Tax Documents

Tax5498Qa

FDX / Data Structures / Tax5498Qa

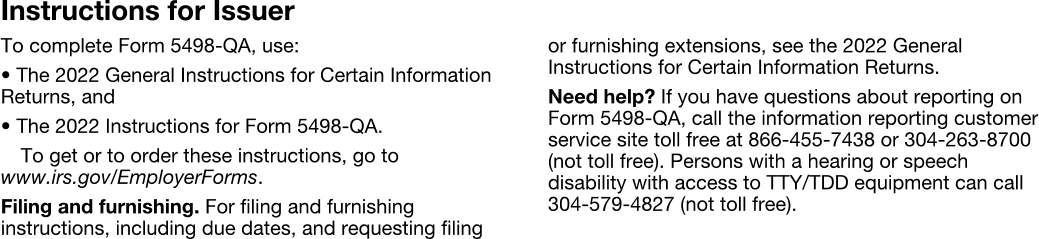

Form 5498-QA, ABLE Account Contribution Information

Extends and inherits all fields from Tax

Tax5498Qa Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | issuerNameAddress | NameAddress | ISSUER'S name, street address, city or town, state or province, country, and ZIP or foreign postal code |

| 2 | issuerTin | string | ISSUER'S TIN |

| 3 | beneficiaryTin | string | BENEFICIARY'S TIN |

| 4 | beneficiaryNameAddress | NameAddress | BENEFICIARY'S name and address |

| 5 | accountNumber | string | Account number |

| 6 | ableContributions | number (double) | Box 1, ABLE contributions |

| 7 | rollovers | number (double) | Box 2, ABLE to ABLE Rollovers |

| 8 | cumulativeContributions | number (double) | Box 3, Cumulative contributions |

| 9 | fairMarketValue | number (double) | Box 4, Fair market value |

| 10 | openedInTaxYear | boolean | Box 5, Check if account opened in current tax year |

| 11 | basisOfDisabilityCode | string | Box 6, Basis of eligibility |

| 12 | typeOfDisabilityCode | string | Box 7, Code |

Tax5498Qa Usage:

- TaxData tax5498Qa

FDX Data Structure as JSON

{

"tax5498Qa" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"issuerNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"issuerTin" : "string",

"beneficiaryTin" : "string",

"beneficiaryNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"accountNumber" : "string",

"ableContributions" : 0.0,

"rollovers" : 0.0,

"cumulativeContributions" : 0.0,

"fairMarketValue" : 0.0,

"openedInTaxYear" : true,

"basisOfDisabilityCode" : "string",

"typeOfDisabilityCode" : "string"

