IRIS >

IRIS CSV

CSV Template

Form Type,Tax Year,Filer TIN Type,Filer Taxpayer ID Number,Filer Name Type,Filer Business or Entity Name Line 1,Filer Business or Entity Name Line 2,Filer First Name,Filer Middle Name,Filer Last Name (Surname),Filer Suffix,Filer Country,Filer Address Line 1,Filer Address Line 2,Filer City/Town,Filer State/Province/Territory,Filer ZIP/Postal Code,Filer Phone Type,Filer Phone,Filer Email Address,Payee TIN Type,Payee Taxpayer ID Number,Payee Name Type,Payee Business or Entity Name Line 1,Payee Business or Entity Name Line 2,Payee First Name,Payee Middle Name,Payee Last Name (Surname),Payee Suffix,Payee Country,Payee Address Line 1,Payee Address Line 2,Payee City/Town,Payee State/Province/Territory,Payee ZIP/Postal Code,Office Code,Form Account Number,2nd TIN Notice,Indicate if FILER is a Payment settlement entity (PSE) or an Electronic Payment Facilitator (EPF)/Other third party,Indicate transactions reported are Payment card or Third party network,Payment Settlement Entity (PSE) Name Line 1,Domestic or International Payment Settlement Entity (PSE) Phone Number,Payment Settlement Entity (PSE) Phone Number,Box 1a - Gross amount of payment card/third party network transactions,Box 1b - Card Not Present transactions,Box 2 - Merchant category code,Box 3 - Number of payment transactions,Box 4 - Federal income tax withheld,Box 5a - January,Box 5b - February,Box 5c - March,Box 5d - April,Box 5e - May,Box 5f - June,Box 5g - July,Box 5h - August,Box 5i - September,Box 5j - October,Box 5k - November,Box 5l - December,Combined Federal/State Filing,State 1,State 1 - State Tax Withheld,State 1 - State/Payer state number,State 1 - State income,State 1 - Local income tax withheld,State 1 - Special Data Entries,State 2,State 2 - State Tax Withheld,State 2 - State/Payer state number,State 2 - State income,State 2 - Local income tax withheld,State 2 - Special Data Entries

