Tax1099B_V100

OFX / Types / Tax1099B_V100

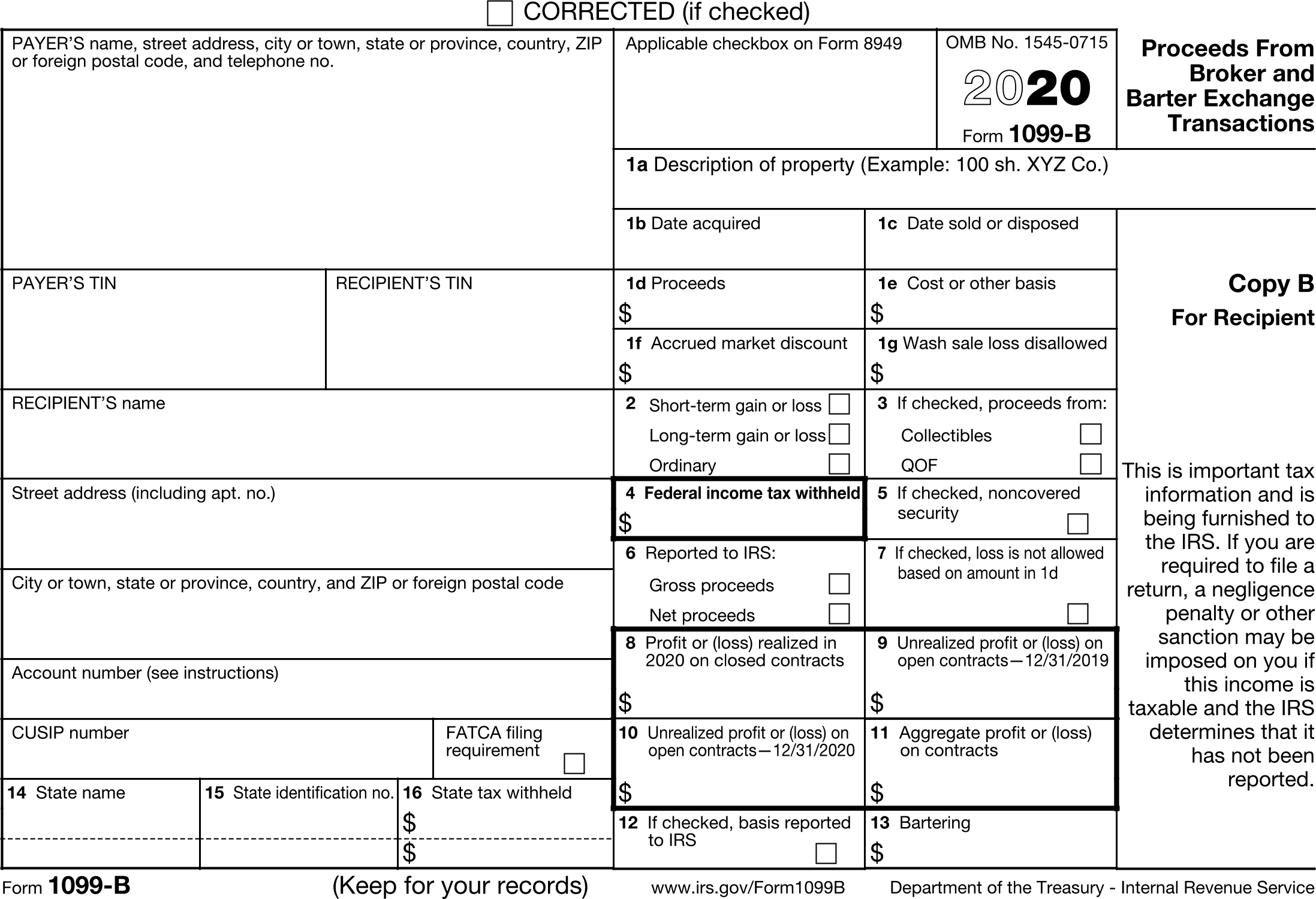

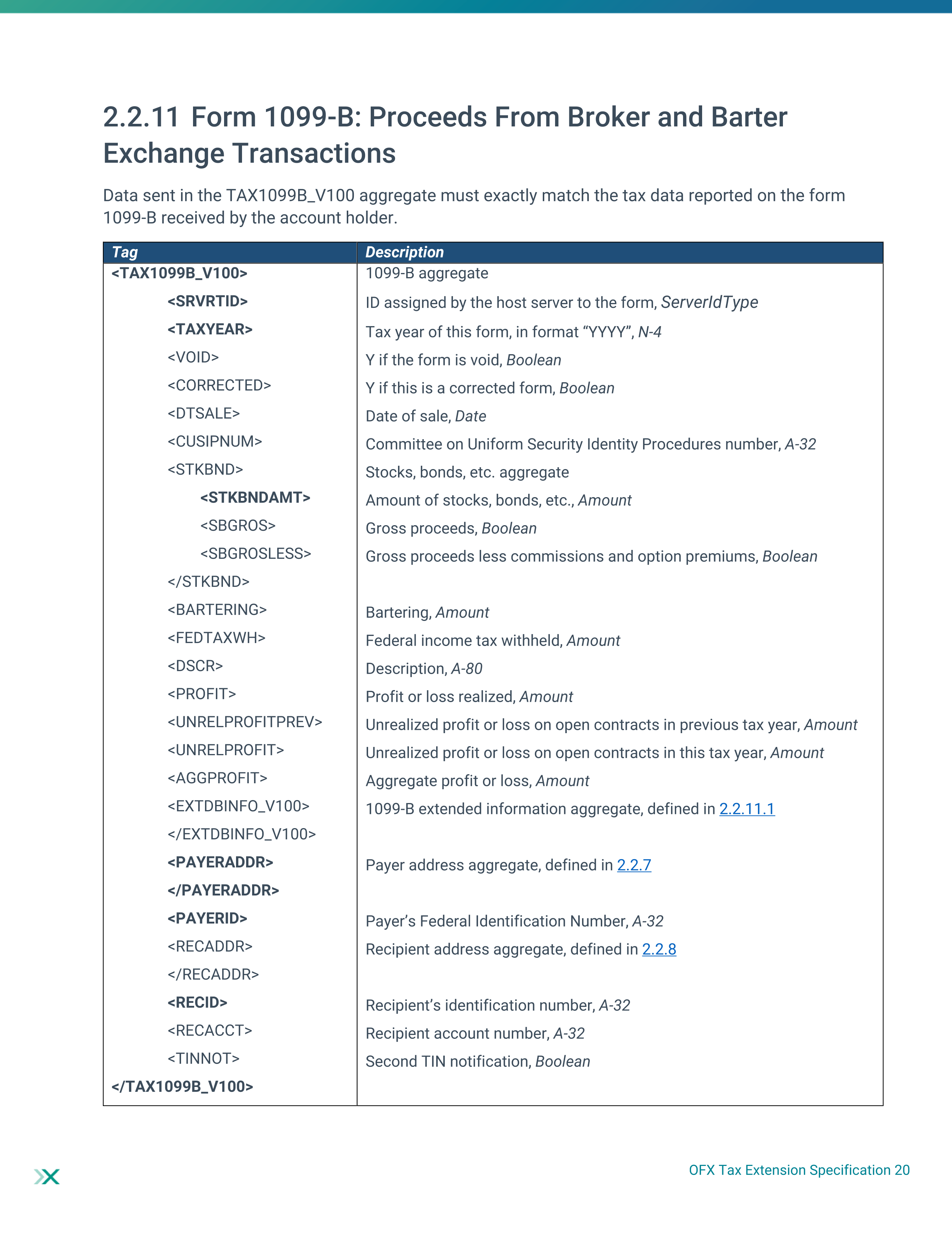

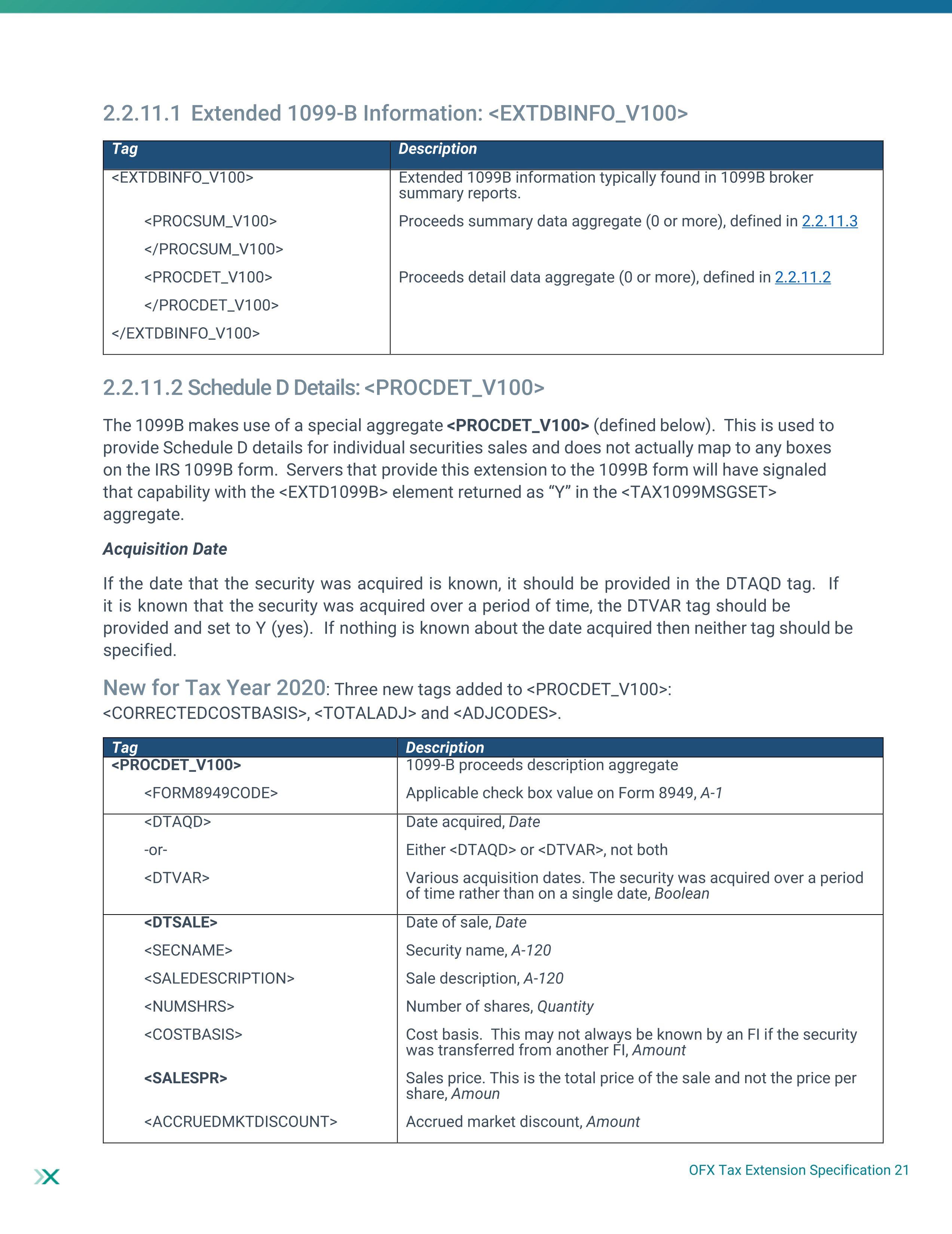

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | DTSALE | DateTimeType |

| 6 | CUSIPNUM | CusipType |

| 7 | STKBND | StocksBonds |

| 8 | BARTERING | AmountType |

| 9 | FEDTAXWH | AmountType |

| 10 | DSCR | ShortMessageType |

| 11 | PROFIT | AmountType |

| 12 | UNRELPROFITPREV | AmountType |

| 13 | UNRELPROFIT | AmountType |

| 14 | AGGPROFIT | AmountType |

| 15 | EXTDBINFO_V100 | ExtendedBInfo_V100 |

| 16 | PAYERADDR | PayerAddress |

| 17 | PAYERID | GenericNameType |

| 18 | RECADDR | RecipientAddress |

| 19 | RECID | IdType |

| 20 | RECACCT | GenericNameType |

| 21 | TINNOT | BooleanType |

Usages:

- Tax1099Response TAX1099B_V100

XSD

<xsd:complexType name="Tax1099B_V100"> <xsd:annotation> <xsd:documentation>The OFX element "TAX1099B_V100" is of type "Tax1099B_V100"</xsd:documentation> </xsd:annotation> <xsd:complexContent> <xsd:extension base="ofx:AbstractTaxForm1099"> <xsd:sequence> <xsd:element name="DTSALE" type="ofx:DateTimeType" minOccurs="0"/> <xsd:element name="CUSIPNUM" type="ofx:CusipType" minOccurs="0"/> <xsd:element name="STKBND" type="ofx:StocksBonds" minOccurs="0"/> <xsd:element name="BARTERING" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="FEDTAXWH" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="DSCR" type="ofx:ShortMessageType" minOccurs="0"/> <xsd:element name="PROFIT" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="UNRELPROFITPREV" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="UNRELPROFIT" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="AGGPROFIT" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="EXTDBINFO_V100" type="ofx:ExtendedBInfo_V100" minOccurs="0"/> <xsd:element name="PAYERADDR" type="ofx:PayerAddress"/> <xsd:element name="PAYERID" type="ofx:GenericNameType"/> <xsd:element name="RECADDR" type="ofx:RecipientAddress" minOccurs="0"/> <xsd:element name="RECID" type="ofx:IdType"/> <xsd:element name="RECACCT" type="ofx:GenericNameType" minOccurs="0"/> <xsd:element name="TINNOT" type="ofx:BooleanType" minOccurs="0"/> </xsd:sequence> </xsd:extension> </xsd:complexContent> </xsd:complexType>

OFX XML

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>39210131000000</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>fiName</ORG>

<FID>fiId</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAX1099MSGSRSV1>

<TAX1099TRNRS>

<TRNUID>_GUID_</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAX1099RS>

<TAX1099B_V100>

<TAXYEAR>2020</TAXYEAR>

<BARTERING></BARTERING>

<FEDTAXWH></FEDTAXWH>

<PROFIT></PROFIT>

<UNRELPROFITPREV></UNRELPROFITPREV>

<UNRELPROFIT></UNRELPROFIT>

<AGGPROFIT></AGGPROFIT>

<EXTDBINFO_V100>

<PROCDET_V100>

<FORM8949CODE>A</FORM8949CODE>

<DTAQD>20190701</DTAQD>

<DTSALE>20201201</DTSALE>

<SECNAME>Xerox</SECNAME>

<NUMSHRS>100.00</NUMSHRS>

<COSTBASIS>1500.00</COSTBASIS>

<SALESPR>1400.00</SALESPR>

<ACCRUEDMKTDISCOUNT>nu</ACCRUEDMKTDISCOUNT>

<FEDTAXWH>nu</FEDTAXWH>

<WASHSALELOSSDISALLOWED>140.00</WASHSALELOSSDISALLOWED>

</PROCDET_V100>

</EXTDBINFO_V100>

<PAYERADDR>

<PAYERNAME1>Financial Data Exchange</PAYERNAME1>

<ADDR1>12020 Sunrise Valley Dr</ADDR1>

<CITY>Prescott</CITY>

<STATE>VA</STATE>

<POSTALCODE>20191</POSTALCODE>

<PHONE></PHONE>

</PAYERADDR>

<PAYERID>12-3456789</PAYERID>

<RECADDR>

<RECNAME1>Kris Q. Public</RECNAME1>

<ADDR1>1 Main St</ADDR1>

<CITY>Melrose</CITY>

<STATE>NY</STATE>

<POSTALCODE>12121</POSTALCODE>

</RECADDR>

<RECID>XXX-XX-1234</RECID>

<RECACCT>123-1234567</RECACCT>

</TAX1099B_V100>

</TAX1099RS>

</TAX1099TRNRS>

</TAX1099MSGSRSV1>

</OFX>

FDX JSON

{

"tax1099B" : {

"taxYear" : 2021,

"taxFormDate" : "2022-02-01",

"additionalInformation" : "FDX v5.0",

"taxFormType" : "Tax1099B",

"payerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"name1" : "Tax Form Issuer, Inc"

},

"payerTin" : "12-3456789",

"recipientTin" : "XXX-XX-1234",

"recipientNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"name1" : "Kris Q. Public"

