Tax1099MISC_V100

OFX / Types / Tax1099MISC_V100

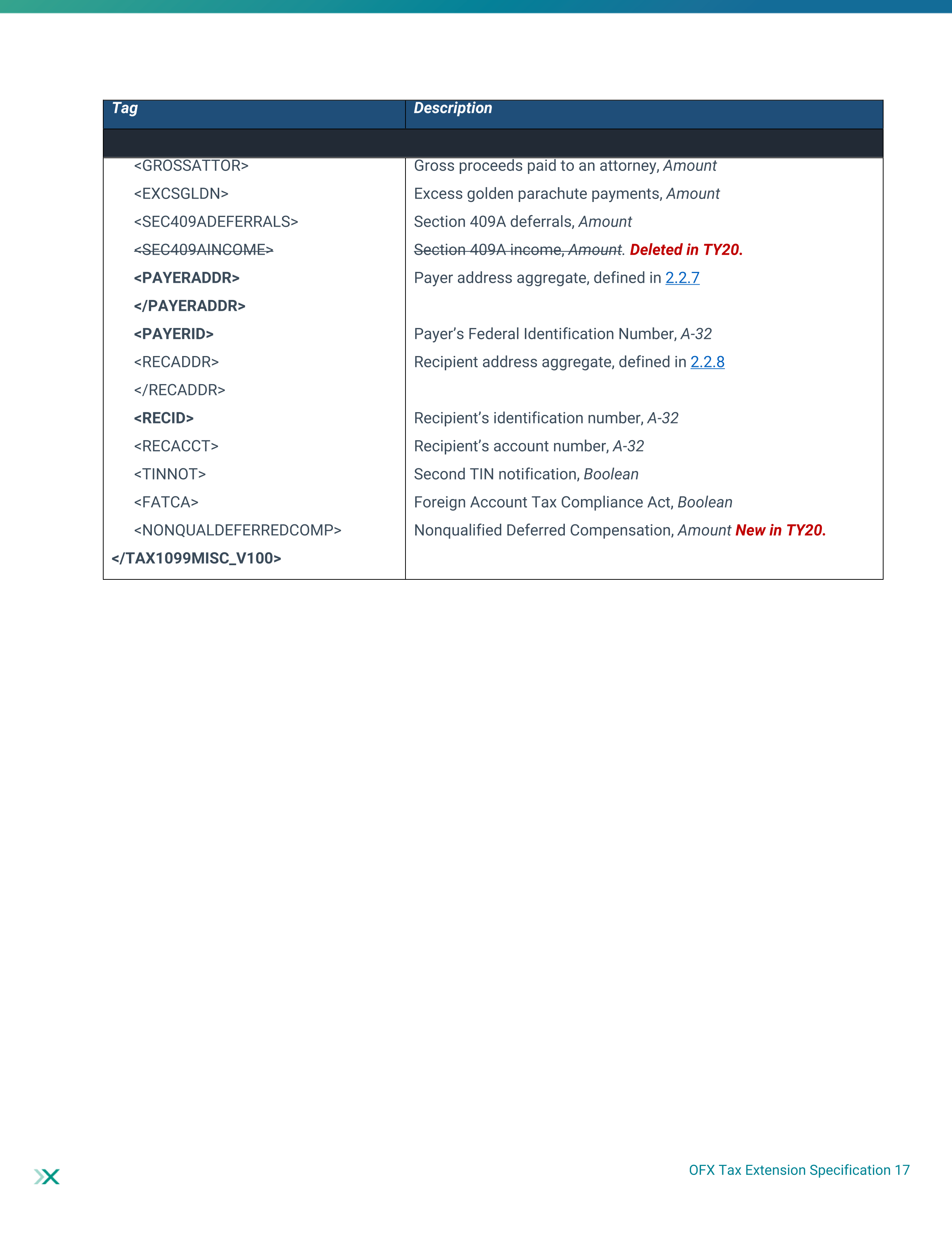

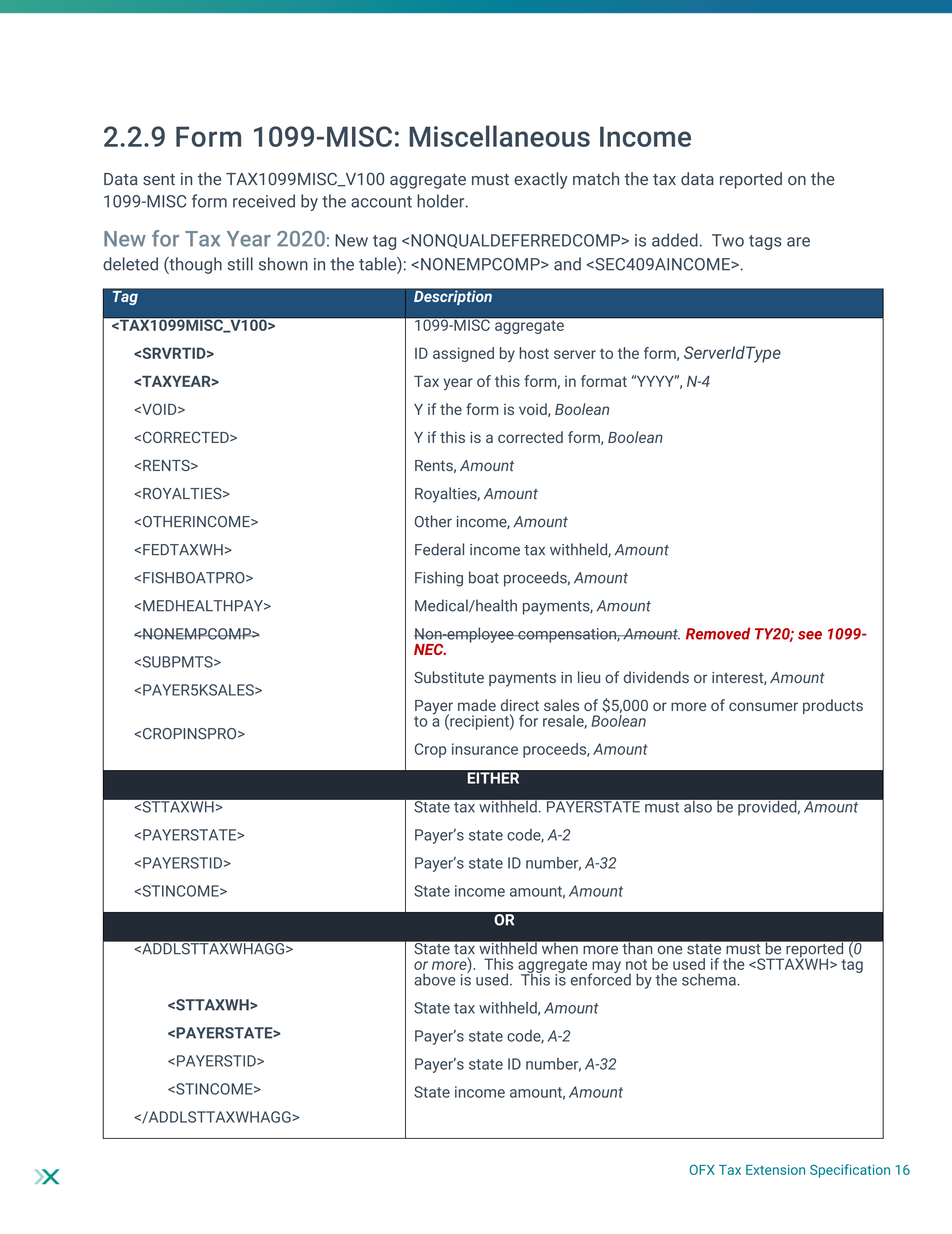

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | RENTS | AmountType |

| 6 | ROYALTIES | AmountType |

| 7 | OTHERINCOME | AmountType |

| 8 | FEDTAXWH | AmountType |

| 9 | FISHBOATPRO | AmountType |

| 10 | MEDHEALTHPAY | AmountType |

| 11 | NONEMPCOMP | AmountType |

| 12 | SUBPMTS | AmountType |

| 13 | PAYER5KSALES | BooleanType |

| 14 | CROPINSPRO | AmountType |

| 15 | FORTAXPD | AmountType |

| 16 | FORCNT | GenericNameType |

| 17 | STTAXWH | AmountType |

| 18 | PAYERSTATE | StateCodeType |

| 19 | PAYERSTID | IdType |

| 20 | STINCOME | AmountType |

| 21 | ADDLSTTAXWHAGG | AdditionalStateTaxWithheldAggregate |

| 22 | GROSSATTOR | AmountType |

| 23 | EXCSGLDN | AmountType |

| 24 | SEC409ADEFERRALS | AmountType |

| 25 | SEC409AINCOME | AmountType |

| 26 | PAYERADDR | PayerAddress |

| 27 | PAYERID | GenericNameType |

| 28 | RECADDR | RecipientAddress |

| 29 | RECID | IdType |

| 30 | RECACCT | GenericNameType |

| 31 | TINNOT | BooleanType |

| 32 | FATCA | BooleanType |

| 33 | NONQUALDEFERREDCOMP | AmountType |

Usages:

- Tax1099Response TAX1099MISC_V100

XSD

