IRIS >

IRIS CSV

CSV Template

Form Type,Tax Year,Payer TIN Type,Payer Taxpayer ID Number,Payer Name Type,Payer Business or Entity Name Line 1,Payer Business or Entity Name Line 2,Payer First Name,Payer Middle Name,Payer Last Name (Surname),Payer Suffix,Payer Country,Payer Address Line 1,Payer Address Line 2,Payer City/Town,Payer State/Province/Territory,Payer ZIP/Postal Code,Payer Phone Type,Payer Phone,Payer Email Address,Recipient TIN Type,Recipient Taxpayer ID Number,Recipient Name Type,Recipient Business or Entity Name Line 1,Recipient Business or Entity Name Line 2,Recipient First Name,Recipient Middle Name,Recipient Last Name (Surname),Recipient Suffix,Recipient Country,Recipient Address Line 1,Recipient Address Line 2,Recipient City/Town,Recipient State/Province/Territory,Recipient ZIP/Postal Code,Office Code,Form Account Number,FATCA Filing Requirements,2nd TIN Notice,Box 1a - Total ordinary dividends,Box 1b - Qualified dividends,Box 2a - Total capital gain distribution,Box 2b - Unrecap. Sec. 1250 gain,Box 2c - Section 1202 gain,Box 2d - Collectibles (28%) gain,Box 2e - Section 897 ordinary dividends,Box 2f - Section 897 capital gain,Box 3 - Nondividend distributions,Box 4 - Federal income tax withheld,Box 5 - Section 199A dividends,Box 6 - Investment expenses,Box 7 - Foreign tax paid,Box 8 - Foreign country or U.S. possession,Box 9 - Cash liquidation distributions,Box 10 - Noncash liquidation distributions,Box 12 - Exempt-interest dividends,Box 13 - Specified private activity bond interest dividends,Combined Federal/State Filing,State 1,State 1 - State Tax Withheld,State 1 - State/Payer state number,State 1 - State income,State 1 - Local income tax withheld,State 1 - Special Data Entries,State 2,State 2 - State Tax Withheld,State 2 - State/Payer state number,State 2 - State income,State 2 - Local income tax withheld,State 2 - Special Data Entries