},

"accountNumber" : "123-1234567",

"securityDetails" : [ {

"checkboxOnForm8949" : "A",

"securityName" : "AAPL-Apple",

"numberOfShares" : 100.0,

"saleDescription" : "TODO: Create example details for different transactions and adjustmentCodes",

"dateAcquired" : "2019-07-01",

"variousDatesAcquired" : true,

"dateOfSale" : "2020-12-01",

"salesPrice" : 1400.0,

"accruedMarketDiscount" : 0.0,

"adjustmentCodes" : [ {

"code" : "B",

"amount" : 10.0

} ],

"costBasis" : 1500.0,

"correctedCostBasis" : 1500.0,

"washSaleLossDisallowed" : 140.0,

"longOrShort" : "LONG",

"ordinary" : true,

"collectible" : false,

"qof" : false,

"federalTaxWithheld" : 0.0,

"noncoveredSecurity" : false,

"grossOrNet" : "NET",

"lossNotAllowed" : true,

"basisReported" : true,

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 0.0,

"state" : "NY",

"stateTaxId" : "012345678",

"stateIncome" : 0.0

} ],

"cusip" : "037833100",

"foreignAccountTaxCompliance" : true,

"expiredOption" : "PURCHASED",

"investmentSaleType" : "OTHER"

} ]