}

}

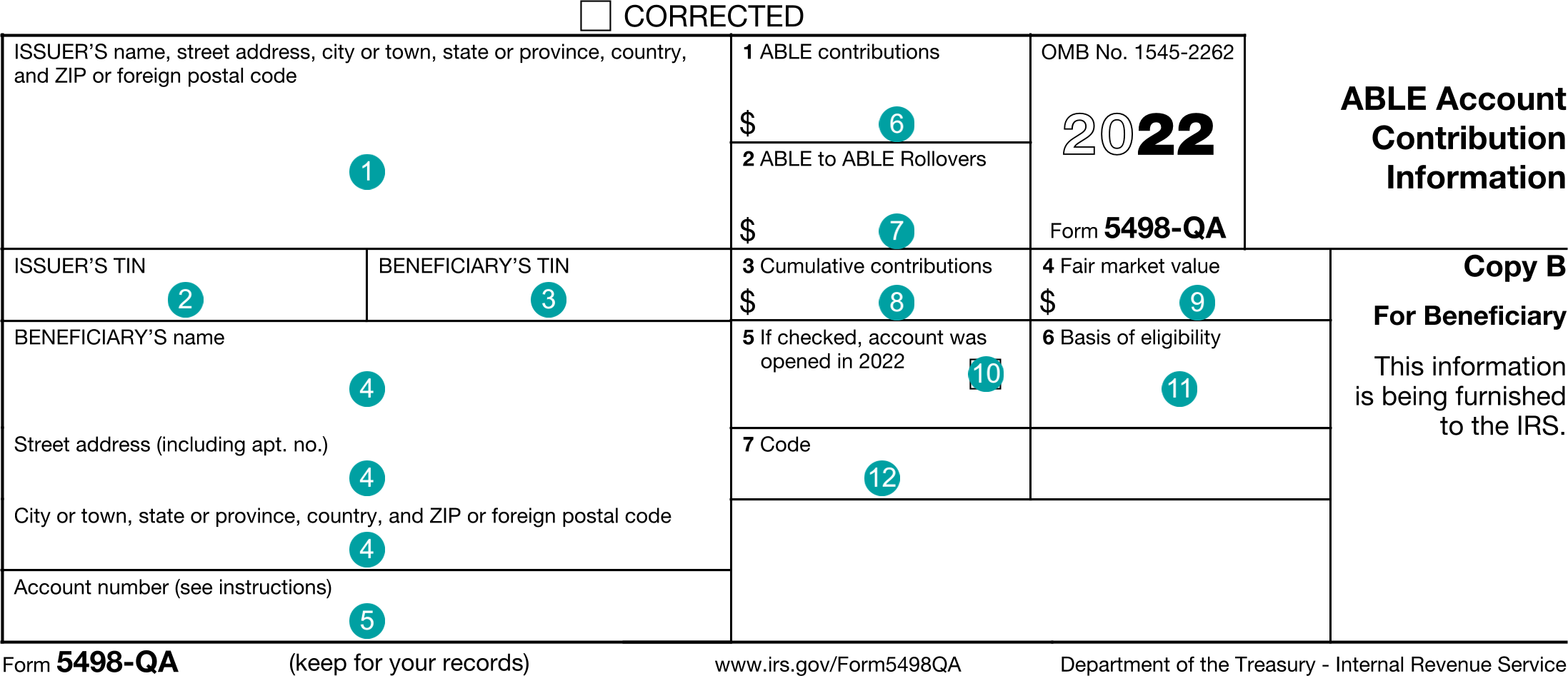

Example Form PDF

Example Form JSON

{

"tax5498Qa" : {

"taxYear" : 2022,

"taxFormDate" : "2020-12-31",

"taxFormType" : "Tax5498Qa",

"issuerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"name1" : "Tax Form Issuer, Inc"

},

"issuerTin" : "12-3456789",

"beneficiaryTin" : "XXX-XX-1234",

"beneficiaryNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"name1" : "Kris Q. Public"

},

"accountNumber" : "123-1234567",

"ableContributions" : 2000.0,

"rollovers" : 200.0,

"cumulativeContributions" : 3500.0,

"fairMarketValue" : 8000.0,

"openedInTaxYear" : false,

"basisOfDisabilityCode" : "C",

"typeOfDisabilityCode" : "6"

