Tax Documents

Tax1065K1

FDX / Data Structures / Tax1065K1

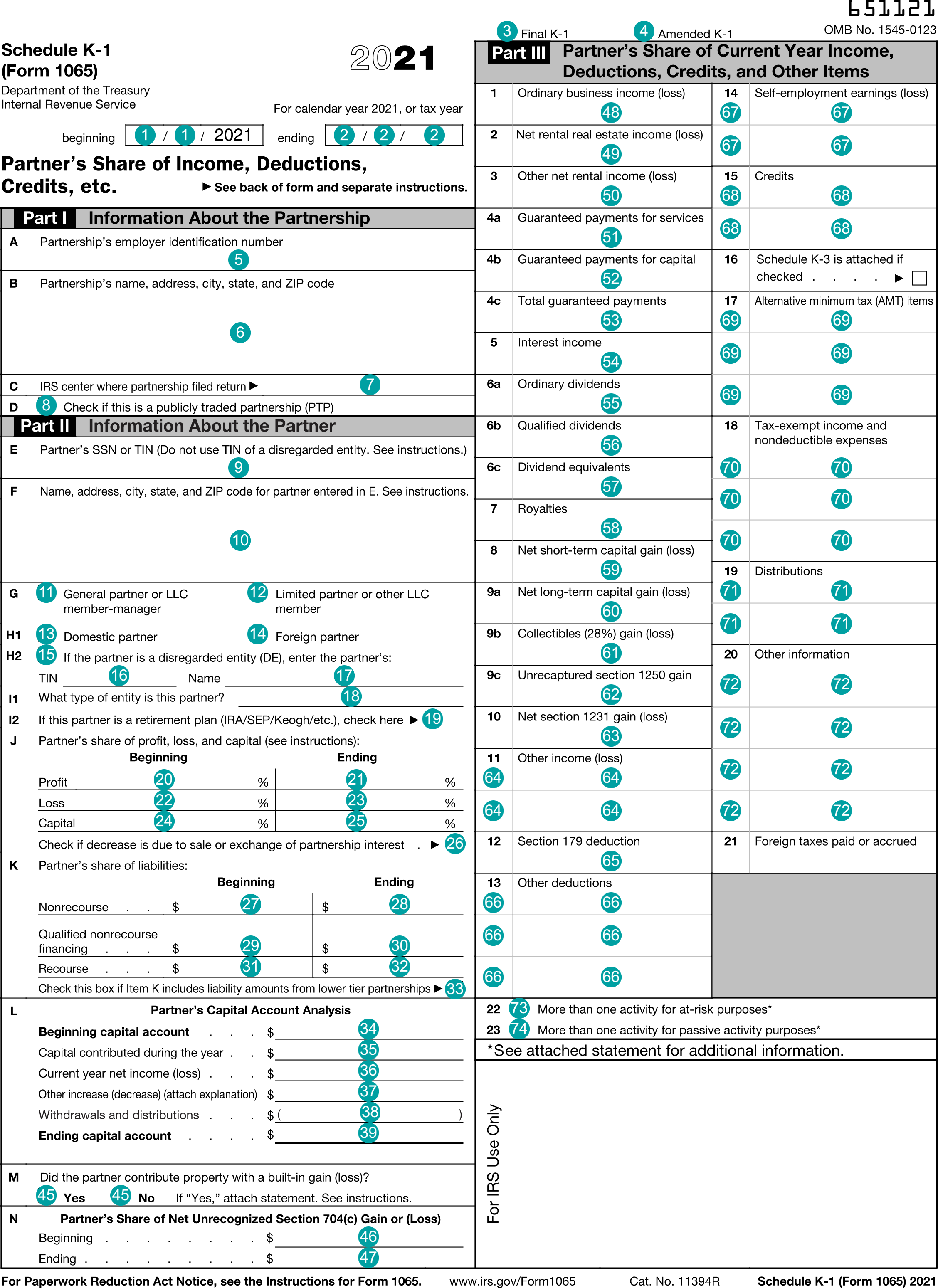

Form 1065 K-1, Partner's Share of Income, Deductions, Credits, etc.