}

}

OFX Tax Specification Page 20

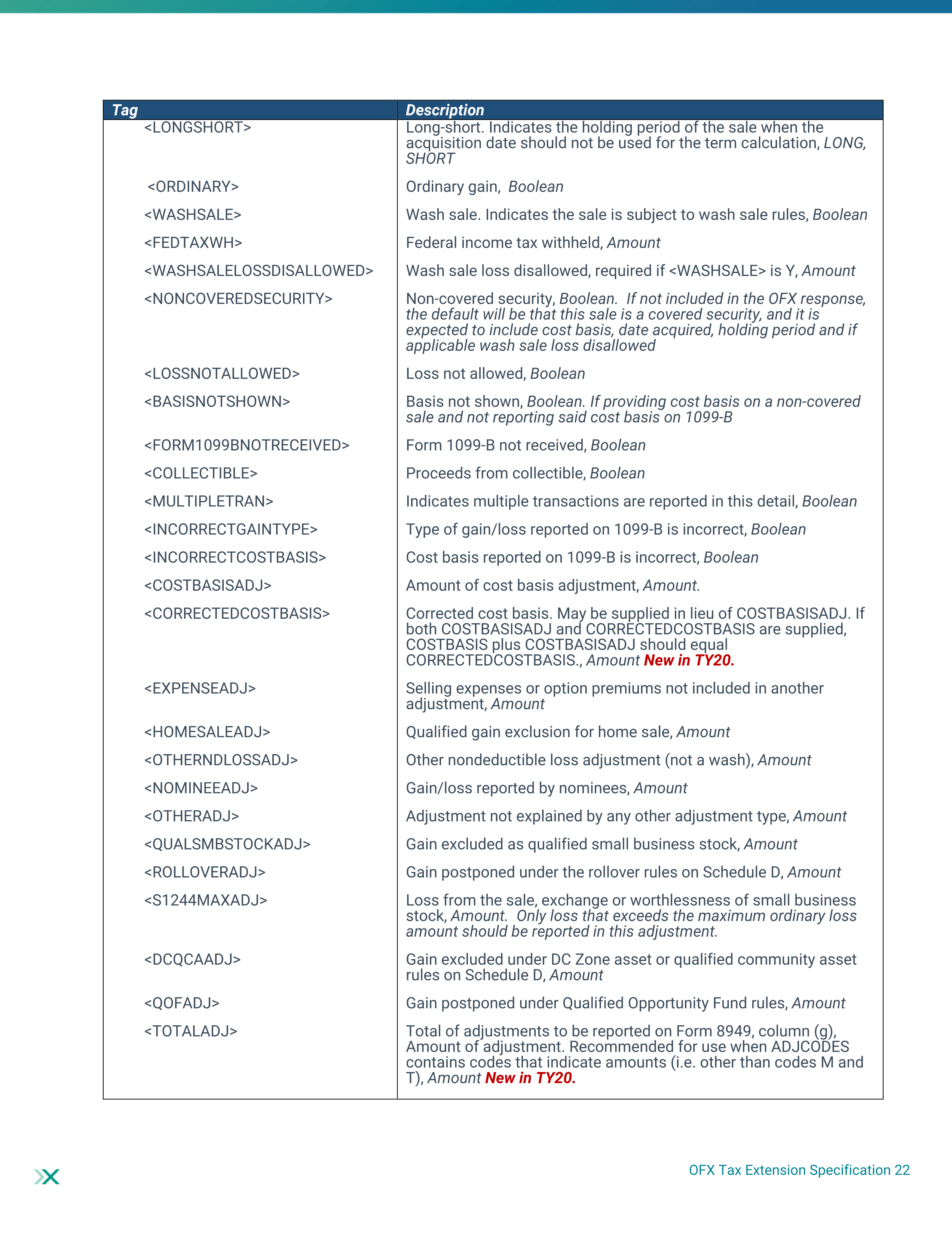

OFX Tax Specification Page 21

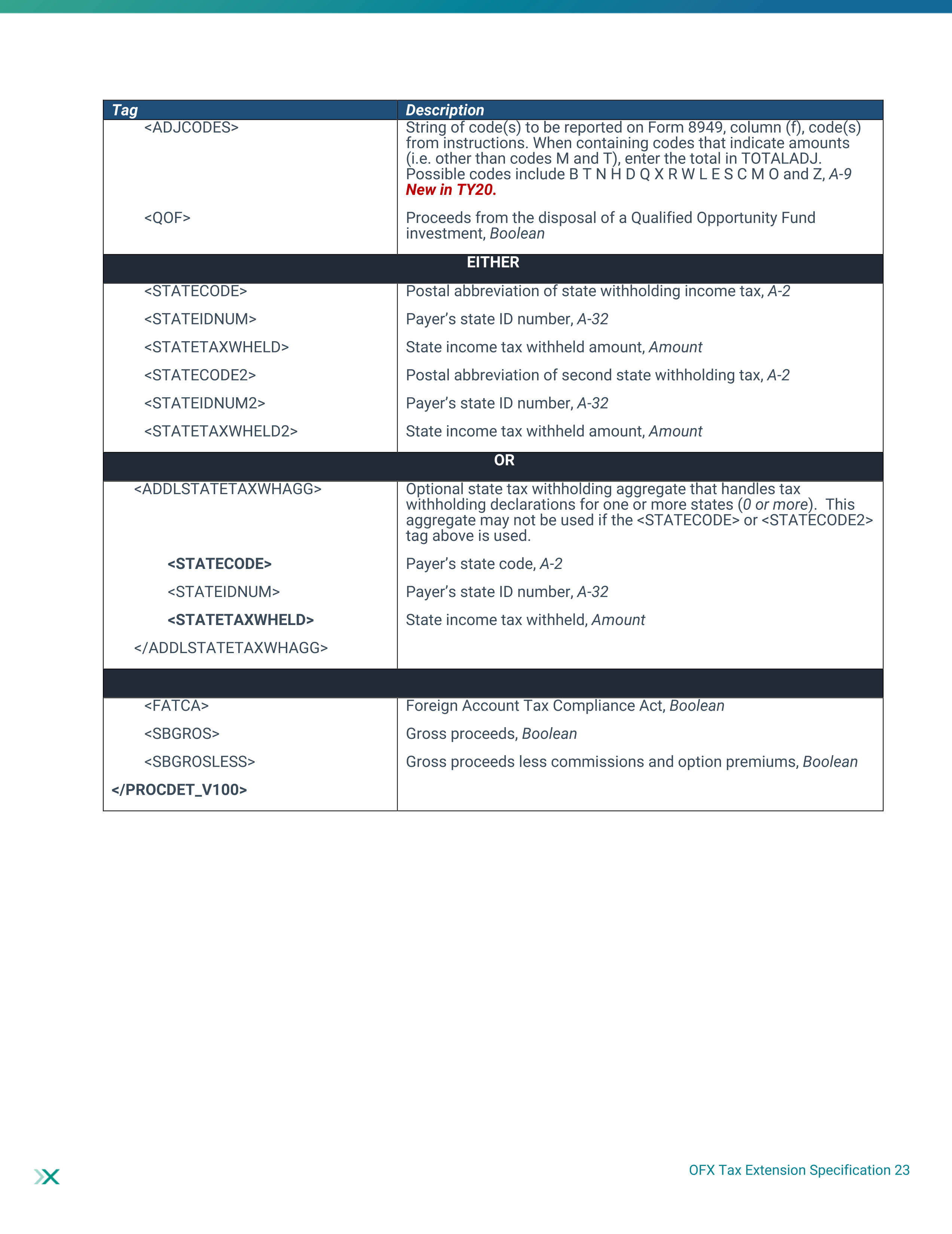

