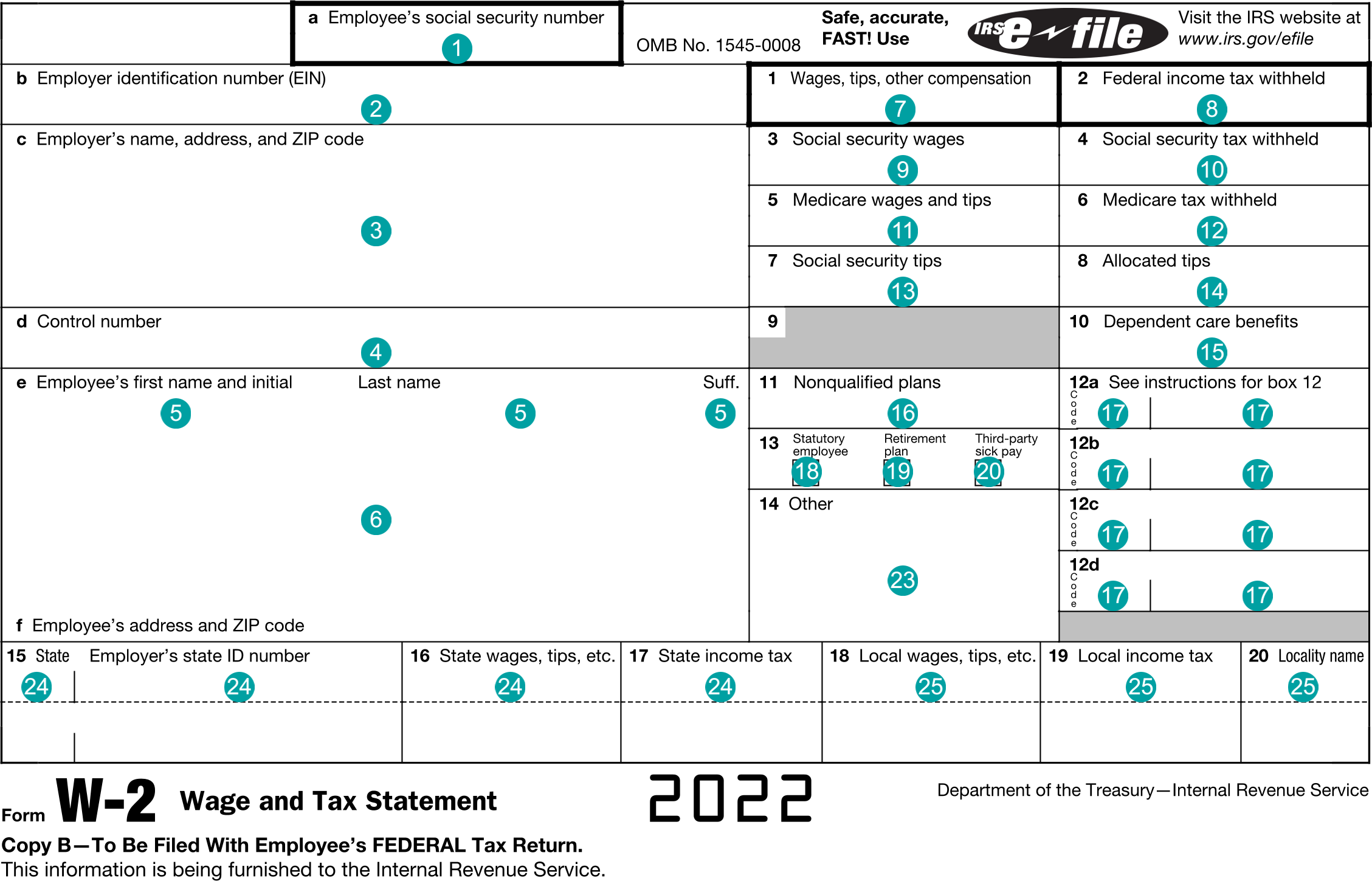

W-2 : Wage and Tax Statement

FDX

FDX / Data Structures / TaxW2

Form W-2, Wage and Tax Statement

Extends and inherits all fields from Tax

TaxW2 Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | employeeTin | string | Employee's social security number |

| 2 | employerTin | string | Employer identification number (EIN) |

| 3 | employerNameAddress | NameAddress | Employer's name and address |

| 4 | controlNumber | string | Control number |

| 5 | employeeName | IndividualName | Employee name |

| 6 | employeeAddress | Address | Employee's address |

| 7 | wages | number (double) | Box 1, Wages, tips, other compensation |

| 8 | federalTaxWithheld | number (double) | Box 2, Federal income tax withheld |

