Tax Documents

Tax1099Ltc

FDX / Data Structures / Tax1099Ltc

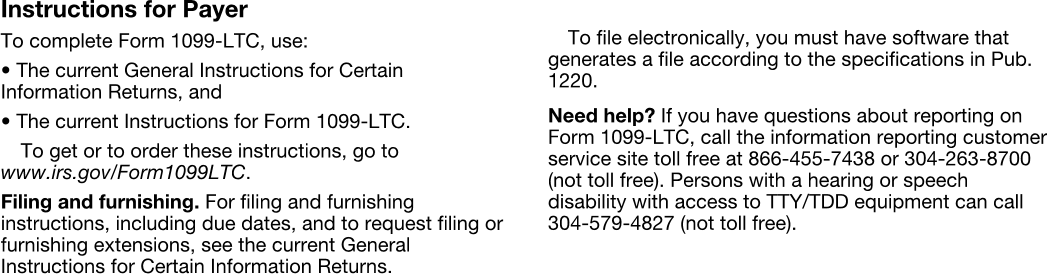

Form 1099-LTC, Long-Term Care and Accelerated Death Benefits

Extends and inherits all fields from Tax

Tax1099Ltc Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | payerNameAddress | NameAddressPhone | Payer's name, address, and phone |

| 2 | payerTin | string | PAYER'S TIN |

| 3 | policyholderTin | string | POLICYHOLDER'S TIN |

| 4 | policyHolderNameAddress | NameAddress | Policyholder name and address |

| 5 | accountNumber | string | Account number |

| 6 | ltcBenefits | number (double) | Box 1, Gross long-term care benefits paid |

| 7 | deathBenefits | number (double) | Box 2, Accelerated death benefits paid |

| 8 | perDiem | boolean | Box 3, Per diem |

| 9 | reimbursedAmount | boolean | Box 3, Reimbursed amount |

| 10 | insuredId | string | INSURED'S taxpayer identification no. |

| 11 | insuredNameAddress | NameAddress | Insured name and address |

| 12 | qualifiedContract | boolean | Box 4, Qualified contract |

| 13 | chronicallyIll | boolean | Box 5, Chronically ill |

| 14 | terminallyIll | boolean | Box 5, Terminally ill |

| 15 | dateCertified | DateString | Date certified |

Tax1099Ltc Usage:

- TaxData tax1099Ltc

FDX Data Structure as JSON

{

"tax1099Ltc" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"payerNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"phone" : {

"type" : "HOME",

"country" : "string",

"number" : "string",

"extension" : "string"

}

},

"payerTin" : "string",

"policyholderTin" : "string",

"policyHolderNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"accountNumber" : "string",

"ltcBenefits" : 0.0,

"deathBenefits" : 0.0,

"perDiem" : true,

"reimbursedAmount" : true,

"insuredId" : "string",

"insuredNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"qualifiedContract" : true,

"chronicallyIll" : true,

"terminallyIll" : true,

"dateCertified" : "2020-07-01"

