IRIS >

IRIS CSV

CSV Template

Form Type,Tax Year,Payer TIN Type,Payer Taxpayer ID Number,Payer Name Type,Payer Business or Entity Name Line 1,Payer Business or Entity Name Line 2,Payer First Name,Payer Middle Name,Payer Last Name (Surname),Payer Suffix,Payer Country,Payer Address Line 1,Payer Address Line 2,Payer City/Town,Payer State/Province/Territory,Payer ZIP/Postal Code,Payer Phone Type,Payer Phone,Payer Email Address,Recipient TIN Type,Recipient Taxpayer ID Number,Recipient Name Type,Recipient Business or Entity Name Line 1,Recipient Business or Entity Name Line 2,Recipient First Name,Recipient Middle Name,Recipient Last Name (Surname),Recipient Suffix,Recipient Country,Recipient Address Line 1,Recipient Address Line 2,Recipient City/Town,Recipient State/Province/Territory,Recipient ZIP/Postal Code,Office Code,Form Account Number,FATCA Filing Requirements,2nd TIN Notice,Box 1 - Rents,Box 2 - Royalties,Box 3 - Other Income,Box 4 - Federal income tax withheld,Box 5 - Fishing boat proceeds,Box 6 - Medical and health care payments,Box 7 - Direct sales of $5000 or more of consumer products to a recipient for resale,Box 8 - Subtitute payments in lieu of dividends or interest,Box 9 - Crop insurance proceeds,Box 10 - Gross proceeds paid to an attorney,Box 11 - Fish purchased for resale,Box 12 - Section 409A deferrals,Box 14 - Excess golden parachute payments,Box 15 - Nonqualified deferred compensation,Combined Federal/State Filing,State 1,State 1 - State Tax Withheld,State 1 - State/Payer state number,State 1 - State income,State 1 - Local income tax withheld,State 1 - Special Data Entries,State 2,State 2 - State Tax Withheld,State 2 - State/Payer state number,State 2 - State income,State 2 - Local income tax withheld,State 2 - Special Data Entries