Extends and inherits all fields from Tax

Tax1065K1 Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | fiscalYearBegin | DateString | Fiscal year begin date |

| 2 | fiscalYearEnd | DateString | Fiscal year end data |

| 3 | finalK1 | boolean | Final K-1 |

| 4 | amendedK1 | boolean | Amended K-1 |

| 5 | partnershipTin | string | Box A, Partnership's employer identification number |

| 6 | partnershipNameAddress | NameAddress | Box D, Partnership's name, address, city, state, and ZIP code |

| 7 | irsCenter | string | Box C, IRS Center where partnership filed return |

| 8 | publiclyTraded | boolean | Box D, Check if this is a publicly traded partnership (PTP) |

| 9 | partnerTin | string | Box E, Partner's SSN or TIN |

| 10 | partnerNameAddress | NameAddress | Box F, Name, address, city, state, and ZIP code for partner entered in box E |

| 11 | generalPartner | boolean | Box G, General partner or LLC member-manager |

| 12 | limitedPartner | boolean | Box G, Limited partner or other LLC member |

| 13 | domestic | boolean | Box H1, Domestic partner |

| 14 | foreign | boolean | Box H1, Foreign partner |

| 15 | disregardedEntity | boolean | Box H2, Check if the partner is a disregarded entity (DE), and enter the partner's TIN and Name |

| 16 | disregardedEntityTin | string | Box H2, Disregarded entity partner's TIN |

| 17 | disregardedEntityName | string | Box H2, Disregarded entity partner's Name |

| 18 | entityType | string | Box I1, What type of entity is this partner? |

| 19 | retirementPlan | boolean | Box I2, If this partner is a retirement plan (IRA/SEP/Keogh/etc.), check here |

| 20 | profitShareBegin | number (double) | Box J, Partner's share of profit - beginning |

| 21 | profitShareEnd | number (double) | Box J, Partner's share of profit - ending |

| 22 | lossShareBegin | number (double) | Box J, Partner's share of loss - beginning |

| 23 | lossShareEnd | number (double) | Box J, Partner's share of loss - ending |

| 24 | capitalShareBegin | number (double) | Box J, Partner's share of capital - beginning |

| 25 | capitalShareEnd | number (double) | Box J, Partner's share of capital - ending |

| 26 | decreaseDueToSaleOrExchange | boolean | Box J, Check if decrease is due to sale or exchange of partnership interest |

| 27 | nonrecourseLiabilityShareBegin | number (double) | Box K, Partner's share of liabilities - beginning - nonrecourse |

| 28 | nonrecourseLiabilityShareEnd | number (double) | Box K, Partner's share of liabilities - ending - nonrecourse |

| 29 | qualifiedLiabilityShareBegin | number (double) | Box K, Partner's share of liabilities - beginning - qualified nonrecourse financing |

| 30 | qualifiedLiabilityShareEnd | number (double) | Box K, Partner's share of liabilities - ending - qualified nonrecourse financing |

| 31 | recourseLiabilityShareBegin | number (double) | Box K, Partner's share of liabilities - beginning - recourse |

| 32 | recourseLiabilityShareEnd | number (double) | Box K, Partner's share of liabilities - ending - recourse |

| 33 | includesLowerTierLiability | boolean | Box K, Check this box if item K includes liability amounts from lower tier partnerships |

| 34 | capitalAccountBegin | number (double) | Box L, Partner's capital account analysis - Beginning capital account |

| 35 | capitalAccountContributions | number (double) | Box L, Partner's capital account analysis - Capital contributed during the year |

| 36 | capitalAccountIncrease | number (double) | Box L, Partner's capital account analysis - Current year net income (loss) |

| 37 | capitalAccountOther | number (double) | Box L, Partner's capital account analysis - Other increase (decrease) |

| 38 | capitalAccountWithdrawals | number (double) | Box L, Partner's capital account analysis - Withdrawals & distributions |

| 39 | capitalAccountEnd | number (double) | Box L, Partner's capital account analysis - Ending capital account |

| 40 | bookTax | boolean | 2018 Box L, Tax basis (IRS removed 2019) |

| 41 | bookGaap | boolean | 2018 Box L, GAAP (IRS removed 2019) |

| 42 | book704b | boolean | 2018 Box L, Section 704(b) book (IRS removed 2019) |

| 43 | bookOther | boolean | 2018 Box L, Other (explain) (IRS removed 2019) |

| 44 | bookOtherExplain | string | 2018 Box L, Other (explain) (IRS removed 2019) |

| 45 | builtInGain | boolean | Box M, Did the partner contribute property with a built-in gain or loss? - Yes |

| 46 | unrecognizedSection704Begin | number (double) | Box N, Partner's Share of Net Unrecognized Section 704(c) Gain or (Loss) - beginning |

