TaxW2C_V200

OFX / Types / TaxW2C_V200

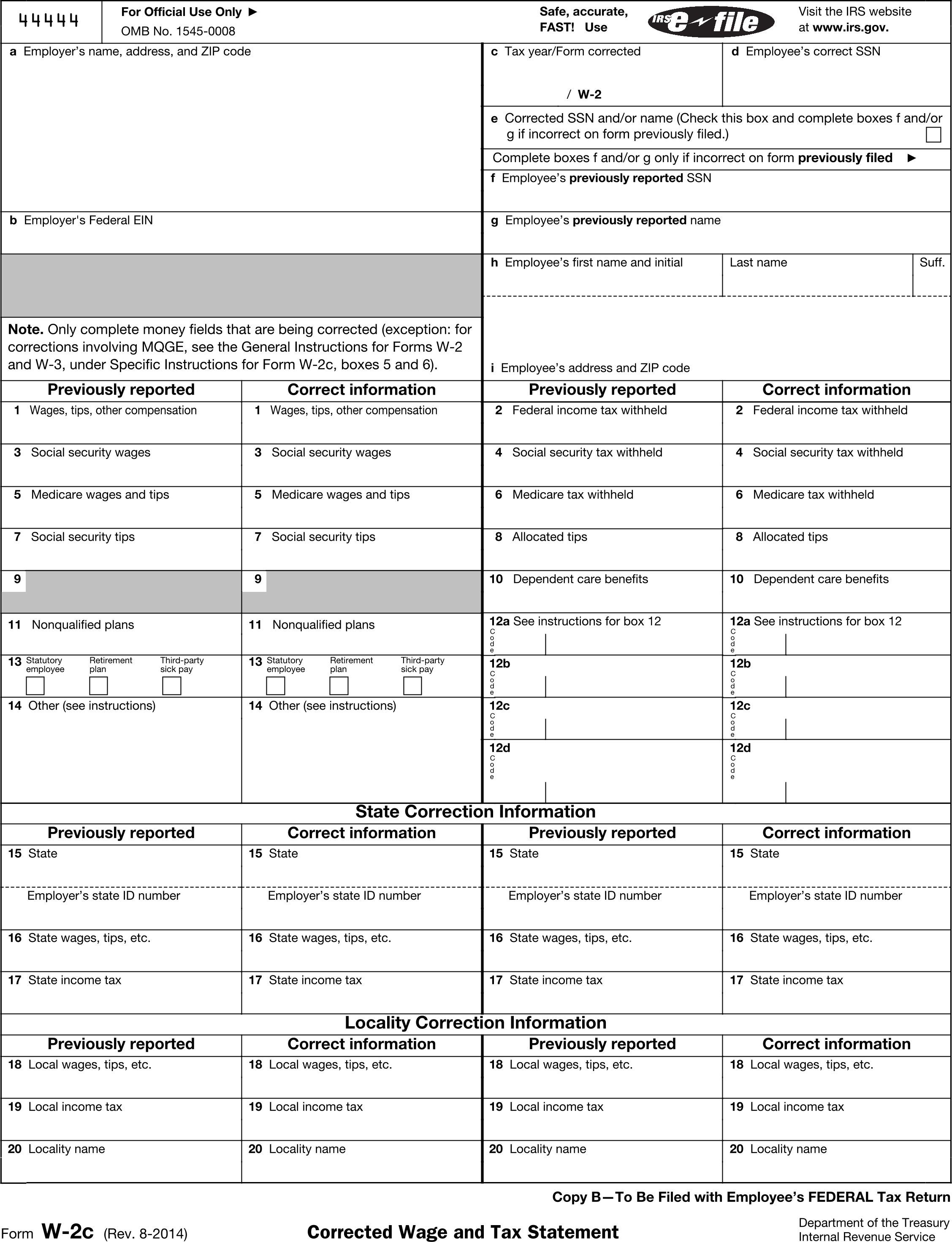

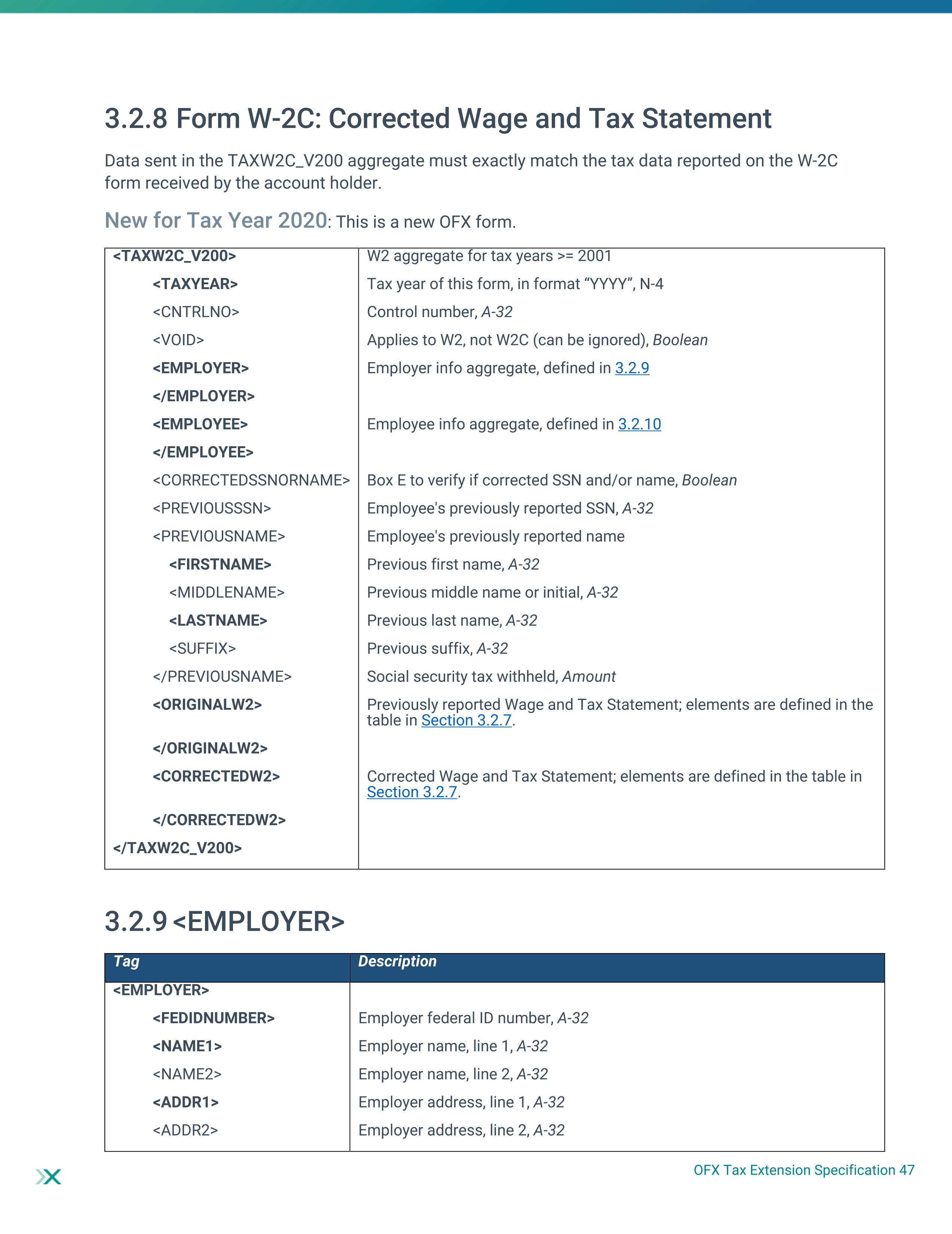

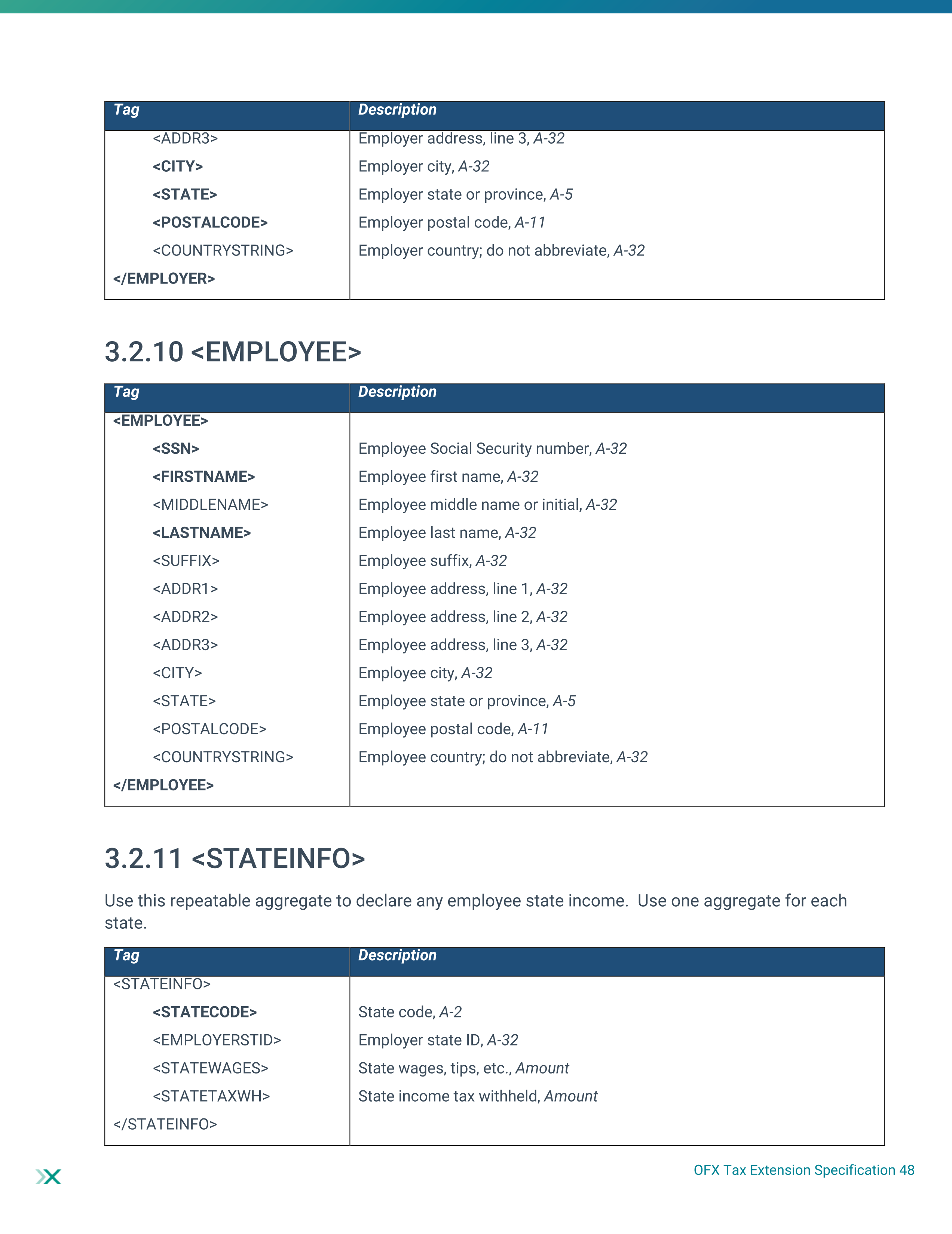

| # | Tag | Type |

|---|---|---|

| 1 | TAXYEAR | YearType |

| 2 | CNTRLNO | ControlNumber |

| 3 | VOID | BooleanType |

| 4 | EMPLOYER | Employer |

| 5 | EMPLOYEE | Employee |

| 6 | CORRECTEDSSNORNAME | BooleanType |

| 7 | PREVIOUSSSN | GenericNameType |

| 8 | PREVIOUSNAME | EmployeeName |

| 9 | ORIGINALW2 | TaxW2_V200 |

| 10 | CORRECTEDW2 | TaxW2_V200 |

Usages:

- TaxW2Response TAXW2C_V200

XSD

<xsd:complexType name="TaxW2C_V200"> <xsd:annotation> <xsd:documentation>IRS Form W2-C, Corrected Wage and Tax Statement. New TY20</xsd:documentation> </xsd:annotation> <xsd:complexContent> <xsd:extension base="ofx:AbstractTaxW2"> <xsd:sequence> <xsd:element name="EMPLOYER" type="ofx:Employer"/> <xsd:element name="EMPLOYEE" type="ofx:Employee"/> <xsd:element name="CORRECTEDSSNORNAME" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box e, Corrected SSN and/or name</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PREVIOUSSSN" type="ofx:GenericNameType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box f, Employee's previously reported SSN</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PREVIOUSNAME" type="ofx:EmployeeName" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box g, Employee's previously reported name</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="ORIGINALW2" type="ofx:TaxW2_V200"> <xsd:annotation> <xsd:documentation>Boxes 1-20 of Previously reported Wage and Tax Statement</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="CORRECTEDW2" type="ofx:TaxW2_V200"> <xsd:annotation> <xsd:documentation>Boxes 1-20 of Correct information Wage and Tax Statement</xsd:documentation> </xsd:annotation> </xsd:element> </xsd:sequence> </xsd:extension> </xsd:complexContent> </xsd:complexType>

OFX XML

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>39210131000000</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>fiName</ORG>

