IRIS >

IRIS CSV

CSV Template

Form Type,Tax Year,Payer TIN Type,Payer Taxpayer ID Number,Payer Name Type,Payer Business or Entity Name Line 1,Payer Business or Entity Name Line 2,Payer First Name,Payer Middle Name,Payer Last Name (Surname),Payer Suffix,Payer Country,Payer Address Line 1,Payer Address Line 2,Payer City/Town,Payer State/Province/Territory,Payer ZIP/Postal Code,Payer Phone Type,Payer Phone,Payer Email Address,Recipient TIN Type,Recipient Taxpayer ID Number,Recipient Name Type,Recipient Business or Entity Name Line 1,Recipient Business or Entity Name Line 2,Recipient First Name,Recipient Middle Name,Recipient Last Name (Surname),Recipient Suffix,Recipient Country,Recipient Address Line 1,Recipient Address Line 2,Recipient City/Town,Recipient State/Province/Territory,Recipient ZIP/Postal Code,Office Code,Form Account Number,FATCA Filing Requirements,2nd TIN Notice,Payer's RTN,Box 1 - Interest Income,Box 2 - Early withdrawal penalty,Box 3 - Interest on U.S. Savings Bonds and Treasury obligations,Box 4 - Federal income tax withheld,Box 5 - Investment expenses,Box 6 - Foreign tax paid,Box 7 - Foreign country or U.S. possession,Box 8 - Tax-exempt interest,Box 9 - Specified private activity bond interest,Box 10 - Market discount,Box 11 - Bond premium,Box 12 - Bond premium on Treasury obligations,Box 13 - Bond premium on tax-exempt bond,Box 14 - Tax-exempt and tax credit bond CUSIP no.,Combined Federal/State Filing,State 1,State 1 - State Tax Withheld,State 1 - State/Payer state number,State 1 - State income,State 1 - Local income tax withheld,State 1 - Special Data Entries,State 2,State 2 - State Tax Withheld,State 2 - State/Payer state number,State 2 - State income,State 2 - Local income tax withheld,State 2 - Special Data Entries

