IRIS >

IRIS CSV

CSV Template

Form Type,Tax Year,Payer TIN Type,Payer Taxpayer ID Number,Payer Name Type,Payer Business or Entity Name Line 1,Payer Business or Entity Name Line 2,Payer First Name,Payer Middle Name,Payer Last Name (Surname),Payer Suffix,Payer Country,Payer Address Line 1,Payer Address Line 2,Payer City/Town,Payer State/Province/Territory,Payer ZIP/Postal Code,Payer Phone Type,Payer Phone,Payer Email Address,Recipient TIN Type,Recipient Taxpayer ID Number,Recipient Name Type,Recipient Business or Entity Name Line 1,Recipient Business or Entity Name Line 2,Recipient First Name,Recipient Middle Name,Recipient Last Name (Surname),Recipient Suffix,Recipient Country,Recipient Address Line 1,Recipient Address Line 2,Recipient City/Town,Recipient State/Province/Territory,Recipient ZIP/Postal Code,Office Code,Form Account Number,2nd TIN Notice,Box 1 - Patronage dividends,Box 2 - Nonpatronage distributions,Box 3 - Per-unit retain allocations,Box 4 - Federal income tax withheld,Box 5 - Redeemed nonqualified notices,Box 6 - Section 199A(a) deduction,Box 7 - Qualified payments (Sections 199A(b)(7)),Box 8 - Section 199A(a) qualified items,Box 9 - Section 199A(a) SSTB items,Box 10 - Investment credit,Box 11 - Work opportunity credit,Box 12a - Form 8844 credit amount,Box 12b - Form 8896 credit amount,Box 12c - Form 8941 credit amount,Box 12d - Form 8932 credit amount,Box 12e - EPA sulfur regulations deduction amount,Box 12f - Form 8864 credit amount,Box 13 - Specified cooperatives,Combined Federal/State Filing,State 1,State 1 - State Tax Withheld,State 1 - State/Payer state number,State 1 - State income,State 1 - Local income tax withheld,State 1 - Special Data Entries,State 2,State 2 - State Tax Withheld,State 2 - State/Payer state number,State 2 - State income,State 2 - Local income tax withheld,State 2 - Special Data Entries

,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,

CSV Columns

Form Type

Tax Year

Payer TIN Type

Payer Taxpayer ID Number

Payer Name Type

Payer Business or Entity Name Line 1

Payer Business or Entity Name Line 2

Payer First Name

Payer Middle Name

Payer Last Name (Surname)

Payer Suffix

Payer Country

Payer Address Line 1

Payer Address Line 2

Payer City/Town

Payer State/Province/Territory

Payer ZIP/Postal Code

Payer Phone Type

Payer Phone

Payer Email Address

Recipient TIN Type

Recipient Taxpayer ID Number

Recipient Name Type

Recipient Business or Entity Name Line 1

Recipient Business or Entity Name Line 2

Recipient First Name

Recipient Middle Name

Recipient Last Name (Surname)

