5227 K-1 : Split-Interest Trust Beneficiary's schedule K-1

FDX

FDX / Data Structures / Tax5227K1

Form 5227-K1, Split-Interest Trust Beneficiary's schedule K-1, uses Tax1041K1 entity

Extends and inherits all fields from Tax1041K1

FDX / Data Structures / Tax1041K1

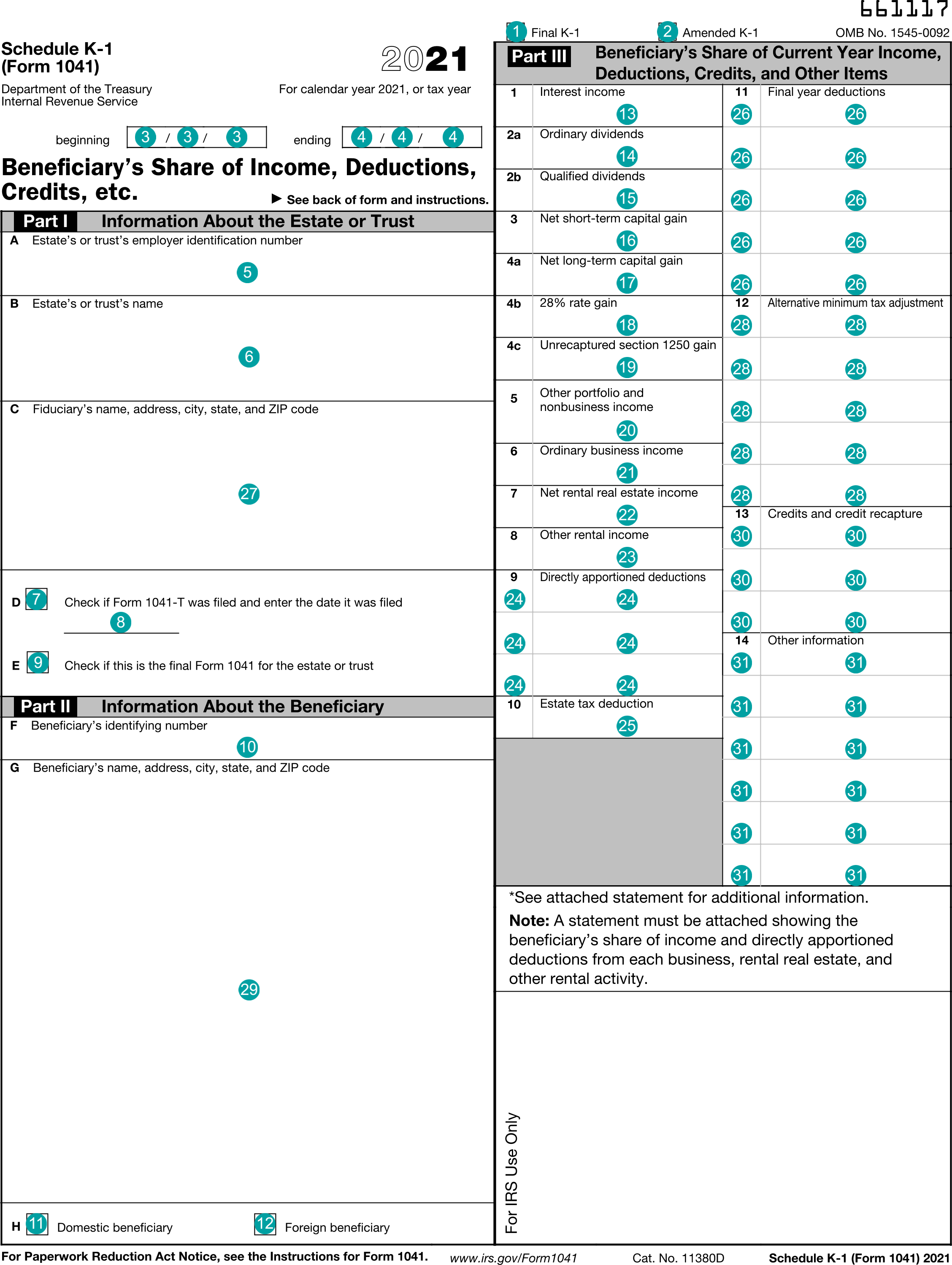

Form 1041 K-1, Beneficiary's Share of Income, Deductions, Credits, etc.

