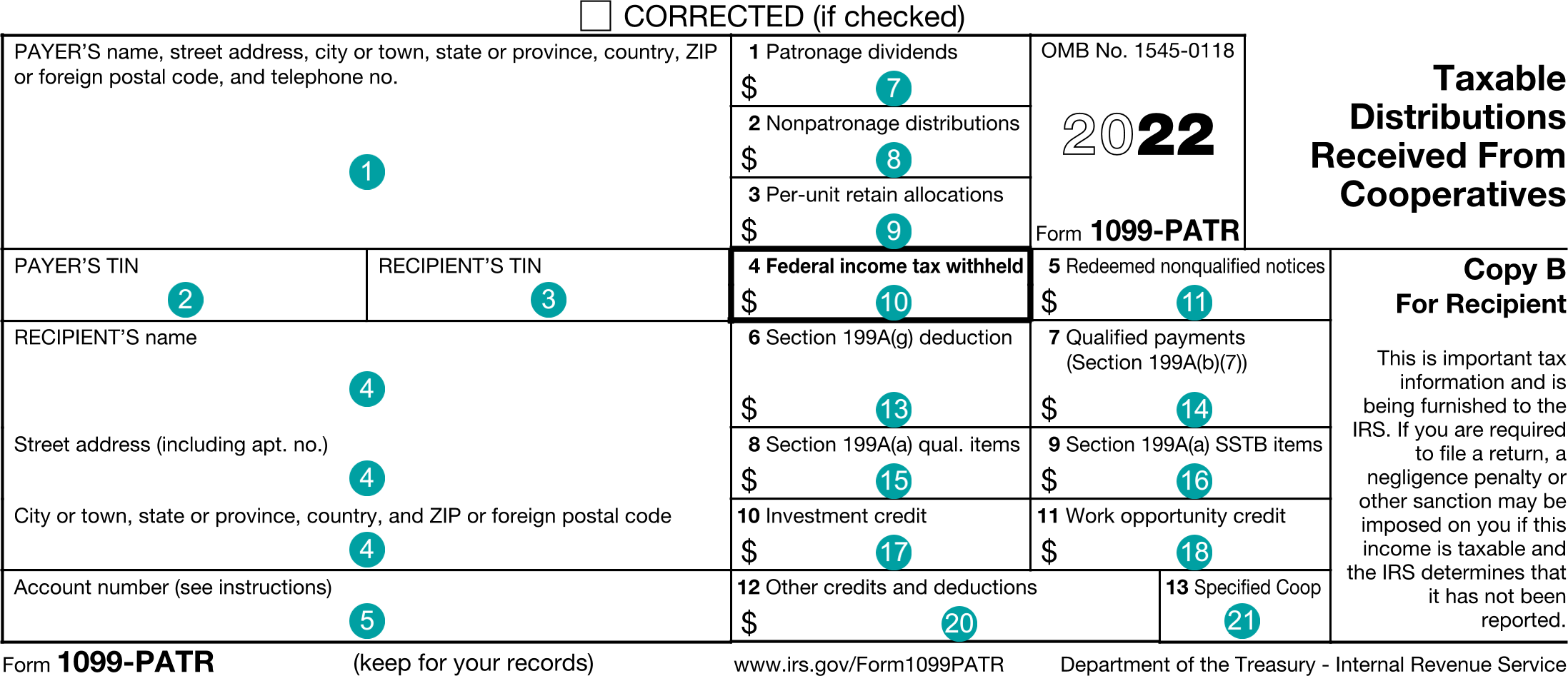

1099-PATR : Taxable Distributions Received From Cooperatives

FDX

FDX / Data Structures / Tax1099Patr

Form 1099-PATR, Taxable Distributions Received From Cooperatives

Extends and inherits all fields from Tax

Tax1099Patr Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | payerNameAddress | NameAddressPhone | Payer's name, address, and phone |

| 2 | payerTin | string | PAYER'S TIN |

| 3 | recipientTin | string | RECIPIENT'S TIN |

| 4 | recipientNameAddress | NameAddress | Recipient's name and address |

| 5 | accountNumber | string | Account number |

| 6 | patronageDividends | number (double) | Box 1, Patronage dividends |

| 7 | nonpatronageDistributions | number (double) | Box 2, Nonpatronage distributions |

| 8 | perUnitRetainAllocations | number (double) | Box 3, Per-unit retain allocations |

| 9 | federalTaxWithheld | number (double) | Box 4, Federal income tax withheld |

| 10 | redemption | number (double) | Box 5, Redemption of nonqualified notices and retain allocations |

| 11 | dpaDeduction | number (double) | 2019 Box 6, Domestic production activities deduction (IRS removed 2020) |

| 12 | section199Deduction | number (double) | Box 6, Section 199A(g) deduction |

| 13 | qualifiedPayments | number (double) | Box 7, Qualified payments |

| 14 | section199QualifiedItems | number (double) | Box 8, Section 199A(a) qualified items |

| 15 | section199SstbItems | number (double) | Box 9, Section 199A(a) SSTB (Specified Service Trade or Business) items |

| 16 | investmentCredit | number (double) | Box 10, Investment credit |

| 17 | workOpportunityCredit | number (double) | Box 11, Work opportunity credit |

| 18 | patronsAmtAdjustment | number (double) | 2019 Box 10, Patron's AMT adjustment (IRS removed 2020) |

| 19 | otherCreditsAndDeductions | number (double) | Box 12, Other credits and deductions |

| 20 | specifiedCoop | boolean | Box 13, Specified Cooperative |

| 21 | secondTinNotice | boolean | Second TIN Notice |

Tax1099Patr Usage:

- TaxData tax1099Patr

OFX

OFX / Types / Tax1099PATR_V100

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | PAYERADDR | PayerAddressType |

| 6 | RECIPADDR | RecipientAddressType |

| 7 | PAYERID | GenericNameType |

| 8 | RECID | IdType |

| 9 | ACCTNUM | GenericNameType |

| 10 | PATRDIV | AmountType |

| 11 | NONPATRDIST | AmountType |

| 12 | PERUNIT | AmountType |

| 13 | FEDWITHHOLDING | AmountType |

| 14 | REDEMPTION | AmountType |

| 15 | DPADED | AmountType |

| 16 | QUALIFIEDPAYMENTS | AmountType |

| 17 | INVESTCRED | AmountType |

| 18 | WORKOPPCRED | AmountType |

| 19 | AMTADJUST | AmountType |

| 20 | OTHER | AmountType |

| 21 | S199AGDEDUCTION | AmountType |

| 22 | S199AAQUALITEMS | AmountType |

| 23 | S199AASSTBITEMS | AmountType |

| 24 | SPECIFIEDCOOP | BooleanType |

Usages:

- Tax1099Response TAX1099PATR_V100

FIRE

Under Development

TXF

The TXF standard does not support this form.