,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,

CSV Columns

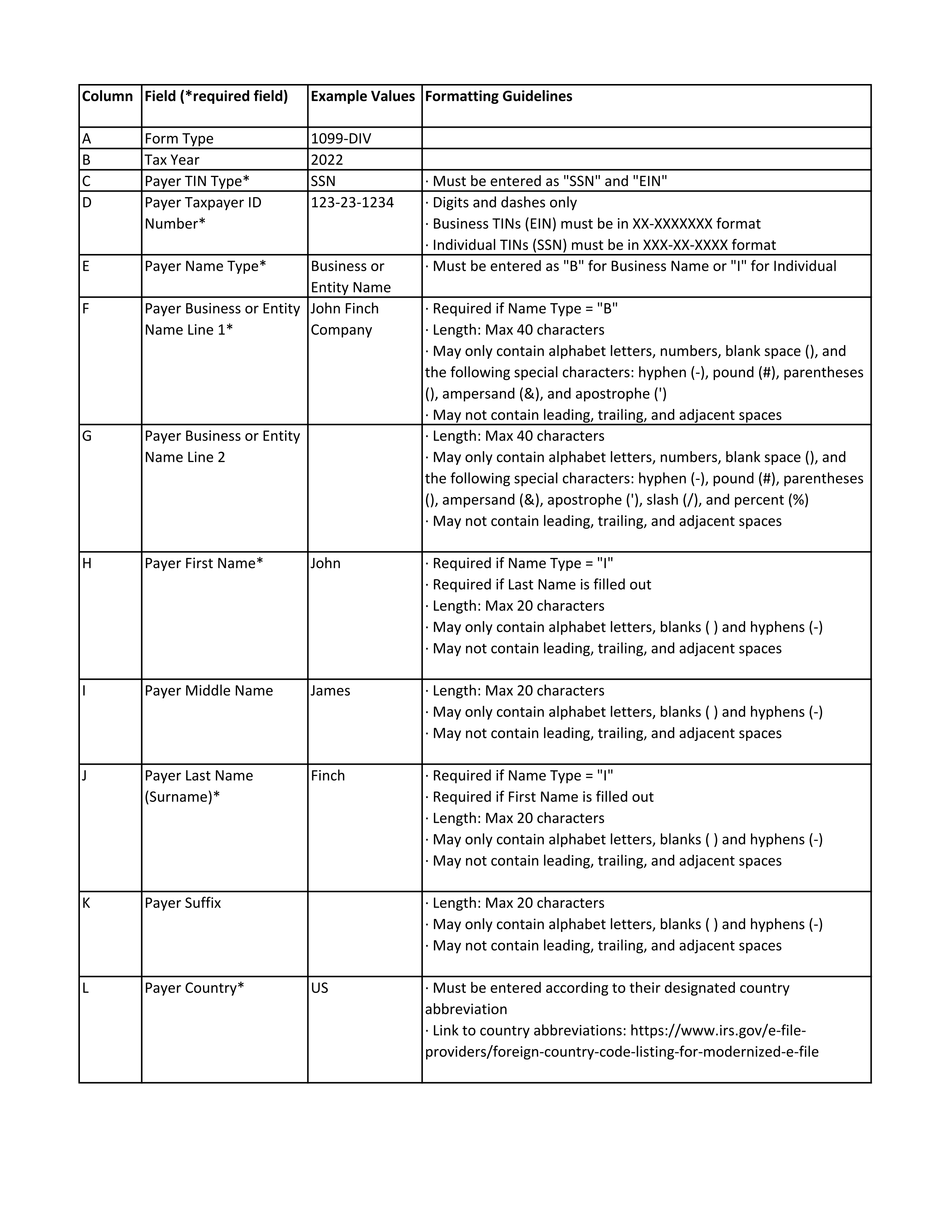

Form Type

Tax Year

Payer TIN Type

Payer Taxpayer ID Number

Payer Name Type

Payer Business or Entity Name Line 1

Payer Business or Entity Name Line 2

Payer First Name

Payer Middle Name

Payer Last Name (Surname)

