IRIS >

IRIS CSV

CSV Template

Form Type,Tax Year,Payer TIN Type,Payer Taxpayer ID Number,Payer Name Type,Payer Business or Entity Name Line 1,Payer Business or Entity Name Line 2,Payer First Name,Payer Middle Name,Payer Last Name (Surname),Payer Suffix,Payer Country,Payer Address Line 1,Payer Address Line 2,Payer City/Town,Payer State/Province/Territory,Payer ZIP/Postal Code,Payer Phone Type,Payer Phone,Payer Email Address,Recipient TIN Type,Recipient Taxpayer ID Number,Recipient Name Type,Recipient Business or Entity Name Line 1,Recipient Business or Entity Name Line 2,Recipient First Name,Recipient Middle Name,Recipient Last Name (Surname),Recipient Suffix,Recipient Country,Recipient Address Line 1,Recipient Address Line 2,Recipient City/Town,Recipient State/Province/Territory,Recipient ZIP/Postal Code,Office Code,Form Account Number,FATCA Filing Requirements,Box 1 - Gross distribution,Box 2a - Taxable amount,Box 2b - Taxable amount not determined,Box 2b - Total distribution,Box 3 - Capital gain (included in box 2a),Box 4 - Federal income tax withheld,Box 5 - Employee contributions/Desginated Roth contributions or insurance premiums,Box 6 - Net unrealized appreciation in employer's securities,Box 7 - Distribution code(s),Box 7 - IRA/SEP/SIMPLE,Box 8 - Other ($),Box 8 - Other (%),Box 9a - Your percentage of total distribution,Box 9b - Total employee contributions,Box 10 - Amount allocable to IRR within 5 years,Box 11 - 1st year of desingated Roth contributions,Box 13 - Date of Payment,Combined Federal/State Filing,State 1,State 1 - State Tax Withheld,State 1 - State/Payer state number,State 1 - State income,State 1 - Local income tax withheld,State 1 - Special Data Entries,State 2,State 2 - State Tax Withheld,State 2 - State/Payer state number,State 2 - State income,State 2 - Local income tax withheld,State 2 - Special Data Entries

