IRIS >

IRIS CSV

CSV Template

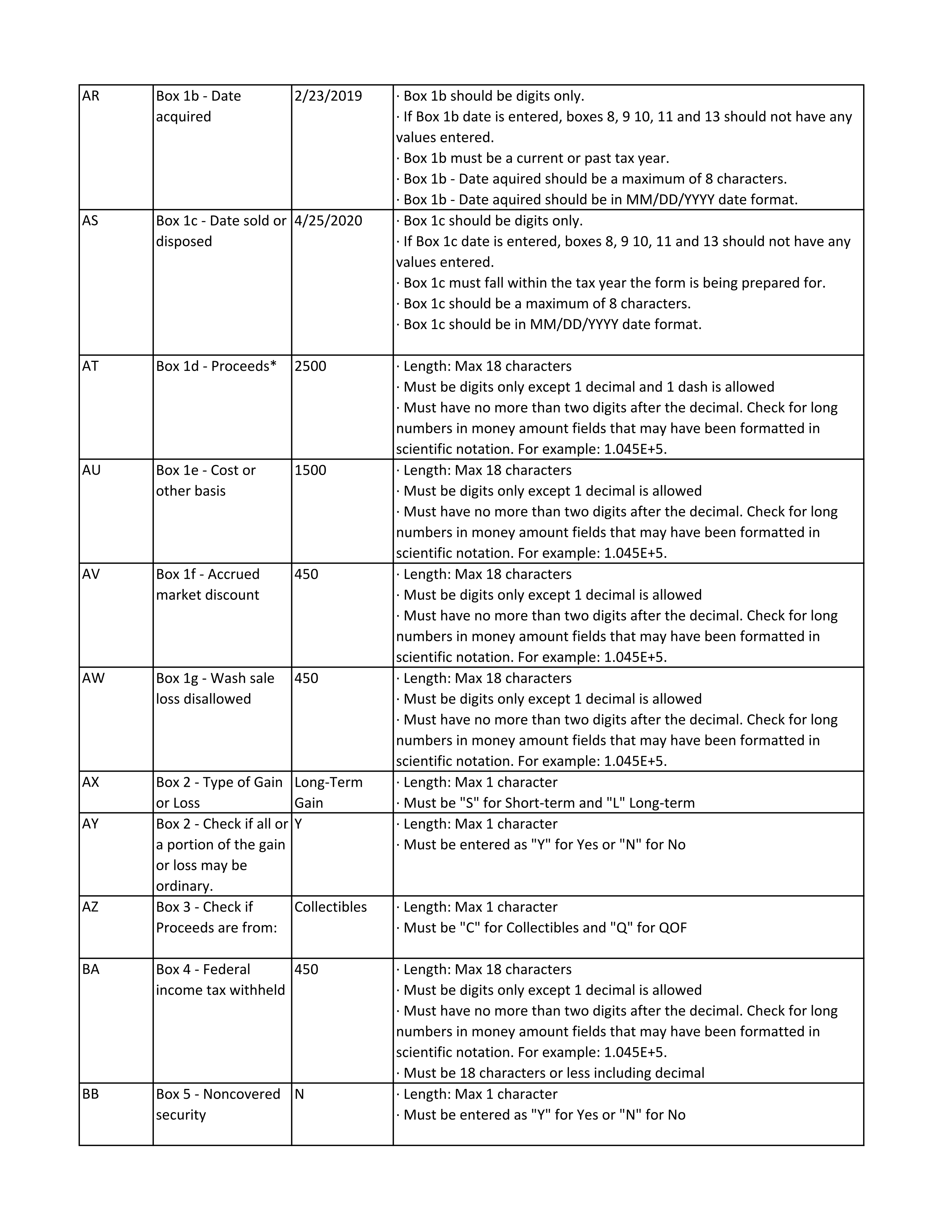

Form Type,Tax Year,Payer TIN Type,Payer Taxpayer ID Number,Payer Name Type,Payer Business or Entity Name Line 1,Payer Business or Entity Name Line 2,Payer First Name,Payer Middle Name,Payer Last Name (Surname),Payer Suffix,Payer Country,Payer Address Line 1,Payer Address Line 2,Payer City/Town,Payer State/Province/Territory,Payer ZIP/Postal Code,Payer Phone Type,Payer Phone,Payer Email Address,Recipient TIN Type,Recipient Taxpayer ID Number,Recipient Name Type,Recipient Business or Entity Name Line 1,Recipient Business or Entity Name Line 2,Recipient First Name,Recipient Middle Name,Recipient Last Name (Surname),Recipient Suffix,Recipient Country,Recipient Address Line 1,Recipient Address Line 2,Recipient City/Town,Recipient State/Province/Territory,Recipient ZIP/Postal Code,Office Code,Form Account Number,FATCA Filing Requirements,2nd TIN Notice,1099-B Form Type,Applicable checkbox on Form 8949,CUSIP Number,Box 1a - Description of property,Box 1b - Date acquired,Box 1c - Date sold or disposed,Box 1d - Proceeds,Box 1e - Cost or other basis,Box 1f - Accrued market discount,Box 1g - Wash sale loss disallowed,Box 2 - Type of Gain or Loss,Box 2 - Check if all or a portion of the gain or loss may be ordinary.,Box 3 - Check if Proceeds are from:,Box 4 - Federal income tax withheld,Box 5 - Noncovered security,Box 6 - Reported to IRS:,Box 7 - Loss not allowed based on amount in 1d,Box 12 - Basis reported to IRS,Combined Federal/State Filing,State 1,State 1 - State Tax Withheld,State 1 - State/Payer state number,State 1 - State income,State 1 - Local income tax withheld,State 1 - Special Data Entries,State 2,State 2 - State Tax Withheld,State 2 - State/Payer state number,State 2 - State income,State 2 - Local income tax withheld,State 2 - Special Data Entries