,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,

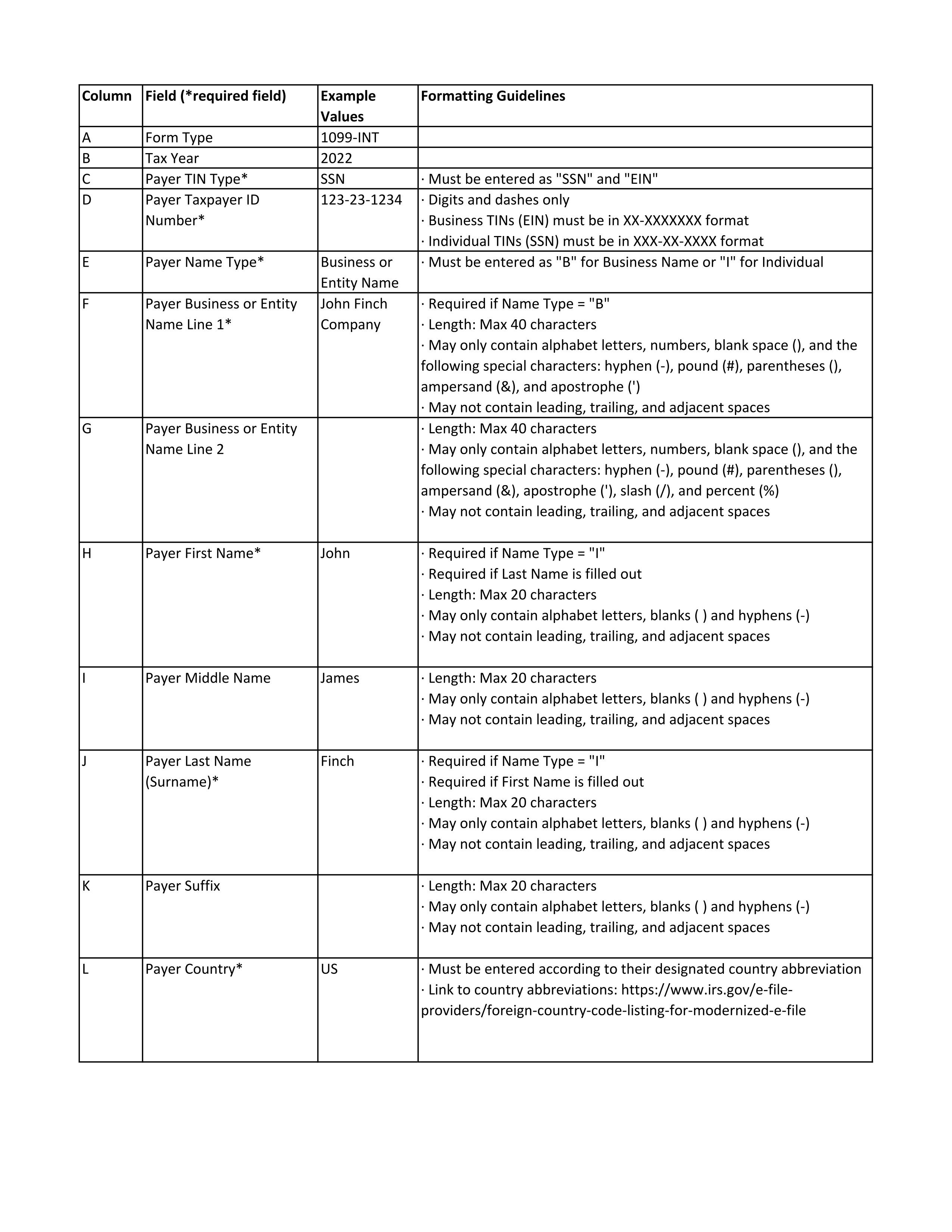

CSV Columns

Form Type

Tax Year

Payer TIN Type

Payer Taxpayer ID Number

Payer Name Type

Payer Business or Entity Name Line 1

Payer Business or Entity Name Line 2

Payer First Name

Payer Middle Name

Payer Last Name (Surname)