| 47 | unrecognizedSection704End | number (double) | Box N, Partner's Share of Net Unrecognized Section 704(c) Gain or (Loss) - ending |

| 48 | ordinaryIncome | number (double) | Box 1, Ordinary business income (loss) |

| 49 | netRentalRealEstateIncome | number (double) | Box 2, Net rental real estate income (loss) |

| 50 | otherRentalIncome | number (double) | Box 3, Other net rental income (loss) |

| 51 | guaranteedPaymentServices | number (double) | Box 4a, Guaranteed payments for services |

| 52 | guaranteedPaymentCapital | number (double) | Box 4b, Guaranteed payments for capital |

| 53 | guaranteedPayment | number (double) | Box 4c, Total guaranteed payments |

| 54 | interestIncome | number (double) | Box 5, Interest income |

| 55 | ordinaryDividends | number (double) | Box 6a, Ordinary dividends |

| 56 | qualifiedDividends | number (double) | Box 6b, Qualified dividends |

| 57 | dividendEquivalents | number (double) | Box 6c, Dividend equivalents |

| 58 | royalties | number (double) | Box 7, Royalties |

| 59 | netShortTermGain | number (double) | Box 8, Net short-term capital gain (loss) |

| 60 | netLongTermGain | number (double) | Box 9a, Net long-term capital gain (loss) |

| 61 | collectiblesGain | number (double) | Box 9b, Collectibles (28%) gain (loss) |

| 62 | unrecaptured1250Gain | number (double) | Box 9c, Unrecaptured section 1250 gain |

| 63 | net1231Gain | number (double) | Box 10, Net section 1231 gain (loss) |

| 64 | otherIncome | Array of CodeAmount | Box 11, Other income |

| 65 | section179Deduction | number (double) | Box 12, Section 179 deduction |

| 66 | otherDeductions | Array of CodeAmount | Box 13, Other deductions |

| 67 | selfEmployment | Array of CodeAmount | Box 14, Self-employment earnings (loss) |

| 68 | credits | Array of CodeAmount | Box 15, Credits |

| 69 | scheduleK3 | boolean | Box 16, Schedule K-3 is attached |

| 70 | foreignCountry | string | Box 16, Foreign country. IRS deprecated 2021 and is now reported on Schedule K-3 |

| 71 | foreignTransactions | Array of CodeAmount | Box 16, Foreign transactions. IRS deprecated 2021 and is now reported on Schedule K-3 |

| 72 | amtItems | Array of CodeAmount | Box 17, Alternative minimum tax (AMT) items |

| 73 | taxExemptIncome | Array of CodeAmount | Box 18, Tax-exempt income and nondeductible expenses |

| 74 | distributions | Array of CodeAmount | Box 19, Distributions |

| 75 | otherInfo | Array of CodeAmount | Box 20, Other information |

| 76 | foreignTaxPaid | number (double) | Box 21, Foreign taxes paid or accrued |

| 77 | multipleAtRiskActivities | boolean | Box 22, More than one activity for at-risk purposes |

| 78 | multiplePassiveActivities | boolean | Box 23, More than one activity for passive activity purposes |

Tax1065K1 Usage:

- TaxData tax1065K1

FDX Data Structure as JSON

{

"tax1065K1" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"fiscalYearBegin" : "2020-07-01",

"fiscalYearEnd" : "2020-07-01",

"finalK1" : true,

"amendedK1" : true,

"partnershipTin" : "string",

"partnershipNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"irsCenter" : "string",

"publiclyTraded" : true,

"partnerTin" : "string",

"partnerNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"generalPartner" : true,

