Tax Documents

Tax1098T

FDX / Data Structures / Tax1098T

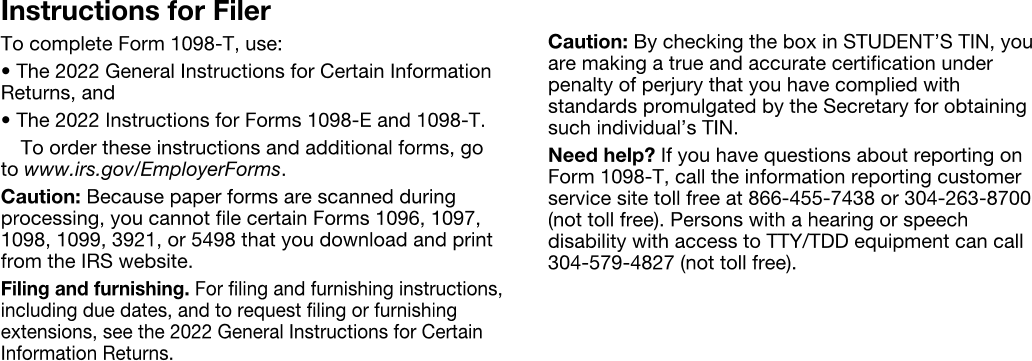

Form 1098-T, Tuition Statement

Extends and inherits all fields from Tax

Tax1098T Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | filerNameAddress | NameAddressPhone | Filer's name, address, and phone |

| 2 | filerTin | string | Filer's federal identification number |

| 3 | studentTin | string | Student's social security number |

| 4 | studentTinCertification | boolean | By checking the box in STUDENT'S TIN, filer is making a true and accurate certification under penalty of perjury that they have complied with standards promulgated by the Secretary for obtaining such individual's TIN |

| 5 | studentNameAddress | NameAddress | Student's name and address |

| 6 | accountNumber | string | Account number |

| 7 | halfTime | boolean | Box 8, Check if at least half-time student |

| 8 | qualifiedTuitionFees | number (double) | Box 1, Payments received for qualified tuition and related expenses |

| 9 | adjustmentPriorYear | number (double) | Box 4, Adjustments made for a prior year |

| 10 | scholarship | number (double) | Box 5, Scholarships or grants |

| 11 | adjustScholarship | number (double) | Box 6, Adjustments to scholarships or grants for a prior year |

| 12 | includeJanMar | boolean | Box 7, Check if the amount in box 1 or box 2 includes amounts for an academic period beginning January - March of next year |

| 13 | graduate | boolean | Box 9, Check if graduate student |

| 14 | insuranceRefund | number (double) | Box 10, Insurance contract reimbursement / refund |

Tax1098T Usage:

- TaxData tax1098T

FDX Data Structure as JSON

{

"tax1098T" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"filerNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"phone" : {

"type" : "HOME",

"country" : "string",

"number" : "string",

"extension" : "string"

}

},

"filerTin" : "string",

"studentTin" : "string",

"studentTinCertification" : true,

"studentNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"accountNumber" : "string",