Payer Suffix

Payer Country

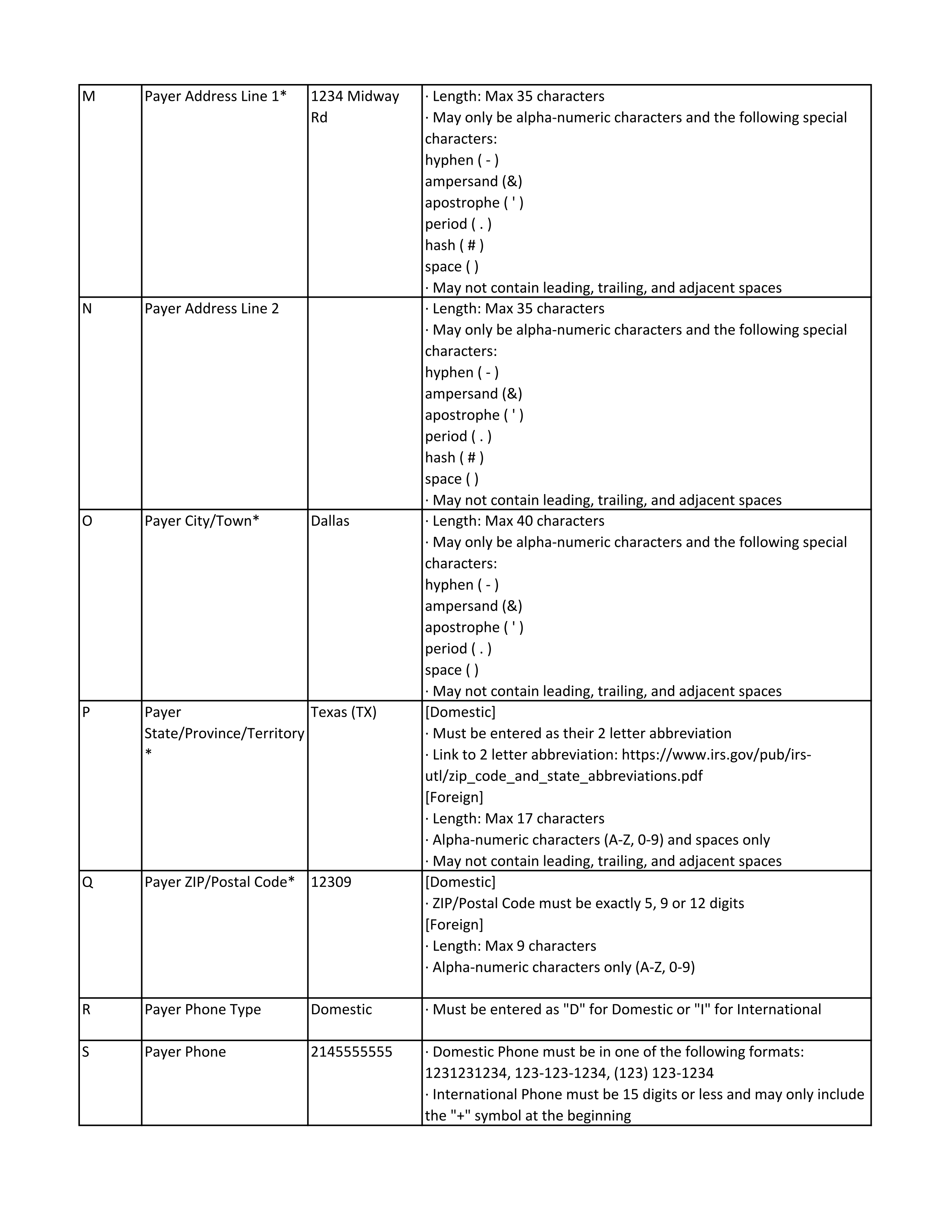

Payer Address Line 1

Payer Address Line 2

Payer City/Town

Payer State/Province/Territory

Payer ZIP/Postal Code

Payer Phone Type

Payer Phone

Payer Email Address