"limitedPartner" : true,

"domestic" : true,

"foreign" : true,

"disregardedEntity" : true,

"disregardedEntityTin" : "string",

"disregardedEntityName" : "string",

"entityType" : "string",

"retirementPlan" : true,

"profitShareBegin" : 0.0,

"profitShareEnd" : 0.0,

"lossShareBegin" : 0.0,

"lossShareEnd" : 0.0,

"capitalShareBegin" : 0.0,

"capitalShareEnd" : 0.0,

"decreaseDueToSaleOrExchange" : true,

"nonrecourseLiabilityShareBegin" : 0.0,

"nonrecourseLiabilityShareEnd" : 0.0,

"qualifiedLiabilityShareBegin" : 0.0,

"qualifiedLiabilityShareEnd" : 0.0,

"recourseLiabilityShareBegin" : 0.0,

"recourseLiabilityShareEnd" : 0.0,

"includesLowerTierLiability" : true,

"capitalAccountBegin" : 0.0,

"capitalAccountContributions" : 0.0,

"capitalAccountIncrease" : 0.0,

"capitalAccountOther" : 0.0,

"capitalAccountWithdrawals" : 0.0,

"capitalAccountEnd" : 0.0,

"bookTax" : true,

"bookGaap" : true,

"book704b" : true,

"bookOther" : true,

"bookOtherExplain" : "string",

"builtInGain" : true,

"unrecognizedSection704Begin" : 0.0,

"unrecognizedSection704End" : 0.0,

"ordinaryIncome" : 0.0,

"netRentalRealEstateIncome" : 0.0,

"otherRentalIncome" : 0.0,

"guaranteedPaymentServices" : 0.0,

"guaranteedPaymentCapital" : 0.0,

"guaranteedPayment" : 0.0,

"interestIncome" : 0.0,

"ordinaryDividends" : 0.0,

"qualifiedDividends" : 0.0,

"dividendEquivalents" : 0.0,

"royalties" : 0.0,

"netShortTermGain" : 0.0,

"netLongTermGain" : 0.0,

