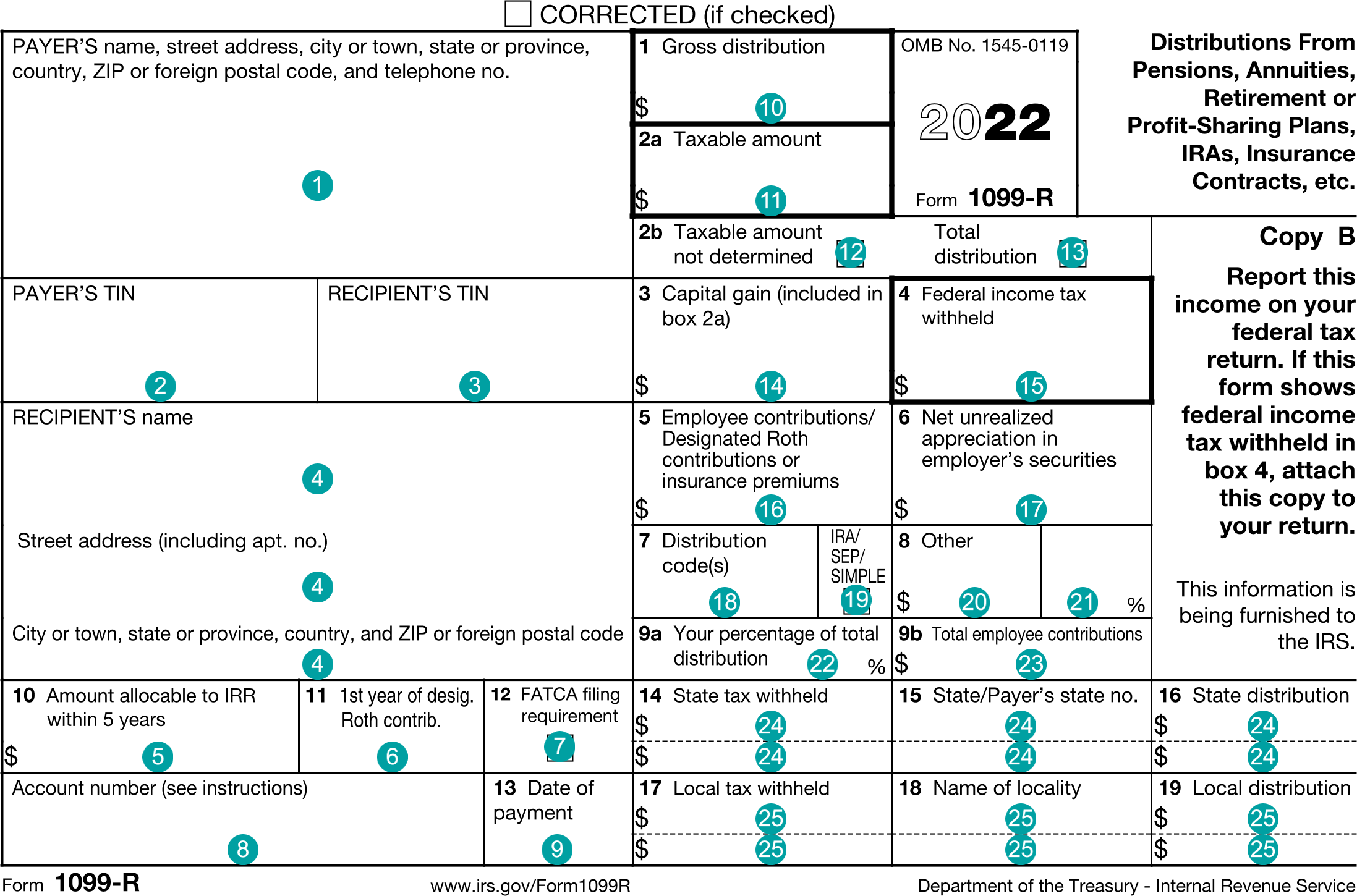

| # | Id | Type | Description |

| 1 | payerNameAddress | NameAddressPhone | Payer's name, address, and phone |

| 2 | payerTin | string | PAYER'S TIN |

| 3 | recipientTin | string | RECIPIENT'S TIN |

| 4 | recipientNameAddress | NameAddress | Recipient's name and address |

| 5 | allocableToIRR | number (double) | Box 10, Amount allocable to IRR within 5 years |