,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,

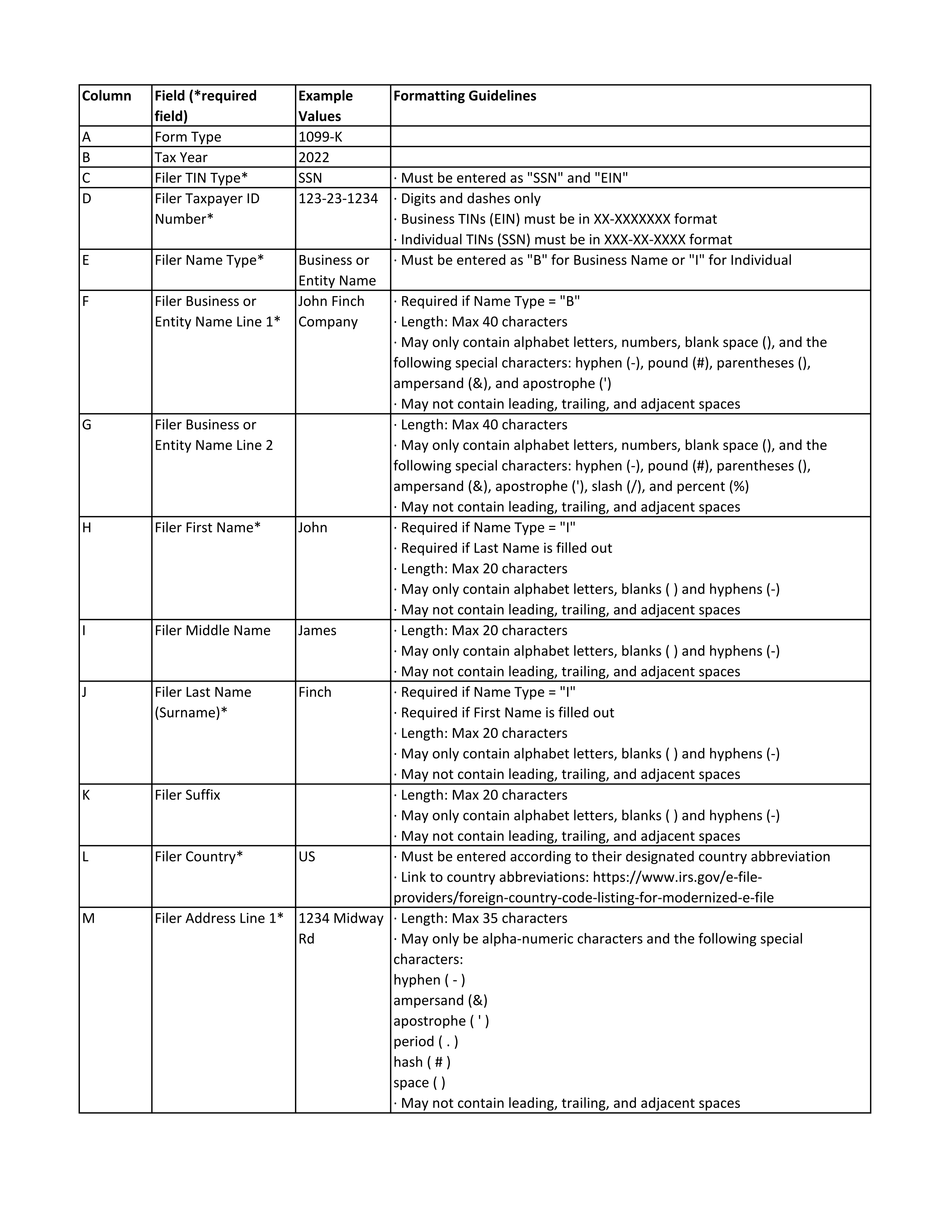

CSV Columns

Form Type

Tax Year

Filer TIN Type

Filer Taxpayer ID Number

Filer Name Type

Filer Business or Entity Name Line 1

Filer Business or Entity Name Line 2

Filer First Name

Filer Middle Name

Filer Last Name (Surname)

