Tax Documents

Tax1099H

FDX / Data Structures / Tax1099H

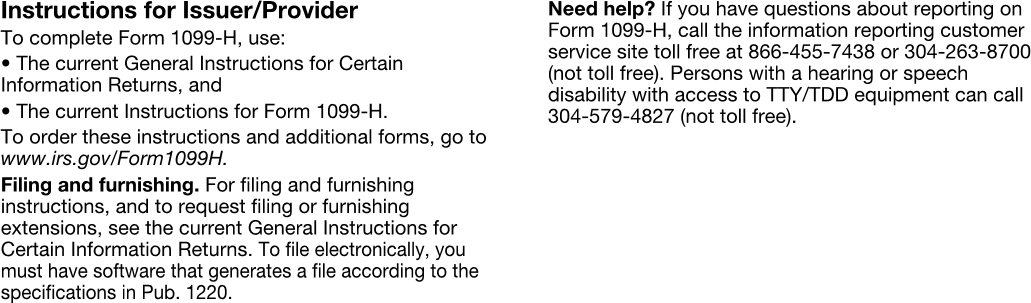

Form 1099-H, 2019 Health Coverage Tax Credit (HCTC) Advance Payments (IRS discontinued in 2020)

Extends and inherits all fields from Tax

Tax1099H Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | issuerNameAddress | NameAddressPhone | Issuer's name, address, and phone |

| 2 | issuerTin | string | ISSUER'S/PROVIDER'S federal identification number |

| 3 | recipientTin | string | RECIPIENT'S identification number |

| 4 | recipientNameAddress | NameAddress | Recipient's name and address |

| 5 | advancePayments | number (double) | Box 1, Amount of HCTC advance payments |

| 6 | numberOfMonths | integer | Box 2, Number of months HCTC advance payments and reimbursement credits paid to you |

| 7 | payments | Array of MonthAmount | Boxes 3-14, Payments by month |

Tax1099H Usage:

- TaxData tax1099H

FDX Data Structure as JSON

{

"tax1099H" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"issuerNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"phone" : {

"type" : "HOME",

"country" : "string",

"number" : "string",

"extension" : "string"

}

},

"issuerTin" : "string",

"recipientTin" : "string",

"recipientNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"advancePayments" : 0.0,

"numberOfMonths" : 0,

"payments" : [ {

"month" : "JAN",

"amount" : 0.0

} ]