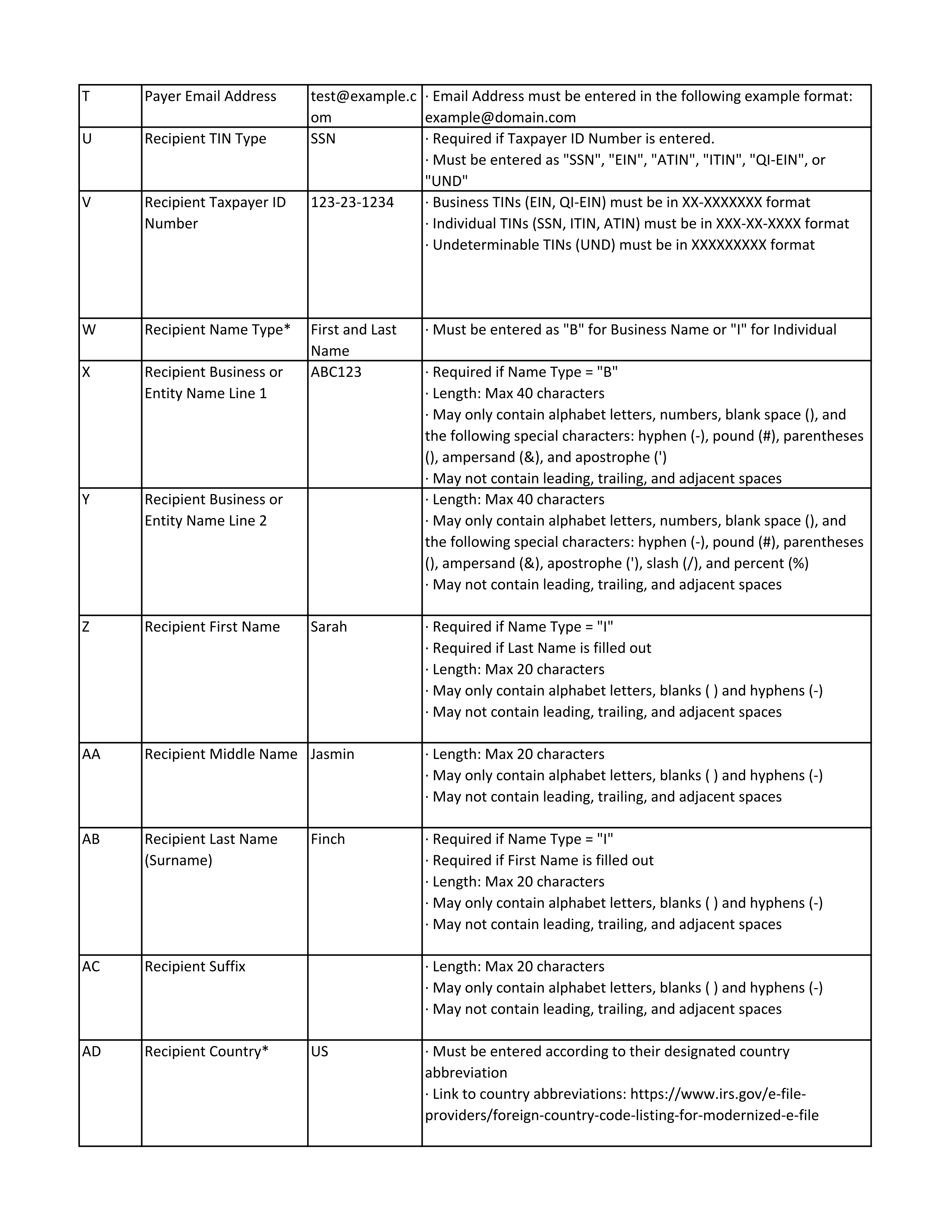

Recipient TIN Type

Recipient Taxpayer ID Number

Recipient Name Type

Recipient Business or Entity Name Line 1

Recipient Business or Entity Name Line 2

Recipient First Name

Recipient Middle Name

Recipient Last Name (Surname)