Filer Suffix

Filer Country

Filer Address Line 1

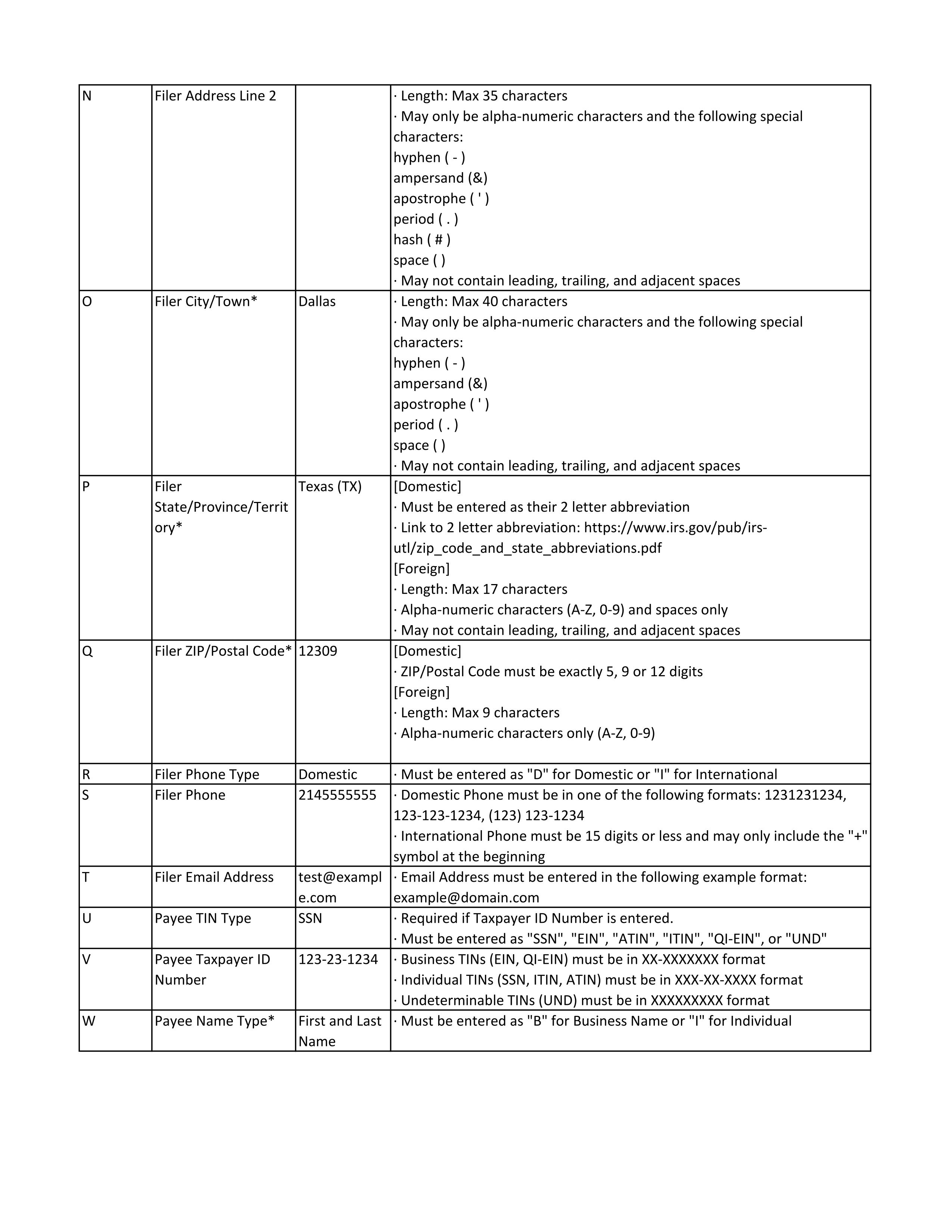

Filer Address Line 2

Filer City/Town

Filer State/Province/Territory

Filer ZIP/Postal Code

Filer Phone Type

Filer Phone

Filer Email Address