<xsd:complexType name="Tax1099MISC_V100"> <xsd:annotation> <xsd:documentation>The OFX element "TAX1099MISC_V100" is of type "Tax1099Misc_V100"</xsd:documentation> </xsd:annotation> <xsd:complexContent> <xsd:extension base="ofx:AbstractTaxForm1099"> <xsd:sequence> <xsd:element name="RENTS" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="ROYALTIES" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="OTHERINCOME" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="FEDTAXWH" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="FISHBOATPRO" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="MEDHEALTHPAY" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="NONEMPCOMP" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>IRS removed TY20, now on 1099-NEC</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="SUBPMTS" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="PAYER5KSALES" type="ofx:BooleanType" minOccurs="0"/> <xsd:element name="CROPINSPRO" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="FORTAXPD" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>IRS removed from form TY14</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="FORCNT" type="ofx:GenericNameType" minOccurs="0"> <xsd:annotation> <xsd:documentation>IRS removed from form TY14</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:choice> <xsd:sequence> <xsd:element name="STTAXWH" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="PAYERSTATE" type="ofx:StateCodeType" minOccurs="0"/> <xsd:element name="PAYERSTID" type="ofx:IdType" minOccurs="0"/> <xsd:element name="STINCOME" type="ofx:AmountType" minOccurs="0"/> </xsd:sequence> <xsd:element name="ADDLSTTAXWHAGG" type="ofx:AdditionalStateTaxWithheldAggregate" minOccurs="0" maxOccurs="unbounded"/> </xsd:choice> <xsd:element name="GROSSATTOR" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="EXCSGLDN" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="SEC409ADEFERRALS" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="SEC409AINCOME" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>IRS removed TY20</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PAYERADDR" type="ofx:PayerAddress"/> <xsd:element name="PAYERID" type="ofx:GenericNameType"/> <xsd:element name="RECADDR" type="ofx:RecipientAddress" minOccurs="0"/> <xsd:element name="RECID" type="ofx:IdType"/> <xsd:element name="RECACCT" type="ofx:GenericNameType" minOccurs="0"/> <xsd:element name="TINNOT" type="ofx:BooleanType" minOccurs="0"/> <xsd:element name="FATCA" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>FATCA filing requirement</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="NONQUALDEFERREDCOMP" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 14, Nonqualified Deferred Compensation. New TY20</xsd:documentation> </xsd:annotation> </xsd:element> </xsd:sequence> </xsd:extension> </xsd:complexContent> </xsd:complexType>

