Tax1099PATR_V100

OFX / Types / Tax1099PATR_V100

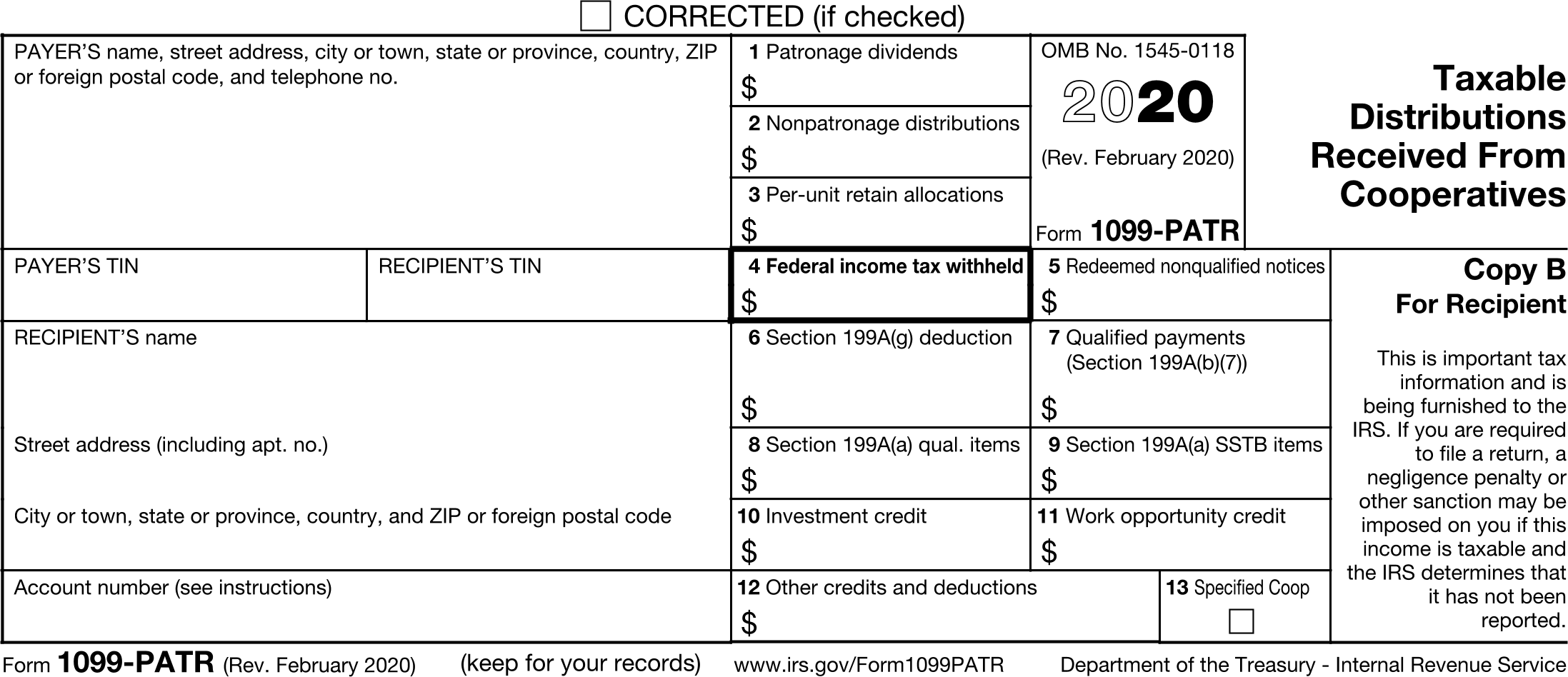

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | PAYERADDR | PayerAddressType |

| 6 | RECIPADDR | RecipientAddressType |

| 7 | PAYERID | GenericNameType |

| 8 | RECID | IdType |

| 9 | ACCTNUM | GenericNameType |

| 10 | PATRDIV | AmountType |

| 11 | NONPATRDIST | AmountType |

| 12 | PERUNIT | AmountType |

| 13 | FEDWITHHOLDING | AmountType |

| 14 | REDEMPTION | AmountType |

| 15 | DPADED | AmountType |

| 16 | QUALIFIEDPAYMENTS | AmountType |

| 17 | INVESTCRED | AmountType |

| 18 | WORKOPPCRED | AmountType |

| 19 | AMTADJUST | AmountType |

| 20 | OTHER | AmountType |

| 21 | S199AGDEDUCTION | AmountType |

| 22 | S199AAQUALITEMS | AmountType |

| 23 | S199AASSTBITEMS | AmountType |

| 24 | SPECIFIEDCOOP | BooleanType |

Usages:

- Tax1099Response TAX1099PATR_V100

XSD

<xsd:complexType name="Tax1099PATR_V100"> <xsd:annotation> <xsd:documentation>Form 1099-PATR - Taxable Distributions Received From Cooperatives</xsd:documentation> </xsd:annotation> <xsd:complexContent> <xsd:extension base="ofx:AbstractTaxForm1099Type"> <xsd:sequence> <xsd:element name="PAYERADDR" type="ofx:PayerAddressType" minOccurs="0"/> <xsd:element name="RECIPADDR" type="ofx:RecipientAddressType" minOccurs="0"/> <xsd:element name="PAYERID" type="ofx:GenericNameType" minOccurs="0"> <xsd:annotation> <xsd:documentation>PAYER’S federal identification number</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="RECID" type="ofx:IdType" minOccurs="0"> <xsd:annotation> <xsd:documentation>RECIPIENT’S identification number</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="ACCTNUM" type="ofx:GenericNameType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Account number</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PATRDIV" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 1. Patronage dividends</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="NONPATRDIST" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 2. Nonpatronage distributions</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PERUNIT" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 3. Per-unit retain allocations</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="FEDWITHHOLDING" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 4. Federal income tax withheld</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="REDEMPTION" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 5. Redeemed nonqualified notices</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="DPADED" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Domestic production activities deduction. IRS removed TY20.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="QUALIFIEDPAYMENTS" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>New TY19. Box 7. Qualified payments (Section 199A(b)(7))</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="INVESTCRED" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 10. Investment credit</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="WORKOPPCRED" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 11. Work opportunity credit</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="AMTADJUST" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Patron’s AMT adjustment. IRS removed TY20.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="OTHER" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 12. Other credits and deductions</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="S199AGDEDUCTION" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 6, Section 199A(g) deduction. New TY20</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="S199AAQUALITEMS" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 8, Section 199A(a) qualified items. New TY20</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="S199AASSTBITEMS" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 9, Section 199A(a) SSTB (Specified Service Trade or Business) items. New TY20</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="SPECIFIEDCOOP" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 13. Specified Cooperative. New TY20</xsd:documentation> </xsd:annotation> </xsd:element> </xsd:sequence> </xsd:extension> </xsd:complexContent> </xsd:complexType>

OFX XML

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>39210131000000</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>fiName</ORG>

<FID>fiId</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAX1099MSGSRSV1>

<TAX1099TRNRS>

<TRNUID>_GUID_</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAX1099RS>

<TAX1099PATR_V100>

<TAXYEAR>2020</TAXYEAR>

<PAYERADDR>

<ADDR1>12020 Sunrise Valley Dr</ADDR1>

<ADDR2>Suite 230</ADDR2>

<CITY>Prescott</CITY>

<STATE>VA</STATE>

<POSTALCODE>20191</POSTALCODE>

<PHONE>888-555-1212</PHONE>

<PAYERNAME1>Financial Data Exchange</PAYERNAME1>

</PAYERADDR>

<RECIPADDR>

<ADDR1>1 Main St</ADDR1>

<CITY>Melrose</CITY>

<STATE>NY</STATE>

<POSTALCODE>12121</POSTALCODE>

<RECIPNAME1>Kris Q Public</RECIPNAME1>

</RECIPADDR>

<PAYERID>12-3456789</PAYERID>

<RECID>xxx-xx-1234</RECID>

<ACCTNUM>111-5555555</ACCTNUM>

<PATRDIV>10000.00</PATRDIV>

<NONPATRDIST>2000.00</NONPATRDIST>

<PERUNIT>3000.00</PERUNIT>

<FEDWITHHOLDING>400.00</FEDWITHHOLDING>

<REDEMPTION>500.00</REDEMPTION>

<DPADED>600.00</DPADED>

<QUALIFIEDPAYMENTS>700.00</QUALIFIEDPAYMENTS>

<INVESTCRED>800.00</INVESTCRED>

<WORKOPPCRED>900.00</WORKOPPCRED>

<AMTADJUST>1000.00</AMTADJUST>

<OTHER>110.00</OTHER>

</TAX1099PATR_V100>

</TAX1099RS>

</TAX1099TRNRS>

</TAX1099MSGSRSV1>

</OFX>

FDX JSON

{

"tax1099Patr" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1099Patr",

"payerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"payerTin" : "12-3456789",

"recipientTin" : "xxx-xx-1234",

"recipientNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q Public"

},

"accountNumber" : "111-5555555",

"patronageDividends" : 10000.0,

"nonpatronageDistributions" : 2000.0,

"perUnitRetainAllocations" : 3000.0,

"federalTaxWithheld" : 400.0,

"redemption" : 500.0,

"dpaDeduction" : 600.0,

"qualifiedPayments" : 700.0,

"investmentCredit" : 800.0,

"workOpportunityCredit" : 900.0,

"patronsAmtAdjustment" : 1000.0,

"otherCreditsAndDeductions" : 110.0

}

}