Payer Suffix

Payer Country

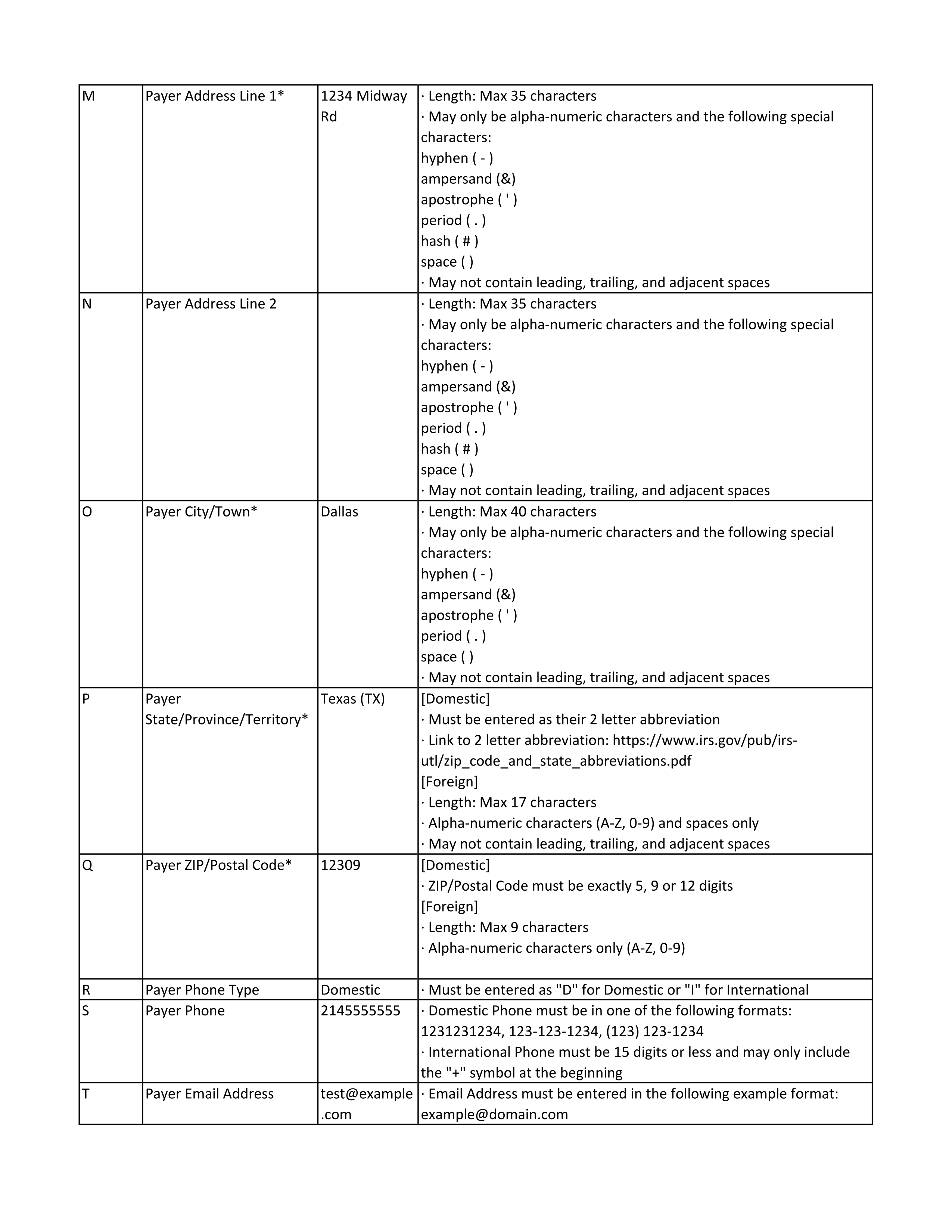

Payer Address Line 1

Payer Address Line 2

Payer City/Town

Payer State/Province/Territory

Payer ZIP/Postal Code

Payer Phone Type

Payer Phone

Payer Email Address