,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,

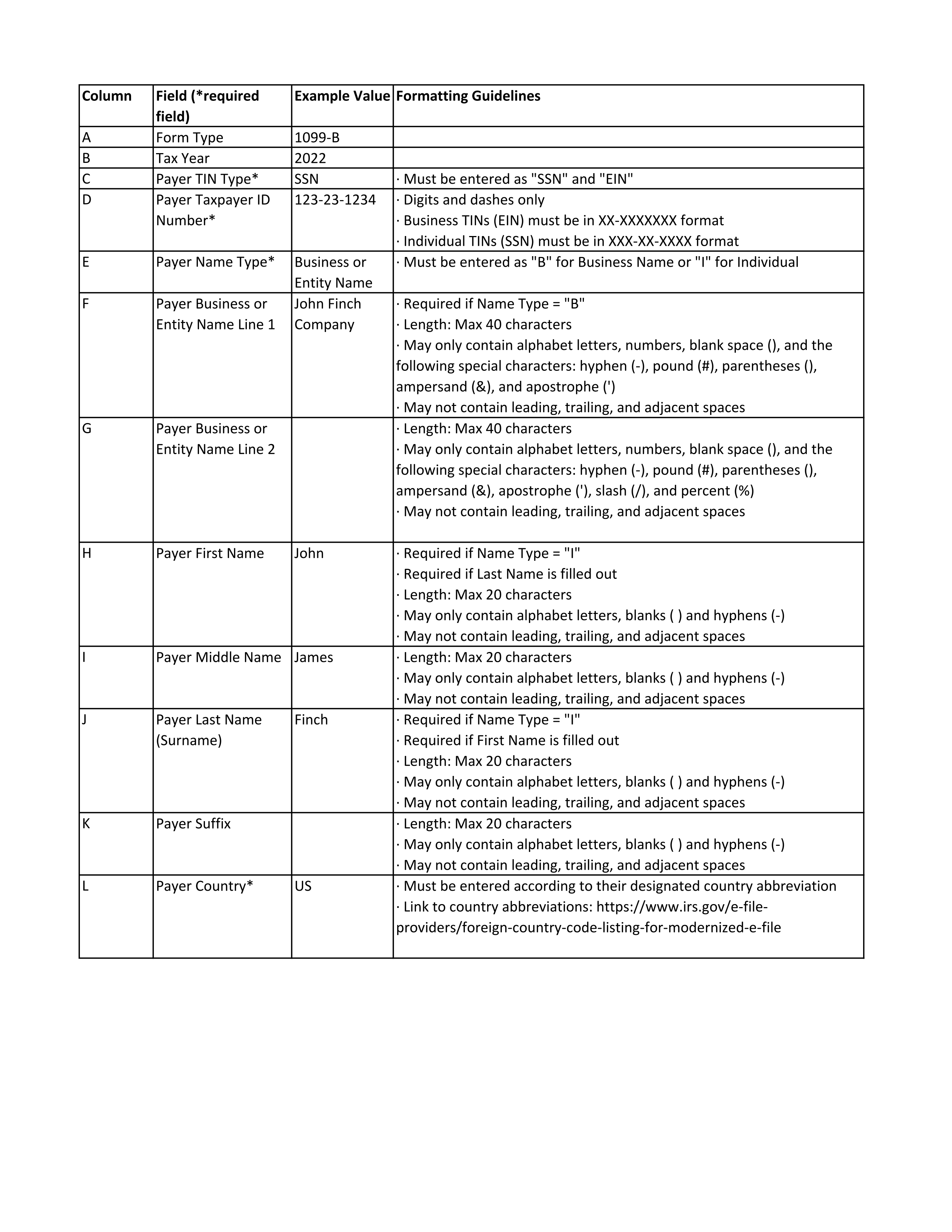

CSV Columns

Form Type

Tax Year

Payer TIN Type

Payer Taxpayer ID Number

Payer Name Type

Payer Business or Entity Name Line 1

Payer Business or Entity Name Line 2

Payer First Name

Payer Middle Name

Payer Last Name (Surname)

Payer Suffix

Payer Country

Payer Address Line 1

Payer Address Line 2

Payer City/Town

Payer State/Province/Territory

Payer ZIP/Postal Code

Payer Phone Type

Payer Phone

Payer Email Address

Recipient TIN Type

Recipient Taxpayer ID Number

Recipient Name Type

Recipient Business or Entity Name Line 1

Recipient Business or Entity Name Line 2

Recipient First Name

Recipient Middle Name

Recipient Last Name (Surname)