| 6 | firstYearOfRoth | integer | Box 11, First year of designated Roth |

| 7 | foreignAccountTaxCompliance | boolean | FATCA filing requirement |

| 8 | recipientAccountNumber | string | Account number |

| 9 | dateOfPayment | DateString | Date of payment |

| 10 | grossDistribution | number (double) | Box 1, Gross distribution |

| 11 | taxableAmount | number (double) | Box 2a, Taxable amount |

| 12 | taxableAmountNotDetermined | boolean | Box 2b, Taxable amount not determined |

| 13 | totalDistribution | boolean | Box 2c, Total distribution |

| 14 | capitalGain | number (double) | Box 3, Capital gain |

| 15 | federalTaxWithheld | number (double) | Box 4, Federal income tax withheld |

| 16 | employeeContributions | number (double) | Box 5, Employee contributions |

| 17 | netUnrealizedAppreciation | number (double) | Box 6, Net unrealized appreciation |

| 18 | distributionCodes | Array of string | Box 7, Distribution codes |

| 19 | iraSepSimple | boolean | Box 7b, IRA/SEP/SIMPLE |

| 20 | otherAmount | number (double) | Box 8, Other |

| 21 | otherPercent | number (double) | Box 8, Other percent |

| 22 | yourPercentOfTotal | number (double) | Box 9a, Your percent of total distribution |

| 23 | totalEmployeeContributions | number (double) | Box 9b, Total employee contributions |

| 24 | stateTaxWithholding | Array of StateTaxWithholding | Boxes 12-14, State tax withholding |

| 25 | localTaxWithholding | Array of LocalTaxWithholding | Boxes 15-17, Local tax withholding |

| Reference Number |

Irs Form or Schedule |

Description |

Record Format |

Sign |

| 474 |

1099-R |

Spouse |

0 |

N/A |

| 473 |

1099-R |

1099-R |

1 |

+ |

| 475 |

1099-R |

Pension total dist - gross |

1 |

+ |

| 476 |

1099-R |

Pension total dist - taxable |

1 |

+ |

| 477 |

1099-R |

IRA total dist - gross |

1 |

+ |

| 478 |

1099-R |

IRA total dist - taxable |

1 |

+ |

| 529 |

1099-R |

Pension federal withholding |

1 |

- |

| 530 |

1099-R |

Pension state withholding |

1 |

- |

| 531 |

1099-R |

Pension local withholding |

1 |

- |

| 532 |

1099-R |

IRA federal withholding |

1 |

- |

| 533 |

1099-R |

IRA state withholding |

1 |

- |

| 534 |

1099-R |

IRA local withholding |

1 |

- |

| 623 |

1099-R |

SIMPLE total distrib-gross |

1 |

+ |

| 624 |

1099-R |

SIMPLE total distrib-taxable |

1 |

+ |

| 625 |

1099-R |

SIMPLE federal withholding |

1 |

- |

| 626 |

1099-R |

SIMPLE state withholding |

1 |

- |

| 627 |

1099-R |

SIMPLE local withholding |

1 |

- |

| 603 |

1099-R |

Pension Payer |

2 |

N/A |

| 604 |

1099-R |

IRA Payer |

2 |

N/A |

| 628 |

1099-R |

SIMPLE Payer |

2 |

N/A |

| 655 |

1099-R |

IRA Distribution code 7A |

2 |

N/A |

| 655 |

1099-R |

Distribution code 7A |

2 |

N/A |

| 656 |

1099-R |

IRA Distribution code 7b |

2 |

N/A |

| 656 |

1099-R |

Distribution code 7b |

2 |

N/A |

| 664 |

1099-R |

IRA State ID |

2 |

N/A |

| 664 |

1099-R |

State ID |

2 |

N/A |

| 665 |

1099-R |

IRA Taxable not determined |

2 |

N/A |

| 665 |

1099-R |

Taxable not determined |

2 |

N/A |

| 666 |

1099-R |

IRA Total distribution |

2 |

N/A |

| 666 |

1099-R |

Total distribution |

2 |

N/A |

| 667 |

1099-R |

Pension Distrib code 7A |

2 |

N/A |

| 668 |

1099-R |

Pension Distrib code 7b |

2 |

N/A |

| 669 |

1099-R |

Pension State ID |

2 |

N/A |

| 670 |

1099-R |

Pension Tax. not determined |

2 |

N/A |

| 671 |

1099-R |

Pension Total distribution |

2 |

N/A |