<FID>fiId</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAXW2MSGSRSV1>

<TAXW2TRNRS>

<TRNUID>_GUID_</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAXW2RS>

<TAXW2C_V200>

<EMPLOYER>

<FEDIDNUMBER>12-3456789</FEDIDNUMBER>

<NAME1>Financial Data Exchange</NAME1>

<ADDR1>12020 Sunrise Valley Dr</ADDR1>

<ADDR2>Suite 230</ADDR2>

<CITY>Prescott</CITY>

<STATE>VA</STATE>

<POSTALCODE>20191</POSTALCODE>

</EMPLOYER>

<EMPLOYEE>

<SSN>XXX-XX-1234</SSN>

<SUFFIX>NY</SUFFIX>

<ADDR1>1 Main St</ADDR1>

<CITY>Melrose</CITY>

<POSTALCODE>12121</POSTALCODE>

</EMPLOYEE>

<CORRECTEDSSNORNAME>N</CORRECTEDSSNORNAME>

<PREVIOUSSSN>XXX-XX-1234</PREVIOUSSSN>

<PREVIOUSNAME>

<FIRSTNAME>Kris</FIRSTNAME>

<MIDDLENAME>Q</MIDDLENAME>

<LASTNAME>Public</LASTNAME>

</PREVIOUSNAME>

<ORIGINALW2>

<TAXYEAR>2020</TAXYEAR>

<CNTRLNO>012547 WY/OA7</CNTRLNO>

<EMPLOYER>

<FEDIDNUMBER>12-3456789</FEDIDNUMBER>

<NAME1>Financial Data Exchange</NAME1>

<ADDR1>12020 Sunrise Valley Dr</ADDR1>

<ADDR2>Suite 230</ADDR2>

<CITY>Prescott</CITY>

<STATE>VA</STATE>

<POSTALCODE>20191</POSTALCODE>

</EMPLOYER>

<EMPLOYEE>

<SSN>XXX-XX-1234</SSN>

<FIRSTNAME>Kris</FIRSTNAME>

<MIDDLENAME>Q</MIDDLENAME>

<LASTNAME>Public</LASTNAME>

<ADDR1>1 Main St</ADDR1>

<CITY>Melrose</CITY>

<STATE>NY</STATE>

<POSTALCODE>12121</POSTALCODE>

</EMPLOYEE>

<WAGES>44416.74</WAGES>

<FEDTAXWH>6907.16</FEDTAXWH>

<SSWAGES>47162.92</SSWAGES>

<SSTAXWH>2924.10</SSTAXWH>

<MEDICAREWAGES>47162.92</MEDICAREWAGES>

<MEDICARETAXWH>683.86</MEDICARETAXWH>

<SSTIPS></SSTIPS>

<ALLOCATEDTIPS>nu</ALLOCATEDTIPS>

<DEPCAREBENEFIT>nu</DEPCAREBENEFIT>

<NONQUALPLAN>nu</NONQUALPLAN>

<CODES>

<CODE>C</CODE>

<CODEAMOUNT>301.50</CODEAMOUNT>

</CODES>

<CODES>

<CODE>D</CODE>

<CODEAMOUNT>2746.18</CODEAMOUNT>

</CODES>

<CODES>

<CODE>DD</CODE>

<CODEAMOUNT>4781.88</CODEAMOUNT>

</CODES>

<RETIREMENTPLAN>Y</RETIREMENTPLAN>

<STATEINFO>

<STATECODE>OH</STATECODE>

<EMPLOYERSTID>OH 036-133505158F-01</EMPLOYERSTID>

<STATEWAGES>44416.74</STATEWAGES>

<STATETAXWH>1726.78</STATETAXWH>

</STATEINFO>

<LOCALINFO>

<LOCALITY>Kirtland</LOCALITY>

<LOCALWAGES>44416.74</LOCALWAGES>

<LOCALTAXWH>427.62</LOCALTAXWH>

<LOCALITYSTATE>OH</LOCALITYSTATE>

</LOCALINFO>

<ESPPQUALDIS></ESPPQUALDIS>

<ESPPNONQUALDIS></ESPPNONQUALDIS>

</ORIGINALW2>

<CORRECTEDW2>

<TAXYEAR>2020</TAXYEAR>

<CNTRLNO>012547 WY/OA7</CNTRLNO>

<EMPLOYER>

<FEDIDNUMBER>12-3456789</FEDIDNUMBER>

<NAME1>Financial Data Exchange</NAME1>

<ADDR1>12020 Sunrise Valley Dr</ADDR1>

<ADDR2>Suite 230</ADDR2>

<CITY>Prescott</CITY>

<STATE>VA</STATE>

<POSTALCODE>20191</POSTALCODE>

</EMPLOYER>

<EMPLOYEE>

<SSN>XXX-XX-1234</SSN>

<FIRSTNAME>Kris</FIRSTNAME>

<MIDDLENAME>Q</MIDDLENAME>

<LASTNAME>Public</LASTNAME>

<ADDR1>1 Main St</ADDR1>

<CITY>Melrose</CITY>

<STATE>NY</STATE>

<POSTALCODE>12121</POSTALCODE>

</EMPLOYEE>

<WAGES>44416.74</WAGES>

<FEDTAXWH>6907.16</FEDTAXWH>

<SSWAGES>47162.92</SSWAGES>

<SSTAXWH>2924.10</SSTAXWH>

<MEDICAREWAGES>47162.92</MEDICAREWAGES>

<MEDICARETAXWH>683.86</MEDICARETAXWH>

<SSTIPS></SSTIPS>

<ALLOCATEDTIPS>nu</ALLOCATEDTIPS>

<DEPCAREBENEFIT>nu</DEPCAREBENEFIT>

<NONQUALPLAN>nu</NONQUALPLAN>

<CODES>

<CODE>C</CODE>

<CODEAMOUNT>301.50</CODEAMOUNT>

</CODES>

<CODES>

<CODE>D</CODE>

<CODEAMOUNT>2746.18</CODEAMOUNT>

</CODES>

<CODES>