,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,

CSV Columns

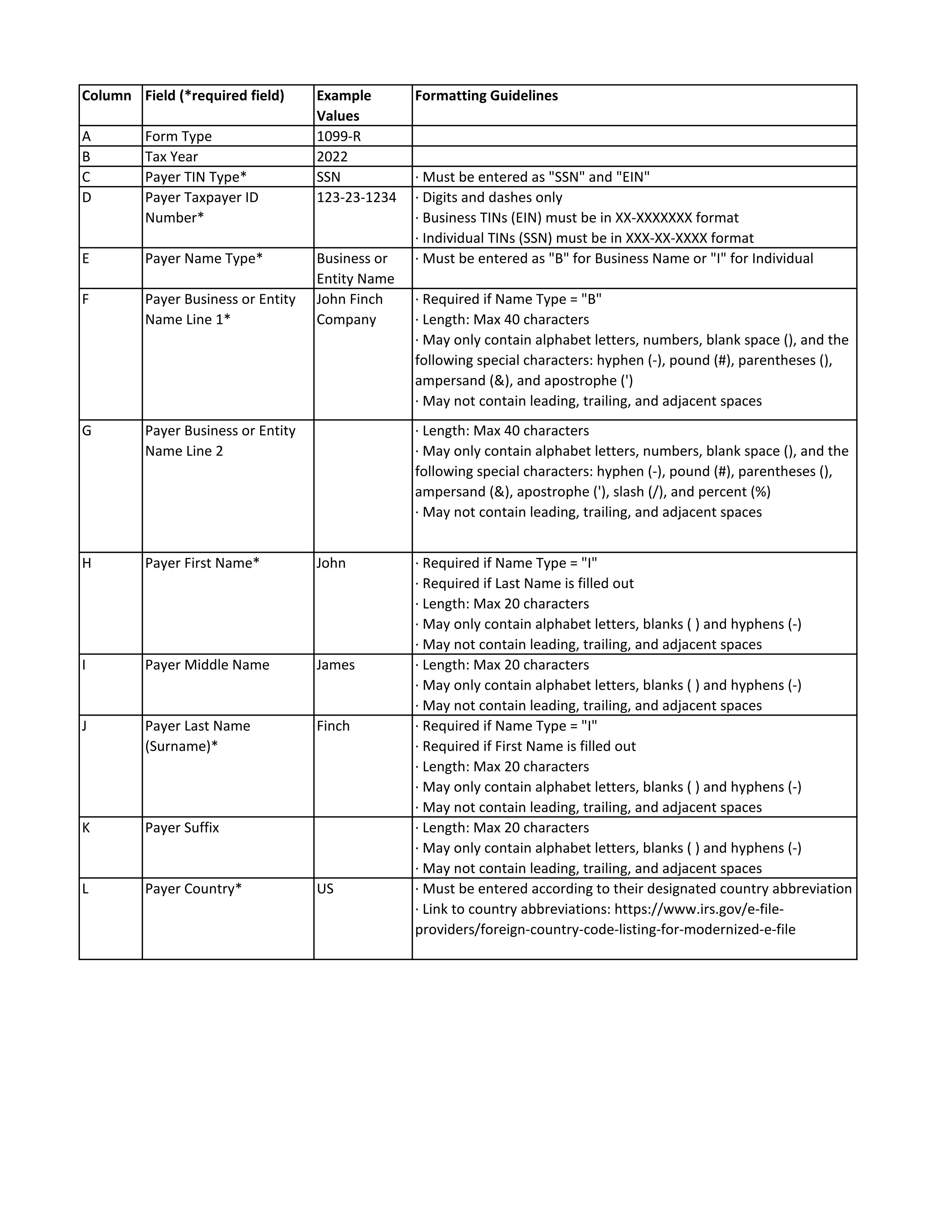

Form Type

Tax Year

Payer TIN Type

Payer Taxpayer ID Number

Payer Name Type

Payer Business or Entity Name Line 1

Payer Business or Entity Name Line 2

Payer First Name

Payer Middle Name

Payer Last Name (Surname)