OFX XML

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>39210131000000</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>fiName</ORG>

<FID>fiId</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAX1099MSGSRSV1>

<TAX1099TRNRS>

<TRNUID>_GUID_</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAX1099RS>

<TAX1099MISC_V100>

<TAXYEAR>2020</TAXYEAR>

<RENTS>1007.00</RENTS>

<ROYALTIES>2008.00</ROYALTIES>

<OTHERINCOME>3009.00</OTHERINCOME>

<FEDTAXWH>4010.00</FEDTAXWH>

<FISHBOATPRO>5011.00</FISHBOATPRO>

<MEDHEALTHPAY>6012.00</MEDHEALTHPAY>

<SUBPMTS>8015.00</SUBPMTS>

<PAYER5KSALES>Y</PAYER5KSALES>

<CROPINSPRO>9016.00</CROPINSPRO>

<ADDLSTTAXWHAGG>

<STTAXWH>15022.00</STTAXWH>

<PAYERSTATE>NY</PAYERSTATE>

<PAYERSTID>xxx-16022</PAYERSTID>

<STINCOME>17022.00</STINCOME>

</ADDLSTTAXWHAGG>

<GROSSATTOR>10017.00</GROSSATTOR>

<EXCSGLDN>13020.00</EXCSGLDN>

<SEC409ADEFERRALS>12018.00</SEC409ADEFERRALS>

<PAYERADDR>

<PAYERNAME1>Financial Data Exchange</PAYERNAME1>

<ADDR1>12020 Sunrise Valley Dr</ADDR1>

<ADDR2>Suite 230</ADDR2>

<CITY>Prescott</CITY>

<STATE>VA</STATE>

<POSTALCODE>20191</POSTALCODE>

<PHONE>888-555-1212</PHONE>

</PAYERADDR>

<PAYERID>12-3456789</PAYERID>

<RECADDR>

<RECNAME1>Kris Q Public</RECNAME1>

<ADDR1>1 Main St</ADDR1>

<CITY>Melrose</CITY>

<STATE>NY</STATE>

<POSTALCODE>12121</POSTALCODE>

</RECADDR>

<RECID>xxx-xx-1234</RECID>

<RECACCT>111-5555555</RECACCT>

<FATCA>N</FATCA>

</TAX1099MISC_V100>

</TAX1099RS>

</TAX1099TRNRS>

</TAX1099MSGSRSV1>

</OFX>

FDX JSON

{

"tax1099Misc" : {

"taxYear" : 2021,

"taxFormDate" : "2022-02-01",

"additionalInformation" : "FDX v5.0",

"taxFormType" : "Tax1099Misc",

"payerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"payerTin" : "12-3456789",

"recipientTin" : "xxx-xx-1234",

"recipientNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q Public"

},

"accountNumber" : "111-5555555",

"foreignAccountTaxCompliance" : false,

"rents" : 1007.0,

"royalties" : 2008.0,

"otherIncome" : 3009.0,

"federalTaxWithheld" : 4010.0,

"fishingBoatProceeds" : 5011.0,

"medicalHealthPayment" : 6012.0,

"payerDirectSales" : true,

"substitutePayments" : 8015.0,

"cropInsurance" : 9016.0,

"secondTinNotice" : false,

"grossAttorney" : 10017.0,

"fishPurchased" : 11017.5,

"section409ADeferrals" : 12018.0,

"excessGolden" : 13020.0,

"nonQualifiedDeferredCompensation" : 14021.0,

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 15022.0,

"state" : "NY",

"stateTaxId" : "xxx-16022",

"stateIncome" : 17022.0

} ]

}

}

OFX Tax Specification Page 16

OFX Tax Specification Page 17