}

}

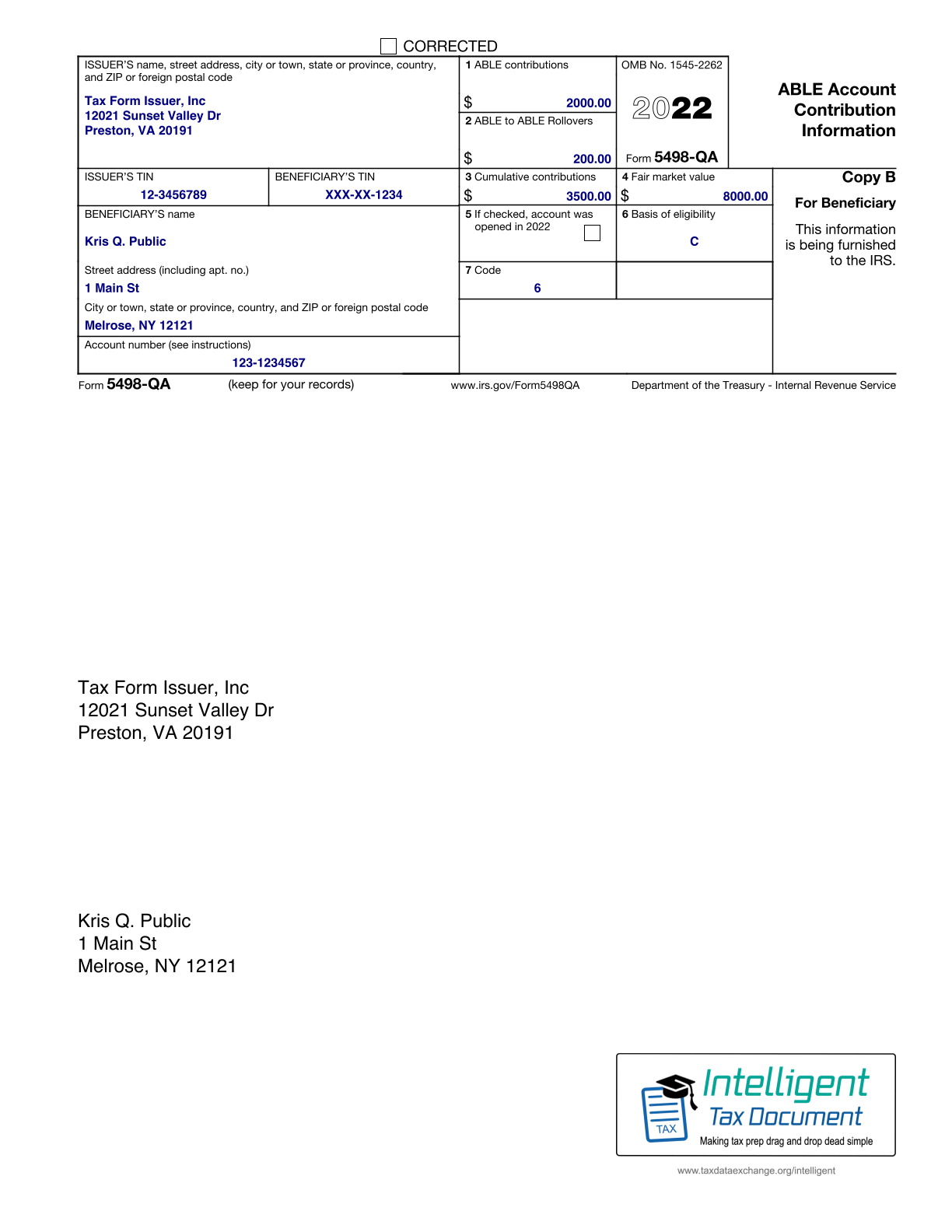

Example Form JSON for QR Code Purposes

Example Form PDF with QR Code

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"taxFormDate": "2020-12-31",

"taxFormType": "Tax5498Qa",

"issuerNameAddress.line1": "12021 Sunset Valley Dr",

"issuerNameAddress.city": "Preston",

"issuerNameAddress.state": "VA",

"issuerNameAddress.postalCode": "20191",

"issuerNameAddress.name1": "Tax Form Issuer, Inc",

"issuerTin": "12-3456789",

"beneficiaryTin": "XXX-XX-1234",

"beneficiaryNameAddress.line1": "1 Main St",

"beneficiaryNameAddress.city": "Melrose",

"beneficiaryNameAddress.state": "NY",

"beneficiaryNameAddress.postalCode": "12121",

"beneficiaryNameAddress.name1": "Kris Q. Public",

"accountNumber": "123-1234567",

"ableContributions": "2000.0",

"rollovers": "200.0",

"cumulativeContributions": "3500.0",

"fairMarketValue": "8000.0",

"openedInTaxYear": "false",

"basisOfDisabilityCode": "C",

"typeOfDisabilityCode": "6"

}

Issuer Instructions