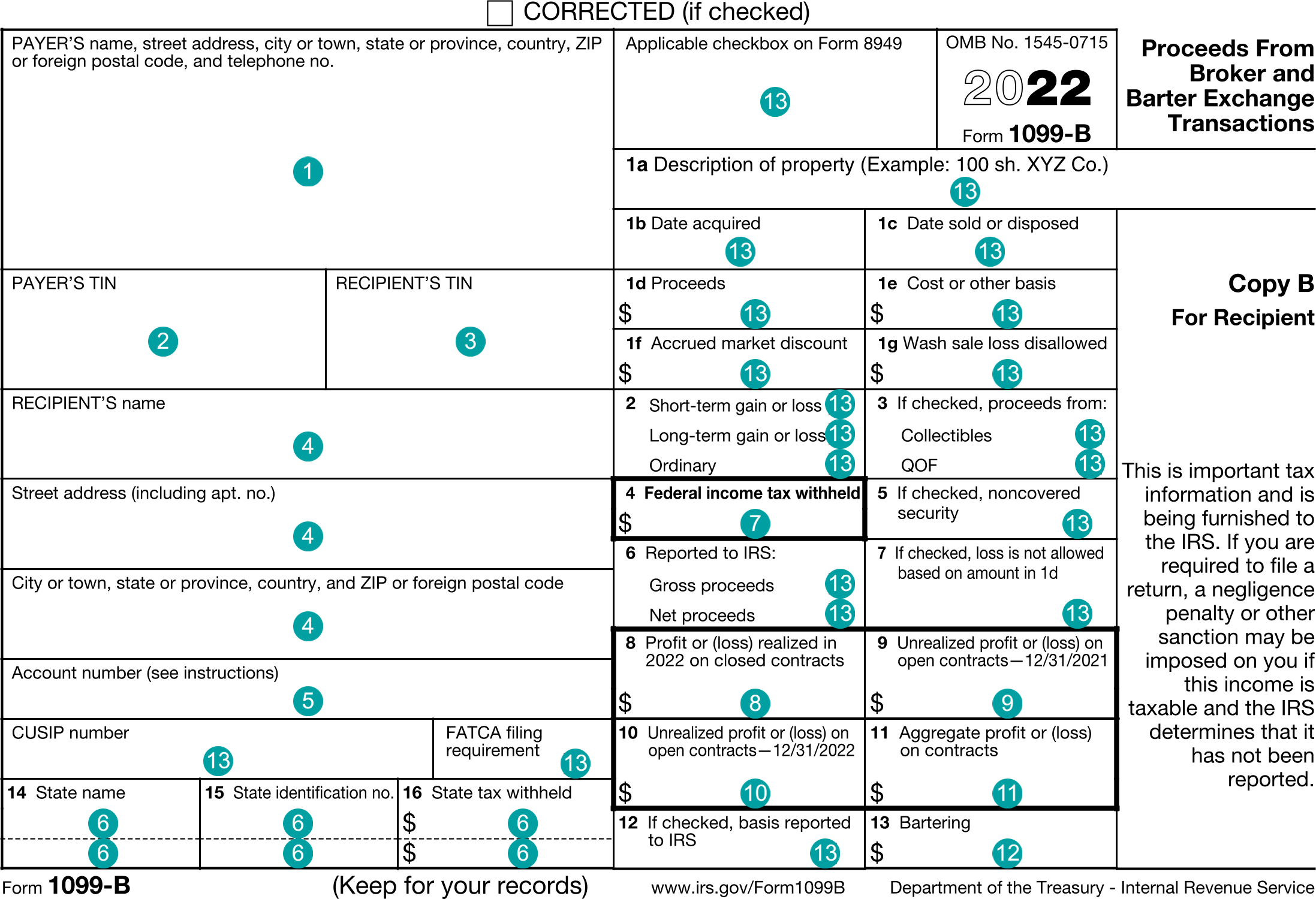

1099-B : Proceeds From Broker and Barter Exchange Transactions

FDX

FDX / Data Structures / Tax1099B

Form 1099-B, Proceeds From Broker and Barter Exchange Transactions

Extends and inherits all fields from Tax

Tax1099B Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | payerNameAddress | NameAddressPhone | Payer's name, address, and phone |