Payer Suffix

Payer Country

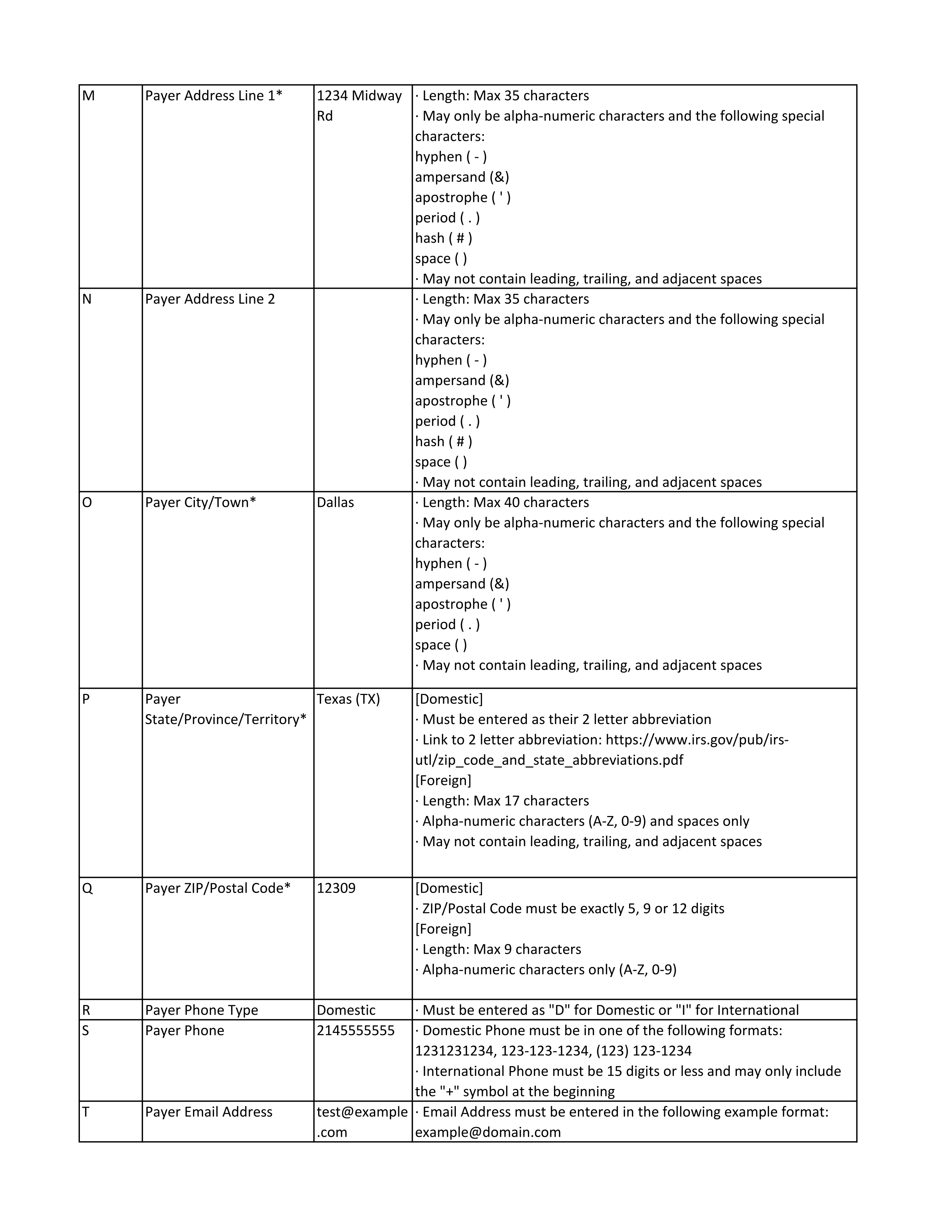

Payer Address Line 1

Payer Address Line 2

Payer City/Town

Payer State/Province/Territory

Payer ZIP/Postal Code

Payer Phone Type

Payer Phone

Payer Email Address

