Tax Documents

Tax5227K1

FDX / Data Structures / Tax5227K1

Form 5227-K1, Split-Interest Trust Beneficiary's schedule K-1, uses Tax1041K1 entity

Extends and inherits all fields from Tax1041K1

FDX / Data Structures / Tax1041K1

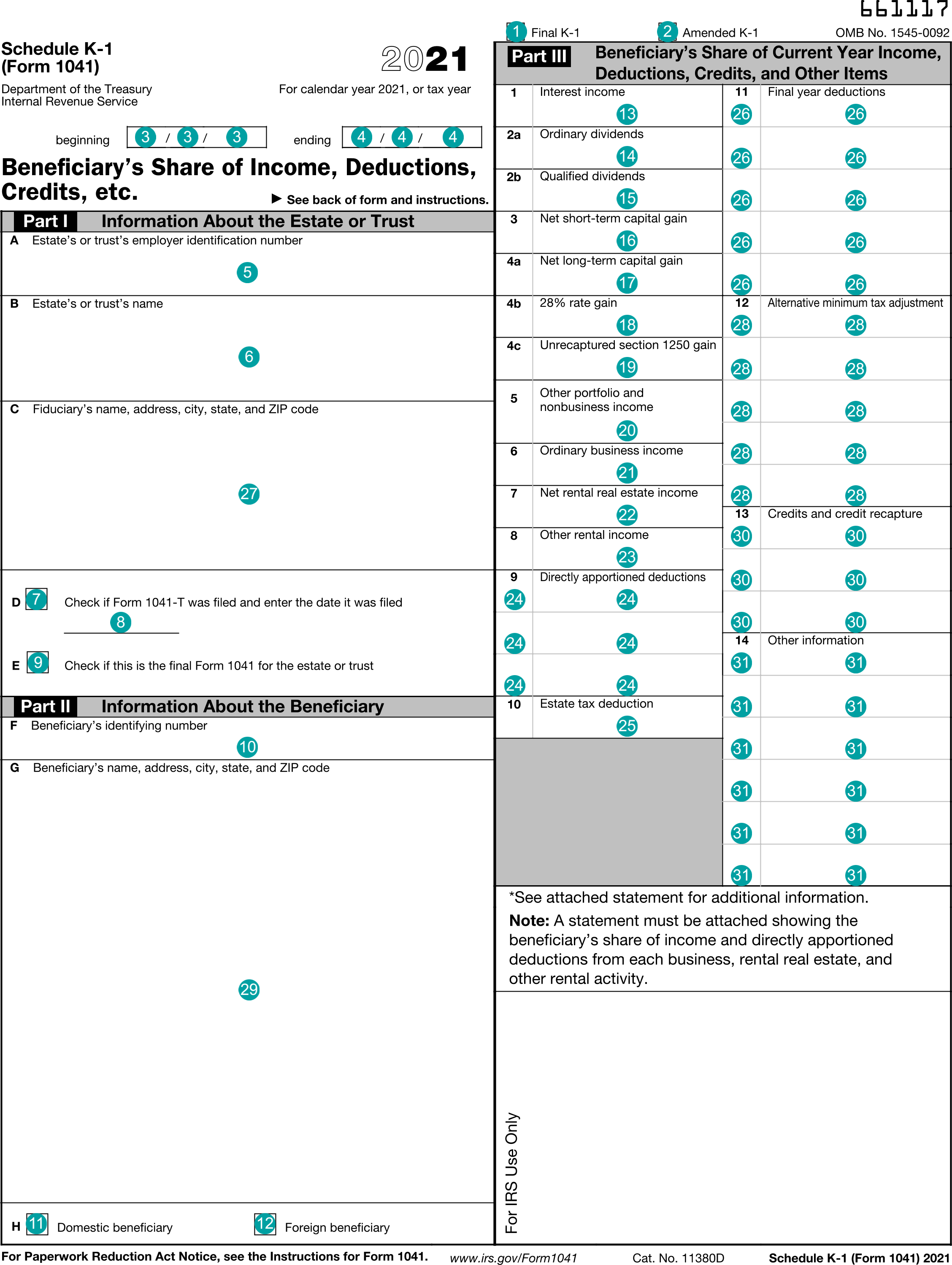

Form 1041 K-1, Beneficiary's Share of Income, Deductions, Credits, etc.

