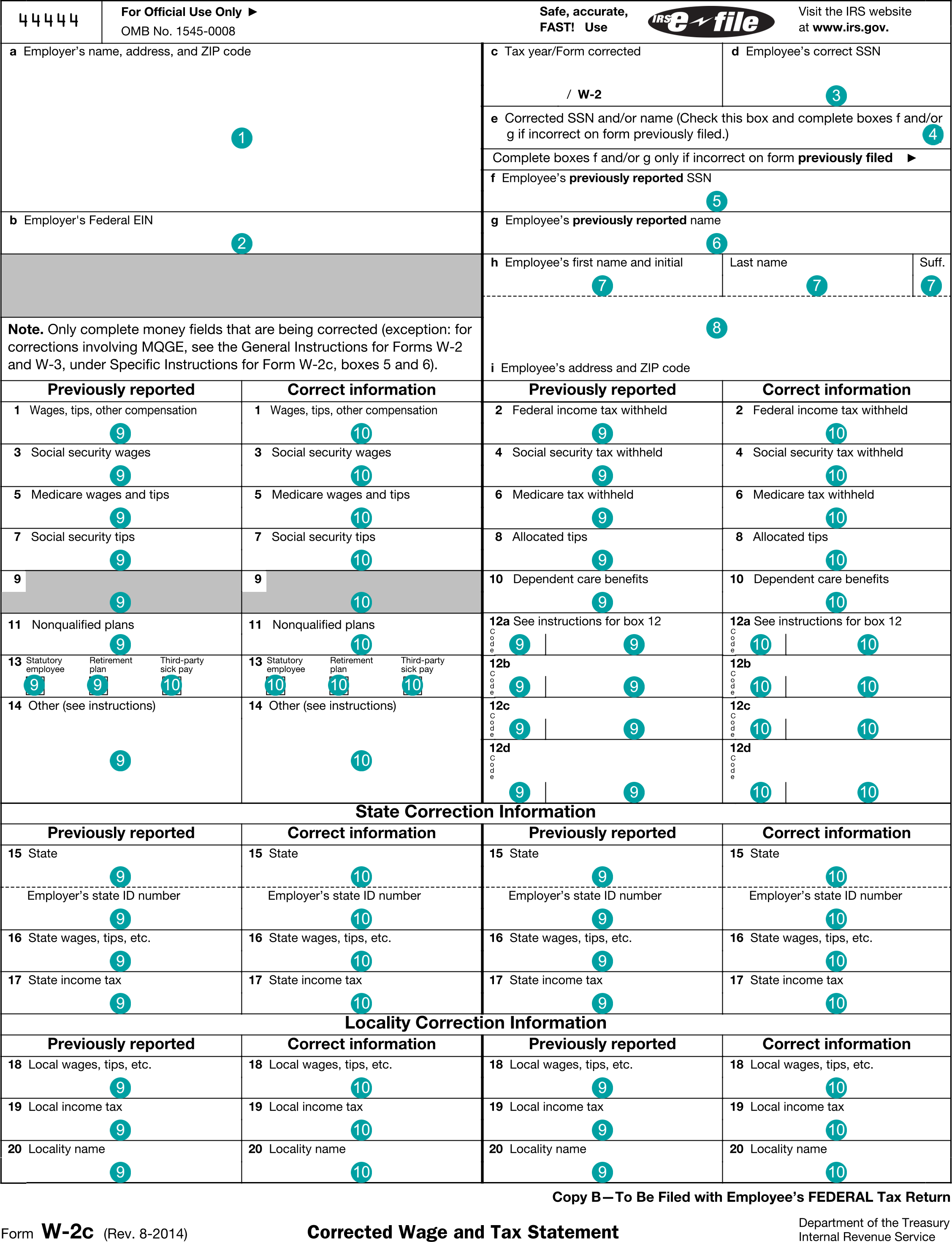

W-2c : Corrected Wage and Tax Statement

FDX

FDX / Data Structures / TaxW2C

Form W-2c, IRS form W-2c, Corrected Wage and Tax Statement

Extends and inherits all fields from Tax

TaxW2C Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | employerNameAddress | NameAddress | Box a, Employer's name, address, and ZIP code |

| 2 | employerTin | string | Box b, Employer's Federal EIN |

| 3 | employeeTin | string | Box d, Employee's correct SSN |

| 4 | correctedTinOrName | boolean | Box e, Corrected SSN and/or name |

| 5 | previousEmployeeTin | string | Box f, Employee's previously reported SSN |

| 6 | previousEmployeeName | IndividualName | Box g, Employee's previously reported name |

| 7 | employeeName | IndividualName | Box h, Employee's name |

| 8 | employeeAddress | Address | Box I, Employee's address and ZIP code |

| 9 | originalW2 | TaxW2 | Boxes 1-20 of Previously reported Wage and Tax Statement |

| 10 | correctedW2 | TaxW2 | Boxes 1-20 of Correct information Wage and Tax Statement |

TaxW2C Usage:

- TaxData taxW2C

OFX

OFX / Types / TaxW2C_V200

| # | Tag | Type |

|---|---|---|

| 1 | TAXYEAR | YearType |

| 2 | CNTRLNO | ControlNumber |

| 3 | VOID | BooleanType |

| 4 | EMPLOYER | Employer |

| 5 | EMPLOYEE | Employee |

| 6 | CORRECTEDSSNORNAME | BooleanType |

| 7 | PREVIOUSSSN | GenericNameType |

| 8 | PREVIOUSNAME | EmployeeName |

| 9 | ORIGINALW2 | TaxW2_V200 |

| 10 | CORRECTEDW2 | TaxW2_V200 |

Usages:

- TaxW2Response TAXW2C_V200

FIRE

This form is not reported in the IRS FIRE system.

TXF

The TXF standard does not support this form.