Tax5227K1_V100

OFX / Types / Tax5227K1_V100

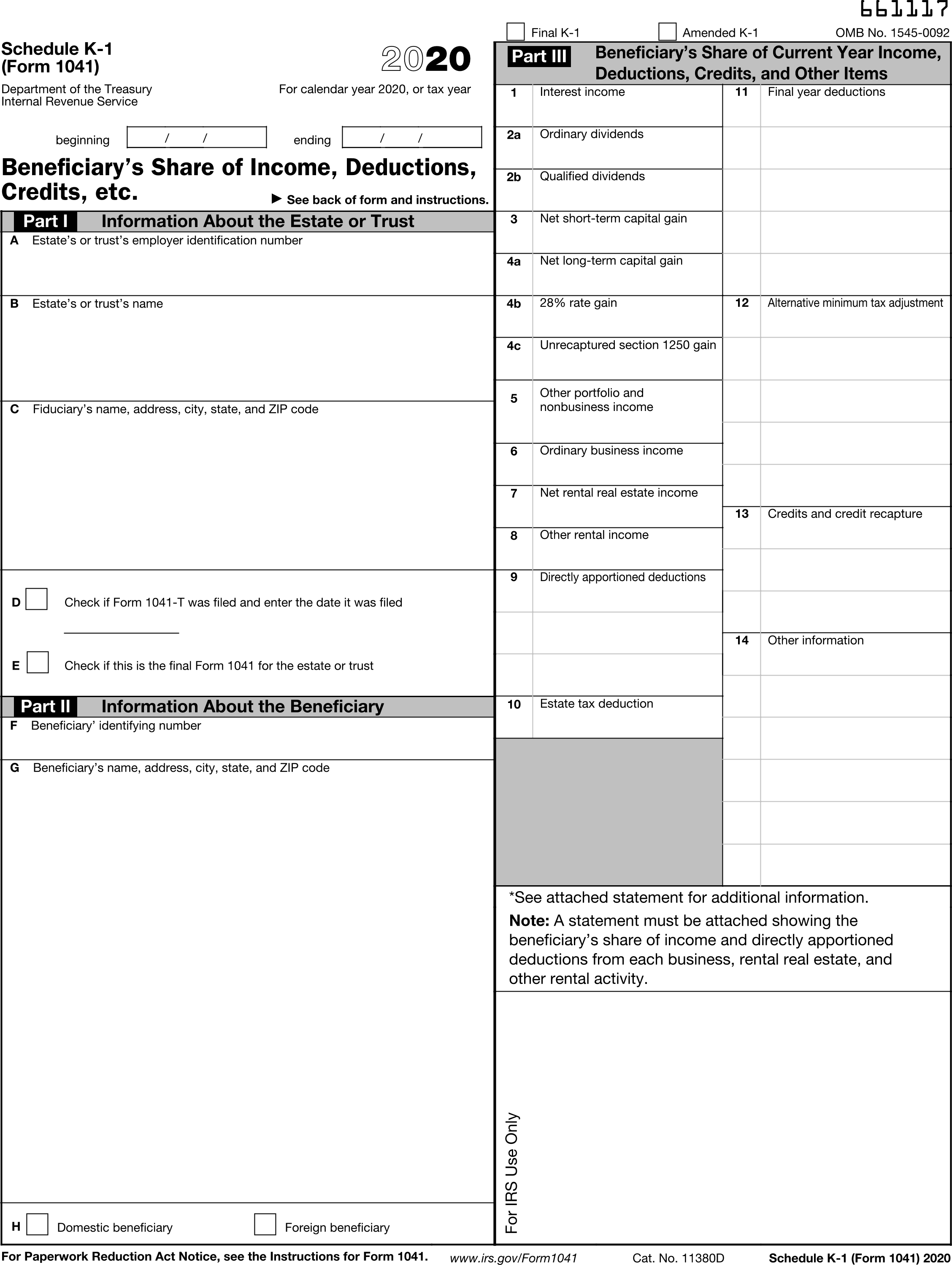

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | FINALK1 | BooleanType |

| 6 | AMENDEDK1 | BooleanType |

| 7 | ESTATETRUSTNAME | GenericNameType |

| 8 | ESTATETRUSTEIN | GenericNameType |

| 9 | FIDUCIARYINFO | anonymous complex type |

| 10 | WASFILEDFORM1041T | BooleanType |

| 11 | DATEFILEDFORM1041T | DateTimeType |

| 12 | ISFINAL1041T | BooleanType |

| 13 | BENEFICIARYID | GenericNameType |

| 14 | BENEFICIARYINFO | anonymous complex type |

| 15 | DOMESTICBENEFICIARY | BooleanType |

| 16 | FOREIGNBENEFICIARY | BooleanType |

| 17 | INTERESTINCOME | AmountType |

| 18 | ORDINARYDIVIDEND | AmountType |

| 19 | QUALIFIEDDIVIDEND | AmountType |

| 20 | NETSTCAPITALGAIN | AmountType |

| 21 | NETLTCAPITALGAIN | AmountType |

| 22 | RATEGAIN28 | AmountType |

| 23 | UNRECAP1250GAIN | AmountType |

| 24 | OTHERPORTFOLIOINCOME | AmountType |

| 25 | ORDINARYBUSINESSINC | AmountType |

| 26 | NETRENTALREINCOME | AmountType |

| 27 | OTHERRENTALINCOME | AmountType |

| 28 | APPORTIONDEDUCTIONS | CodeAmountType |

| 29 | ESTATETAXDEDUCTION | AmountType |

| 30 | FINALYRDEDUCTIONS | CodeAmountType |

| 31 | AMTITEMS | CodeAmountType |

| 32 | CREDITS | CodeAmountType |

| 33 | OTHERINFO | CodeAmountType |

| 34 | FISCALYEARBEGIN | DateTimeType |

| 35 | FISCALYEAREND | DateTimeType |

Usages:

- TaxK1Response TAX5227K1_V100

XSD

<xsd:complexType name="Tax5227K1_V100"> <xsd:annotation> <xsd:documentation>This OFX type "Tax5227K1_V100" is defined on "Tax1041K1_V100". New TY20</xsd:documentation> </xsd:annotation> <xsd:complexContent> <xsd:extension base="ofx:Tax1041K1_V100"/> </xsd:complexContent> </xsd:complexType>

OFX XML

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>39210131000000</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>fiName</ORG>

