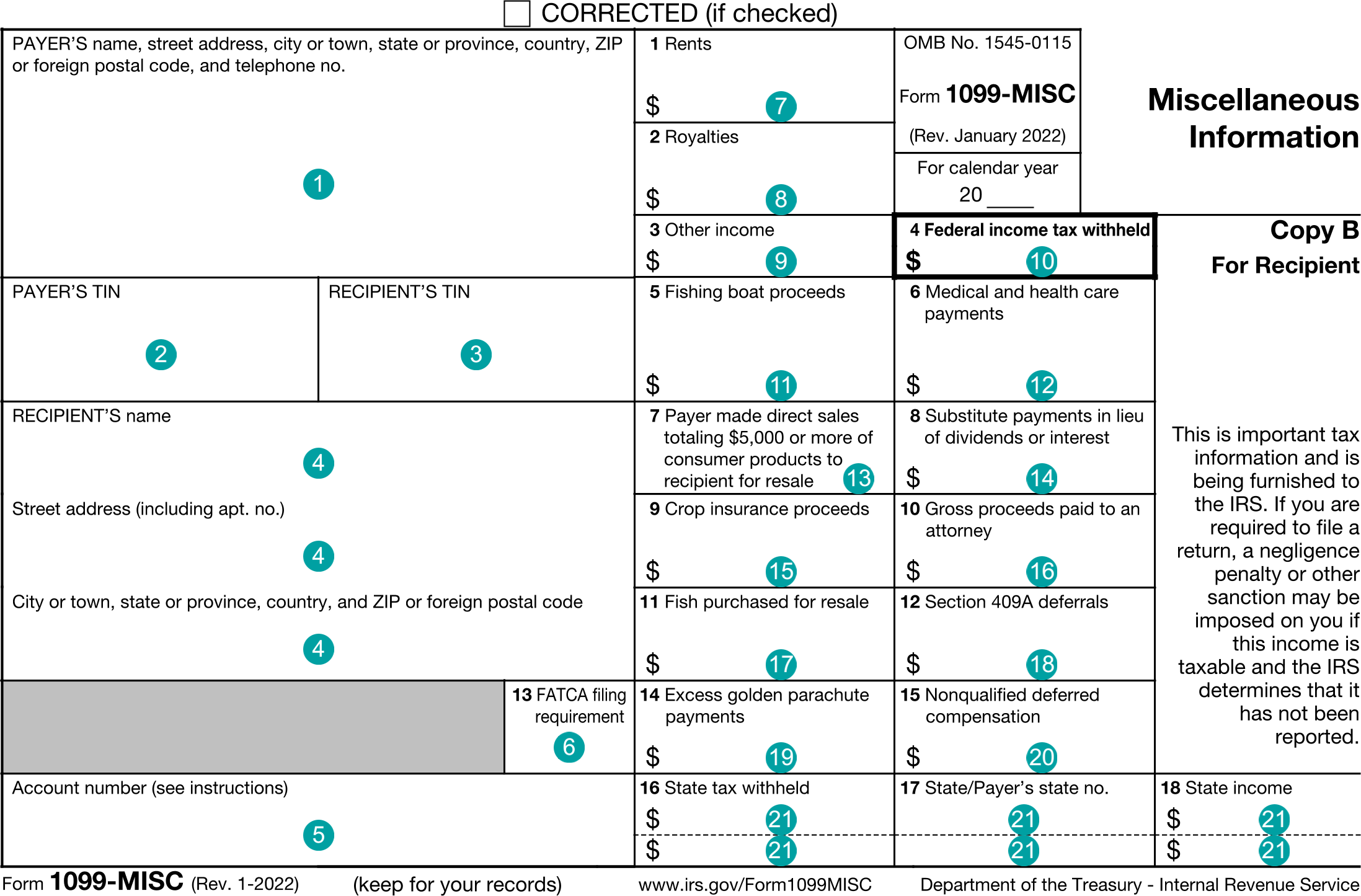

1099-MISC : Miscellaneous Income

FDX

FDX / Data Structures / Tax1099Misc

Form 1099-MISC, Miscellaneous Income

Extends and inherits all fields from Tax

Tax1099Misc Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | payerNameAddress | NameAddressPhone | PAYER'S name, address, and phone |

| 2 | payerTin | string | PAYER'S TIN |

| 3 | recipientTin | string | RECIPIENT'S TIN |

| 4 | recipientNameAddress | NameAddress | RECIPIENT'S name and address |

| 5 | accountNumber | string | Account number |

| 6 | foreignAccountTaxCompliance | boolean | FATCA filing requirement |

| 7 | rents | number (double) | Box 1, Rents |

| 8 | royalties | number (double) | Box 2, Royalties |

| 9 | otherIncome | number (double) | Box 3, Other income |

| 10 | federalTaxWithheld | number (double) | Box 4, Federal income tax withheld |