<CODE>DD</CODE>

<CODEAMOUNT>4781.88</CODEAMOUNT>

</CODES>

<RETIREMENTPLAN>Y</RETIREMENTPLAN>

<STATEINFO>

<STATECODE>OH</STATECODE>

<EMPLOYERSTID>OH 036-133505158F-01</EMPLOYERSTID>

<STATEWAGES>44416.74</STATEWAGES>

<STATETAXWH>1726.78</STATETAXWH>

</STATEINFO>

<LOCALINFO>

<LOCALITY>Kirtland</LOCALITY>

<LOCALWAGES>44416.74</LOCALWAGES>

<LOCALTAXWH>427.62</LOCALTAXWH>

<LOCALITYSTATE>OH</LOCALITYSTATE>

</LOCALINFO>

<ESPPQUALDIS></ESPPQUALDIS>

<ESPPNONQUALDIS></ESPPNONQUALDIS>

</CORRECTEDW2>

</TAXW2C_V200>

</TAXW2RS>

</TAXW2TRNRS>

</TAXW2MSGSRSV1>

</OFX>

FDX JSON

{

"taxW2C" : {

"taxYear" : 2022,

"taxFormDate" : "2020-12-31",

"taxFormType" : "TaxW2C",

"employerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"name1" : "Tax Form Issuer, Inc"

},

"employerTin" : "12-3456789",

"employeeTin" : "XXX-XX-1234",

"correctedTinOrName" : false,

"previousEmployeeTin" : "XXX-XX-1234",

"previousEmployeeName" : {

"first" : "Kris",

"middle" : "Q",

"last" : "Public"

},

"employeeName" : {

"first" : "Kris",

"middle" : "Q",

"last" : "Public"

},

"employeeAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121"

},

"originalW2" : {

"taxYear" : 2022,

"employeeTin" : "XXX-XX-1234",

"employerTin" : "12-3456789",

"employerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"name1" : "Tax Form Issuer, Inc"

},

"controlNumber" : "012547 WY/OA7",

"employeeName" : {

"first" : "Kris",

"middle" : "Q",

"last" : "Public"

},

"employeeAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121"

},

"wages" : 44416.74,

"federalTaxWithheld" : 6907.16,

"socialSecurityWages" : 47162.92,

"socialSecurityTaxWithheld" : 2924.1,

"medicareWages" : 47162.92,

"medicareTaxWithheld" : 683.86,

"codes" : [ {

"code" : "C",

"amount" : 301.5

}, {

"code" : "D",

"amount" : 2746.18

}, {

"code" : "DD",

"amount" : 4781.88

} ],

"retirementPlan" : true,

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 1726.78,

"state" : "OH",

"stateTaxId" : "OH 036-133505158F-01",

"stateIncome" : 44416.74

} ],

"localTaxWithholding" : [ {

"localTaxWithheld" : 427.62,

"localityName" : "Kirtland",

"state" : "OH",

"localIncome" : 44416.74

} ]

},

"correctedW2" : {

"taxYear" : 2022,

"employeeTin" : "XXX-XX-1234",

"employerTin" : "12-3456789",

"employerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"name1" : "Tax Form Issuer, Inc"

},

"controlNumber" : "012547 WY/OA7",

"employeeName" : {

"first" : "Kris",

"middle" : "Q",

"last" : "Public"

},

"employeeAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121"

},

"wages" : 44416.74,

"federalTaxWithheld" : 6907.16,

"socialSecurityWages" : 47162.92,

"socialSecurityTaxWithheld" : 2924.1,

"medicareWages" : 47162.92,

"medicareTaxWithheld" : 683.86,

"codes" : [ {

"code" : "C",

"amount" : 301.5

}, {

"code" : "D",

"amount" : 2746.18

}, {

"code" : "DD",

"amount" : 5781.88

} ],

"retirementPlan" : true,

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 1726.78,

"state" : "OH",

"stateTaxId" : "OH 036-133505158F-01",

"stateIncome" : 44416.74

} ],

"localTaxWithholding" : [ {

"localTaxWithheld" : 427.62,

"localityName" : "Kirtland",

"state" : "OH",

"localIncome" : 44416.74

} ]

}

}

}

OFX Tax Specification Page 47

OFX Tax Specification Page 48

OFX Tax Specification Page 49