OFX Tax Specification Page 22

OFX Tax Specification Page 23

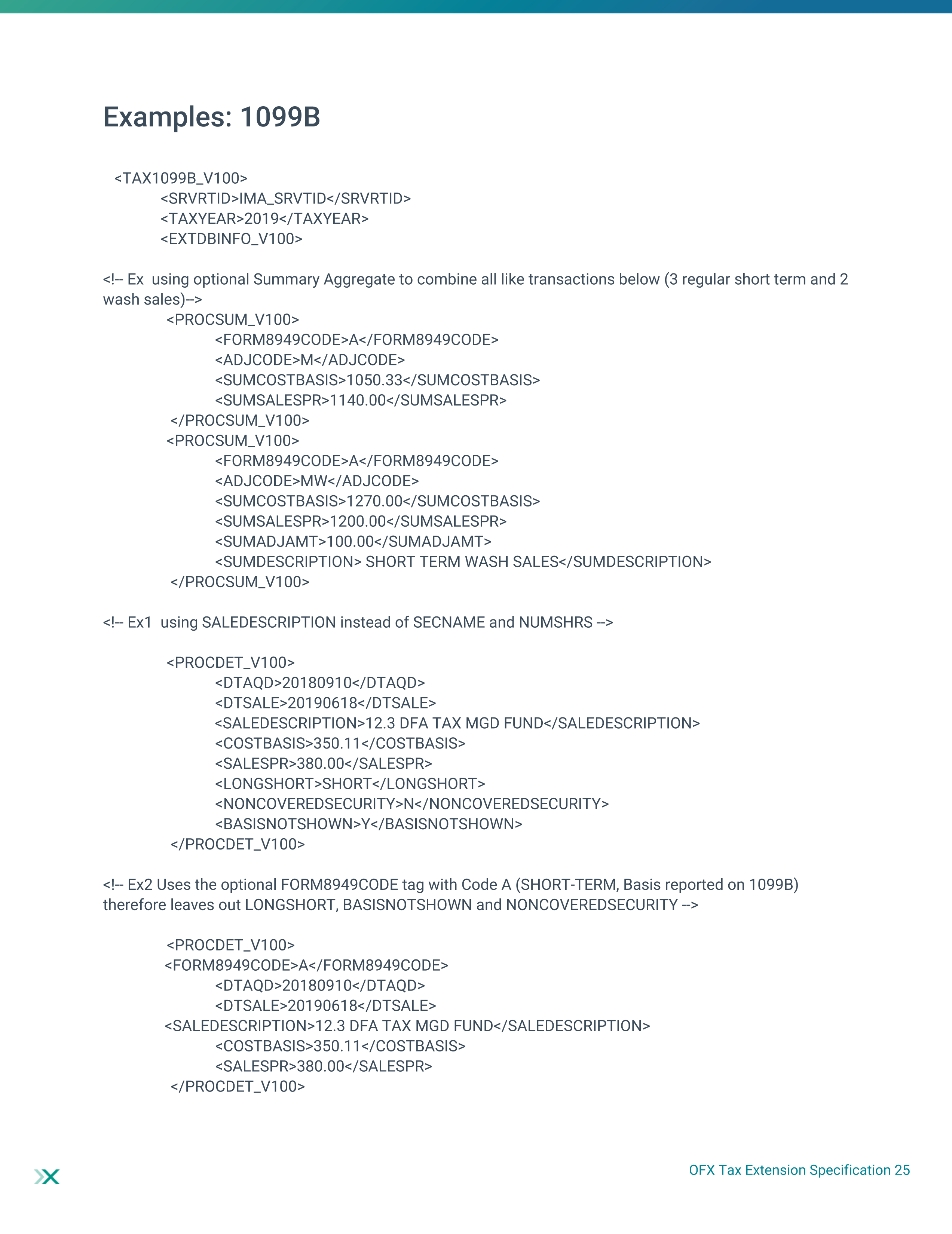

OFX Tax Specification Page 24

