3000.0",

"federalTaxWithheld": "4000.0",

"employeeContributions": "5000.0",

"netUnrealizedAppreciation": "6000.0",

"distributionCodes-1": "A",

"iraSepSimple": "true",

"totalEmployeeContributions": "9200.0",

"stateTaxWithholding-1.stateTaxWithheld": "1400.0",

"stateTaxWithholding-1.state": "NY",

"stateTaxWithholding-1.stateTaxId": "State Id",

"stateTaxWithholding-1.stateIncome": "16000.0"

}

Issuer Instructions