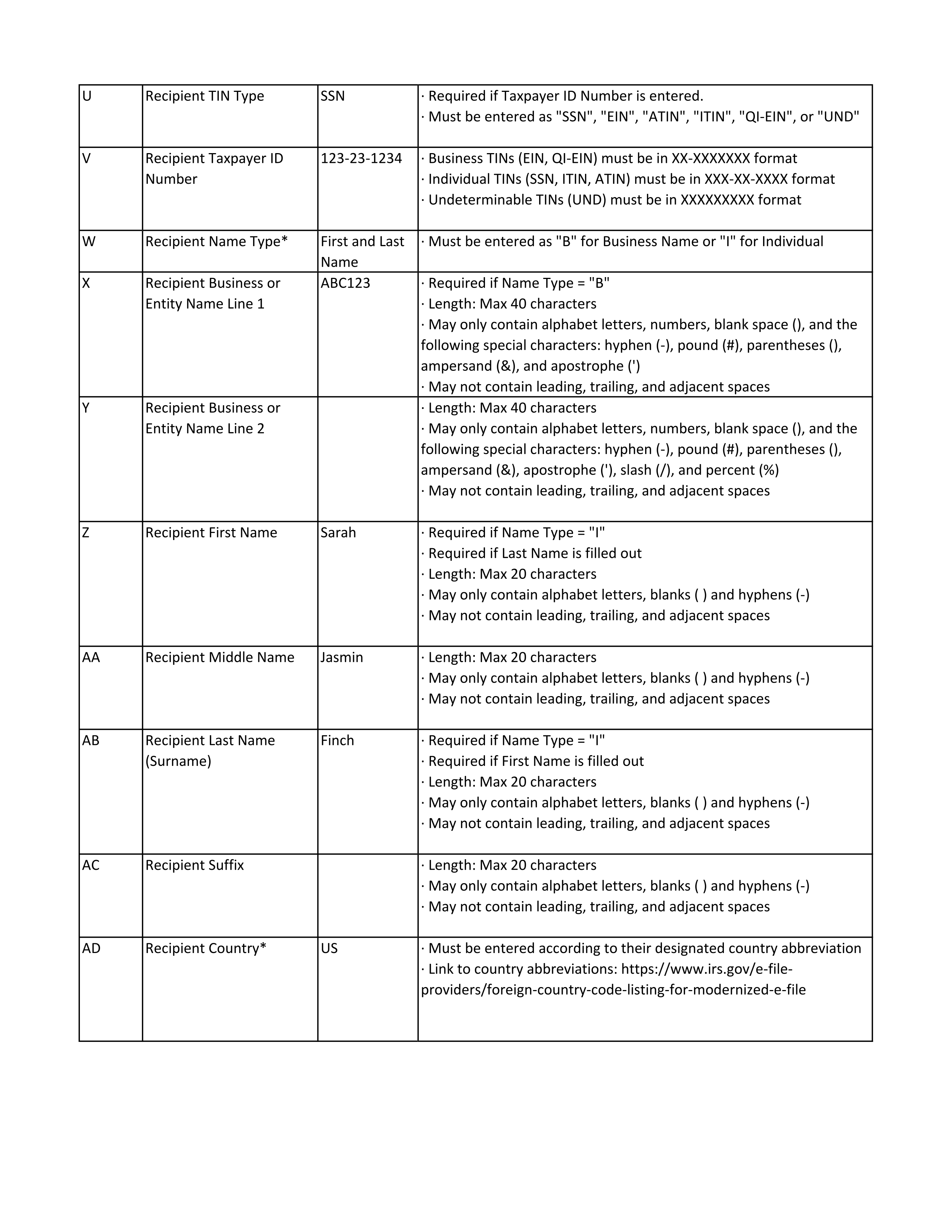

Recipient TIN Type

Recipient Taxpayer ID Number

Recipient Name Type

Recipient Business or Entity Name Line 1

Recipient Business or Entity Name Line 2

Recipient First Name

Recipient Middle Name

Recipient Last Name (Surname)