"halfTime" : true,

"qualifiedTuitionFees" : 0.0,

"adjustmentPriorYear" : 0.0,

"scholarship" : 0.0,

"adjustScholarship" : 0.0,

"includeJanMar" : true,

"graduate" : true,

"insuranceRefund" : 0.0

}

}

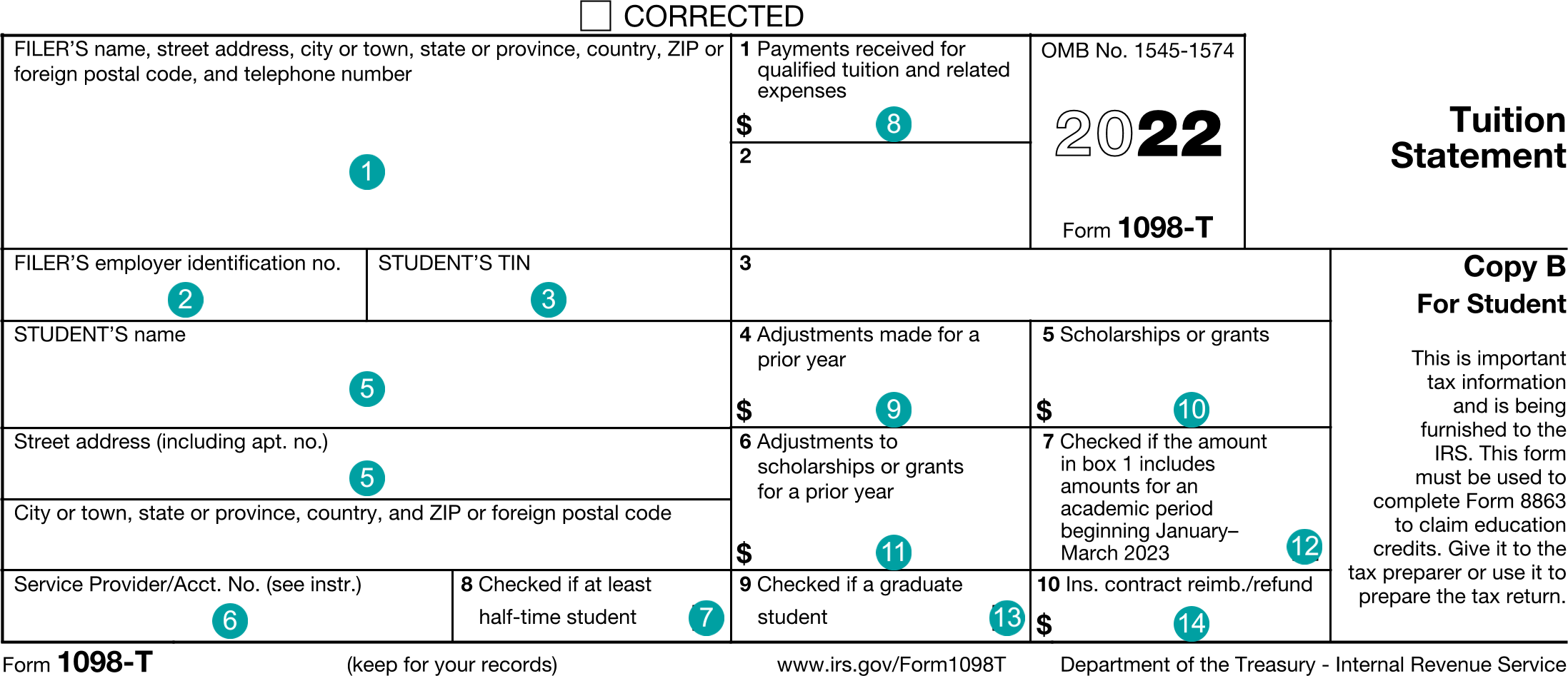

Example Form PDF

Example Form JSON

{

"tax1098T" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1098T",

"filerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"name1" : "Tax Form Issuer, Inc"

},

"filerTin" : "12-3456789",

"studentTin" : "XXX-XX-1234",

"studentNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"name1" : "Kris Q. Public"