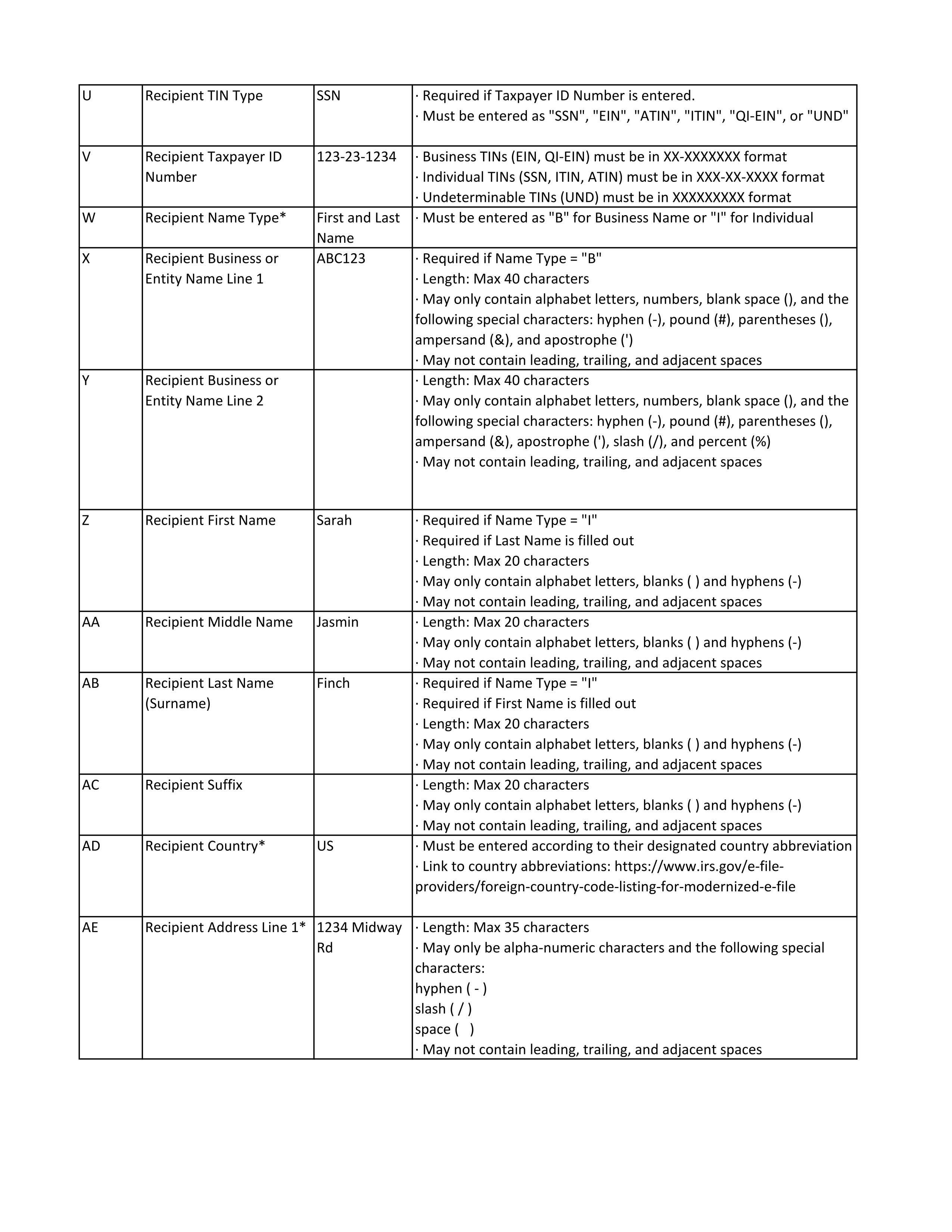

Recipient TIN Type

Recipient Taxpayer ID Number

Recipient Name Type

Recipient Business or Entity Name Line 1

Recipient Business or Entity Name Line 2

Recipient First Name

Recipient Middle Name

Recipient Last Name (Surname)