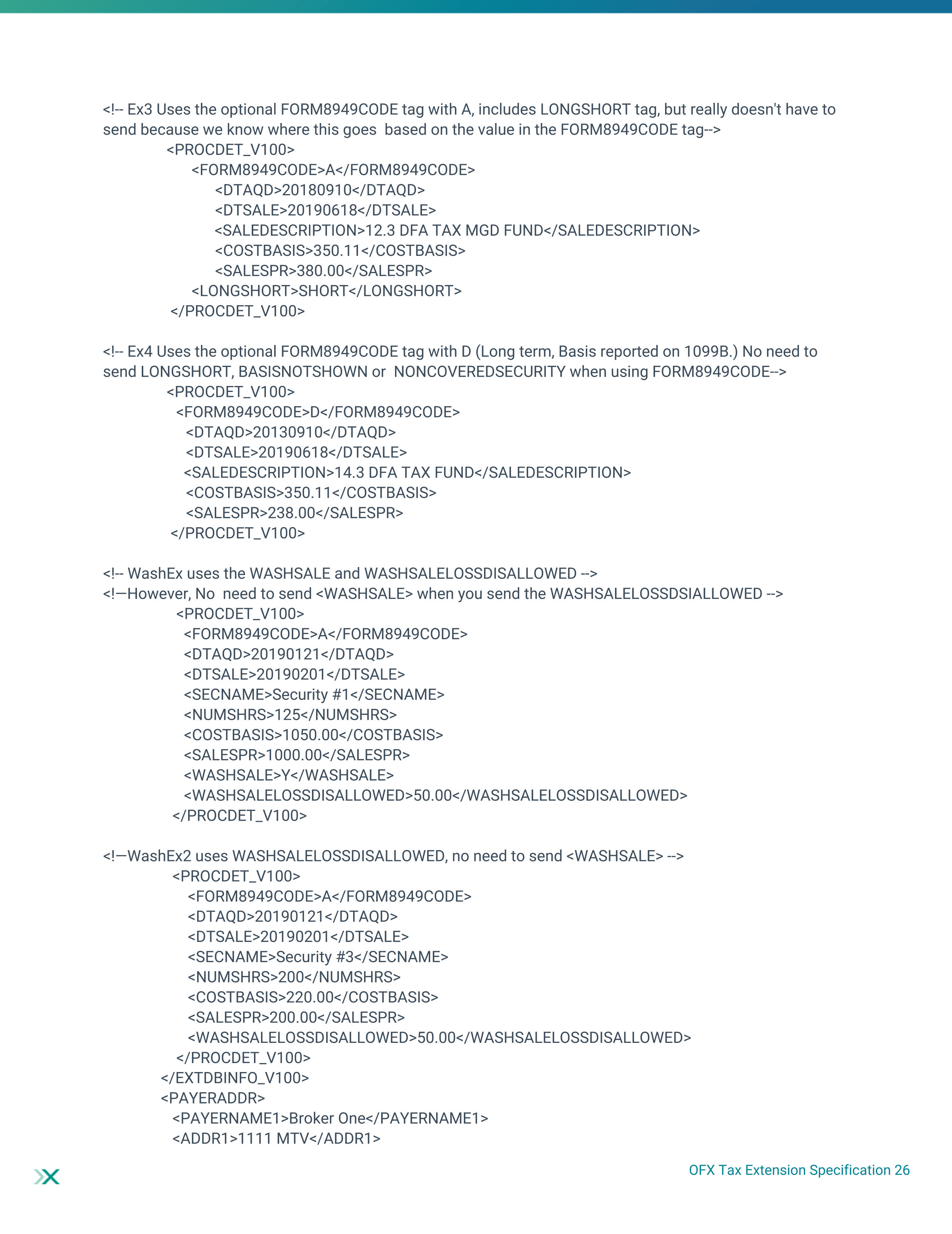

OFX Tax Specification Page 25

OFX Tax Specification Page 26

OFX Tax Specification Page 27