Payee TIN Type

Payee Taxpayer ID Number

Payee Name Type

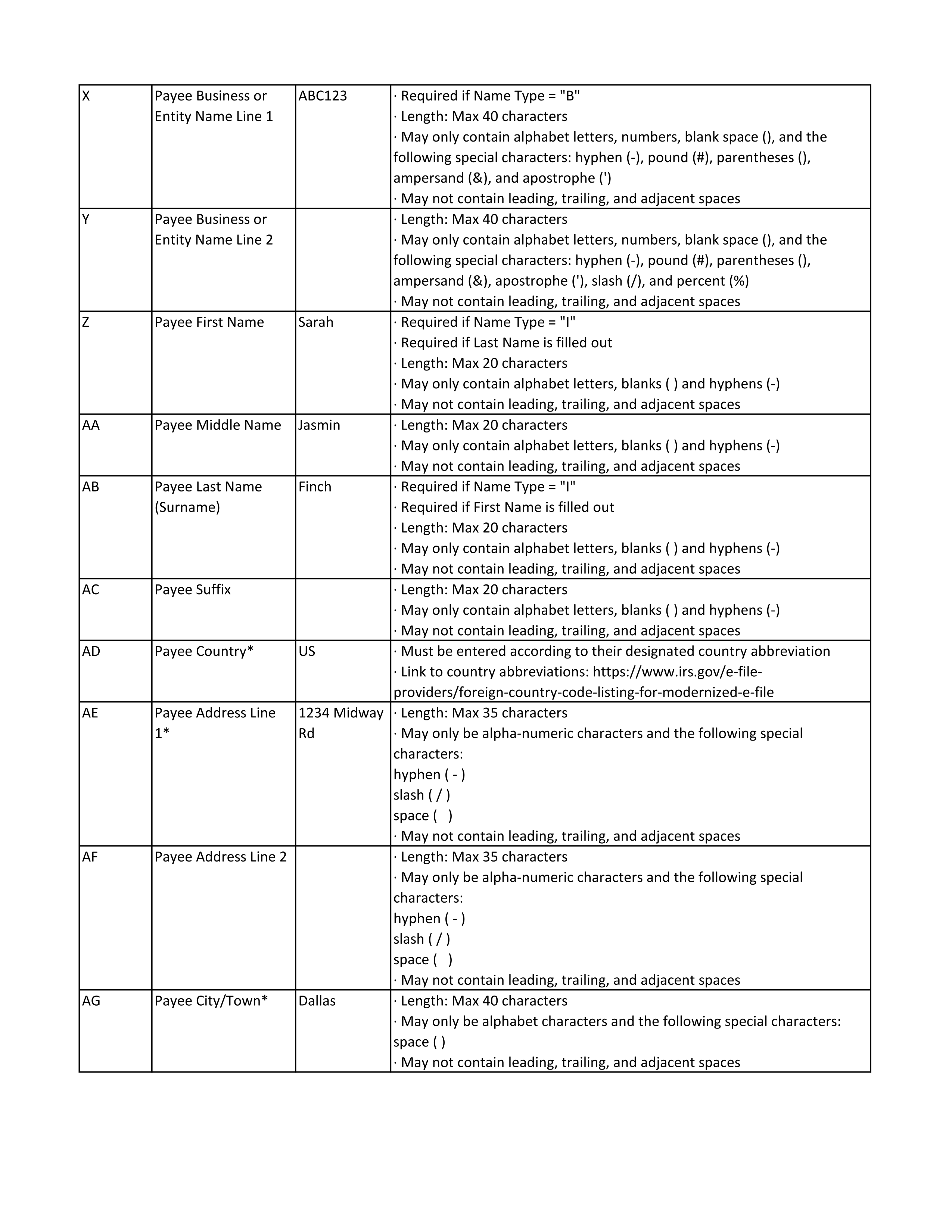

Payee Business or Entity Name Line 1

Payee Business or Entity Name Line 2

Payee First Name

Payee Middle Name

Payee Last Name (Surname)