Recipient Suffix

Recipient Country

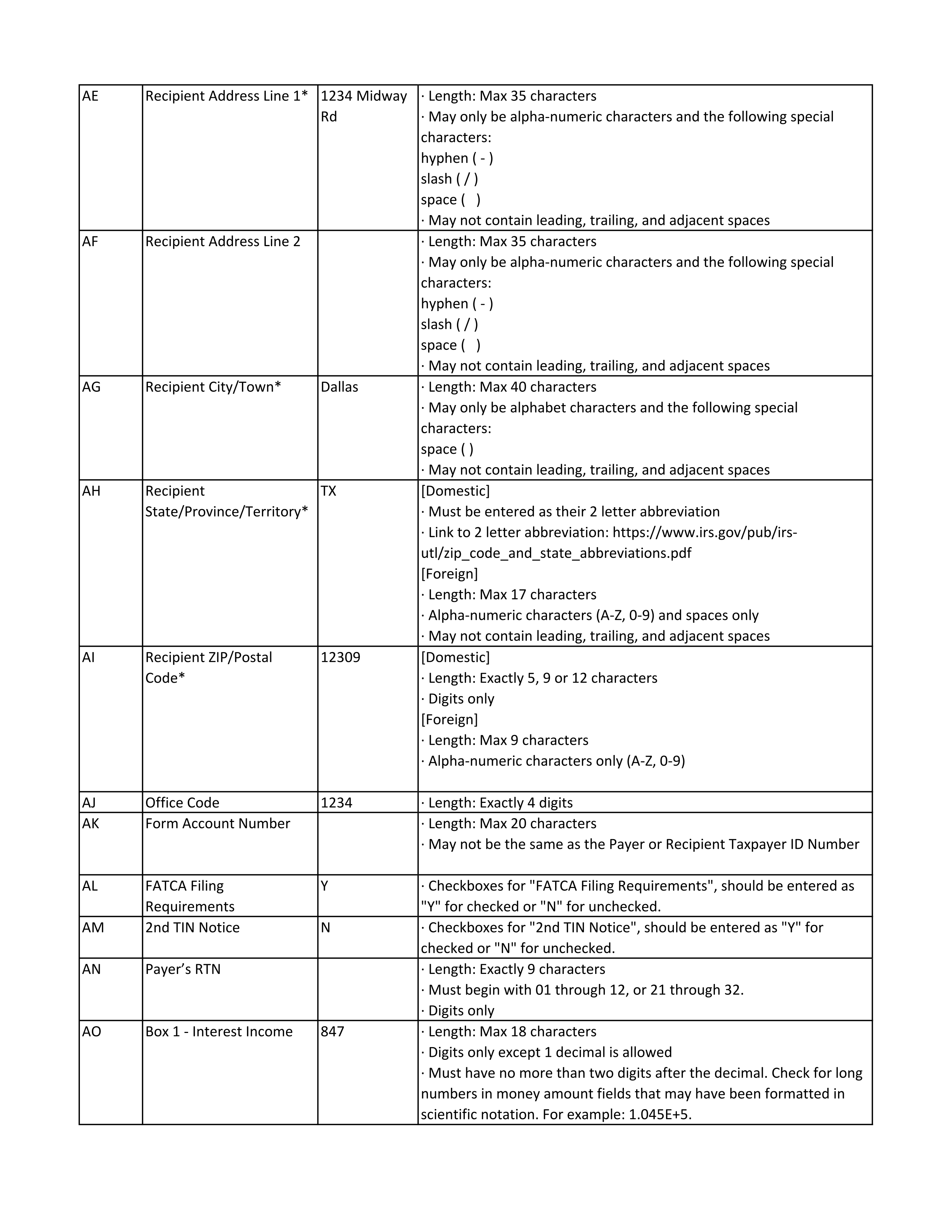

Recipient Address Line 1

Recipient Address Line 2

Recipient City/Town

Recipient State/Province/Territory

Recipient ZIP/Postal Code

Office Code

Form Account Number

FATCA Filing Requirements

2nd TIN Notice

Payer's RTN

Box 1 - Interest Income

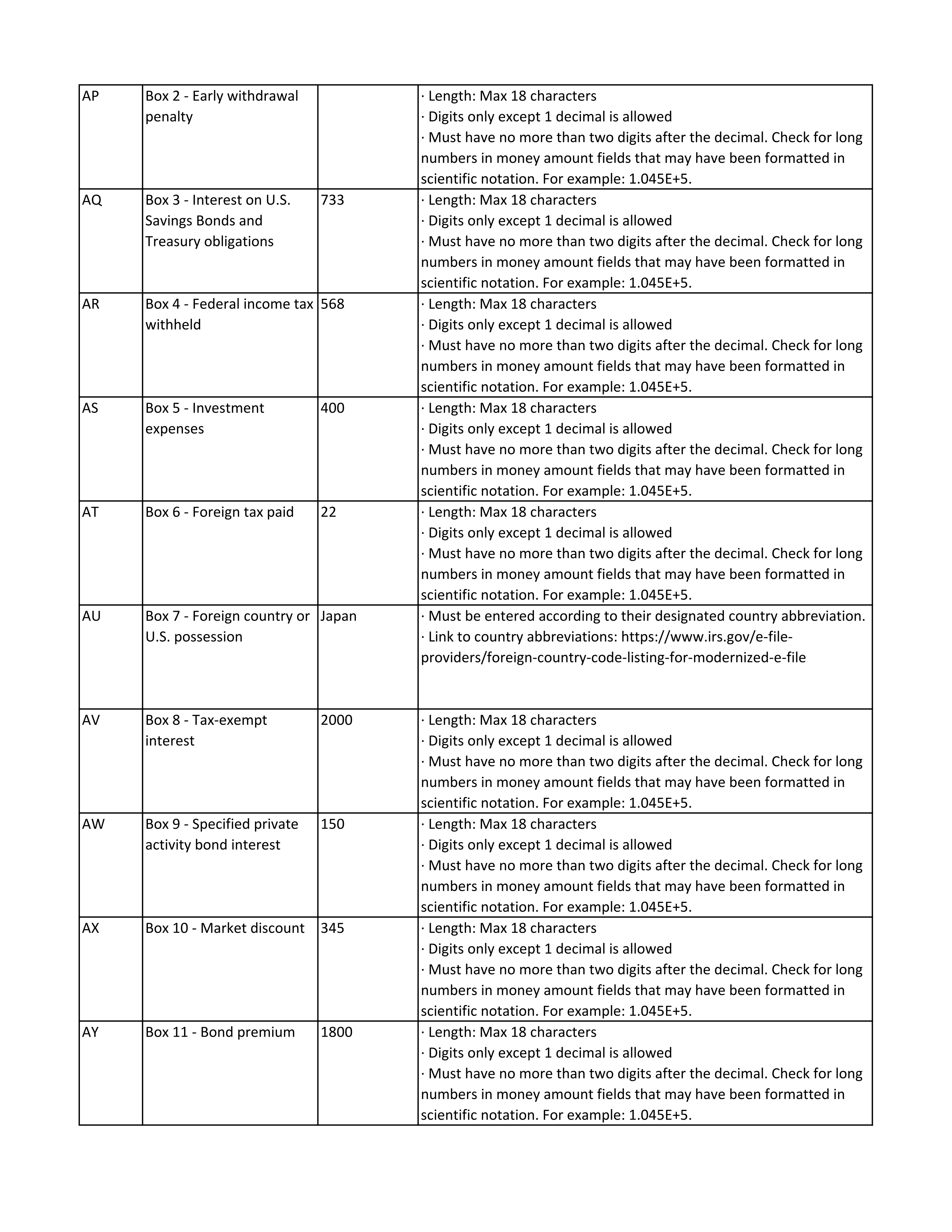

Box 2 - Early withdrawal penalty

Box 3 - Interest on U.S. Savings Bonds and Treasury obligations