Recipient Suffix

Recipient Country

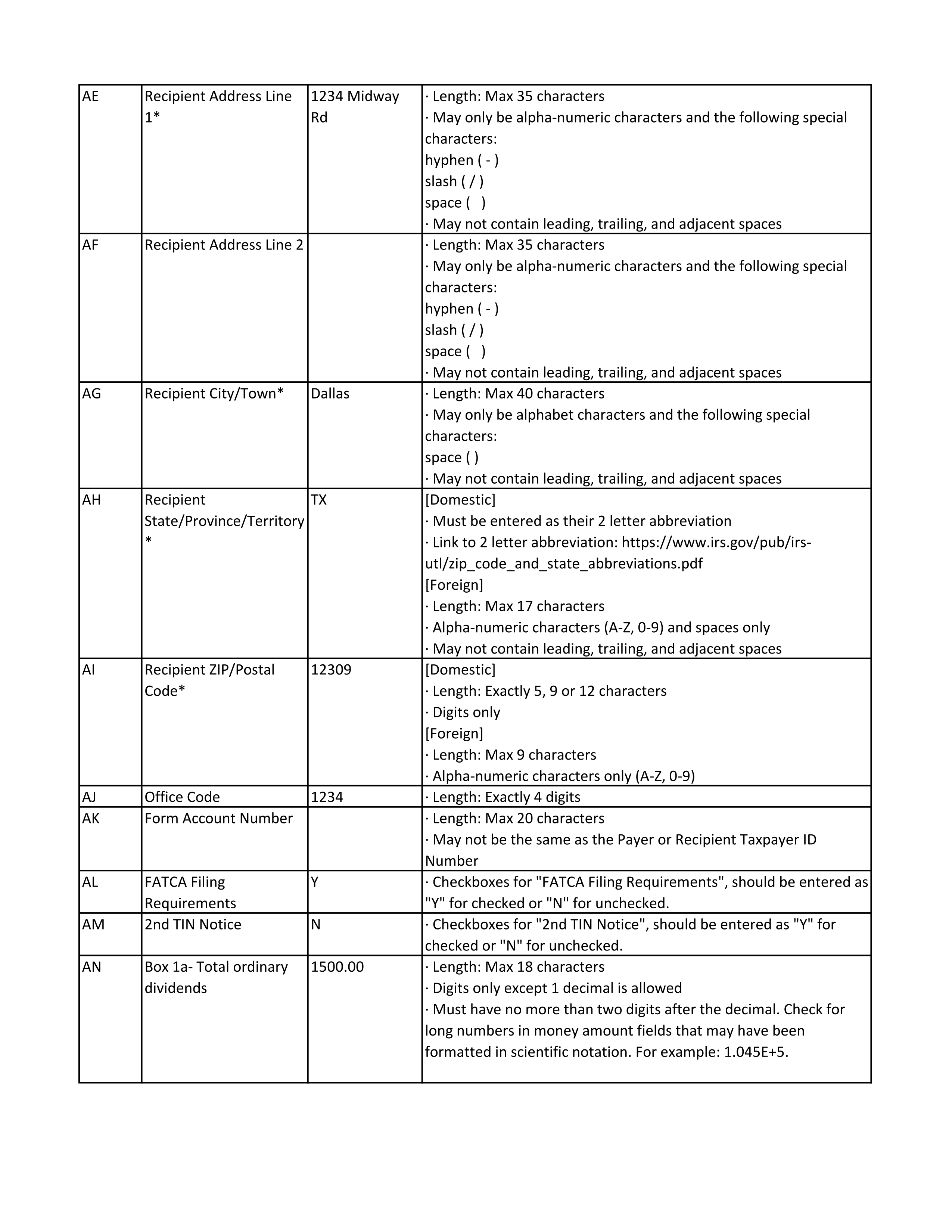

Recipient Address Line 1

Recipient Address Line 2

Recipient City/Town

Recipient State/Province/Territory

Recipient ZIP/Postal Code

Office Code

Form Account Number

FATCA Filing Requirements

2nd TIN Notice

Box 1a - Total ordinary dividends

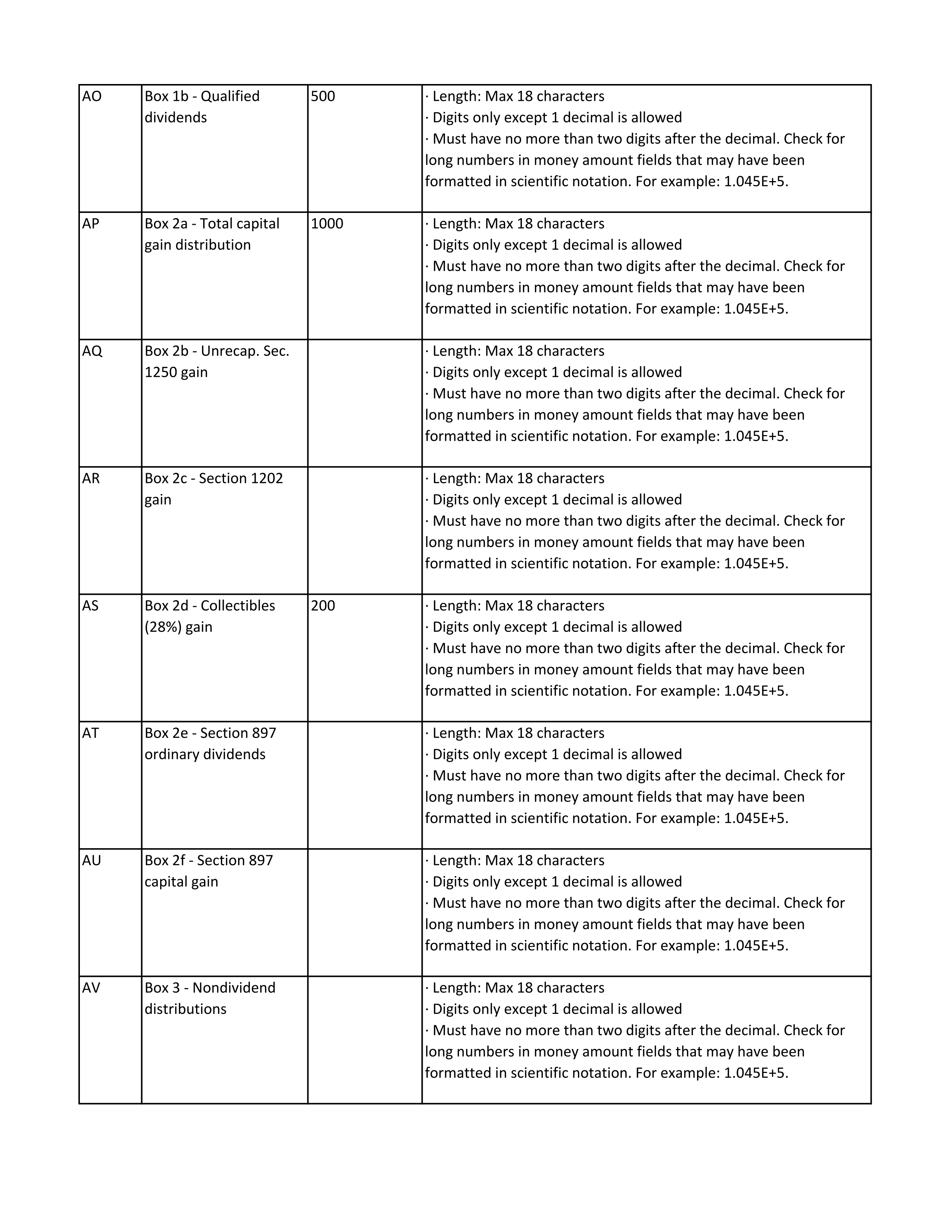