Extends and inherits all fields from Tax

Tax1041K1 Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | finalK1 | boolean | Final K-1 |

| 2 | amendedK1 | boolean | Amended K-1 |

| 3 | fiscalYearBegin | DateString | Fiscal year begin date |

| 4 | fiscalYearEnd | DateString | Fiscal year end date |

| 5 | trustTin | string | Box A, Estate's or trust's employer identification number |

| 6 | trustName | string | Box B, Estate's or trust's name |

| 7 | form1041T | boolean | Box D, Check if Form 1041-T was filed |

| 8 | date1041T | DateString | Box D, and enter the date it was filed |

| 9 | final1041 | boolean | Box E, Check if this is the final Form 1041 for the estate or trust |

| 10 | beneficiaryTin | string | Box F, Beneficiary's identifying number |

| 11 | domestic | boolean | Box H, Domestic beneficiary |

| 12 | foreign | boolean | Box H, Foreign beneficiary |

| 13 | interestIncome | number (double) | Box 1, Interest income |

| 14 | ordinaryDividends | number (double) | Box 2a, Ordinary dividends |

| 15 | qualifiedDividends | number (double) | Box 2b, Qualified dividends |

| 16 | netShortTermGain | number (double) | Box 3, Net short-term capital gain |

| 17 | netLongTermGain | number (double) | Box 4a, Net long-term capital gain |

| 18 | gain28Rate | number (double) | Box 4b, 28% rate gain |

| 19 | unrecaptured1250Gain | number (double) | Box 4c, Unrecaptured section 1250 gain |

| 20 | otherPortfolioIncome | number (double) | Box 5, Other portfolio and nonbusiness income |

| 21 | ordinaryBusinessIncome | number (double) | Box 6, Ordinary business income |

| 22 | netRentalRealEstateIncome | number (double) | Box 7, Net rental real estate income |

| 23 | otherRentalIncome | number (double) | Box 8, Other rental income |

| 24 | directlyApportionedDeductions | Array of CodeAmount | Box 9, Directly apportioned deductions |

| 25 | estateTaxDeduction | number (double) | Box 10, Estate tax deduction |

| 26 | finalYearDeductions | Array of CodeAmount | Box 11, Final year deductions |

| 27 | fiduciaryNameAddress | NameAddress | Box C, Fiduciary's name and address |

| 28 | amtAdjustments | Array of CodeAmount | Box 12, Alternative minimum tax adjustment |

| 29 | beneficiaryNameAddress | NameAddress | Box G, Beneficiary's name and address |

| 30 | credits | Array of CodeAmount | Box 13, Credits and credit recapture |

| 31 | otherInfo | Array of CodeAmount | Box 14, Other information |

Tax1041K1 Usage:

- TaxData tax1041K1

Tax5227K1 Usage:

- TaxData tax5227K1

FDX Data Structure as JSON

{

"tax5227K1" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"finalK1" : true,

"amendedK1" : true,

"fiscalYearBegin" : "2020-07-01",

"fiscalYearEnd" : "2020-07-01",

"trustTin" : "string",

"trustName" : "string",

"form1041T" : true,

"date1041T" : "2020-07-01",

"final1041" : true,

"beneficiaryTin" : "string",

"domestic" : true,

"foreign" : true,

"interestIncome" : 0.0,

"ordinaryDividends" : 0.0,

"qualifiedDividends" : 0.0,

"netShortTermGain" : 0.0,

"netLongTermGain" : 0.0,

"gain28Rate" : 0.0,

"unrecaptured1250Gain" : 0.0,

"otherPortfolioIncome" : 0.0,

"ordinaryBusinessIncome" : 0.0,

"netRentalRealEstateIncome" : 0.0,

"otherRentalIncome" : 0.0,

"directlyApportionedDeductions" : [ {

"code" : "string",

"amount" : 0.0

} ],

"estateTaxDeduction" : 0.0,

"finalYearDeductions" : [ {

"code" : "string",

"amount" : 0.0

} ],

"fiduciaryNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"amtAdjustments" : [ {

"code" : "string",

"amount" : 0.0

} ],

"beneficiaryNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"credits" : [ {