Recipient Suffix

Recipient Country

Recipient Address Line 1

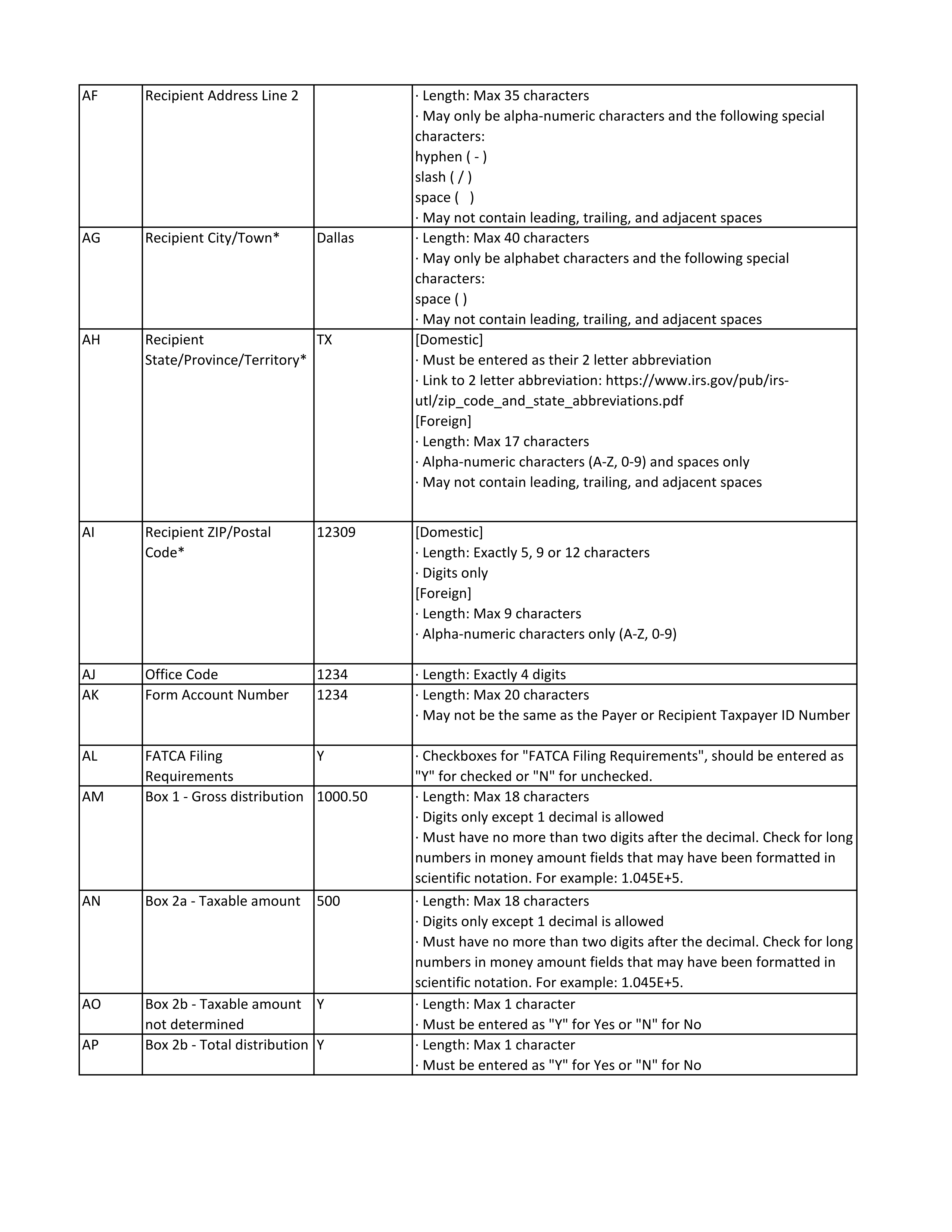

Recipient Address Line 2

Recipient City/Town

Recipient State/Province/Territory

Recipient ZIP/Postal Code

Office Code

Form Account Number

FATCA Filing Requirements

Box 1 - Gross distribution

Box 2a - Taxable amount

Box 2b - Taxable amount not determined

Box 2b - Total distribution

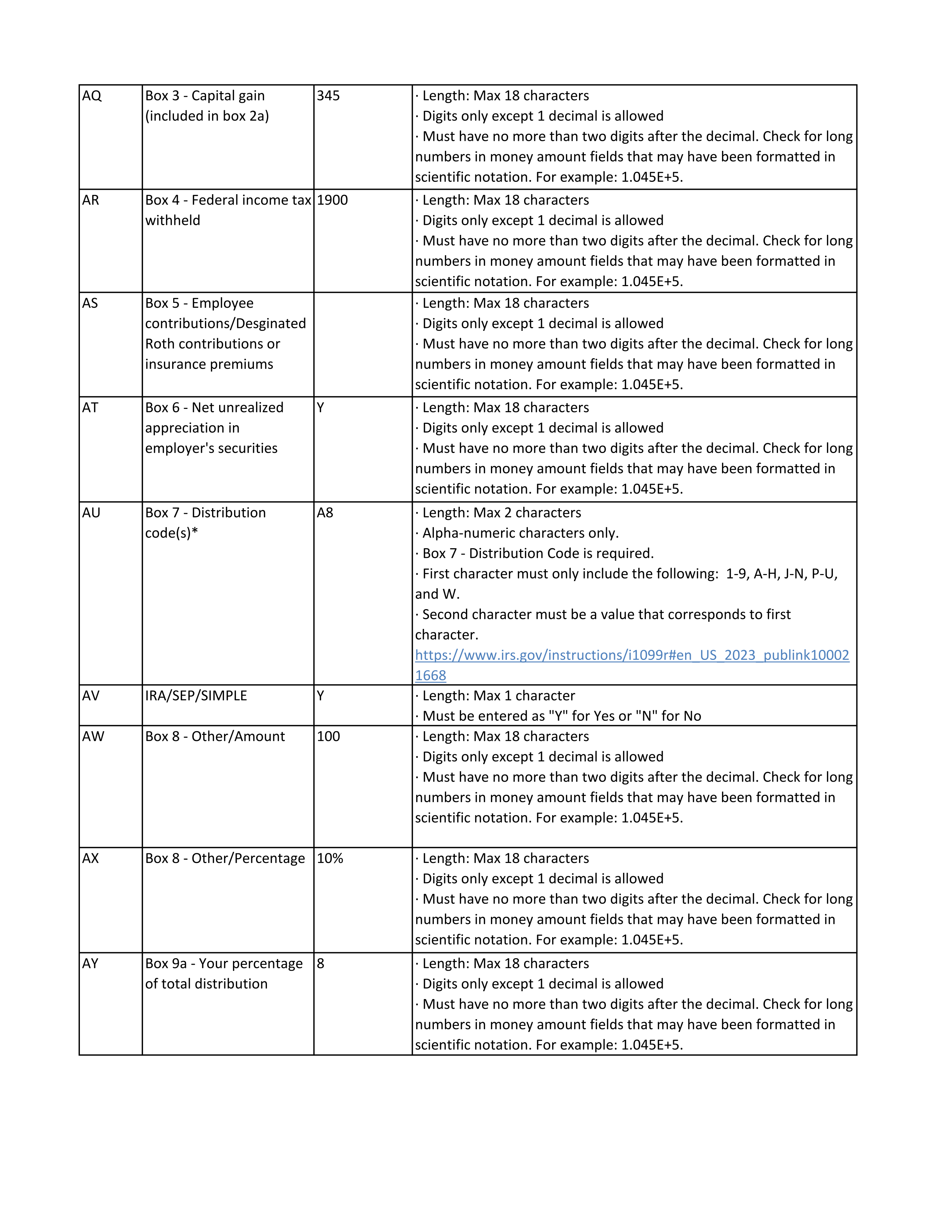

Box 3 - Capital gain (included in box 2a)