Box 1b - Qualified dividends

Box 2a - Total capital gain distribution

Box 2b - Unrecap. Sec. 1250 gain

Box 2c - Section 1202 gain

Box 2d - Collectibles (28%) gain

Box 2e - Section 897 ordinary dividends

Box 2f - Section 897 capital gain

Box 3 - Nondividend distributions

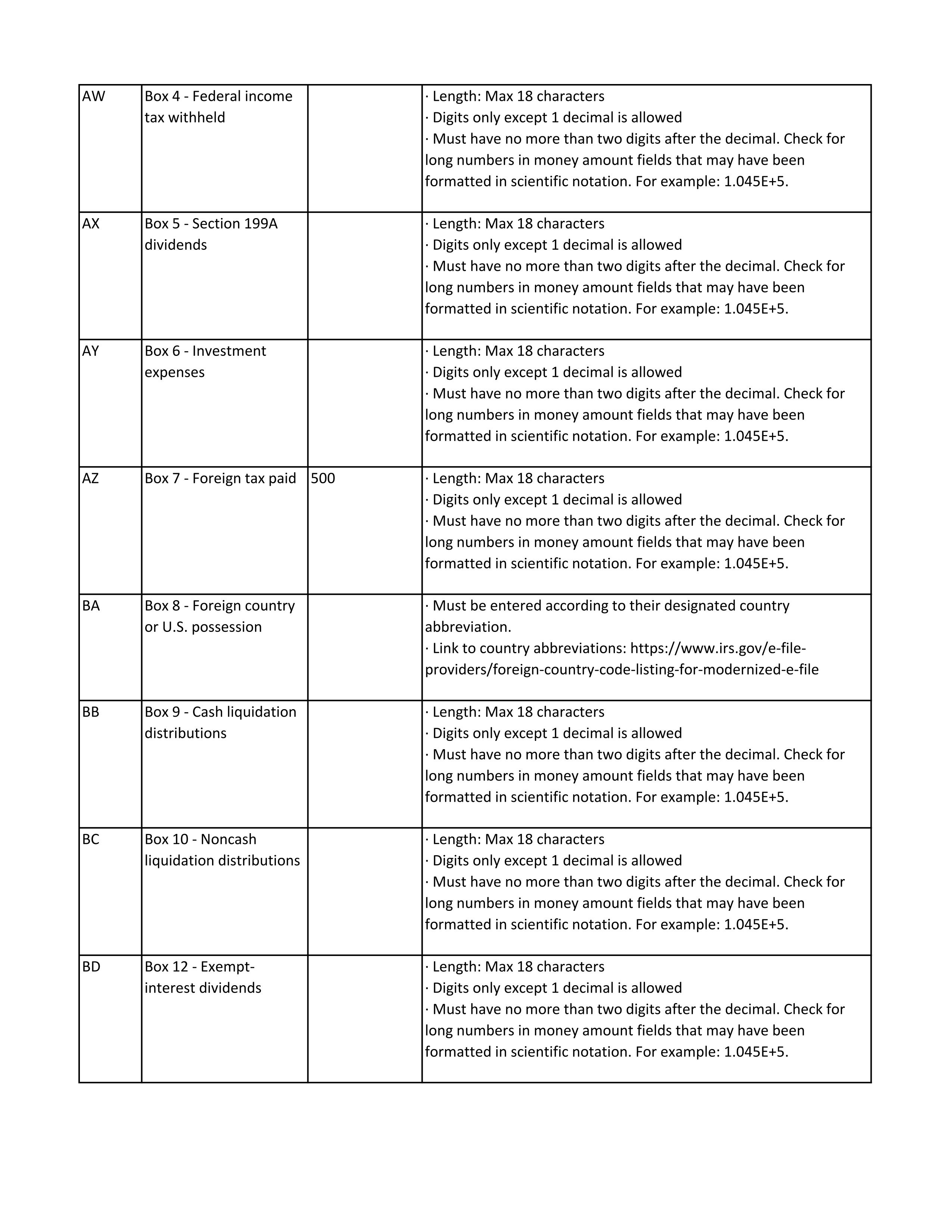

Box 4 - Federal income tax withheld

Box 5 - Section 199A dividends