,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,

CSV Columns

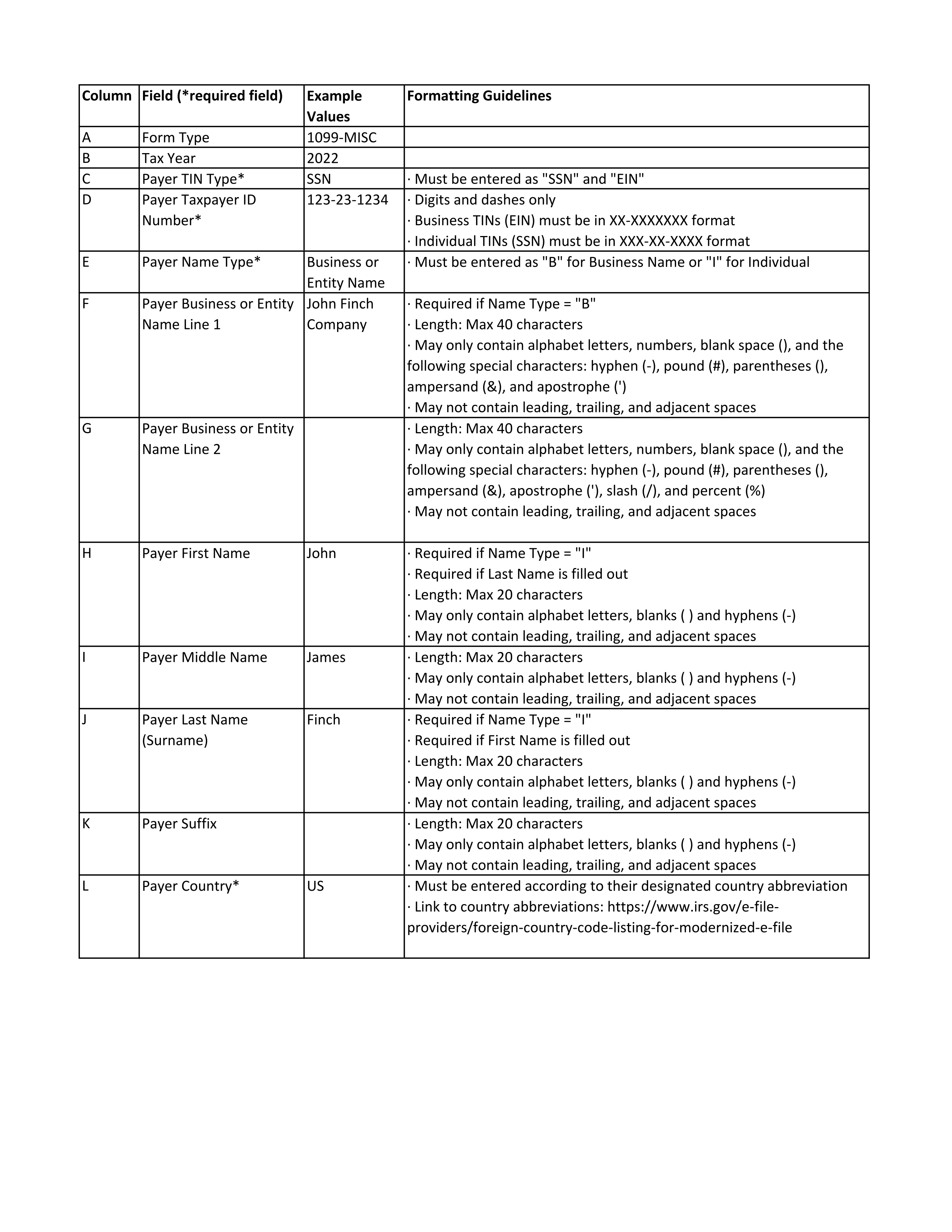

Form Type

Tax Year

Payer TIN Type

Payer Taxpayer ID Number

Payer Name Type

Payer Business or Entity Name Line 1

Payer Business or Entity Name Line 2

Payer First Name

Payer Middle Name

Payer Last Name (Surname)