}

}

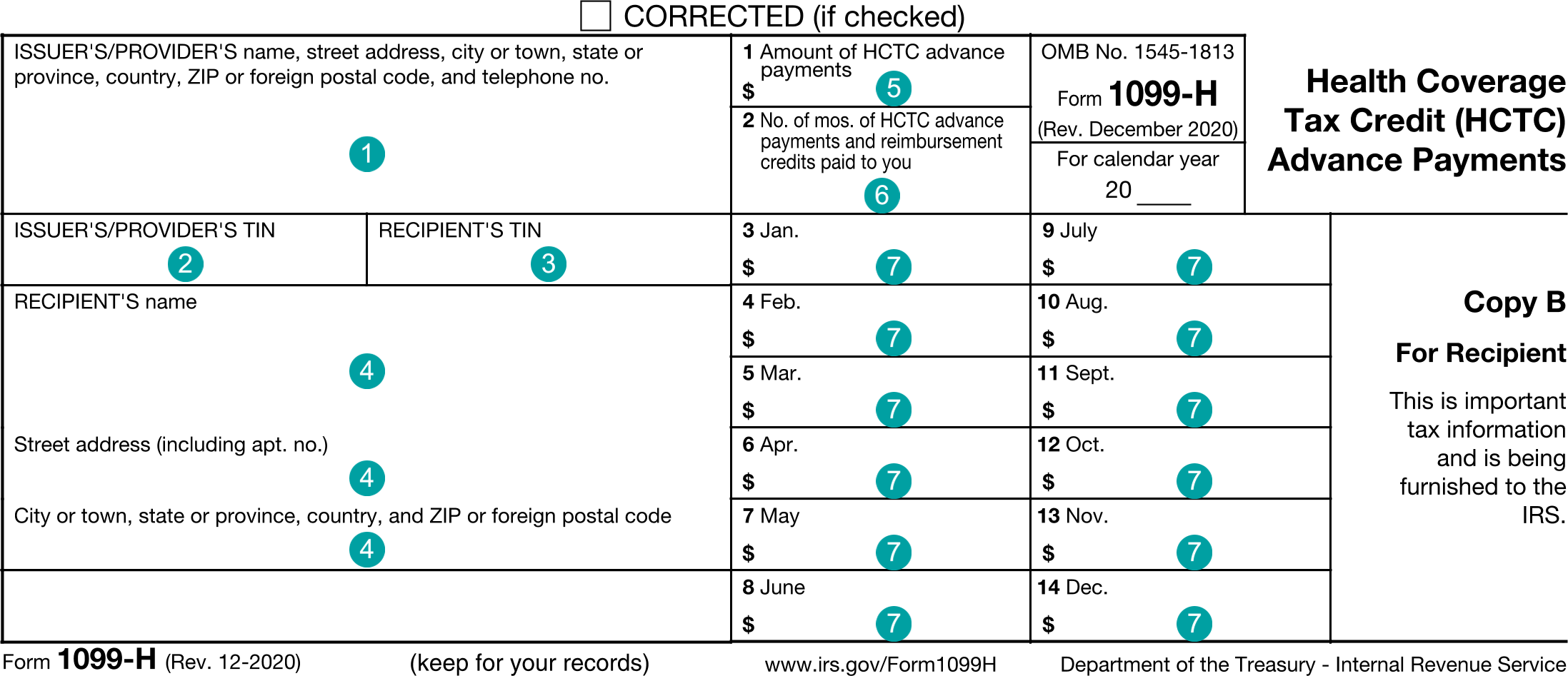

Example Form PDF

Example Form JSON

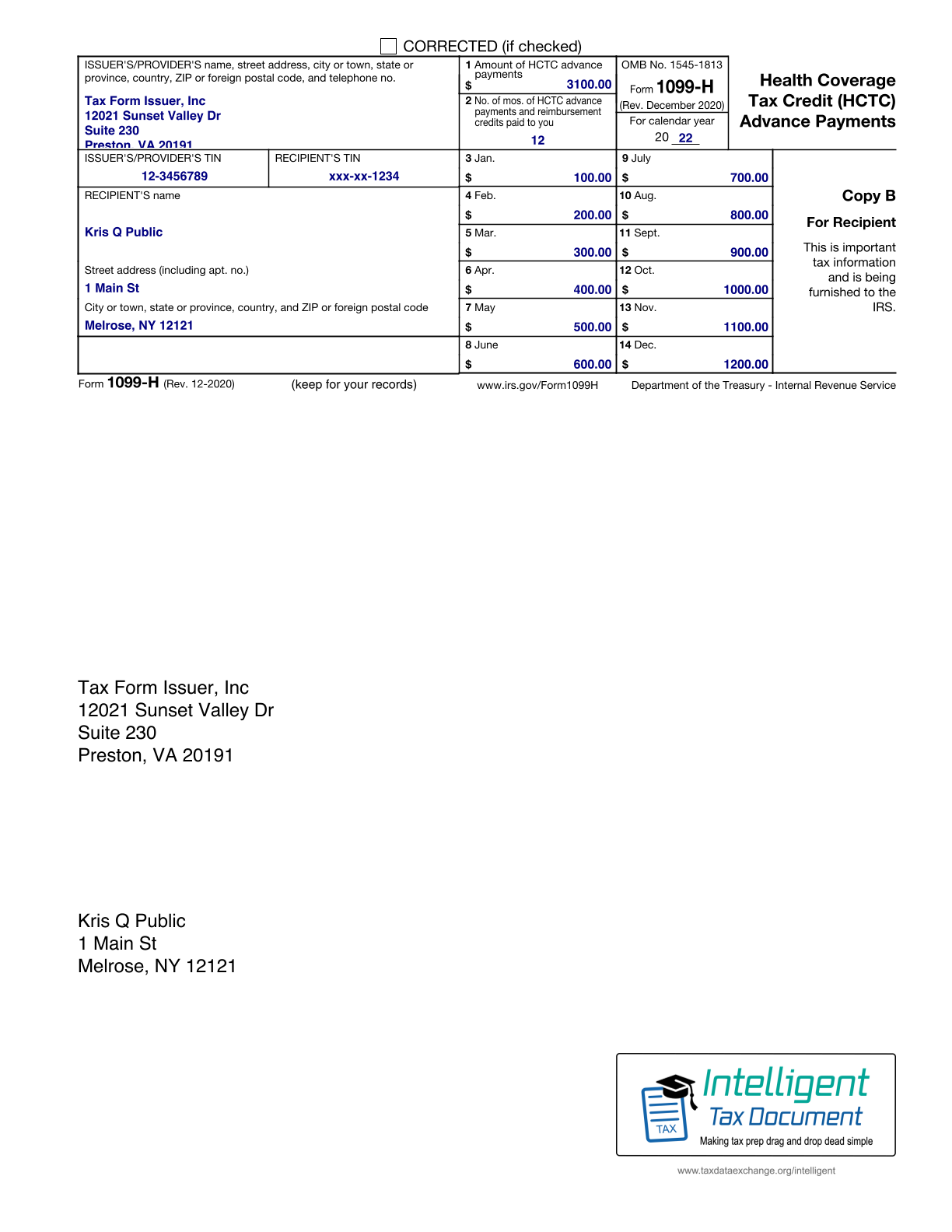

{

"tax1099H" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1099H",

"issuerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"issuerTin" : "12-3456789",

"recipientTin" : "xxx-xx-1234",

"recipientNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q Public"

},

"advancePayments" : 3100.0,

"numberOfMonths" : 12,

"payments" : [ {

"month" : "JAN",

"amount" : 100.0

}, {

"month" : "FEB",

"amount" : 200.0

}, {

"month" : "MAR",

"amount" : 300.0

}, {

"month" : "APR",

"amount" : 400.0

}, {

"month" : "MAY",

"amount" : 500.0

}, {

"month" : "JUN",

"amount" : 600.0

}, {

"month" : "JUL",

"amount" : 700.0

}, {

"month" : "AUG",

"amount" : 800.0

}, {

"month" : "SEP",

"amount" : 900.0

}, {

"month" : "OCT",

"amount" : 1000.0

}, {

"month" : "NOV",

"amount" : 1100.0

}, {

"month" : "DEC",

"amount" : 1200.0

} ]

}

}

Example Form JSON for QR Code Purposes

Example Form PDF with QR Code

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"taxFormDate": "2021-03-30",

"taxFormType": "Tax1099H",

"issuerNameAddress.line1": "12021 Sunset Valley Dr",

"issuerNameAddress.line2": "Suite 230",

"issuerNameAddress.city": "Preston",