Box 6 - Investment expenses

Box 7 - Foreign tax paid

Box 8 - Foreign country or U.S. possession

Box 9 - Cash liquidation distributions

Box 10 - Noncash liquidation distributions

Box 12 - Exempt-interest dividends

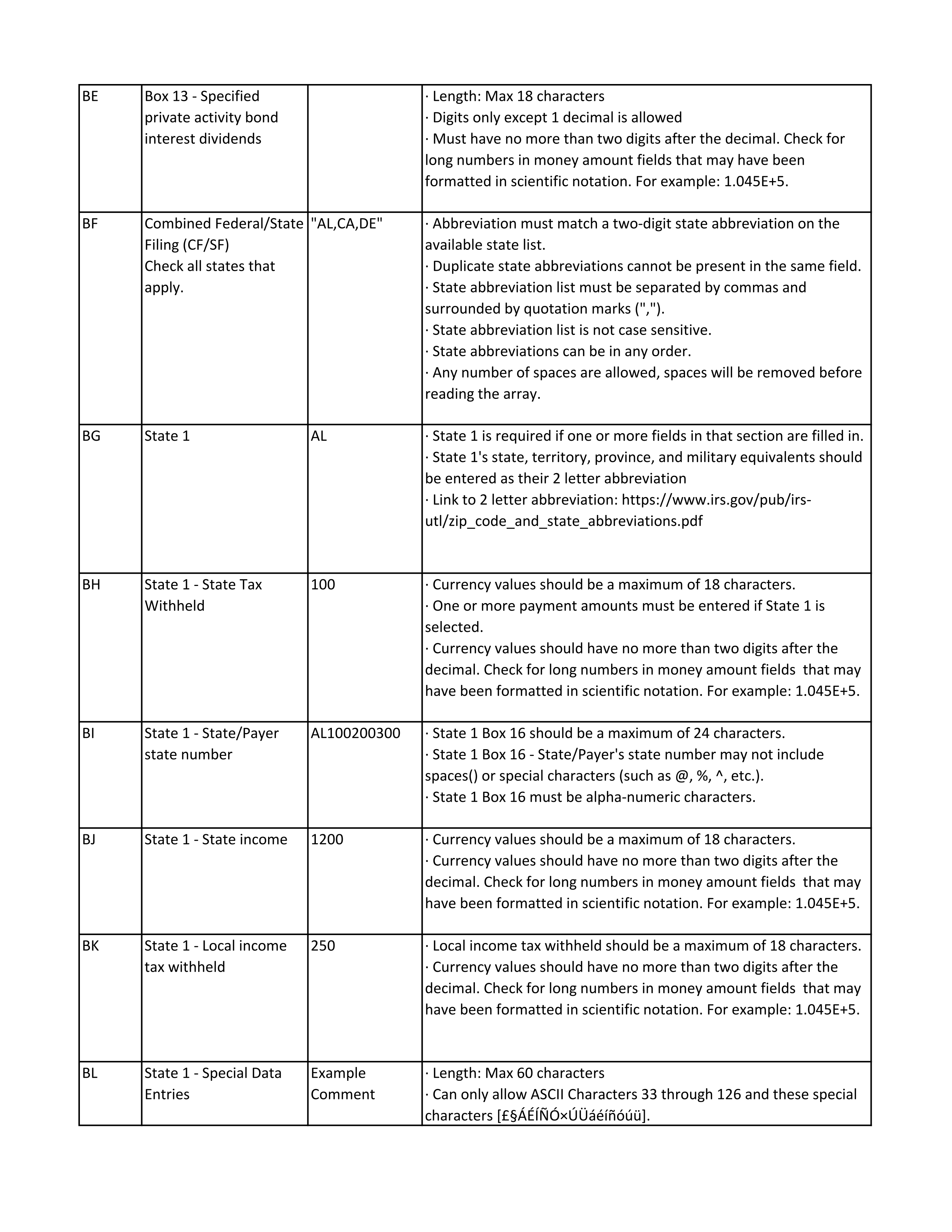

Box 13 - Specified private activity bond interest dividends

Combined Federal/State Filing

State 1