Box 4 - Federal income tax withheld

Box 5 - Employee contributions/Desginated Roth contributions or insurance premiums

Box 6 - Net unrealized appreciation in employer's securities

Box 7 - Distribution code(s)

Box 7 - IRA/SEP/SIMPLE

Box 8 - Other ($)

Box 8 - Other (%)

Box 9a - Your percentage of total distribution

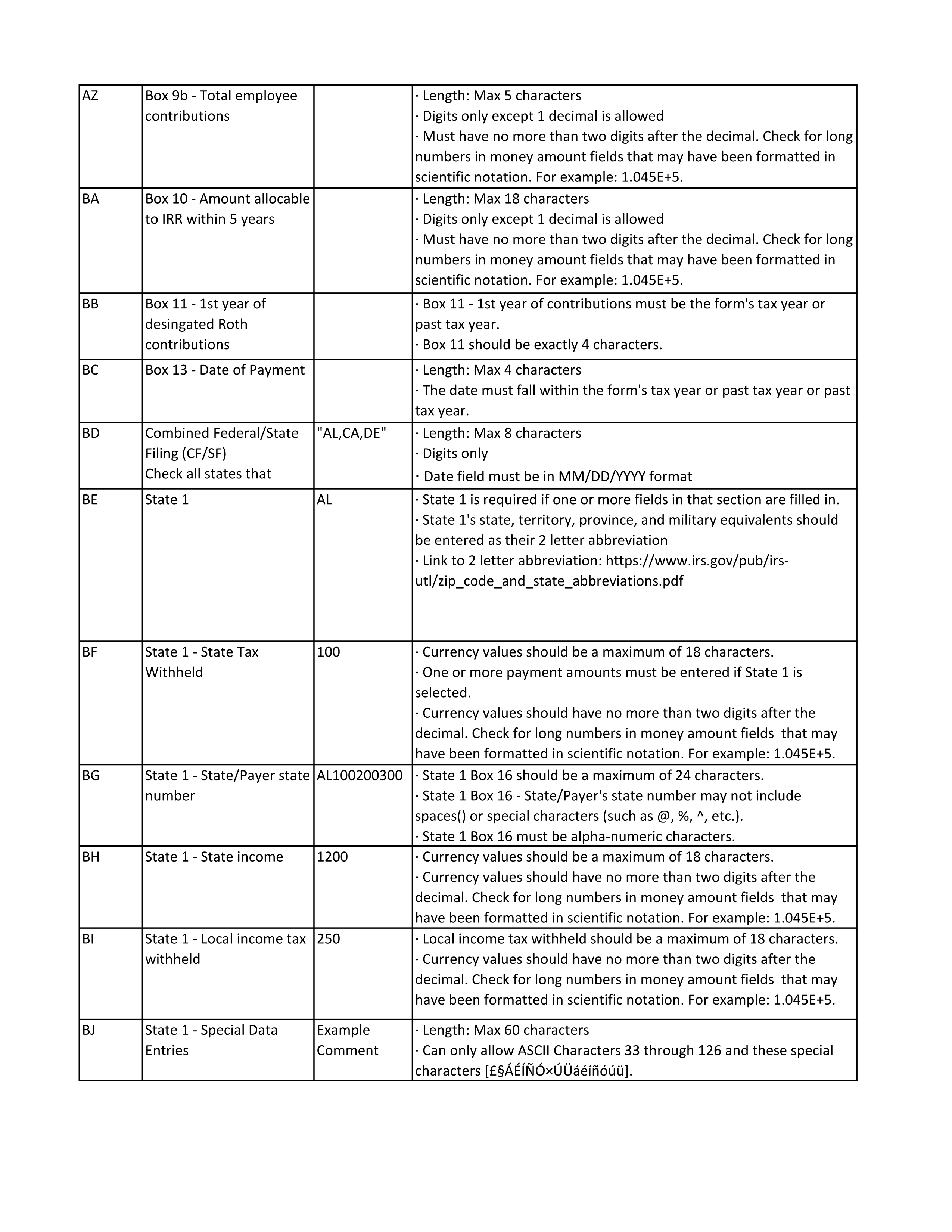

Box 9b - Total employee contributions

Box 10 - Amount allocable to IRR within 5 years

