W-2G : Certain Gambling Winnings

FDX

FDX / Data Structures / TaxW2G

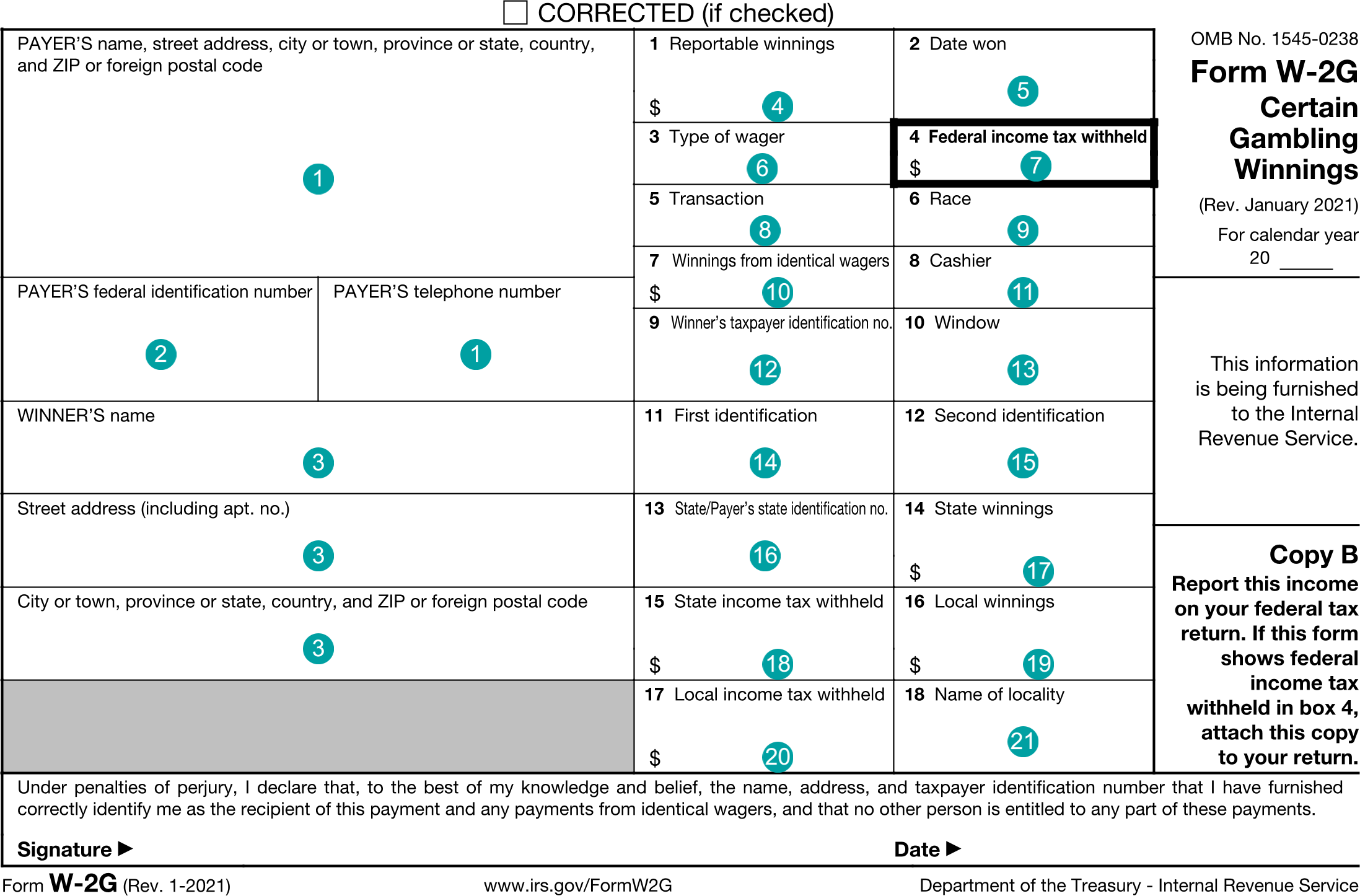

Form W-2G, Certain Gambling Winnings

Extends and inherits all fields from Tax

TaxW2G Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | payerNameAddress | NameAddressPhone | Payer's name, address and phone |

| 2 | payerTin | string | PAYER'S federal identification number |

| 3 | winnerNameAddress | NameAddress | Winner's name and address |

| 4 | winnings | number (double) | Box 1, Reportable winnings |

| 5 | dateWon | DateString | Box 2, Date won |

| 6 | typeOfWager | string | Box 3, Type of wager |

| 7 | federalTaxWithheld | number (double) | Box 4, Federal income tax withheld |

| 8 | transaction | string | Box 5, Transaction |

| 9 | race | string | Box 6, Race |

| 10 | identicalWinnings | number (double) | Box 7, Winnings from identical wagers |

| 11 | cashier | string | Box 8, Cashier |

| 12 | winnerTin | string | Box 9, Winner's taxpayer identification no. |

| 13 | window | string | Box 10, Window |

| 14 | firstId | string | Box 11, First I.D. |

| 15 | secondId | string | Box 12, Second I.D. |

| 16 | payerState | string | Box 13, State |

| 17 | stateWinnings | number (double) | Box 14, State winnings |

| 18 | stateTaxWithheld | number (double) | Box 15, State income tax withheld |

| 19 | localWinnings | number (double) | Box 16, Local winnings |

| 20 | localTaxWithheld | number (double) | Box 17, Local income tax withheld |

| 21 | localityName | string | Box 18, Name of locality |

| 22 | payerStateId | string | Box 13, Payer's state identification no. |

TaxW2G Usage:

- TaxData taxW2G

OFX

OFX / Types / TaxW2G_V100

| # | Tag | Type |

|---|---|---|

| 1 | PAYERADDR | PayerW2GAddressType |

| 2 | WINNERADDR | WinnerAddressType |

| 3 | CORRECTED | BooleanType |

| 4 | PAYERID | GenericNameType |

| 5 | WINNINGS | AmountType |

| 6 | DATEWON | DateTimeType |

| 7 | TYPEWAGER | GenericNameType |

| 8 | FEDTAXWH | AmountType |

| 9 | TRANSACTION | GenericNameType |

| 10 | RACE | GenericNameType |

| 11 | INDENTICAL | AmountType |

| 12 | CASHIER | GenericNameType |

| 13 | WINNERID | IdType |

| 14 | WINDOW | GenericNameType |

| 15 | FIRSTID | GenericNameType |

| 16 | SECONDID | GenericNameType |

| 17 | STWINNINGS | AmountType |

| 18 | STATETAXWH | AmountType |

| 19 | LOCALWINNINGS | AmountType |

| 20 | LOCALTAXWH | AmountType |

| 21 | LOCALITY | GenericNameType |

| 22 | PAYERSTATEID | GenericNameType |

| 23 | PAYSTATE | GenericNameType |

Usages:

- TaxW2GResponse TAXW2G_V100

FIRE

Under Development

TXF

| Reference Number | Irs Form or Schedule | Description | Record Format | Sign |

|---|---|---|---|---|

| 548 | W-2G | Spouse | 0 | N/A |

| 547 | W-2G | W-2G | 1 | + |

| 549 | W-2G | Gross winnings | 1 | + |

| 550 | W-2G | Federal tax withheld | 1 | - |

| 551 | W-2G | State tax withheld | 1 | - |

| 552 | W-2G | Payer | 2 | N/A |