Recipient Suffix

Recipient Country

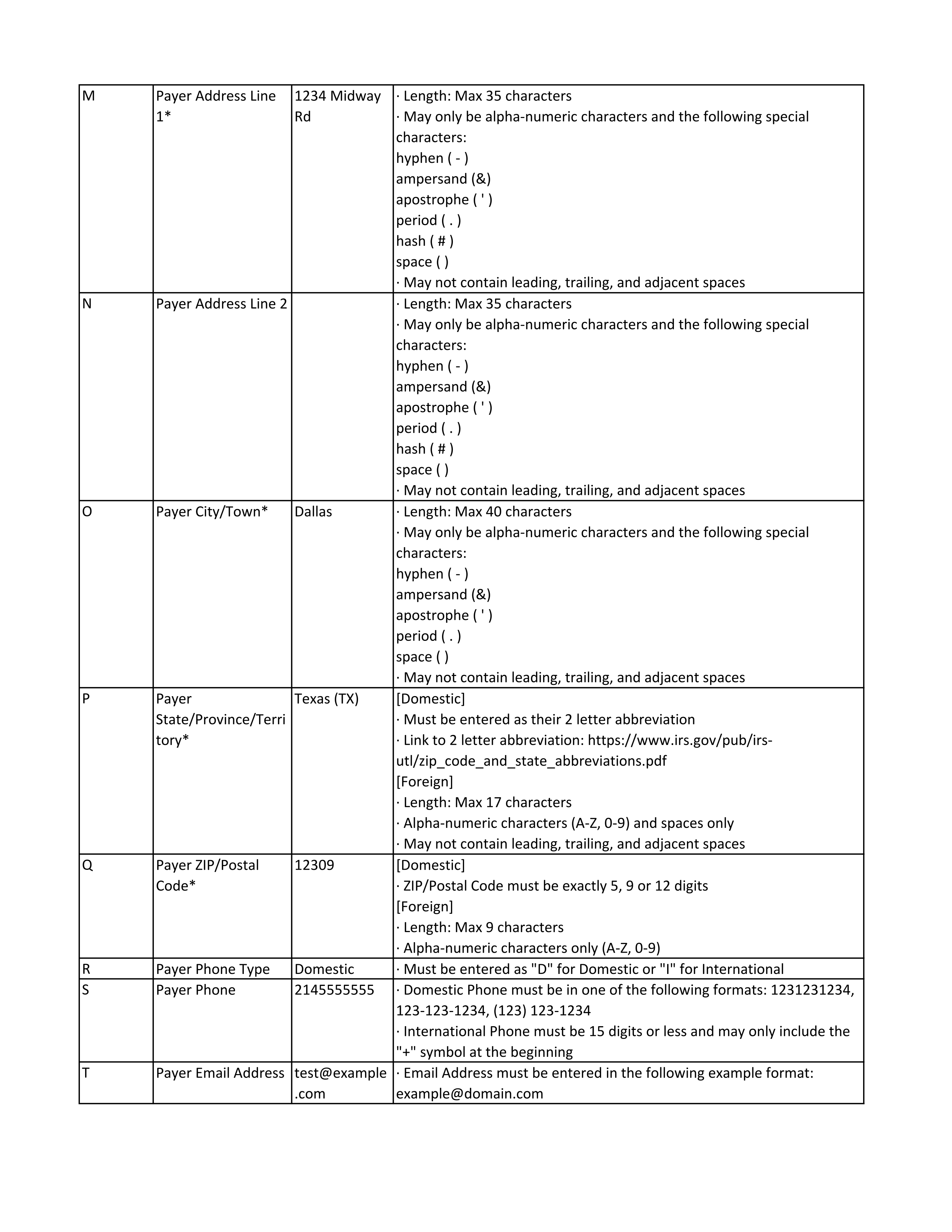

Recipient Address Line 1

Recipient Address Line 2

Recipient City/Town

Recipient State/Province/Territory

Recipient ZIP/Postal Code

Office Code

Form Account Number

FATCA Filing Requirements

2nd TIN Notice

