TaxW2G_V100

OFX / Types / TaxW2G_V100

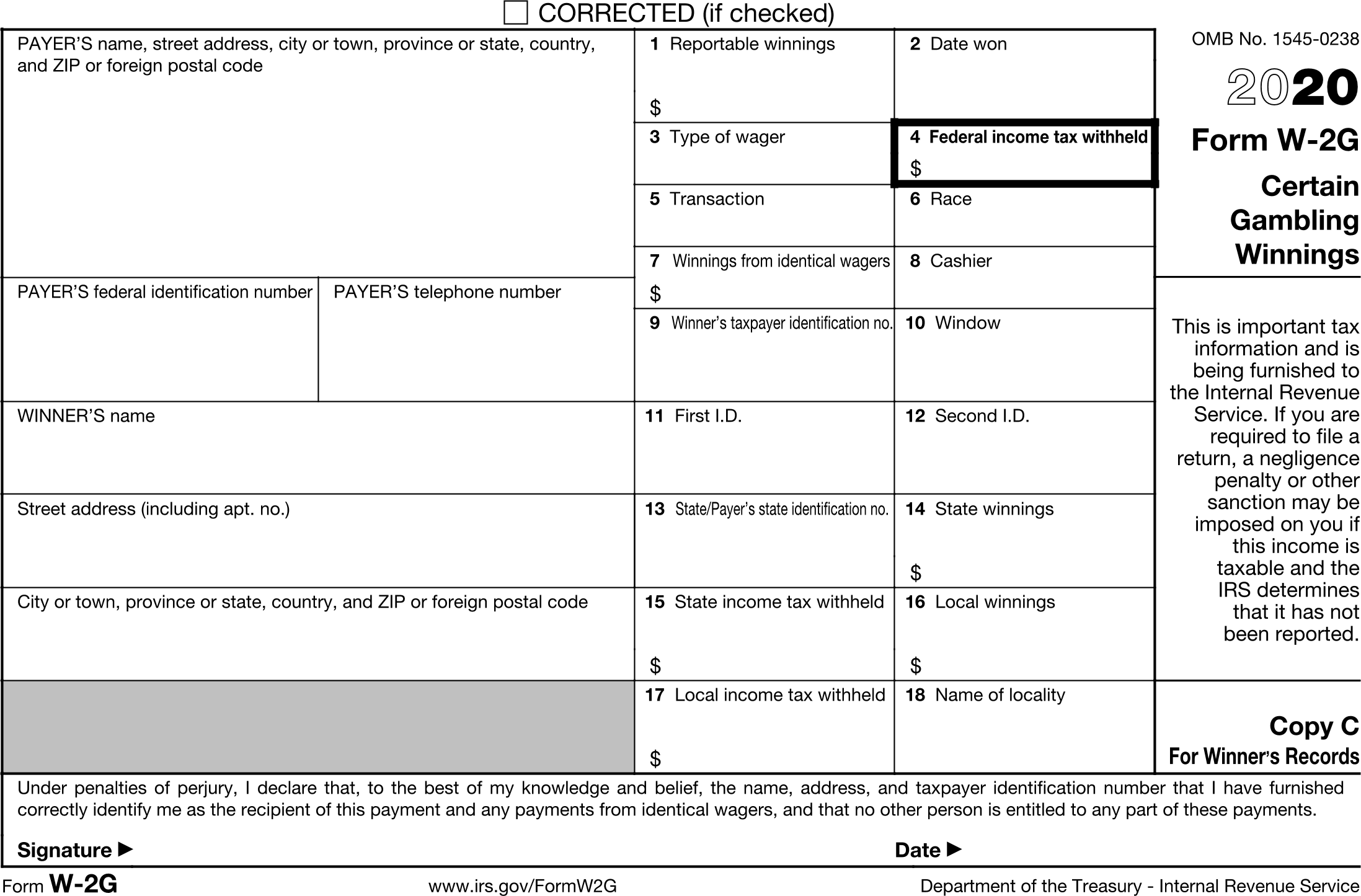

| # | Tag | Type |

|---|---|---|

| 1 | PAYERADDR | PayerW2GAddressType |

| 2 | WINNERADDR | WinnerAddressType |

| 3 | CORRECTED | BooleanType |

| 4 | PAYERID | GenericNameType |

| 5 | WINNINGS | AmountType |

| 6 | DATEWON | DateTimeType |

| 7 | TYPEWAGER | GenericNameType |

| 8 | FEDTAXWH | AmountType |

| 9 | TRANSACTION | GenericNameType |

| 10 | RACE | GenericNameType |

| 11 | INDENTICAL | AmountType |

| 12 | CASHIER | GenericNameType |

| 13 | WINNERID | IdType |

| 14 | WINDOW | GenericNameType |

| 15 | FIRSTID | GenericNameType |

| 16 | SECONDID | GenericNameType |

| 17 | STWINNINGS | AmountType |

| 18 | STATETAXWH | AmountType |

| 19 | LOCALWINNINGS | AmountType |

| 20 | LOCALTAXWH | AmountType |

| 21 | LOCALITY | GenericNameType |

| 22 | PAYERSTATEID | GenericNameType |

| 23 | PAYSTATE | GenericNameType |

Usages:

- TaxW2GResponse TAXW2G_V100

XSD

<xsd:complexType name="TaxW2G_V100">

<xsd:annotation>

<xsd:documentation>Form W-2G - Certain Gambling Winnings</xsd:documentation>

</xsd:annotation>

<xsd:sequence>

<xsd:element name="PAYERADDR" type="ofx:PayerW2GAddressType" minOccurs="0"/>

<xsd:element name="WINNERADDR" type="ofx:WinnerAddressType" minOccurs="0"/>

<xsd:element name="CORRECTED" type="ofx:BooleanType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>CORRECTED (if checked)</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="PAYERID" type="ofx:GenericNameType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>PAYER’S federal identification number</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="WINNINGS" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 1. Reportable winnings</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="DATEWON" type="ofx:DateTimeType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 2. Date won</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="TYPEWAGER" type="ofx:GenericNameType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 3. Type of wager</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="FEDTAXWH" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 4. Federal income tax withheld</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="TRANSACTION" type="ofx:GenericNameType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 5. Transaction</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="RACE" type="ofx:GenericNameType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 6. Race</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="INDENTICAL" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 7. Winnings from identical wagers</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="CASHIER" type="ofx:GenericNameType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 8. Cashier</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="WINNERID" type="ofx:IdType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 9. Winner’s taxpayer identification no.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="WINDOW" type="ofx:GenericNameType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 10. Window</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="FIRSTID" type="ofx:GenericNameType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 11. First I.D.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="SECONDID" type="ofx:GenericNameType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 12. Second I.D.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="STWINNINGS" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 14. State winnings</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="STATETAXWH" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 15. State income tax withheld</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="LOCALWINNINGS" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 16. Local winnings</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="LOCALTAXWH" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 17. Local income tax withheld</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="LOCALITY" type="ofx:GenericNameType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 18. Name of locality</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="PAYERSTATEID" type="ofx:GenericNameType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>PAYER’s state identification no.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="PAYSTATE" type="ofx:GenericNameType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>State</xsd:documentation>

</xsd:annotation>

</xsd:element>

</xsd:sequence>

</xsd:complexType>

OFX XML

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>39210131000000</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>fiName</ORG>

<FID>fiId</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAXW2GMSGSRSV1>

<TAXW2GTRNRS>

<TRNUID>_GUID_</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAXW2GRS>

<TAXW2G_V100>

<PAYERADDR>

<ADDR1>12020 Sunrise Valley Dr</ADDR1>

<CITY>Prescott</CITY>

<STATE>VA</STATE>

<POSTALCODE>20191</POSTALCODE>

<PHONE>702-555-1212 x. 711</PHONE>

<PAYERNAME1>Financial Data Exchange</PAYERNAME1>

</PAYERADDR>

<WINNERADDR>

<ADDR1>1 Main St</ADDR1>

<CITY>Melrose</CITY>

<STATE>NY</STATE>

<POSTALCODE>12121</POSTALCODE>

<WINNERNAME1>Kris Q. Public</WINNERNAME1>

</WINNERADDR>

<PAYERID>12-3456789</PAYERID>

<WINNINGS>24075.65</WINNINGS>

<DATEWON>20200401</DATEWON>

<TYPEWAGER>HHR Jackpot</TYPEWAGER>

<FEDTAXWH>6018.91</FEDTAXWH>

<TRANSACTION>VCH#334249</TRANSACTION>

<RACE>$1 Tiki Bar</RACE>

<INDENTICAL></INDENTICAL>

<CASHIER>NC 3370</CASHIER>

<WINNERID>123-45-6789</WINNERID>

<WINDOW>MI0905</WINDOW>

<FIRSTID>WY DL 123456-789</FIRSTID>

<SECONDID>123-45-6789</SECONDID>

<STWINNINGS></STWINNINGS>

<STATETAXWH></STATETAXWH>

<LOCALWINNINGS></LOCALWINNINGS>

<LOCALTAXWH></LOCALTAXWH>

</TAXW2G_V100>

</TAXW2GRS>

</TAXW2GTRNRS>

</TAXW2GMSGSRSV1>

</OFX>

FDX JSON

{

"taxW2G" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "TaxW2G",

"payerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "7025551212",

"extension" : "711"

}

},

"payerTin" : "12-3456789",

"winnerNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"name1" : "Kris Q. Public"

},

"winnings" : 24075.65,

"dateWon" : "2020-04-01",

"typeOfWager" : "HHR Jackpot",

"federalTaxWithheld" : 6018.91,

"transaction" : "VCH#334249",

"race" : "$1 Tiki Bar",

"cashier" : "NC 3370",

"winnerTin" : "123-45-6789",

"window" : "MI0905",

"firstId" : "WY DL 123456-789",

"secondId" : "123-45-6789"

}

}