Payer Suffix

Payer Country

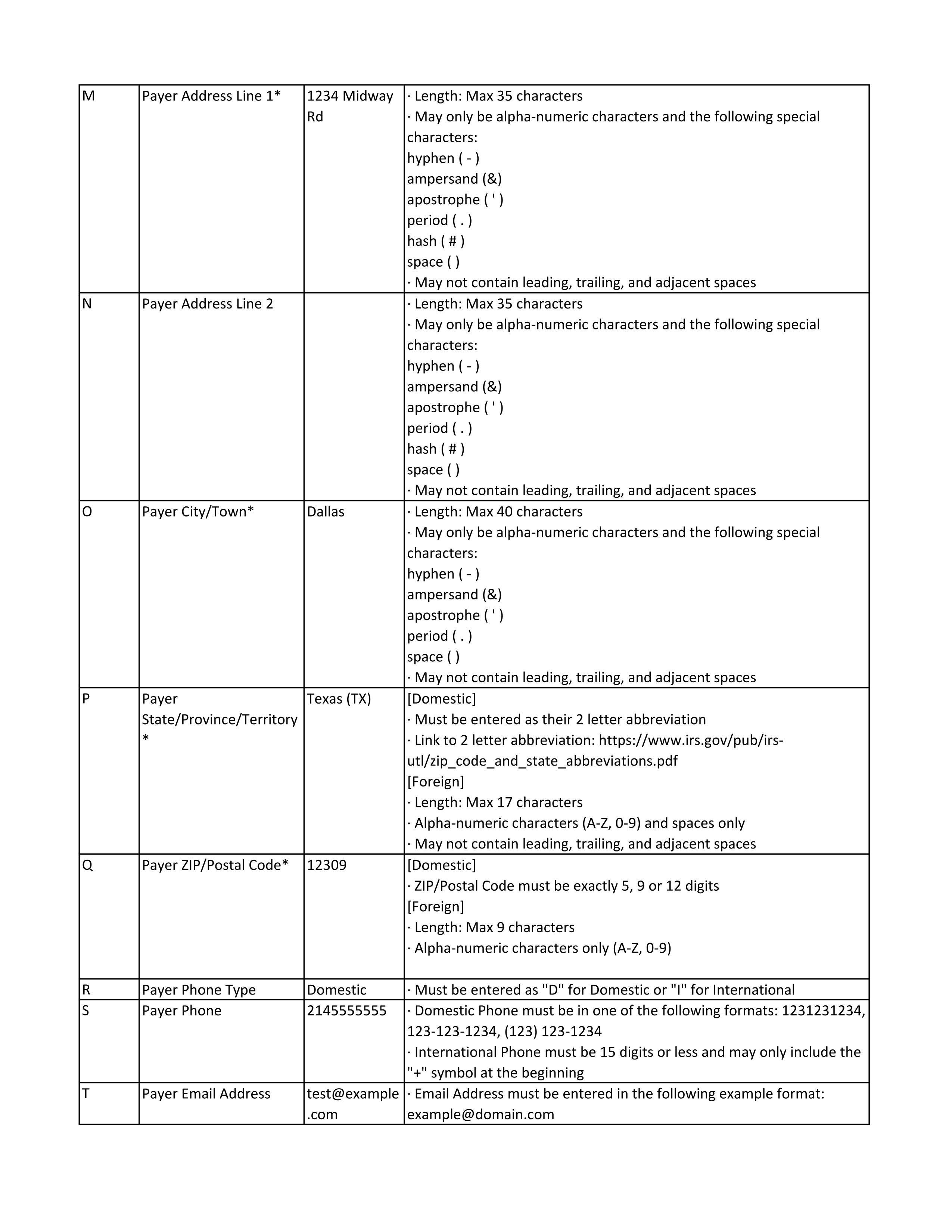

Payer Address Line 1

Payer Address Line 2

Payer City/Town

Payer State/Province/Territory

Payer ZIP/Postal Code

Payer Phone Type

Payer Phone

Payer Email Address

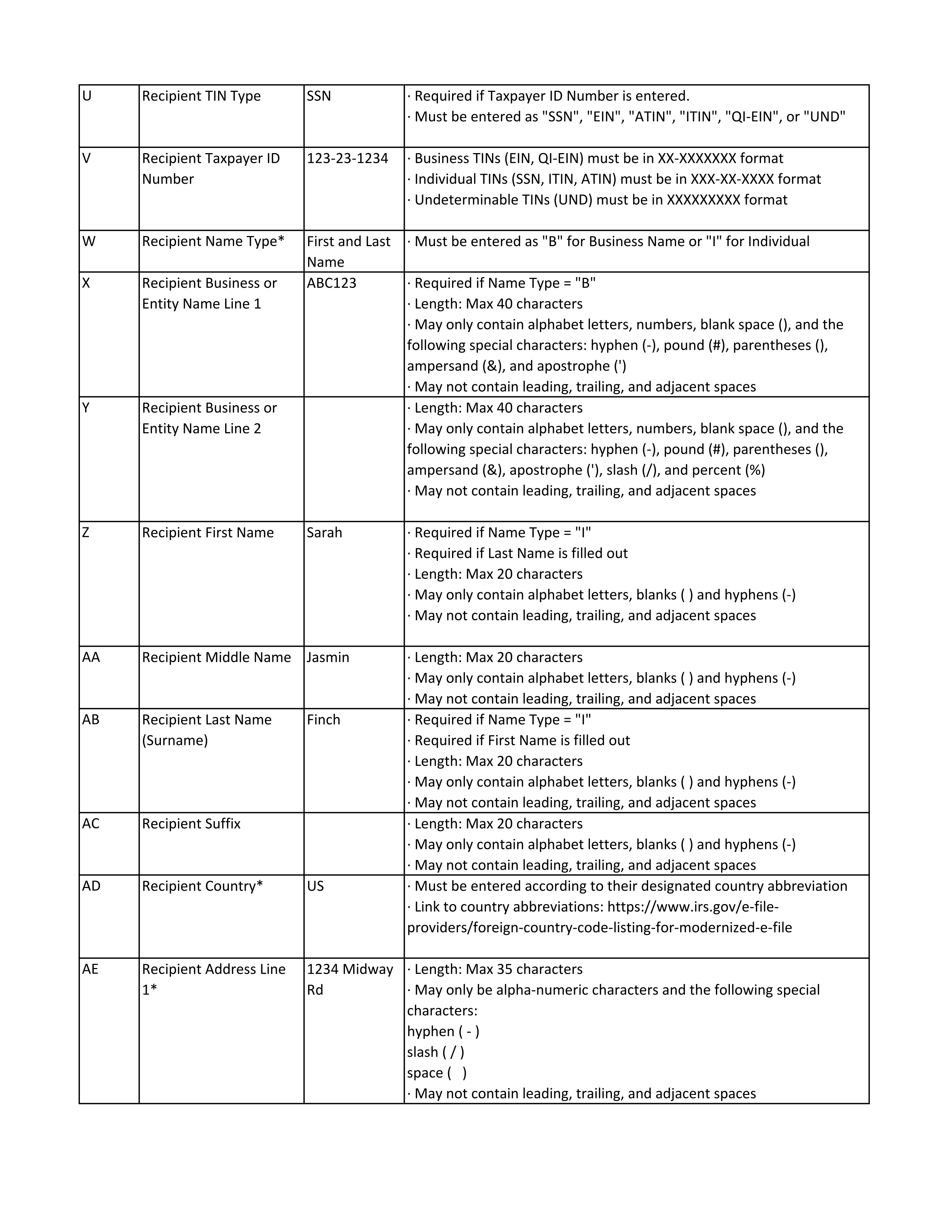

Recipient TIN Type

Recipient Taxpayer ID Number

Recipient Name Type

Recipient Business or Entity Name Line 1

Recipient Business or Entity Name Line 2

Recipient First Name

Recipient Middle Name

Recipient Last Name (Surname)