"code" : "string",

"amount" : 0.0

} ],

"otherInfo" : [ {

"code" : "string",

"amount" : 0.0

} ]

}

}

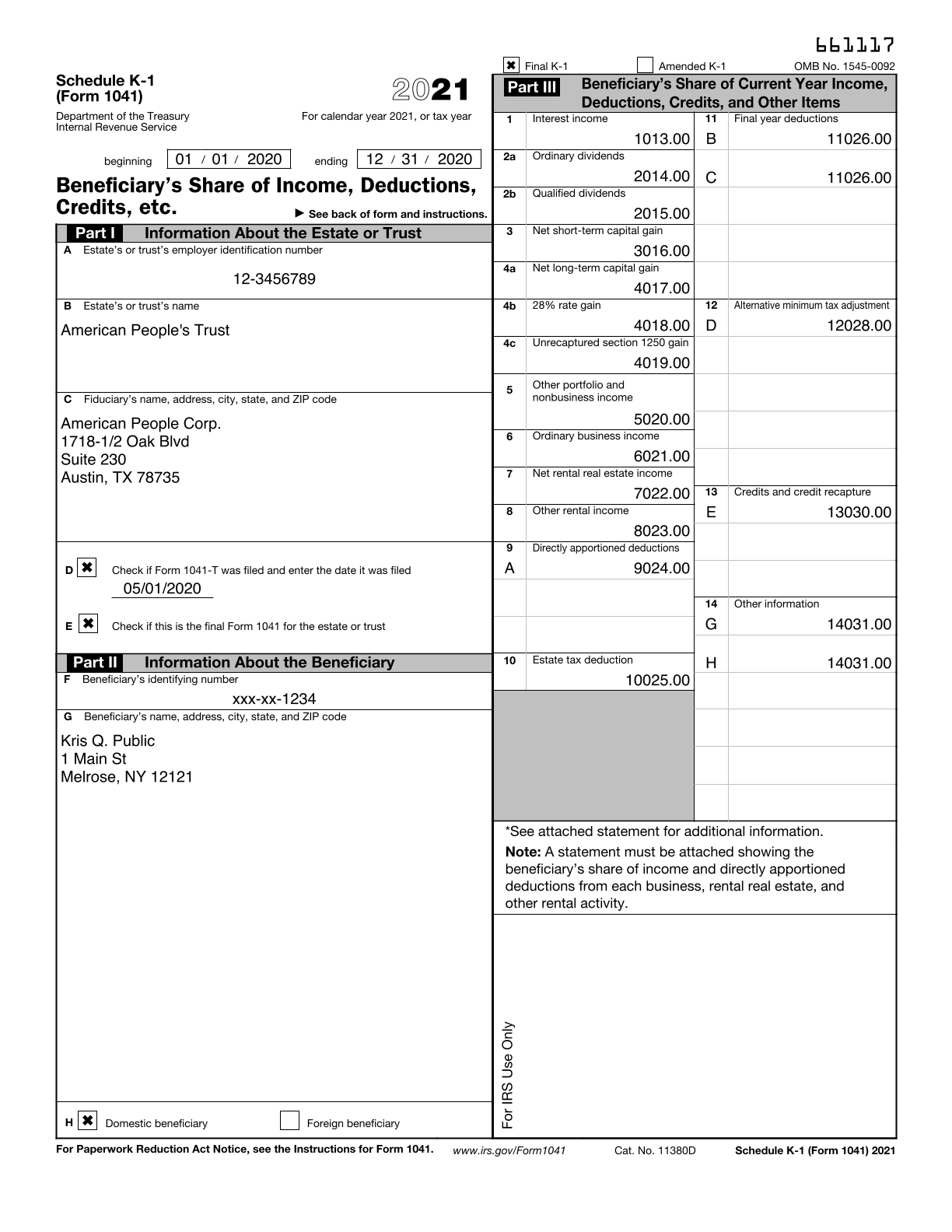

Example Form PDF

Example Form JSON

{

"tax5227K1" : {

"taxYear" : 2022,

"taxFormId" : "e5d4ee73bd1-9295-480f-a426-1041-K1",

"taxFormDate" : "2021-02-01",

"taxFormType" : "Tax5227K1",

"finalK1" : true,

"fiscalYearBegin" : "2020-01-01",

"fiscalYearEnd" : "2020-12-31",

"trustTin" : "12-3456789",

"trustName" : "American People's Trust",

"form1041T" : true,

"date1041T" : "2020-05-01",

"final1041" : true,

"beneficiaryTin" : "xxx-xx-1234",

"domestic" : true,

"interestIncome" : 1013.0,

"ordinaryDividends" : 2014.0,

"qualifiedDividends" : 2015.0,

"netShortTermGain" : 3016.0,

"netLongTermGain" : 4017.0,

"gain28Rate" : 4018.0,

"unrecaptured1250Gain" : 4019.0,

"otherPortfolioIncome" : 5020.0,

"ordinaryBusinessIncome" : 6021.0,

"netRentalRealEstateIncome" : 7022.0,

"otherRentalIncome" : 8023.0,

"directlyApportionedDeductions" : [ {

"code" : "A",

"amount" : 9024.0

} ],

"estateTaxDeduction" : 10025.0,

"finalYearDeductions" : [ {

"code" : "B",

"amount" : 11026.0

}, {

"code" : "C",

"amount" : 11026.0

} ],

"fiduciaryNameAddress" : {

"line1" : "1718-1/2 Oak Blvd",

"line2" : "Suite 230",

"city" : "Austin",

"state" : "TX",

"postalCode" : "78735",

"name1" : "American People Corp."

},

"amtAdjustments" : [ {

"code" : "D",

"amount" : 12028.0

} ],

"beneficiaryNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"name1" : "Kris Q. Public"

},

"credits" : [ {

"code" : "E",

"amount" : 13030.0

} ],

"otherInfo" : [ {

"code" : "G",

"amount" : 14031.0

}, {

"code" : "H",

"amount" : 14031.0

} ]

}

}

Example Form JSON for QR Code Purposes