Recipient Suffix

Recipient Country

Recipient Address Line 1

Recipient Address Line 2

Recipient City/Town

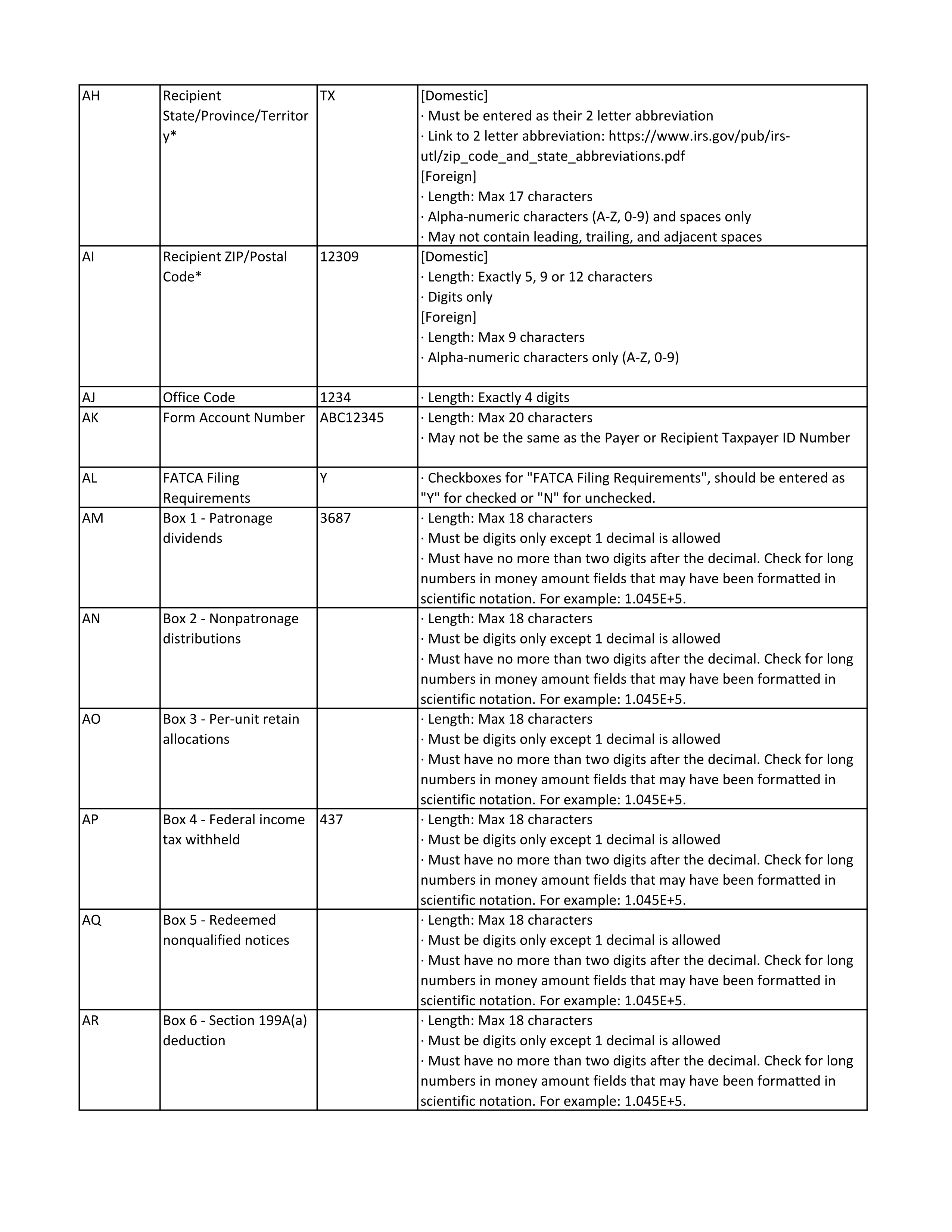

Recipient State/Province/Territory

Recipient ZIP/Postal Code

Office Code

Form Account Number

2nd TIN Notice

Box 1 - Patronage dividends

Box 2 - Nonpatronage distributions

Box 3 - Per-unit retain allocations

Box 4 - Federal income tax withheld

Box 5 - Redeemed nonqualified notices

Box 6 - Section 199A(a) deduction

Box 7 - Qualified payments (Sections 199A(b)(7))