Payee Suffix

Payee Country

Payee Address Line 1

Payee Address Line 2

Payee City/Town

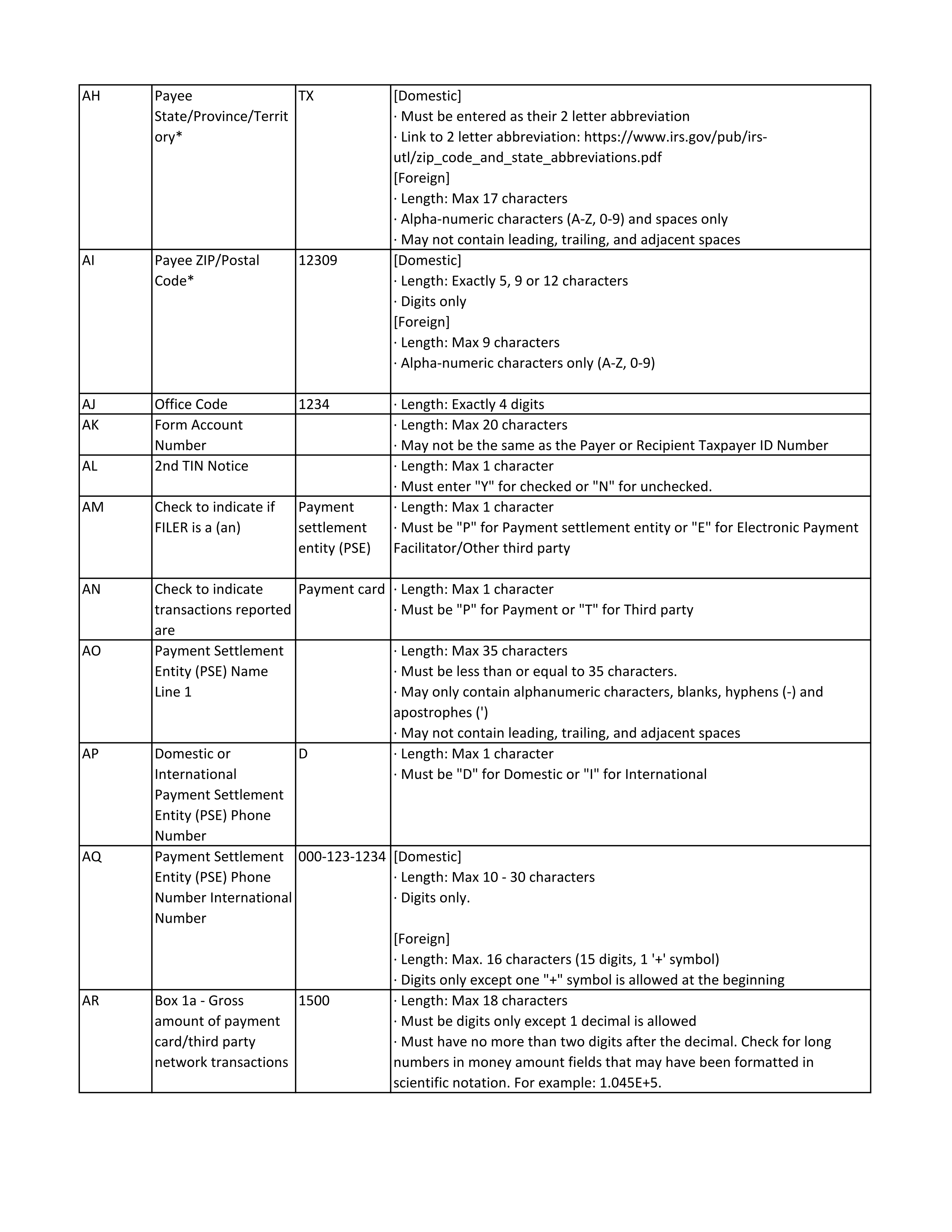

Payee State/Province/Territory

Payee ZIP/Postal Code

Office Code

Form Account Number

2nd TIN Notice

Indicate if FILER is a Payment settlement entity (PSE) or an Electronic Payment Facilitator (EPF)/Other third party