"collectiblesGain" : 0.0,

"unrecaptured1250Gain" : 0.0,

"net1231Gain" : 0.0,

"otherIncome" : [ {

"code" : "string",

"amount" : 0.0

} ],

"section179Deduction" : 0.0,

"otherDeductions" : [ {

"code" : "string",

"amount" : 0.0

} ],

"selfEmployment" : [ {

"code" : "string",

"amount" : 0.0

} ],

"credits" : [ {

"code" : "string",

"amount" : 0.0

} ],

"foreignCountry" : "string",

"foreignTransactions" : [ {

"code" : "string",

"amount" : 0.0

} ],

"amtItems" : [ {

"code" : "string",

"amount" : 0.0

} ],

"taxExemptIncome" : [ {

"code" : "string",

"amount" : 0.0

} ],

"distributions" : [ {

"code" : "string",

"amount" : 0.0

} ],

"otherInfo" : [ {

"code" : "string",

"amount" : 0.0

} ],

"multipleAtRiskActivities" : true,

"multiplePassiveActivities" : true

}

}

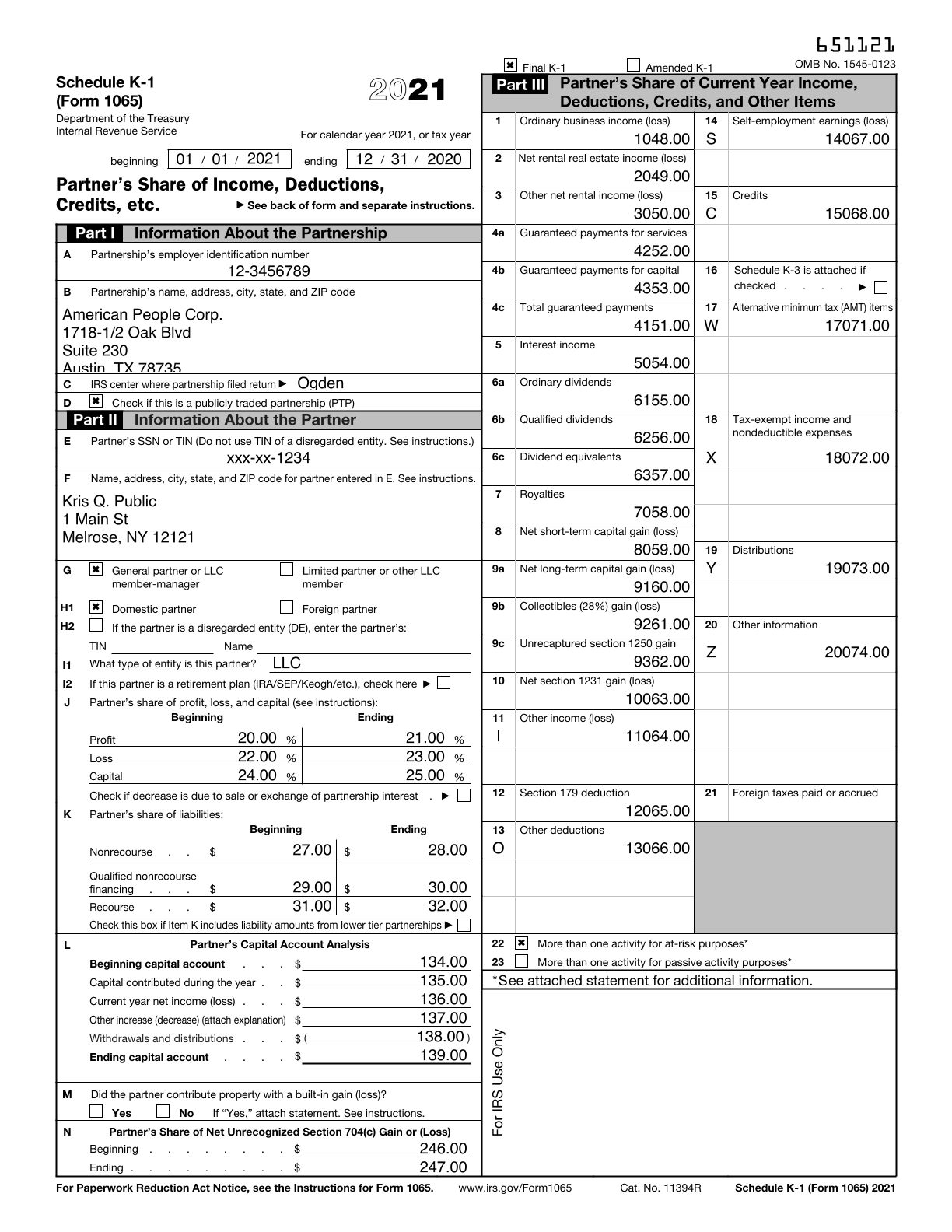

Example Form PDF

Example Form JSON

{

"tax1065K1" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1065K1",

"fiscalYearBegin" : "2020-01-01",

"fiscalYearEnd" : "2020-12-31",

"finalK1" : true,

"partnershipTin" : "12-3456789",

"partnershipNameAddress" : {

"line1" : "1718-1/2 Oak Blvd",

"line2" : "Suite 230",

"city" : "Austin",

"state" : "TX",

"postalCode" : "78735",

"name1" : "American People Corp."

},

"irsCenter" : "Ogden",

"publiclyTraded" : true,

"partnerTin" : "xxx-xx-1234",

"partnerNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"name1" : "Kris Q. Public"