"issuerNameAddress.state": "VA",

"issuerNameAddress.postalCode": "20191",

"issuerNameAddress.country": "US",

"issuerNameAddress.name1": "Tax Form Issuer, Inc",

"issuerNameAddress.phone.number": "8885551212",

"issuerTin": "12-3456789",

"recipientTin": "xxx-xx-1234",

"recipientNameAddress.line1": "1 Main St",

"recipientNameAddress.city": "Melrose",

"recipientNameAddress.state": "NY",

"recipientNameAddress.postalCode": "12121",

"recipientNameAddress.country": "US",

"recipientNameAddress.name1": "Kris Q Public",

"advancePayments": "3100.0",

"numberOfMonths": "12",

"payments-1.month": "JAN",

"payments-1.amount": "100.0",

"payments-2.month": "FEB",

"payments-2.amount": "200.0",

"payments-3.month": "MAR",

"payments-3.amount": "300.0",

"payments-4.month": "APR",

"payments-4.amount": "400.0",

"payments-5.month": "MAY",

"payments-5.amount": "500.0",

"payments-6.month": "JUN",

"payments-6.amount": "600.0",

"payments-7.month": "JUL",

"payments-7.amount": "700.0",

"payments-8.month": "AUG",

"payments-8.amount": "800.0",

"payments-9.month": "SEP",

"payments-9.amount": "900.0",

"payments-10.month": "OCT",

"payments-10.amount": "1000.0",

"payments-11.month": "NOV",

"payments-11.amount": "1100.0",

"payments-12.month": "DEC",

"payments-12.amount": "1200.0"

}

Issuer Instructions