Indicate transactions reported are Payment card or Third party network

Payment Settlement Entity (PSE) Name Line 1

Domestic or International Payment Settlement Entity (PSE) Phone Number

Payment Settlement Entity (PSE) Phone Number

Box 1a - Gross amount of payment card/third party network transactions

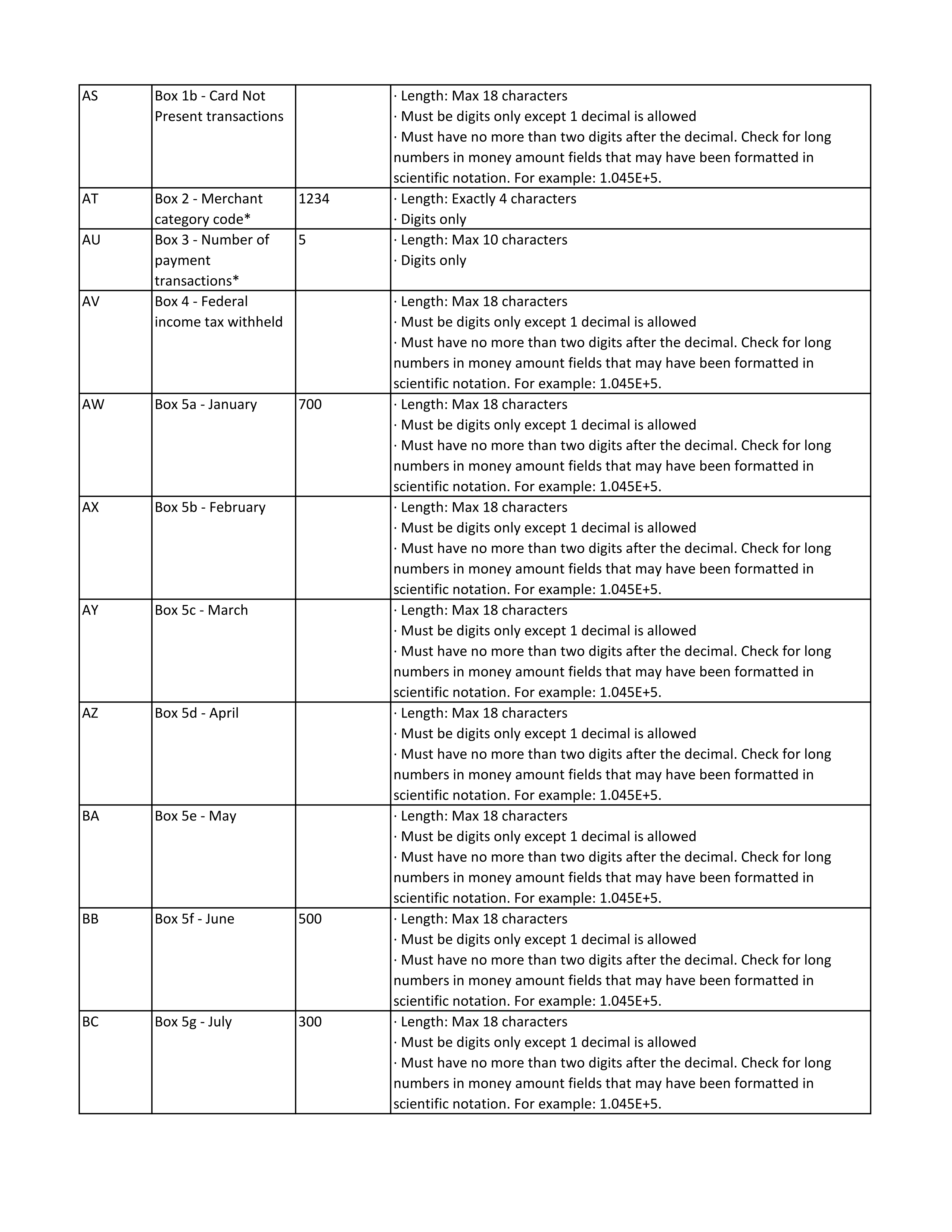

Box 1b - Card Not Present transactions

Box 2 - Merchant category code

Box 3 - Number of payment transactions

Box 4 - Federal income tax withheld

Box 5a - January

Box 5b - February

Box 5c - March

Box 5d - April

Box 5e - May