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"taxFormId": "e5d4ee73bd1-9295-480f-a426-1041-K1",

"taxFormDate": "2021-02-01",

"taxFormType": "Tax5227K1",

"finalK1": "true",

"fiscalYearBegin": "2020-01-01",

"fiscalYearEnd": "2020-12-31",

"trustTin": "12-3456789",

"trustName": "American People\u0027s Trust",

"form1041T": "true",

"date1041T": "2020-05-01",

"final1041": "true",

"beneficiaryTin": "xxx-xx-1234",

"domestic": "true",

"interestIncome": "1013.0",

"ordinaryDividends": "2014.0",

"qualifiedDividends": "2015.0",

"netShortTermGain": "3016.0",

"netLongTermGain": "4017.0",

"gain28Rate": "4018.0",

"unrecaptured1250Gain": "4019.0",

"otherPortfolioIncome": "5020.0",

"ordinaryBusinessIncome": "6021.0",

"netRentalRealEstateIncome": "7022.0",

"otherRentalIncome": "8023.0",

"directlyApportionedDeductions-1.code": "A",

"directlyApportionedDeductions-1.amount": "9024.0",

"estateTaxDeduction": "10025.0",

"finalYearDeductions-1.code": "B",

"finalYearDeductions-1.amount": "11026.0",

"finalYearDeductions-2.code": "C",

"finalYearDeductions-2.amount": "11026.0",

"fiduciaryNameAddress.line1": "1718-1/2 Oak Blvd",

"fiduciaryNameAddress.line2": "Suite 230",

"fiduciaryNameAddress.city": "Austin",

"fiduciaryNameAddress.state": "TX",

"fiduciaryNameAddress.postalCode": "78735",

"fiduciaryNameAddress.name1": "American People Corp.",

"amtAdjustments-1.code": "D",

"amtAdjustments-1.amount": "12028.0",

"beneficiaryNameAddress.line1": "1 Main St",

"beneficiaryNameAddress.city": "Melrose",

"beneficiaryNameAddress.state": "NY",

"beneficiaryNameAddress.postalCode": "12121",

"beneficiaryNameAddress.name1": "Kris Q. Public",

"credits-1.code": "E",

"credits-1.amount": "13030.0",

"otherInfo-1.code": "G",

"otherInfo-1.amount": "14031.0",

"otherInfo-2.code": "H",

"otherInfo-2.amount": "14031.0"

}