Recipient Suffix

Recipient Country

Recipient Address Line 1

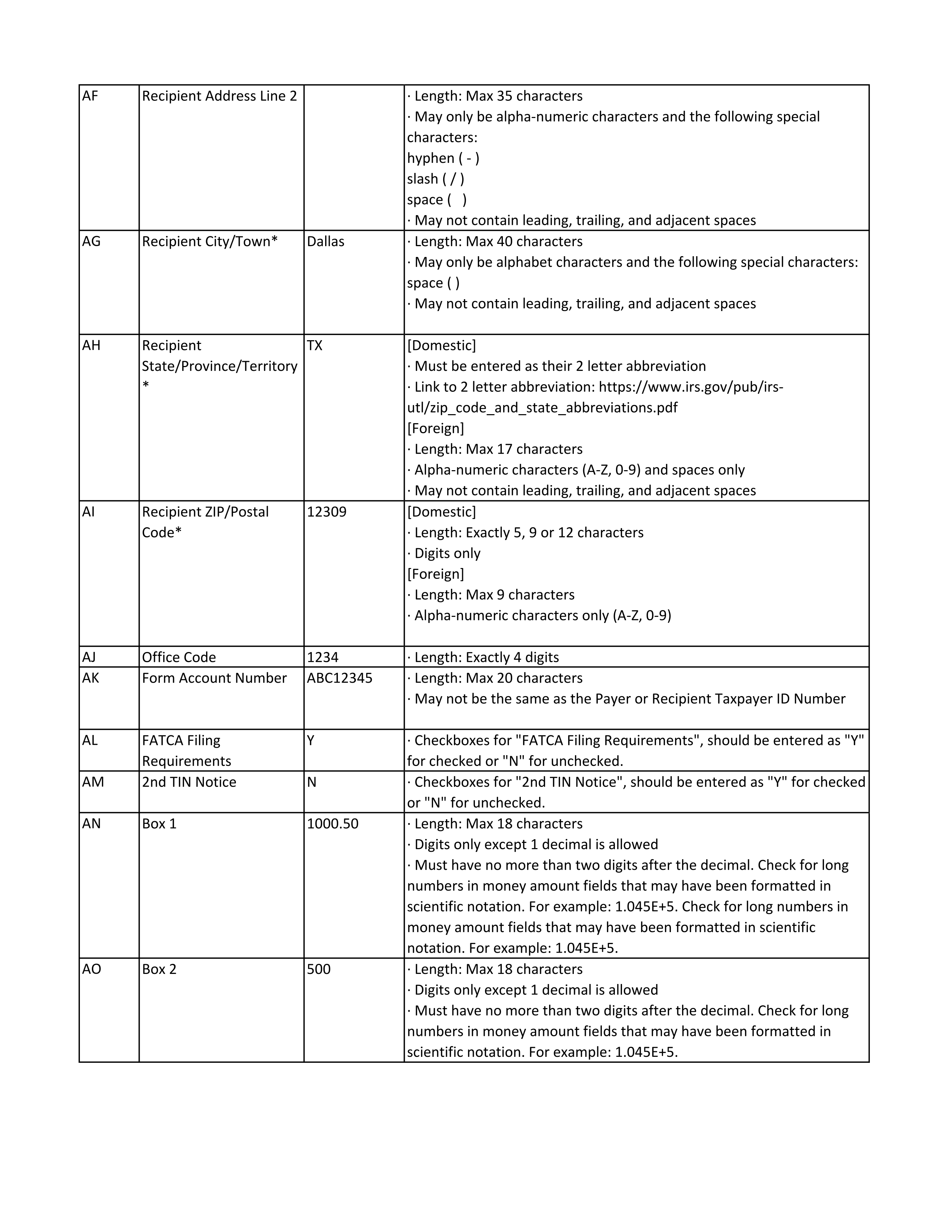

Recipient Address Line 2

Recipient City/Town

Recipient State/Province/Territory

Recipient ZIP/Postal Code

Office Code

Form Account Number

FATCA Filing Requirements

2nd TIN Notice