Box 4 - Federal income tax withheld

Box 5 - Investment expenses

Box 6 - Foreign tax paid

Box 7 - Foreign country or U.S. possession

Box 8 - Tax-exempt interest

Box 9 - Specified private activity bond interest

Box 10 - Market discount

Box 11 - Bond premium

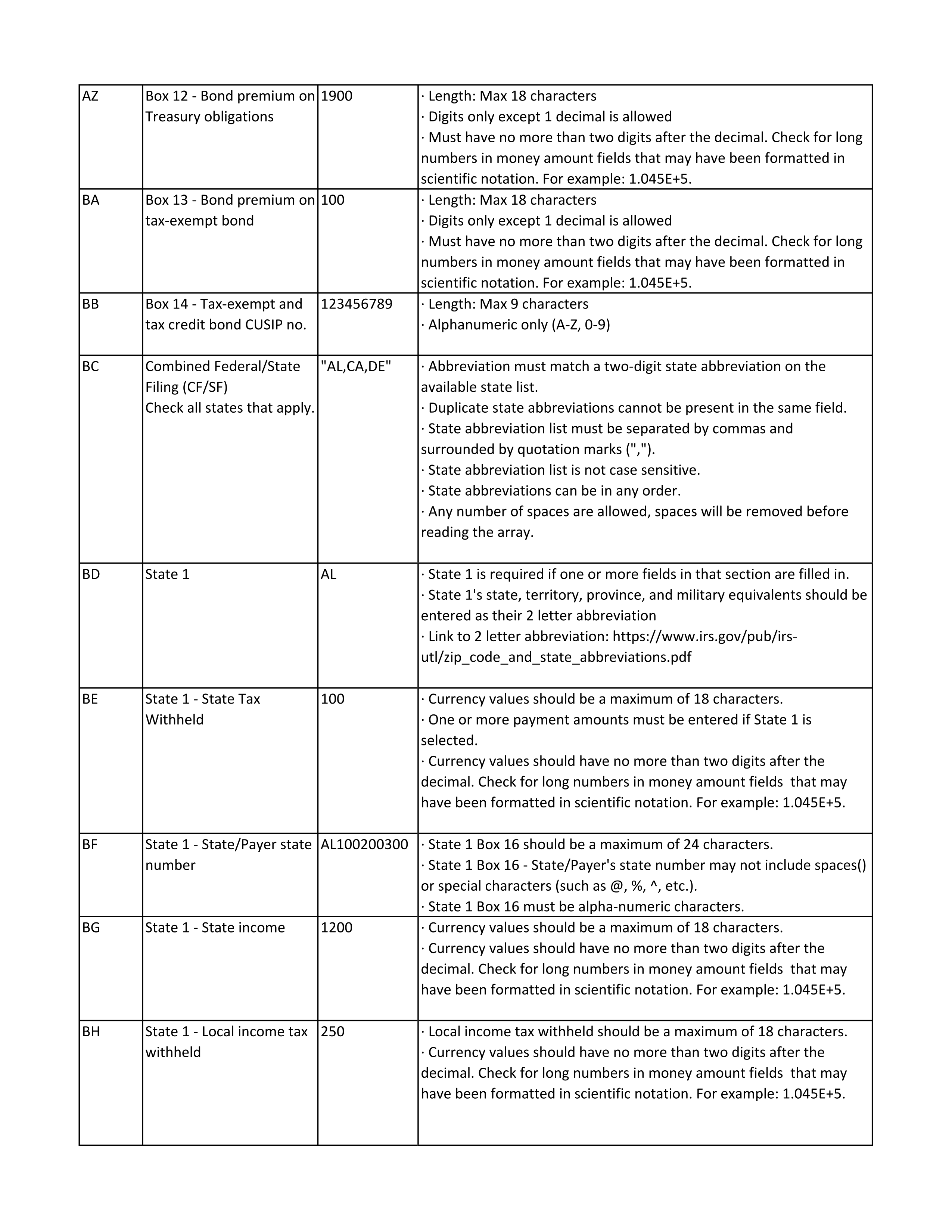

Box 12 - Bond premium on Treasury obligations

Box 13 - Bond premium on tax-exempt bond

Box 14 - Tax-exempt and tax credit bond CUSIP no.