1099-B Form Type

Applicable checkbox on Form 8949

CUSIP Number

Box 1a - Description of property

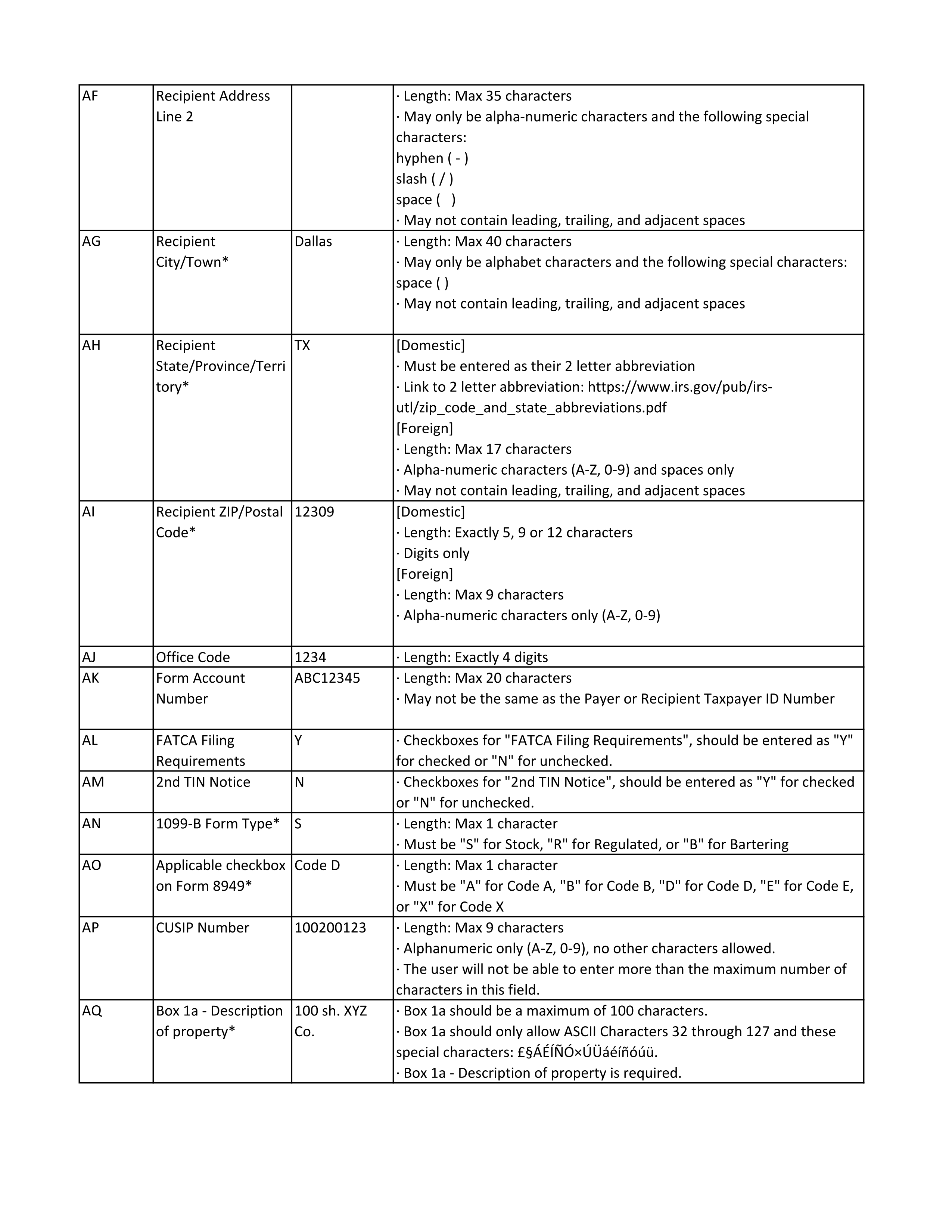

Box 1b - Date acquired

Box 1c - Date sold or disposed

Box 1d - Proceeds

Box 1e - Cost or other basis

Box 1f - Accrued market discount