| 2 | payerTin | string | Payer's federal identification number |

| 3 | recipientTin | string | Recipient's identification number |

| 4 | recipientNameAddress | NameAddress | Recipient's name and address |

| 5 | accountNumber | string | Account number |

| 6 | stateTaxWithholding | Array of StateTaxWithholding | Boxes 14-16, State tax withholding |

| 7 | federalTaxWithheld | number (double) | Box 4, Federal income tax withheld |

| 8 | profitOnClosedContracts | number (double) | Box 8, Profit or (loss) realized in current year on closed contracts |

| 9 | unrealizedProfitOpenContractsBegin | number (double) | Box 9, Unrealized profit or loss on open contracts at end of last year |

| 10 | unrealizedProfitOpenContractsEnd | number (double) | Box 10, Unrealized profit or loss on open contracts at end of current year |

| 11 | aggregateProfitOnContracts | number (double) | Box 11, Aggregate profit or (loss) on contracts |

| 12 | bartering | number (double) | Box 13, Bartering |

| 13 | securityDetails | Array of SecurityDetail | Boxes 1-3, 5-7, 12, Security details |

| 14 | secondTinNotice | boolean | Second TIN Notice |

Tax1099B Usage:

- TaxData tax1099B

OFX

OFX / Types / Tax1099B_V100

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | DTSALE | DateTimeType |

| 6 | CUSIPNUM | CusipType |

| 7 | STKBND | StocksBonds |

| 8 | BARTERING | AmountType |

| 9 | FEDTAXWH | AmountType |

| 10 | DSCR | ShortMessageType |

| 11 | PROFIT | AmountType |

| 12 | UNRELPROFITPREV | AmountType |

| 13 | UNRELPROFIT | AmountType |

| 14 | AGGPROFIT | AmountType |

| 15 | EXTDBINFO_V100 | ExtendedBInfo_V100 |

| 16 | PAYERADDR | PayerAddress |

| 17 | PAYERID | GenericNameType |

| 18 | RECADDR | RecipientAddress |

| 19 | RECID | IdType |

| 20 | RECACCT | GenericNameType |

| 21 | TINNOT | BooleanType |

Usages:

- Tax1099Response TAX1099B_V100

FIRE

Under Development

TXF

| Reference Number | Irs Form or Schedule | Description | Record Format | Sign |

|---|---|---|---|---|

| 320 | D | Schedule D | 1 | + |

| 488 | D | Div inc., capital gain dist | 3 | + |

| 644 | D | 28% cap gain | 3 | + |

| 645 | D | Unrec sec 1250 | 3 | + |

| 646 | D | Sec 1202 gain | 3 | + |

| 677 | D | Qualified 5-year gain | 3 | + |

| 684 | D | Div inc., PostMay5 cap gain | 3 | + |

| 321 | D | ST gain/loss 8949 Copy A | 4 | + |

| 322 | D | ST gain/loss - other | 4 | + |

| 323 | D | LT gain/loss 8949 Copy A | 4 | + |

| 324 | D | LT gain/loss - other | 4 | + |

| 673 | D | Short/Long 8949 Copy A | 4 | + |

| 682 | D | Wash Sale - 8949 Copy A | 4 | + |

| 711 | D | ST gain/loss 8949 Copy B | 4 | + |

| 712 | D | ST gain/loss 8949 copy C | 4 | + |

| 713 | D | LT gain/loss 8949 Copy B | 4 | + |

| 714 | D | LT gain/loss 8949 Copy C | 4 | + |

| 715 | D | Short/Long 8949 Copy B | 4 | + |

| 716 | D | Short/Long 8949 Copy C | 4 | + |

| 718 | D | Wash Sale - 8949 Copy B | 4 | + |

| 321 | D | ST gain/loss 8949 Copy A | 5 | + |

| 323 | D | LT gain/loss 8949 Copy A | 5 | + |

| 673 | D | Short/Long 8949 Copy A | 5 | + |

| 682 | D | Wash Sale - 8949 Copy A | 5 | + |

| 711 | D | ST gain/loss 8949 Copy B | 5 | + |

| 712 | D | ST gain/loss 8949 copy C | 5 | + |

| 713 | D | LT gain/loss 8949 Copy B | 5 | + |

| 714 | D | LT gain/loss 8949 Copy C | 5 | + |

| 715 | D | Short/Long 8949 Copy B | 5 | + |

| 716 | D | Short/Long 8949 Copy C | 5 | + |

| 718 | D | Wash Sale - 8949 Copy B | 5 | + |