Combined Federal/State Filing

State 1

State 1 - State Tax Withheld

State 1 - State/Payer state number

State 1 - State income

State 1 - Local income tax withheld

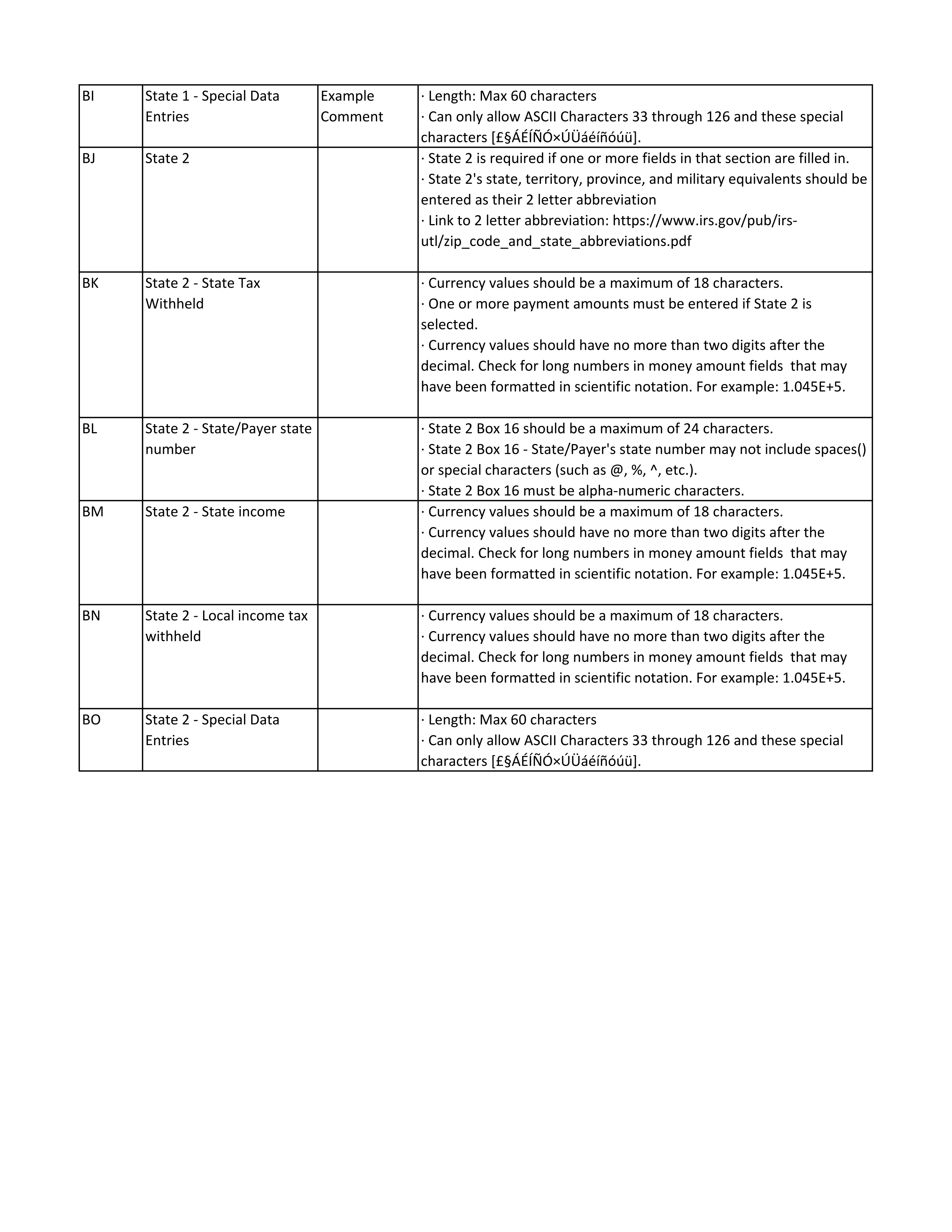

State 1 - Special Data Entries

State 2

State 2 - State Tax Withheld

State 2 - State/Payer state number

State 2 - State income

State 2 - Local income tax withheld

State 2 - Special Data Entries

CSV Guidelines