<FID>fiId</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAXK1MSGSRSV1>

<TAXK1TRNRS>

<TRNUID>_GUID_</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAXK1RS>

<TAX5227K1_V100>

<SRVRTID>e5d4ee73bd1-9295-480f-a426-1041-K1</SRVRTID>

<TAXYEAR>2020</TAXYEAR>

<FINALK1>Y</FINALK1>

<ESTATETRUSTNAME>American People's Trust</ESTATETRUSTNAME>

<ESTATETRUSTEIN>12-3456789</ESTATETRUSTEIN>

<FIDUCIARYINFO>

<NAME>American People Corp.</NAME>

<ADDR1>1718-1/2 Oak Blvd</ADDR1>

<ADDR2>Suite 230</ADDR2>

<CITY>Austin</CITY>

<STATE>TX</STATE>

<POSTALCODE>78735</POSTALCODE>

</FIDUCIARYINFO>

<WASFILEDFORM1041T>Y</WASFILEDFORM1041T>

<DATEFILEDFORM1041T>20200501</DATEFILEDFORM1041T>

<ISFINAL1041T>Y</ISFINAL1041T>

<BENEFICIARYID>xxx-xx-1234</BENEFICIARYID>

<BENEFICIARYINFO>

<NAME>Kris Q. Public</NAME>

<ADDR1>1 Main St</ADDR1>

<CITY>Melrose</CITY>

<STATE>NY</STATE>

<POSTALCODE>12121</POSTALCODE>

</BENEFICIARYINFO>

<DOMESTICBENEFICIARY>Y</DOMESTICBENEFICIARY>

<INTERESTINCOME>1013.00</INTERESTINCOME>

<ORDINARYDIVIDEND>2014.00</ORDINARYDIVIDEND>

<QUALIFIEDDIVIDEND>2015.00</QUALIFIEDDIVIDEND>

<NETSTCAPITALGAIN>3016.00</NETSTCAPITALGAIN>

<NETLTCAPITALGAIN>4017.00</NETLTCAPITALGAIN>

<RATEGAIN28>4018.00</RATEGAIN28>

<UNRECAP1250GAIN>4019.00</UNRECAP1250GAIN>

<OTHERPORTFOLIOINCOME>5020.00</OTHERPORTFOLIOINCOME>

<ORDINARYBUSINESSINC>6021.00</ORDINARYBUSINESSINC>

<NETRENTALREINCOME>7022.00</NETRENTALREINCOME>

<OTHERRENTALINCOME>8023.00</OTHERRENTALINCOME>

<APPORTIONDEDUCTIONS>

<K1CODE>A</K1CODE>

<AMOUNT>9024.00</AMOUNT>

</APPORTIONDEDUCTIONS>

<ESTATETAXDEDUCTION>10025.00</ESTATETAXDEDUCTION>

<FINALYRDEDUCTIONS>

<K1CODE>B</K1CODE>

<AMOUNT>11026.00</AMOUNT>

</FINALYRDEDUCTIONS>

<FINALYRDEDUCTIONS>

<K1CODE>C</K1CODE>

<AMOUNT>11026.00</AMOUNT>

</FINALYRDEDUCTIONS>

<AMTITEMS>

<K1CODE>D</K1CODE>

<AMOUNT>12028.00</AMOUNT>

</AMTITEMS>

<CREDITS>

<K1CODE>E</K1CODE>

<AMOUNT>13030.00</AMOUNT>

</CREDITS>

<OTHERINFO>

<K1CODE>G</K1CODE>

<AMOUNT>14031.00</AMOUNT>

</OTHERINFO>

<OTHERINFO>

<K1CODE>H</K1CODE>

<AMOUNT>14031.00</AMOUNT>

</OTHERINFO>

<FISCALYEARBEGIN>20200101</FISCALYEARBEGIN>

<FISCALYEAREND>20201231</FISCALYEAREND>

</TAX5227K1_V100>

</TAXK1RS>

</TAXK1TRNRS>

</TAXK1MSGSRSV1>

</OFX>

FDX JSON

{

"tax5227K1" : {

"taxYear" : 2022,

"taxFormId" : "e5d4ee73bd1-9295-480f-a426-1041-K1",

"taxFormDate" : "2021-02-01",

"taxFormType" : "Tax5227K1",

"finalK1" : true,

"fiscalYearBegin" : "2020-01-01",

"fiscalYearEnd" : "2020-12-31",

"trustTin" : "12-3456789",

"trustName" : "American People's Trust",

"form1041T" : true,

"date1041T" : "2020-05-01",

"final1041" : true,

"beneficiaryTin" : "xxx-xx-1234",

"domestic" : true,

"interestIncome" : 1013.0,

"ordinaryDividends" : 2014.0,

"qualifiedDividends" : 2015.0,

"netShortTermGain" : 3016.0,

"netLongTermGain" : 4017.0,

"gain28Rate" : 4018.0,

"unrecaptured1250Gain" : 4019.0,

"otherPortfolioIncome" : 5020.0,

"ordinaryBusinessIncome" : 6021.0,

"netRentalRealEstateIncome" : 7022.0,

"otherRentalIncome" : 8023.0,

"directlyApportionedDeductions" : [ {

"code" : "A",

"amount" : 9024.0

} ],

"estateTaxDeduction" : 10025.0,

"finalYearDeductions" : [ {

"code" : "B",

"amount" : 11026.0

}, {

"code" : "C",

"amount" : 11026.0

} ],

"fiduciaryNameAddress" : {

"line1" : "1718-1/2 Oak Blvd",

"line2" : "Suite 230",

"city" : "Austin",

"state" : "TX",

"postalCode" : "78735",

"name1" : "American People Corp."

},

"amtAdjustments" : [ {

"code" : "D",

"amount" : 12028.0

} ],

"beneficiaryNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"name1" : "Kris Q. Public"

},

"credits" : [ {

"code" : "E",

"amount" : 13030.0

} ],

"otherInfo" : [ {

"code" : "G",

"amount" : 14031.0

}, {

"code" : "H",

"amount" : 14031.0

} ]

}

}