},

"generalPartner" : true,

"limitedPartner" : false,

"domestic" : true,

"foreign" : false,

"disregardedEntity" : false,

"entityType" : "LLC",

"retirementPlan" : false,

"profitShareBegin" : 20.0,

"profitShareEnd" : 21.0,

"lossShareBegin" : 22.0,

"lossShareEnd" : 23.0,

"capitalShareBegin" : 24.0,

"capitalShareEnd" : 25.0,

"nonrecourseLiabilityShareBegin" : 27.0,

"nonrecourseLiabilityShareEnd" : 28.0,

"qualifiedLiabilityShareBegin" : 29.0,

"qualifiedLiabilityShareEnd" : 30.0,

"recourseLiabilityShareBegin" : 31.0,

"recourseLiabilityShareEnd" : 32.0,

"capitalAccountBegin" : 134.0,

"capitalAccountContributions" : 135.0,

"capitalAccountIncrease" : 136.0,

"capitalAccountOther" : 137.0,

"capitalAccountWithdrawals" : 138.0,

"capitalAccountEnd" : 139.0,

"builtInGain" : false,

"unrecognizedSection704Begin" : 246.0,

"unrecognizedSection704End" : 247.0,

"ordinaryIncome" : 1048.0,

"netRentalRealEstateIncome" : 2049.0,

"otherRentalIncome" : 3050.0,

"guaranteedPaymentServices" : 4252.0,

"guaranteedPaymentCapital" : 4353.0,

"guaranteedPayment" : 4151.0,

"interestIncome" : 5054.0,

"ordinaryDividends" : 6155.0,

"qualifiedDividends" : 6256.0,

"dividendEquivalents" : 6357.0,

"royalties" : 7058.0,

"netShortTermGain" : 8059.0,

"netLongTermGain" : 9160.0,

"collectiblesGain" : 9261.0,

"unrecaptured1250Gain" : 9362.0,

"net1231Gain" : 10063.0,

"otherIncome" : [ {

"code" : "I",

"amount" : 11064.0

} ],

"section179Deduction" : 12065.0,

"otherDeductions" : [ {

"code" : "O",

"amount" : 13066.0

} ],

"selfEmployment" : [ {

"code" : "S",

"amount" : 14067.0

} ],

"credits" : [ {

"code" : "C",

"amount" : 15068.0

} ],

"foreignCountry" : "Norway",

"foreignTransactions" : [ {

"code" : "B",

"amount" : 16070.0

} ],

"amtItems" : [ {

"code" : "W",

"amount" : 17071.0

} ],

"taxExemptIncome" : [ {

"code" : "X",

"amount" : 18072.0

} ],

"distributions" : [ {

"code" : "Y",

"amount" : 19073.0

} ],

"otherInfo" : [ {

"code" : "Z",

"amount" : 20074.0

} ],

"multipleAtRiskActivities" : true,

"multiplePassiveActivities" : false

}

}

Example Form JSON for QR Code Purposes

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"taxFormDate": "2021-03-30",

"taxFormType": "Tax1065K1",

"fiscalYearBegin": "2020-01-01",

"fiscalYearEnd": "2020-12-31",

"finalK1": "true",

"partnershipTin": "12-3456789",

"partnershipNameAddress.line1": "1718-1/2 Oak Blvd",

"partnershipNameAddress.line2": "Suite 230",

"partnershipNameAddress.city": "Austin",

"partnershipNameAddress.state": "TX",

"partnershipNameAddress.postalCode": "78735",

"partnershipNameAddress.name1": "American People Corp.",

"irsCenter": "Ogden",

"publiclyTraded": "true",

"partnerTin": "xxx-xx-1234",

"partnerNameAddress.line1": "1 Main St",

"partnerNameAddress.city": "Melrose",

"partnerNameAddress.state": "NY",

"partnerNameAddress.postalCode": "12121",

"partnerNameAddress.name1": "Kris Q. Public",

"generalPartner": "true",

"limitedPartner": "false",

"domestic": "true",

"foreign": "false",

"disregardedEntity": "false",

"entityType": "LLC",

"retirementPlan": "false",

"profitShareBegin": "20.0",

"profitShareEnd": "21.0",

"lossShareBegin": "22.0",

"lossShareEnd": "23.0",

"capitalShareBegin": "24.0",

"capitalShareEnd": "25.0",

"nonrecourseLiabilityShareBegin": "27.0",

"nonrecourseLiabilityShareEnd": "28.0",

"qualifiedLiabilityShareBegin": "29.0",

"qualifiedLiabilityShareEnd": "30.0",

"recourseLiabilityShareBegin": "31.0",

"recourseLiabilityShareEnd": "32.0",

"capitalAccountBegin": "134.0",

"capitalAccountContributions": "135.0",

"capitalAccountIncrease": "136.0",

"capitalAccountOther": "137.0",

"capitalAccountWithdrawals": "138.0",

"capitalAccountEnd": "139.0",

"builtInGain": "false",

"unrecognizedSection704Begin": "246.0",

"unrecognizedSection704End": "247.0",

"ordinaryIncome": "1048.0",

"netRentalRealEstateIncome": "2049.0",

"otherRentalIncome": "3050.0",

"guaranteedPaymentServices": "4252.0",

"guaranteedPaymentCapital": "4353.0",

"guaranteedPayment": "4151.0",

"interestIncome": "5054.0",

"ordinaryDividends": "6155.0",

"qualifiedDividends": "6256.0",

"dividendEquivalents": "6357.0",

"royalties": "7058.0",

"netShortTermGain": "8059.0",

"netLongTermGain": "9160.0",

"collectiblesGain": "9261.0",

"unrecaptured1250Gain": "9362.0",

"net1231Gain": "10063.0",

"otherIncome-1.code": "I",

"otherIncome-1.amount": "11064.0",

"section179Deduction": "12065.0",

"otherDeductions-1.code": "O",

"otherDeductions-1.amount": "13066.0",

"selfEmployment-1.code": "S",

"selfEmployment-1.amount": "14067.0",

"credits-1.code": "C",

"credits-1.amount": "15068.0",

"foreignCountry": "Norway",

"foreignTransactions-1.code": "B",

"foreignTransactions-1.amount": "16070.0",

"amtItems-1.code": "W",

"amtItems-1.amount": "17071.0",

"taxExemptIncome-1.code": "X",

"taxExemptIncome-1.amount": "18072.0",

"distributions-1.code": "Y",

"distributions-1.amount": "19073.0",

"otherInfo-1.code": "Z",

"otherInfo-1.amount": "20074.0",

"multipleAtRiskActivities": "true",

"multiplePassiveActivities": "false"

}