| 9 | socialSecurityWages | number (double) | Box 3, Social security wages |

| 10 | socialSecurityTaxWithheld | number (double) | Box 4, Social security tax withheld |

| 11 | medicareWages | number (double) | Box 5, Medicare wages and tips |

| 12 | medicareTaxWithheld | number (double) | Box 6, Medicare tax withheld |

| 13 | socialSecurityTips | number (double) | Box 7, Social security tips |

| 14 | allocatedTips | number (double) | Box 8, Allocated tips |

| 15 | dependentCareBenefit | number (double) | Box 10, Dependent care benefits |

| 16 | nonQualifiedPlan | number (double) | Box 11, Nonqualified plans |

| 17 | codes | Array of CodeAmount | Box 12, Codes and amounts |

| 18 | statutory | boolean | Box 13, Statutory employee |

| 19 | retirementPlan | boolean | Box 13, Retirement plan |

| 20 | thirdPartySickPay | boolean | Box 13, Third-party sick pay |

| 21 | esppQualified | number (double) | Employee Stock Purchase Plan Qualified Disposition amount |

| 22 | esppNonQualified | number (double) | Employee Stock Purchase Plan Nonqualified Disposition amount |

| 23 | other | Array of DescriptionAmount | Box 14, Other descriptions and amounts |

| 24 | stateTaxWithholding | Array of StateTaxWithholding | Boxes 15-17, State tax withholding |

| 25 | localTaxWithholding | Array of LocalTaxWithholding | Boxes 18-20, Local tax withholding |

TaxW2 Usage:

OFX

OFX / Types / TaxW2_V200

| # | Tag | Type |

|---|---|---|

| 1 | TAXYEAR | YearType |

| 2 | CNTRLNO | ControlNumber |

| 3 | VOID | BooleanType |

| 4 | EMPLOYER | Employer |

| 5 | EMPLOYEE | Employee |

| 6 | WAGES | AmountType |

| 7 | FEDTAXWH | AmountType |

| 8 | SSWAGES | AmountType |

| 9 | SSTAXWH | AmountType |

| 10 | MEDICAREWAGES | AmountType |

| 11 | MEDICARETAXWH | AmountType |

| 12 | SSTIPS | AmountType |

| 13 | ALLOCATEDTIPS | AmountType |

| 14 | ADVANCEDEIC | AmountType |

| 15 | DEPCAREBENEFIT | AmountType |

| 16 | NONQUALPLAN | AmountType |

| 17 | CODES | Codes |

| 18 | OTHER | Other |

| 19 | STATUTORY | BooleanType |

| 20 | RETIREMENTPLAN | BooleanType |

| 21 | THIRDPARTYSICKPAY | BooleanType |

| 22 | DEFERREDCOMP | BooleanType |

| 23 | STATEINFO | StateInfo |

| 24 | LOCALINFO | LocalInfo |

| 25 | W2VERIFICATIONCODE | anonymous simple type |

| 26 | ESPPQUALDIS | AmountType |

| 27 | ESPPNONQUALDIS | AmountType |

Usages:

- TaxW2C_V200 CORRECTEDW2

- TaxW2C_V200 ORIGINALW2

- TaxW2Response TAXW2_V200

FIRE

This form is not reported in the IRS FIRE system.

TXF

| Reference Number | Irs Form or Schedule | Description | Record Format | Sign |

|---|---|---|---|---|

| 459 | W-2 | Spouse | 0 | N/A |

| 267 | W-2 | Moving exp. reimb. | 1 | + |

| 458 | W-2 | W-2 | 1 | + |

| 460 | W-2 | Salary | 1 | + |

| 461 | W-2 | Federal withholding | 1 | - |

| 462 | W-2 | Soc Sec tax withholding | 1 | - |

| 463 | W-2 | Local withholding | 1 | - |

| 464 | W-2 | State withholding | 1 | - |

| 465 | W-2 | Dependent care benefits | 1 | + |

| 480 | W-2 | Medicare tax withholding | 1 | - |

| 506 | W-2 | Salary, spouse | 1 | + |

| 507 | W-2 | Federal withholding,spouse | 1 | - |

| 508 | W-2 | Soc Sec tax withhld, spouse | 1 | - |

| 509 | W-2 | Local withholding, spouse | 1 | - |

| 510 | W-2 | Medicare tax withhld, spouse | 1 | - |

| 511 | W-2 | State withholding, spouse | 1 | - |

| 512 | W-2 | Dependent care ben., spouse | 1 | + |

| 546 | W-2 | Moving exp. reimb., spouse | 1 | + |

| 466 | W-2 | Payer | 2 | N/A |

| 513 | W-2 | Payer, spouse | 2 | N/A |