State 1 - State Tax Withheld

State 1 - State/Payer state number

State 1 - State income

State 1 - Local income tax withheld

State 1 - Special Data Entries

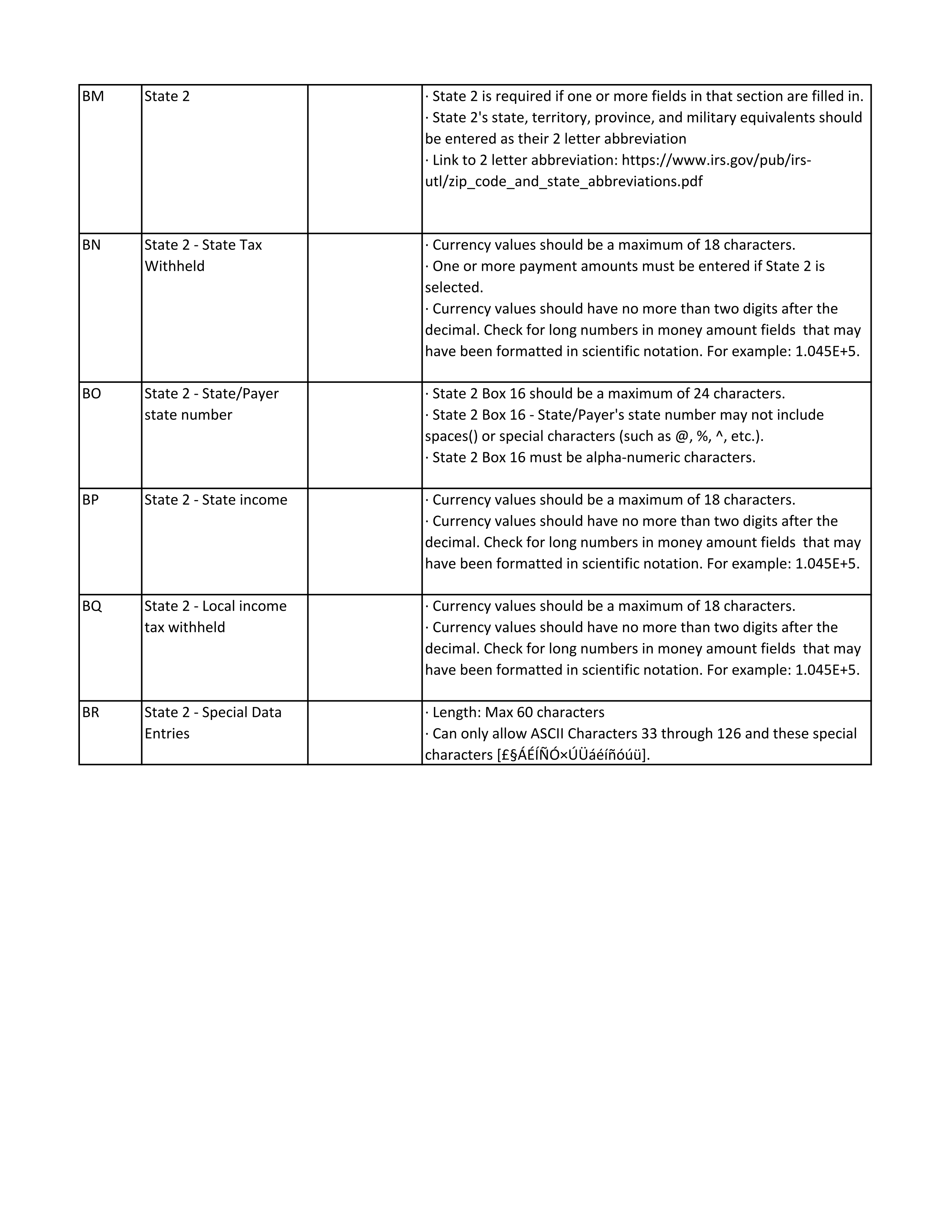

State 2

State 2 - State Tax Withheld

State 2 - State/Payer state number

State 2 - State income

State 2 - Local income tax withheld

State 2 - Special Data Entries

CSV Guidelines