},

"accountNumber" : "123-1234567",

"halfTime" : true,

"qualifiedTuitionFees" : 14000.0,

"adjustmentPriorYear" : 2000.0,

"scholarship" : 3000.0,

"adjustScholarship" : 400.0,

"includeJanMar" : true,

"graduate" : true,

"insuranceRefund" : 50.0

}

}

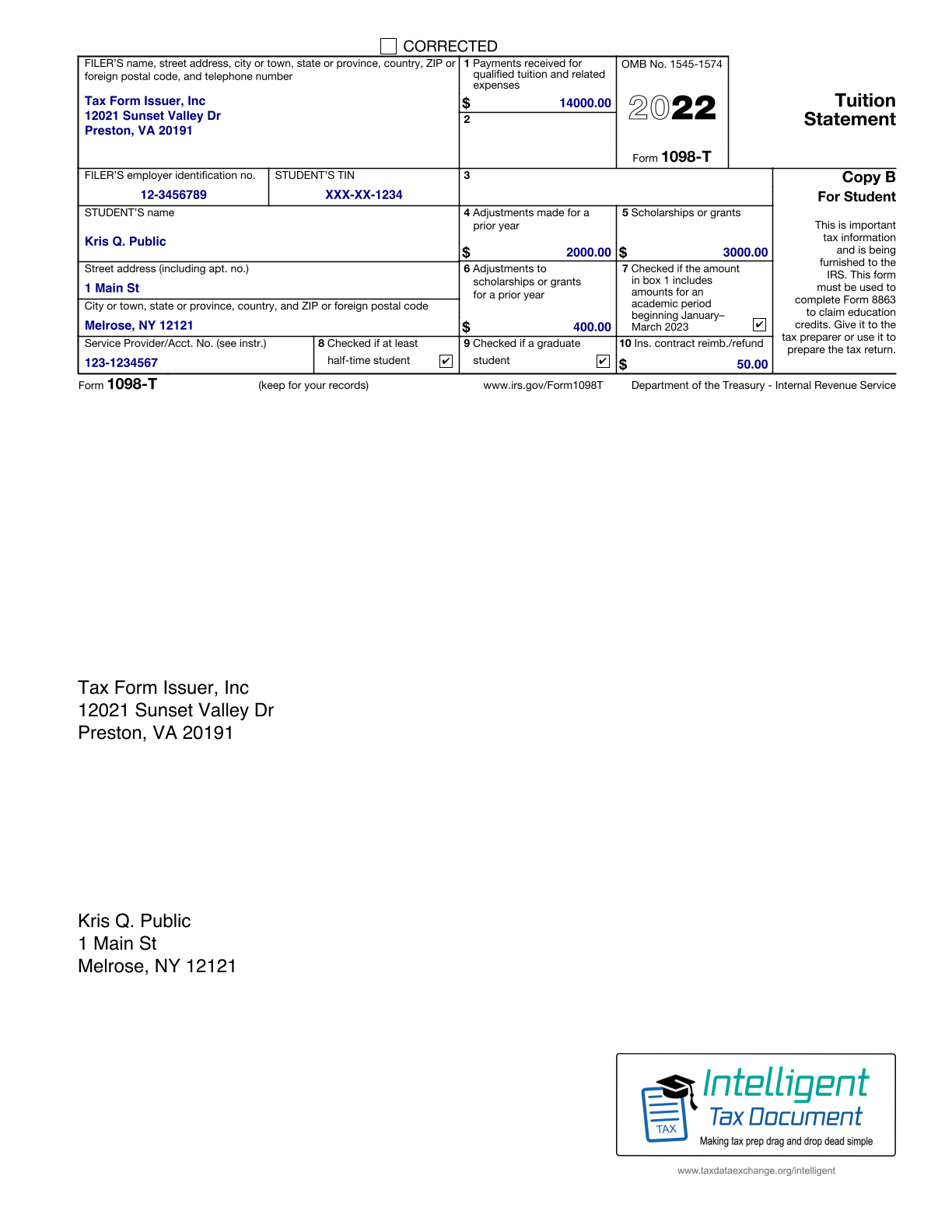

Example Form JSON for QR Code Purposes

Example Form PDF with QR Code

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"taxFormDate": "2021-03-30",

"taxFormType": "Tax1098T",

"filerNameAddress.line1": "12021 Sunset Valley Dr",

"filerNameAddress.city": "Preston",

"filerNameAddress.state": "VA",

"filerNameAddress.postalCode": "20191",

"filerNameAddress.name1": "Tax Form Issuer, Inc",

"filerTin": "12-3456789",

"studentTin": "XXX-XX-1234",

"studentNameAddress.line1": "1 Main St",

"studentNameAddress.city": "Melrose",

"studentNameAddress.state": "NY",

"studentNameAddress.postalCode": "12121",

"studentNameAddress.name1": "Kris Q. Public",

"accountNumber": "123-1234567",

"halfTime": "true",

"qualifiedTuitionFees": "14000.0",

"adjustmentPriorYear": "2000.0",

"scholarship": "3000.0",

"adjustScholarship": "400.0",

"includeJanMar": "true",

"graduate": "true",

"insuranceRefund": "50.0"

}

Issuer Instructions