Box 8 - Section 199A(a) qualified items

Box 9 - Section 199A(a) SSTB items

Box 10 - Investment credit

Box 11 - Work opportunity credit

Box 12a - Form 8844 credit amount

Box 12b - Form 8896 credit amount

Box 12c - Form 8941 credit amount

Box 12d - Form 8932 credit amount

Box 12e - EPA sulfur regulations deduction amount

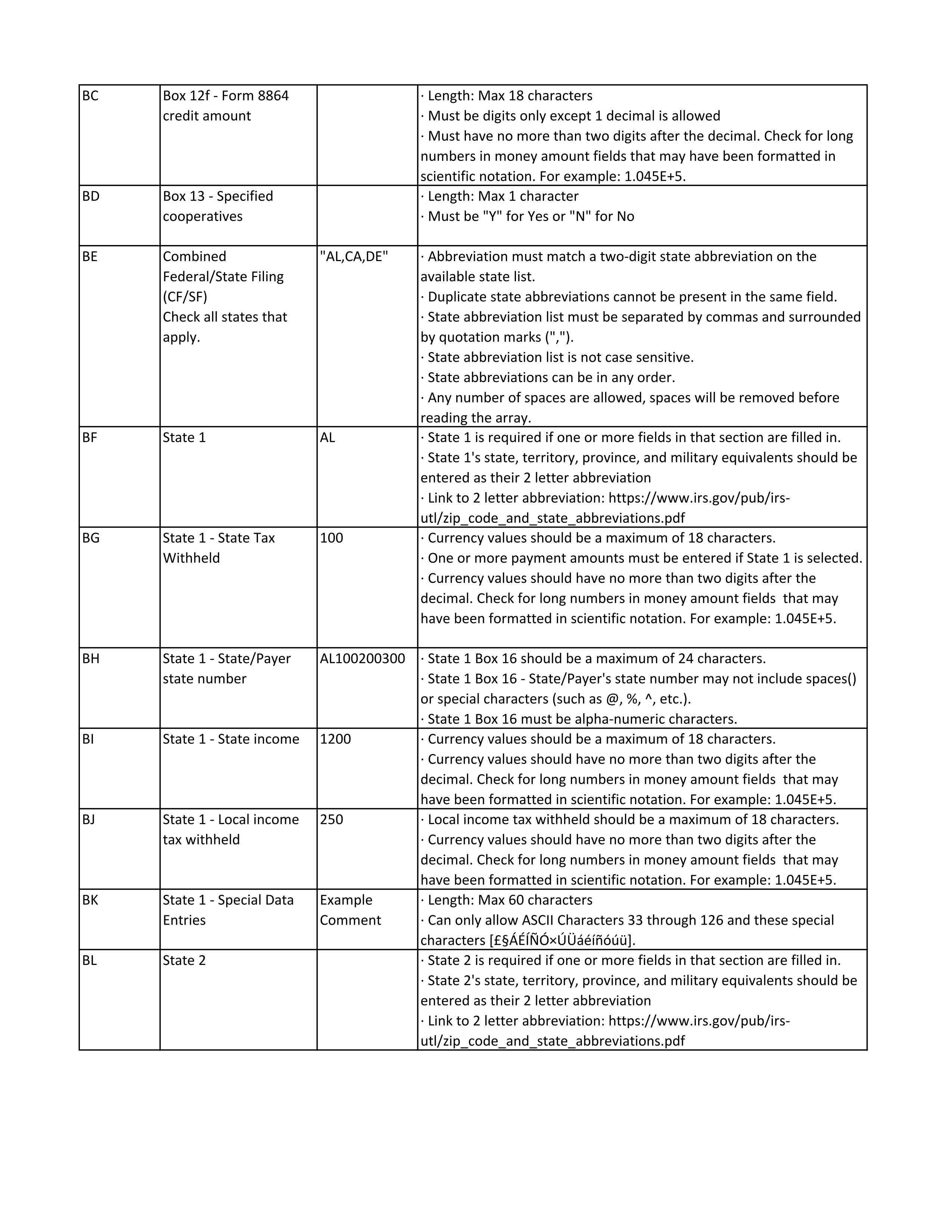

Box 12f - Form 8864 credit amount

Box 13 - Specified cooperatives

Combined Federal/State Filing

State 1

State 1 - State Tax Withheld

State 1 - State/Payer state number

State 1 - State income

State 1 - Local income tax withheld

State 1 - Special Data Entries

State 2

State 2 - State Tax Withheld

State 2 - State/Payer state number

State 2 - State income

State 2 - Local income tax withheld

State 2 - Special Data Entries

CSV Guidelines