Tax Documents

Tax1098C

FDX / Data Structures / Tax1098C

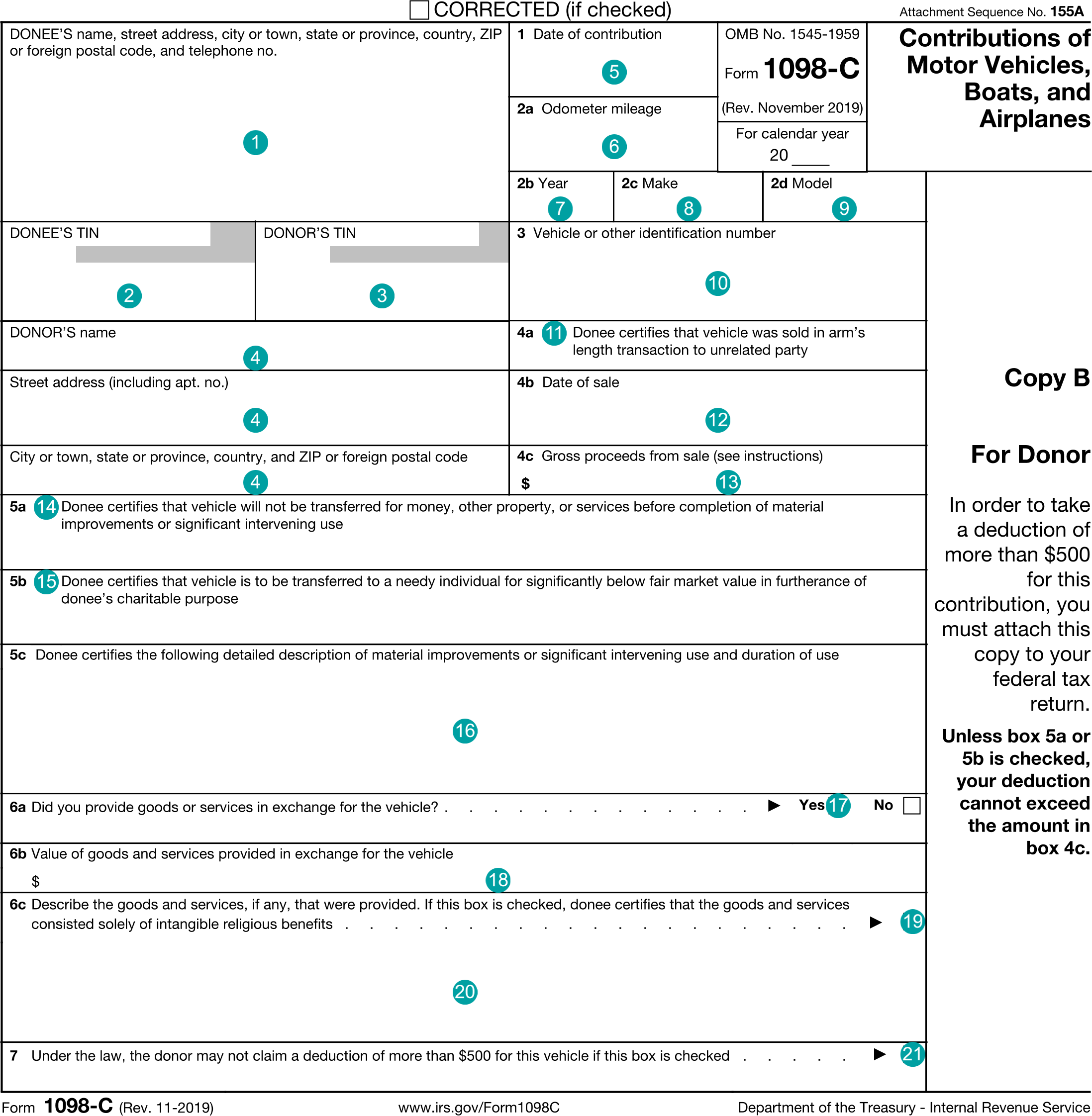

Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes

Extends and inherits all fields from Tax

Tax1098C Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | doneeNameAddress | NameAddressPhone | Donee's name, address and phone |