Box 1 - Rents

Box 2 - Royalties

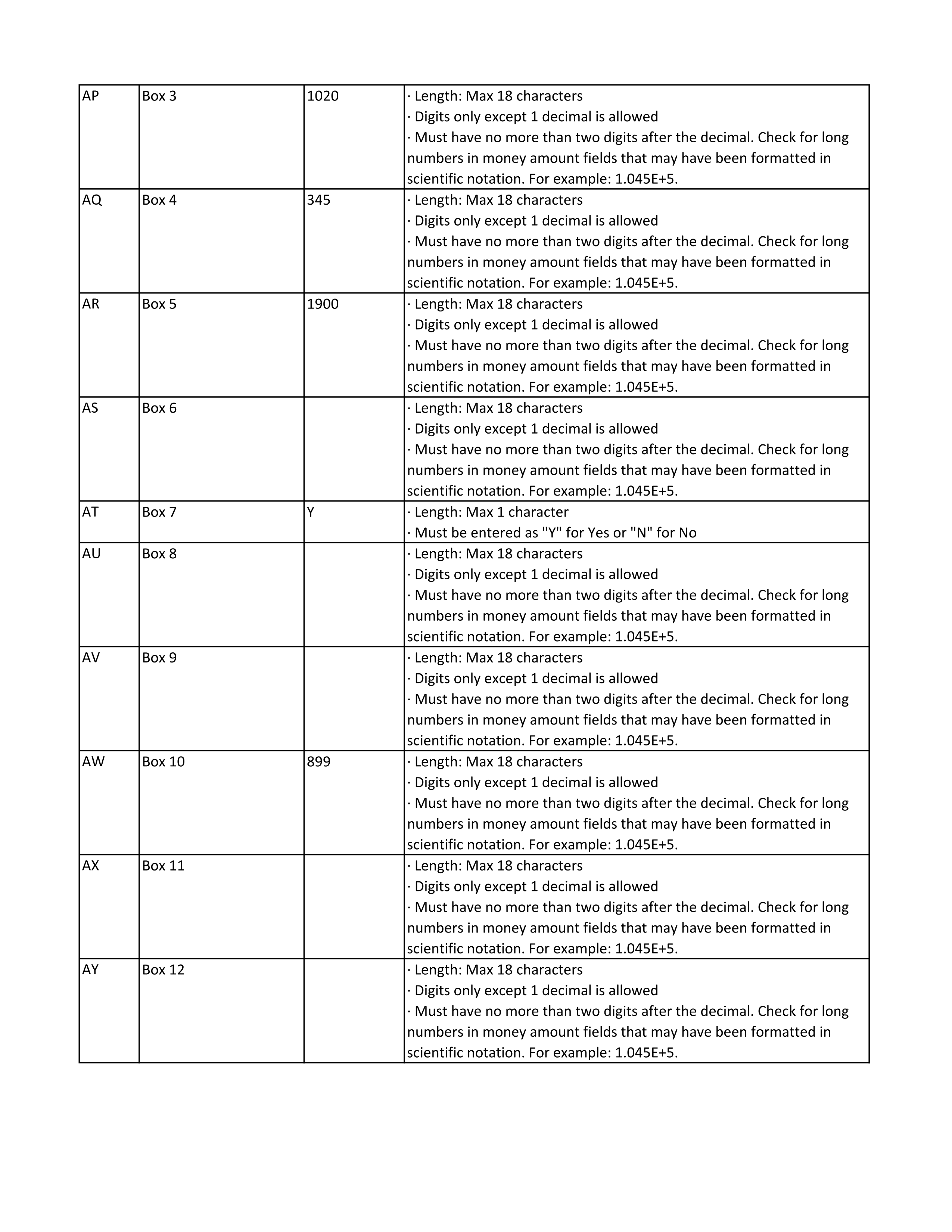

Box 3 - Other Income

Box 4 - Federal income tax withheld

Box 5 - Fishing boat proceeds

Box 6 - Medical and health care payments

Box 7 - Direct sales of $5000 or more of consumer products to a recipient for resale