Box 5f - June

Box 5g - July

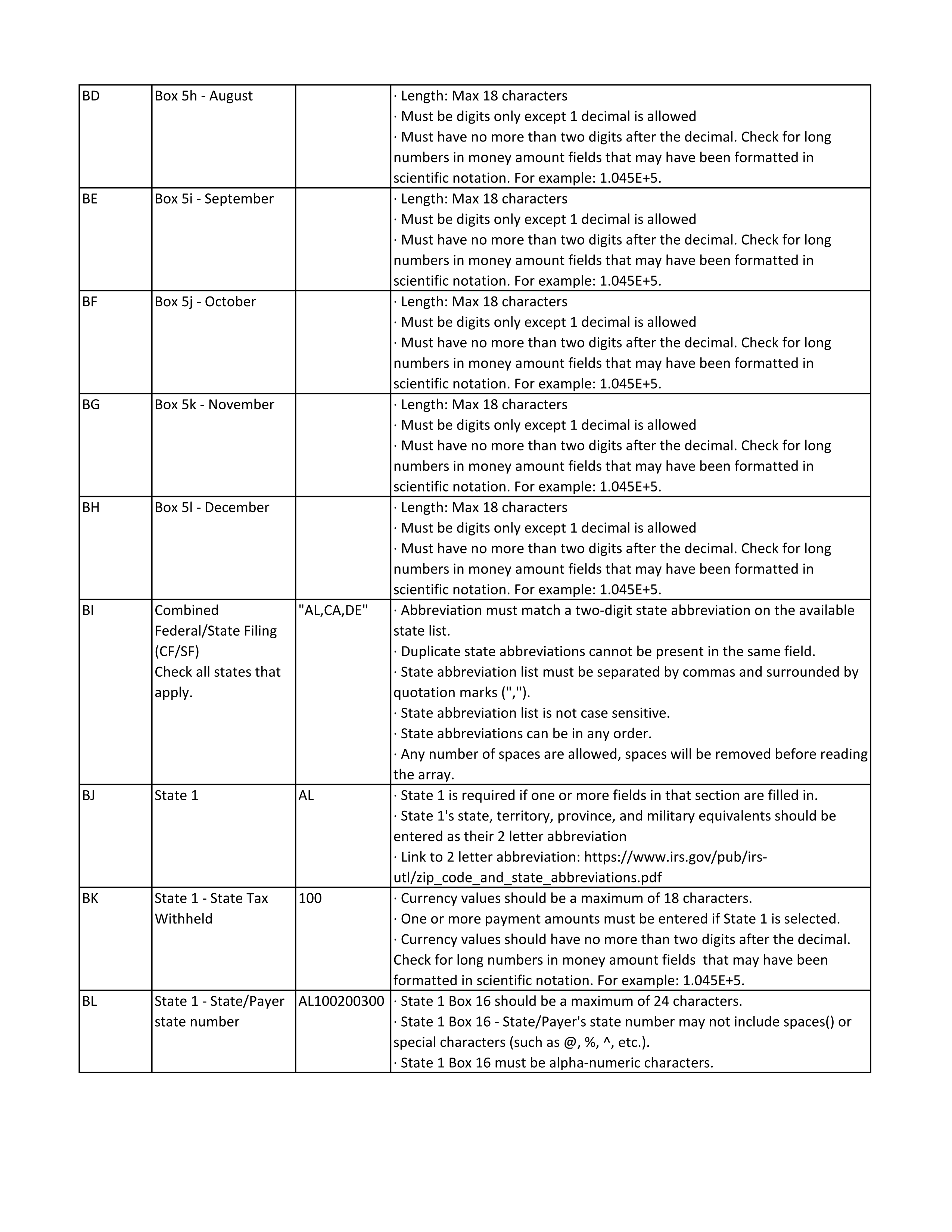

Box 5h - August

Box 5i - September

Box 5j - October

Box 5k - November

Box 5l - December

Combined Federal/State Filing

State 1

State 1 - State Tax Withheld

State 1 - State/Payer state number

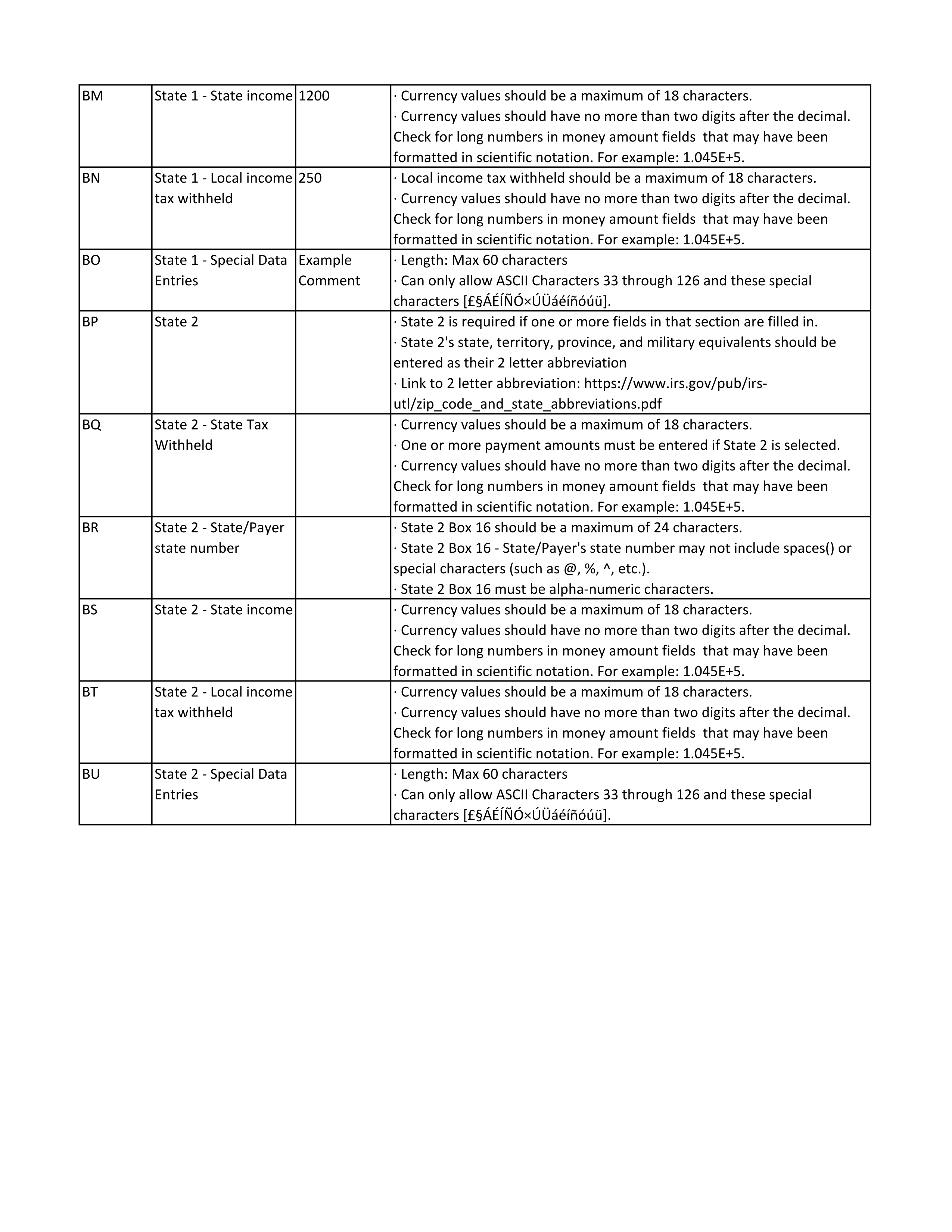

State 1 - State income

State 1 - Local income tax withheld

State 1 - Special Data Entries

State 2

State 2 - State Tax Withheld

State 2 - State/Payer state number

State 2 - State income

State 2 - Local income tax withheld

State 2 - Special Data Entries

CSV Guidelines