| 2 | doneeTin | string | DONEE'S TIN |

| 3 | donorTin | string | DONOR'S TIN |

| 4 | donorNameAddress | NameAddress | Donor's name and address |

| 5 | dateOfContribution | DateString | Box 1, Date of contribution |

| 6 | odometerMileage | integer | Box 2a, Odometer mileage |

| 7 | carYear | integer | Box 2b, Year |

| 8 | make | string | Box 2c, Make |

| 9 | model | string | Box 2d, Model |

| 10 | vin | string | Box 3, Vehicle or other identification number |

| 11 | armsLengthTransaction | boolean | Box 4a, Donee certifies that vehicle was sold in arm's length transaction to unrelated party |

| 12 | dateOfSale | DateString | Box 4b, Date of sale |

| 13 | grossProceeds | number (double) | Box 4c, Gross proceeds from sale (see instructions) |

| 14 | notTransferredBefore | boolean | Box 5a, Donee certifies that vehicle will not be transferred for money, other property, or services before completion of material improvements or significant intervening use |

| 15 | needyIndividual | boolean | Box 5b, Donee certifies that vehicle is to be transferred to a needy individual for significantly below fair market value in furtherance of donee's charitable purpose |

| 16 | descriptionOfImprovements | string | Box 5c, Donee certifies the following detailed description of material improvements or significant intervening use and duration of use |

| 17 | goodsInExchange | boolean | Box 6a, Did you provide goods or services in exchange for the vehicle? Yes |

| 18 | valueOfExchange | number (double) | Box 6b, Value of goods and services provided in exchange for the vehicle |

| 19 | intangibleReligious | boolean | Box 6c, If this box is checked, donee certifies that the goods and services consisted solely of intangible religious benefits |

| 20 | descriptionOfGoods | string | Box 6c, Describe the goods and services, if any, that were provided |

| 21 | maxDeductionApplies | boolean | Box 7, Under the law, the donor may not claim a deduction of more than $500 for this vehicle if this box is checked |

Tax1098C Usage:

- TaxData tax1098C

FDX Data Structure as JSON

{

"tax1098C" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"doneeNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"phone" : {

"type" : "HOME",

"country" : "string",

"number" : "string",

"extension" : "string"

}

},

"doneeTin" : "string",

"donorTin" : "string",

"donorNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"dateOfContribution" : "2020-07-01",