Extends and inherits all fields from Tax

Tax1041K1 Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | finalK1 | boolean | Final K-1 |

| 2 | amendedK1 | boolean | Amended K-1 |

| 3 | fiscalYearBegin | DateString | Fiscal year begin date |

| 4 | fiscalYearEnd | DateString | Fiscal year end date |

| 5 | trustTin | string | Box A, Estate's or trust's employer identification number |

| 6 | trustName | string | Box B, Estate's or trust's name |

| 7 | form1041T | boolean | Box D, Check if Form 1041-T was filed |

| 8 | date1041T | DateString | Box D, and enter the date it was filed |

| 9 | final1041 | boolean | Box E, Check if this is the final Form 1041 for the estate or trust |

| 10 | beneficiaryTin | string | Box F, Beneficiary's identifying number |

| 11 | domestic | boolean | Box H, Domestic beneficiary |

| 12 | foreign | boolean | Box H, Foreign beneficiary |

| 13 | interestIncome | number (double) | Box 1, Interest income |

| 14 | ordinaryDividends | number (double) | Box 2a, Ordinary dividends |

| 15 | qualifiedDividends | number (double) | Box 2b, Qualified dividends |

| 16 | netShortTermGain | number (double) | Box 3, Net short-term capital gain |

| 17 | netLongTermGain | number (double) | Box 4a, Net long-term capital gain |

| 18 | gain28Rate | number (double) | Box 4b, 28% rate gain |

| 19 | unrecaptured1250Gain | number (double) | Box 4c, Unrecaptured section 1250 gain |

| 20 | otherPortfolioIncome | number (double) | Box 5, Other portfolio and nonbusiness income |

| 21 | ordinaryBusinessIncome | number (double) | Box 6, Ordinary business income |

| 22 | netRentalRealEstateIncome | number (double) | Box 7, Net rental real estate income |

| 23 | otherRentalIncome | number (double) | Box 8, Other rental income |

| 24 | directlyApportionedDeductions | Array of CodeAmount | Box 9, Directly apportioned deductions |

| 25 | estateTaxDeduction | number (double) | Box 10, Estate tax deduction |

| 26 | finalYearDeductions | Array of CodeAmount | Box 11, Final year deductions |

| 27 | fiduciaryNameAddress | NameAddress | Box C, Fiduciary's name and address |

| 28 | amtAdjustments | Array of CodeAmount | Box 12, Alternative minimum tax adjustment |

| 29 | beneficiaryNameAddress | NameAddress | Box G, Beneficiary's name and address |

| 30 | credits | Array of CodeAmount | Box 13, Credits and credit recapture |

| 31 | otherInfo | Array of CodeAmount | Box 14, Other information |

Tax1041K1 Usage:

- TaxData tax1041K1

Tax5227K1 Usage:

- TaxData tax5227K1

OFX

OFX / Types / Tax5227K1_V100

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | FINALK1 | BooleanType |

| 6 | AMENDEDK1 | BooleanType |

| 7 | ESTATETRUSTNAME | GenericNameType |

| 8 | ESTATETRUSTEIN | GenericNameType |

| 9 | FIDUCIARYINFO | anonymous complex type |

| 10 | WASFILEDFORM1041T | BooleanType |

| 11 | DATEFILEDFORM1041T | DateTimeType |

| 12 | ISFINAL1041T | BooleanType |

| 13 | BENEFICIARYID | GenericNameType |

| 14 | BENEFICIARYINFO | anonymous complex type |

| 15 | DOMESTICBENEFICIARY | BooleanType |

| 16 | FOREIGNBENEFICIARY | BooleanType |

| 17 | INTERESTINCOME | AmountType |

| 18 | ORDINARYDIVIDEND | AmountType |

| 19 | QUALIFIEDDIVIDEND | AmountType |

| 20 | NETSTCAPITALGAIN | AmountType |

| 21 | NETLTCAPITALGAIN | AmountType |

| 22 | RATEGAIN28 | AmountType |

| 23 | UNRECAP1250GAIN | AmountType |

| 24 | OTHERPORTFOLIOINCOME | AmountType |

| 25 | ORDINARYBUSINESSINC | AmountType |

| 26 | NETRENTALREINCOME | AmountType |

| 27 | OTHERRENTALINCOME | AmountType |

| 28 | APPORTIONDEDUCTIONS | CodeAmountType |

| 29 | ESTATETAXDEDUCTION | AmountType |

| 30 | FINALYRDEDUCTIONS | CodeAmountType |

| 31 | AMTITEMS | CodeAmountType |

| 32 | CREDITS | CodeAmountType |

| 33 | OTHERINFO | CodeAmountType |

| 34 | FISCALYEARBEGIN | DateTimeType |

| 35 | FISCALYEAREND | DateTimeType |

Usages:

- TaxK1Response TAX5227K1_V100

FIRE

This form is not reported in the IRS FIRE system.

TXF

The TXF standard does not support this form.