| 11 | fishingBoatProceeds | number (double) | Box 5, Fishing boat proceeds |

| 12 | medicalHealthPayment | number (double) | Box 6, Medical and health care payments |

| 13 | nonEmployeeCompensation | number (double) | 2019 Box 7, Nonemployee compensation (IRS removed 2020) |

| 14 | payerDirectSales | boolean | Box 7, Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale |

| 15 | substitutePayments | number (double) | Box 8, Substitute payments in lieu of dividends or interest |

| 16 | cropInsurance | number (double) | Box 9, Crop insurance proceeds |

| 17 | secondTinNotice | boolean | Second TIN Notice |

| 18 | grossAttorney | number (double) | Box 10, Gross proceeds paid to an attorney |

| 19 | fishPurchased | number (double) | Box 11, Fish purchased for resale |

| 20 | section409ADeferrals | number (double) | Box 12, Section 409A deferrals |

| 21 | section409AIncome | number (double) | 2019 Box 15b, Section 409A income (IRS removed 2020) |

| 22 | excessGolden | number (double) | Box 13, Excess golden parachute payments |

| 23 | nonQualifiedDeferredCompensation | number (double) | Box 14, Nonqualified Deferred Compensation |

| 24 | stateTaxWithholding | Array of StateTaxWithholding | Boxes 16-18, State tax withholding |

Tax1099Misc Usage:

- TaxData tax1099Misc

OFX

OFX / Types / Tax1099MISC_V100

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | RENTS | AmountType |

| 6 | ROYALTIES | AmountType |

| 7 | OTHERINCOME | AmountType |

| 8 | FEDTAXWH | AmountType |

| 9 | FISHBOATPRO | AmountType |

| 10 | MEDHEALTHPAY | AmountType |

| 11 | NONEMPCOMP | AmountType |

| 12 | SUBPMTS | AmountType |

| 13 | PAYER5KSALES | BooleanType |

| 14 | CROPINSPRO | AmountType |

| 15 | FORTAXPD | AmountType |

| 16 | FORCNT | GenericNameType |

| 17 | STTAXWH | AmountType |

| 18 | PAYERSTATE | StateCodeType |

| 19 | PAYERSTID | IdType |

| 20 | STINCOME | AmountType |

| 21 | ADDLSTTAXWHAGG | AdditionalStateTaxWithheldAggregate |

| 22 | GROSSATTOR | AmountType |

| 23 | EXCSGLDN | AmountType |

| 24 | SEC409ADEFERRALS | AmountType |

| 25 | SEC409AINCOME | AmountType |

| 26 | PAYERADDR | PayerAddress |

| 27 | PAYERID | GenericNameType |

| 28 | RECADDR | RecipientAddress |

| 29 | RECID | IdType |

| 30 | RECACCT | GenericNameType |

| 31 | TINNOT | BooleanType |

| 32 | FATCA | BooleanType |

| 33 | NONQUALDEFERREDCOMP | AmountType |

Usages:

- Tax1099Response TAX1099MISC_V100

FIRE

Under Development

TXF

| Reference Number | Irs Form or Schedule | Description | Record Format | Sign |

|---|---|---|---|---|

| 554 | 1099-MISC | Spouse | 0 | N/A |

| 553 | 1099-MISC | 1099-MISC | 1 | + |

| 555 | 1099-MISC | Rents | 1 | + |

| 556 | 1099-MISC | Royalties | 1 | + |

| 557 | 1099-MISC | Other income | 1 | + |

| 558 | 1099-MISC | Federal tax withheld | 1 | - |

| 559 | 1099-MISC | Fishing boat proceeds | 1 | + |

| 560 | 1099-MISC | Medical/health payments | 1 | + |

| 561 | 1099-MISC | Nonemployee compensation | 1 | + |

| 562 | 1099-MISC | Crop insurance proceeds | 1 | + |

| 563 | 1099-MISC | State tax withheld | 1 | - |

| 674 | 1099-MISC | Substitute payments | 1 | + |

| 675 | 1099-MISC | Gross proceeds to atty | 1 | + |

| 676 | 1099-MISC | Excess golden parachute | 1 | + |

| 564 | 1099-MISC | Payer | 2 | N/A |

| 654 | 1099-MISC | State ID | 2 | N/A |