Box 1g - Wash sale loss disallowed

Box 2 - Type of Gain or Loss

Box 2 - Check if all or a portion of the gain or loss may be ordinary.

Box 3 - Check if Proceeds are from:

Box 4 - Federal income tax withheld

Box 5 - Noncovered security

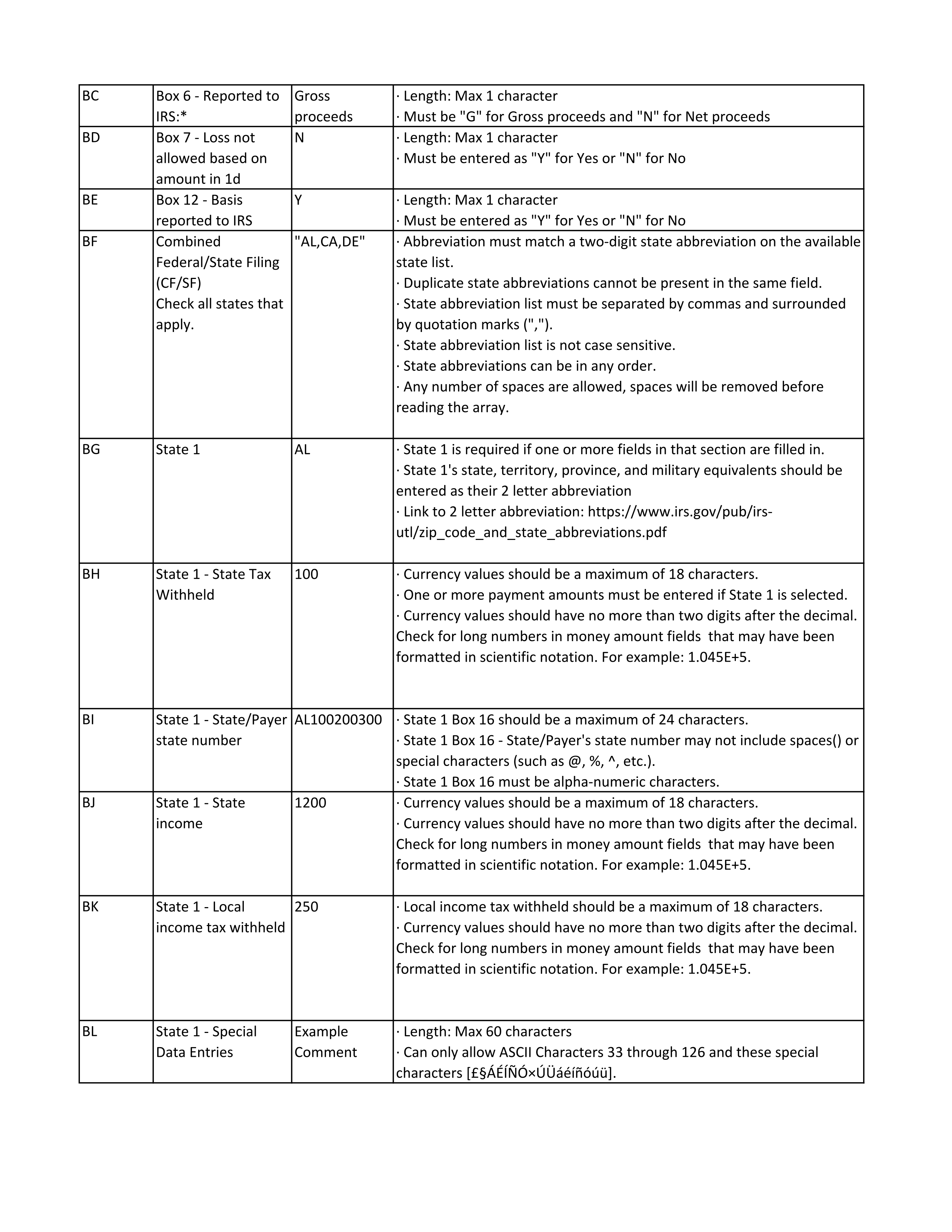

Box 6 - Reported to IRS:

Box 7 - Loss not allowed based on amount in 1d

Box 12 - Basis reported to IRS

Combined Federal/State Filing

State 1

State 1 - State Tax Withheld

State 1 - State/Payer state number

State 1 - State income

State 1 - Local income tax withheld

State 1 - Special Data Entries

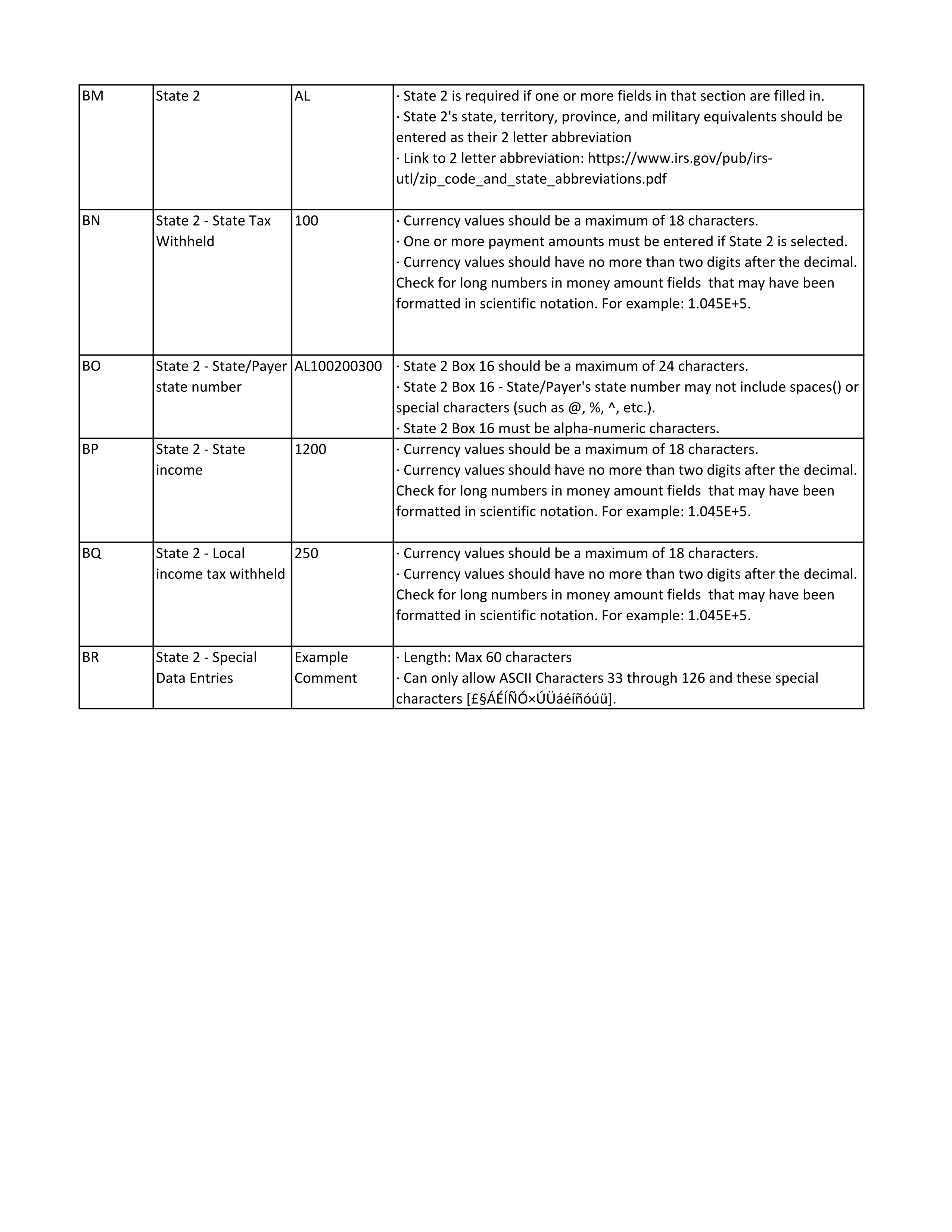

State 2

State 2 - State Tax Withheld

State 2 - State/Payer state number

State 2 - State income

State 2 - Local income tax withheld

State 2 - Special Data Entries

CSV Guidelines