Box 8 - Subtitute payments in lieu of dividends or interest

Box 9 - Crop insurance proceeds

Box 10 - Gross proceeds paid to an attorney

Box 11 - Fish purchased for resale

Box 12 - Section 409A deferrals

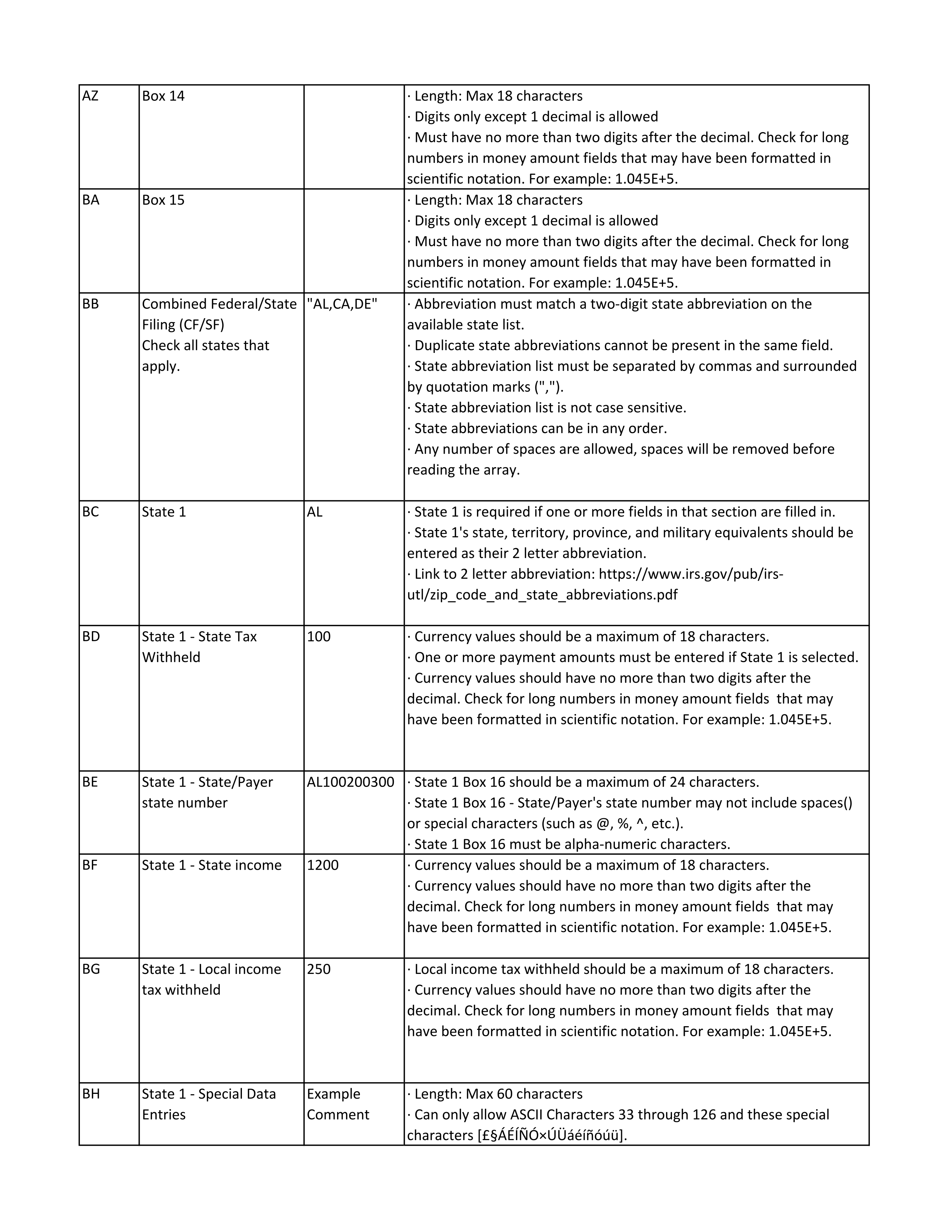

Box 14 - Excess golden parachute payments

Box 15 - Nonqualified deferred compensation

Combined Federal/State Filing

State 1