}

}

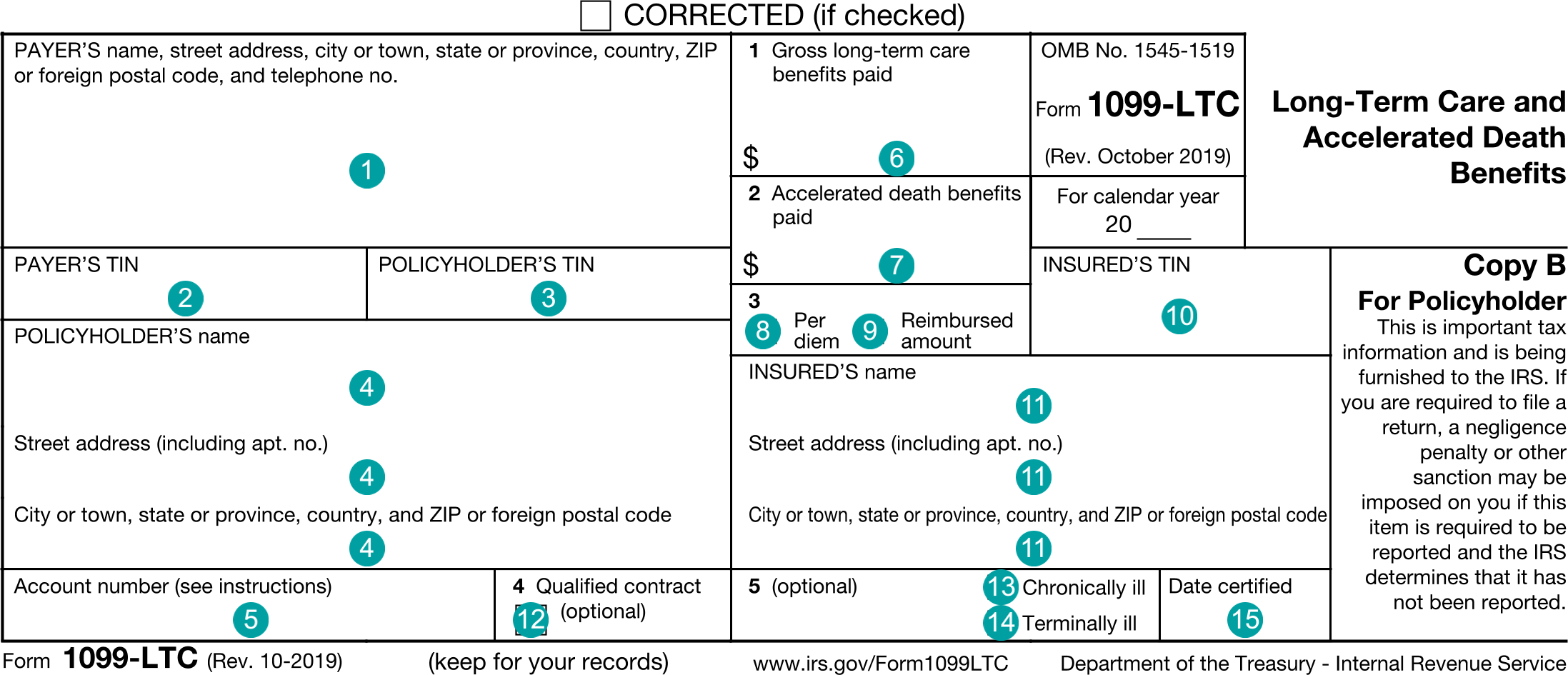

Example Form PDF

Example Form JSON

{

"tax1099Ltc" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1099Ltc",

"payerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"payerTin" : "12-3456789",

"policyholderTin" : "xxx-xx-1234",

"policyHolderNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"name1" : "Kris Q Public"

},

"accountNumber" : "111-55555555",

"ltcBenefits" : 1000.0,

"deathBenefits" : 2000.0,

"perDiem" : true,

"reimbursedAmount" : true,

"insuredId" : "555-55-5555",

"insuredNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"name1" : "Taylor Public"

},

"qualifiedContract" : true,

"chronicallyIll" : true,

"dateCertified" : "2020-04-01"