"odometerMileage" : 0,

"carYear" : 0,

"make" : "string",

"model" : "string",

"vin" : "string",

"armsLengthTransaction" : true,

"dateOfSale" : "2020-07-01",

"grossProceeds" : 0.0,

"notTransferredBefore" : true,

"needyIndividual" : true,

"descriptionOfImprovements" : "string",

"goodsInExchange" : true,

"valueOfExchange" : 0.0,

"intangibleReligious" : true,

"descriptionOfGoods" : "string",

"maxDeductionApplies" : true

}

}

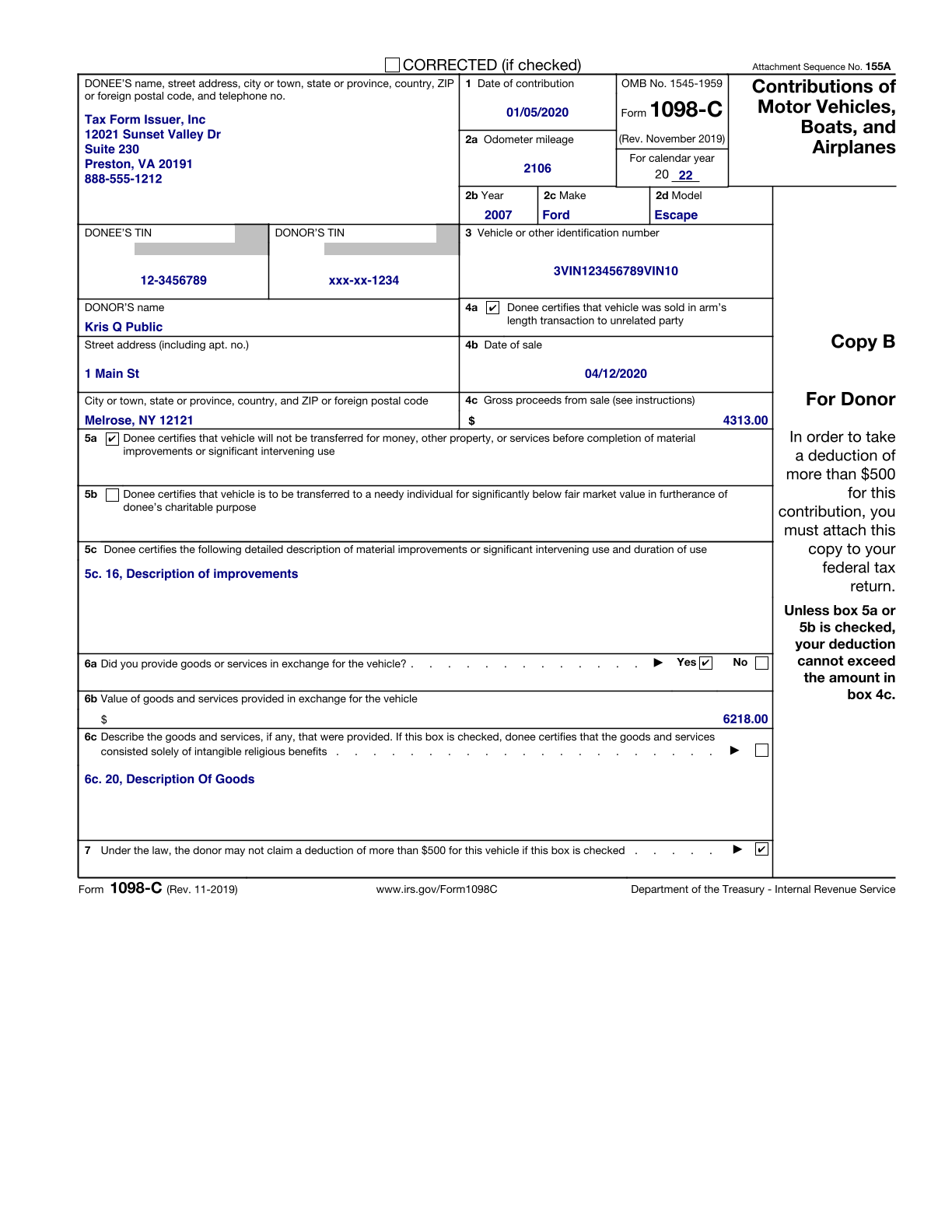

Example Form PDF

Example Form JSON

{

"tax1098C" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1098C",

"doneeNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"doneeTin" : "12-3456789",

"donorTin" : "xxx-xx-1234",

"donorNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q Public"

},

"dateOfContribution" : "2020-01-05",

"odometerMileage" : 2106,

"carYear" : 2007,

"make" : "Ford",

"model" : "Escape",

"vin" : "3VIN123456789VIN10",

"armsLengthTransaction" : true,

"dateOfSale" : "2020-04-12",

"grossProceeds" : 4313.0,

"notTransferredBefore" : true,

"needyIndividual" : false,

"descriptionOfImprovements" : "5c. 16, Description of improvements",

"goodsInExchange" : true,

"valueOfExchange" : 6218.0,

"intangibleReligious" : false,

"descriptionOfGoods" : "6c. 20, Description Of Goods",

"maxDeductionApplies" : true

}

}

Example Form JSON for QR Code Purposes

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"taxFormDate": "2021-03-30",

"taxFormType": "Tax1098C",

"doneeNameAddress.line1": "12021 Sunset Valley Dr",

"doneeNameAddress.line2": "Suite 230",

"doneeNameAddress.city": "Preston",

"doneeNameAddress.state": "VA",

"doneeNameAddress.postalCode": "20191",

"doneeNameAddress.country": "US",

"doneeNameAddress.name1": "Tax Form Issuer, Inc",

"doneeNameAddress.phone.number": "8885551212",

"doneeTin": "12-3456789",

"donorTin": "xxx-xx-1234",

"donorNameAddress.line1": "1 Main St",

"donorNameAddress.city": "Melrose",

"donorNameAddress.state": "NY",

"donorNameAddress.postalCode": "12121",

"donorNameAddress.country": "US",

"donorNameAddress.name1": "Kris Q Public",

"dateOfContribution": "2020-01-05",

"odometerMileage": "2106",

"carYear": "2007",

"make": "Ford",

"model": "Escape",

"vin": "3VIN123456789VIN10",

"armsLengthTransaction": "true",

"dateOfSale": "2020-04-12",

"grossProceeds": "4313.0",

"notTransferredBefore": "true",

"needyIndividual": "false",

"descriptionOfImprovements": "5c. 16, Description of improvements",

"goodsInExchange": "true",

"valueOfExchange": "6218.0",

"intangibleReligious": "false",

"descriptionOfGoods": "6c. 20, Description Of Goods",

"maxDeductionApplies": "true"

}

Issuer Instructions