State 1 - State Tax Withheld

State 1 - State/Payer state number

State 1 - State income

State 1 - Local income tax withheld

State 1 - Special Data Entries

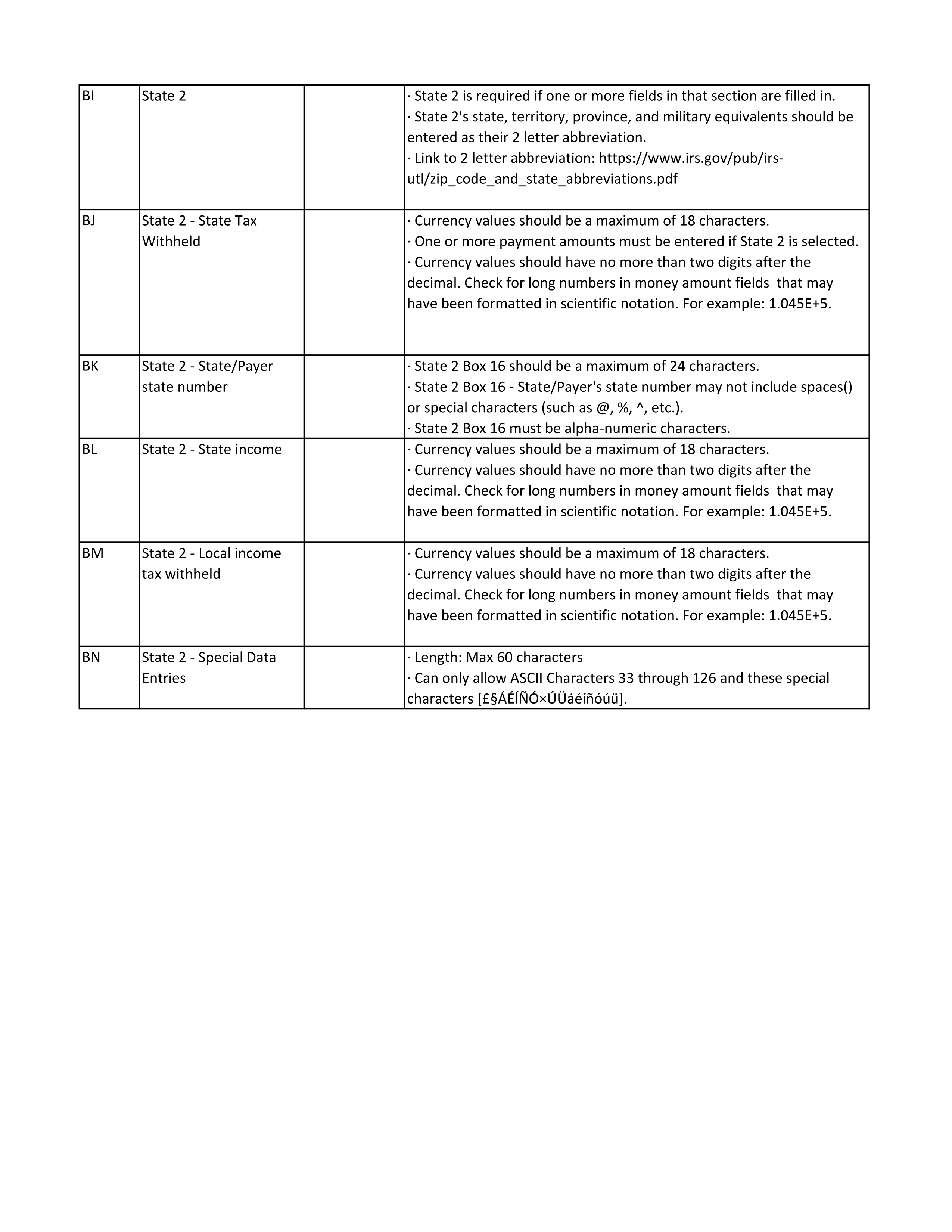

State 2

State 2 - State Tax Withheld

State 2 - State/Payer state number

State 2 - State income

State 2 - Local income tax withheld

State 2 - Special Data Entries

CSV Guidelines