}

}

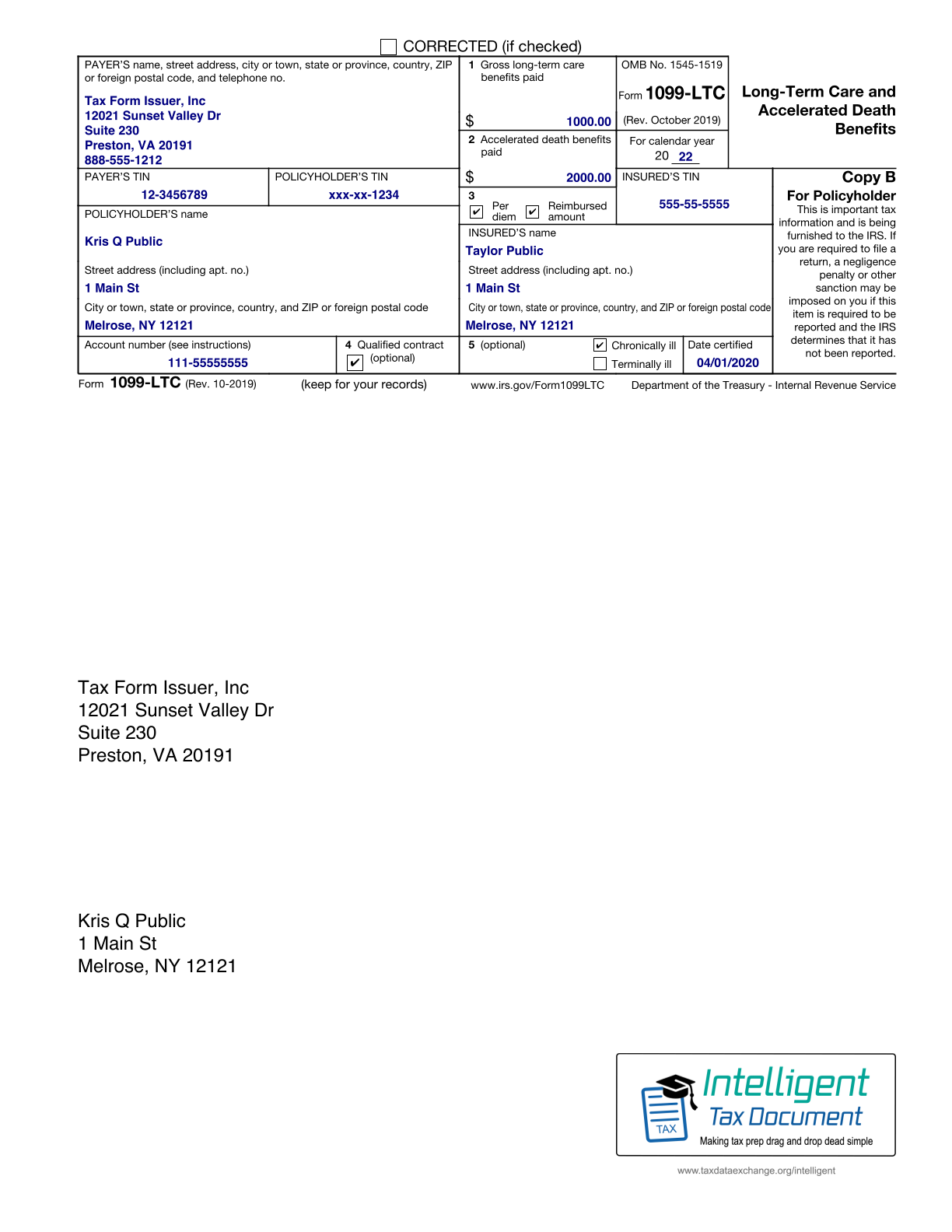

Example Form JSON for QR Code Purposes

Example Form PDF with QR Code

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"taxFormDate": "2021-03-30",

"taxFormType": "Tax1099Ltc",

"payerNameAddress.line1": "12021 Sunset Valley Dr",

"payerNameAddress.line2": "Suite 230",

"payerNameAddress.city": "Preston",

"payerNameAddress.state": "VA",

"payerNameAddress.postalCode": "20191",

"payerNameAddress.country": "US",

"payerNameAddress.name1": "Tax Form Issuer, Inc",

"payerNameAddress.phone.number": "8885551212",

"payerTin": "12-3456789",

"policyholderTin": "xxx-xx-1234",

"policyHolderNameAddress.line1": "1 Main St",

"policyHolderNameAddress.city": "Melrose",

"policyHolderNameAddress.state": "NY",

"policyHolderNameAddress.postalCode": "12121",

"policyHolderNameAddress.name1": "Kris Q Public",

"accountNumber": "111-55555555",

"ltcBenefits": "1000.0",

"deathBenefits": "2000.0",

"perDiem": "true",

"reimbursedAmount": "true",

"insuredId": "555-55-5555",

"insuredNameAddress.line1": "1 Main St",

"insuredNameAddress.city": "Melrose",

"insuredNameAddress.state": "NY",

"insuredNameAddress.postalCode": "12121",

"insuredNameAddress.name1": "Taylor Public",

"qualifiedContract": "true",

"chronicallyIll": "true",

"dateCertified": "2020-04-01"

}

Issuer Instructions