Box 11 - 1st year of desingated Roth contributions

Box 13 - Date of Payment

Combined Federal/State Filing

State 1

State 1 - State Tax Withheld

State 1 - State/Payer state number

State 1 - State income

State 1 - Local income tax withheld

State 1 - Special Data Entries

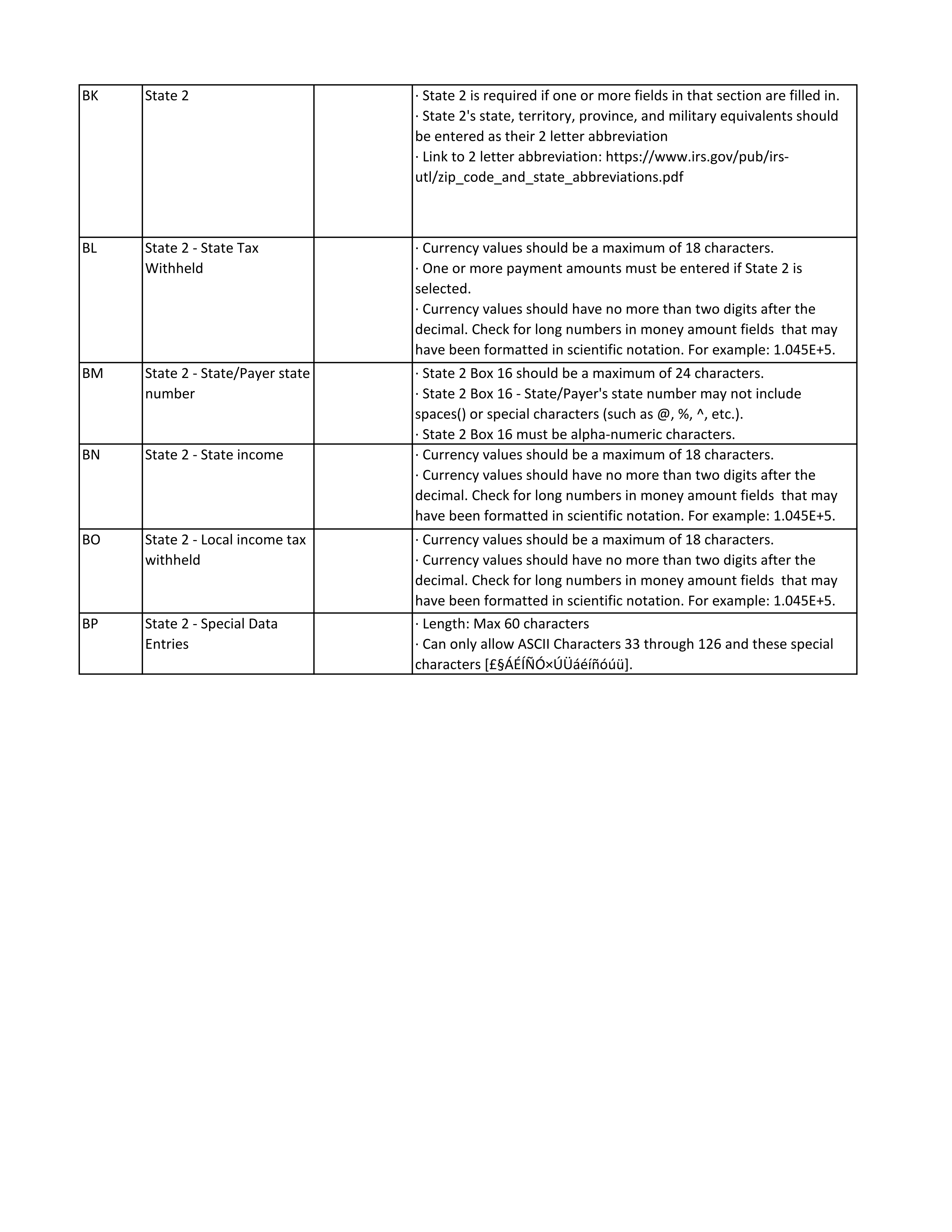

State 2

State 2 - State Tax Withheld

State 2 - State/Payer state number

State 2 - State income

State 2 - Local income tax withheld

State 2 - Special Data Entries