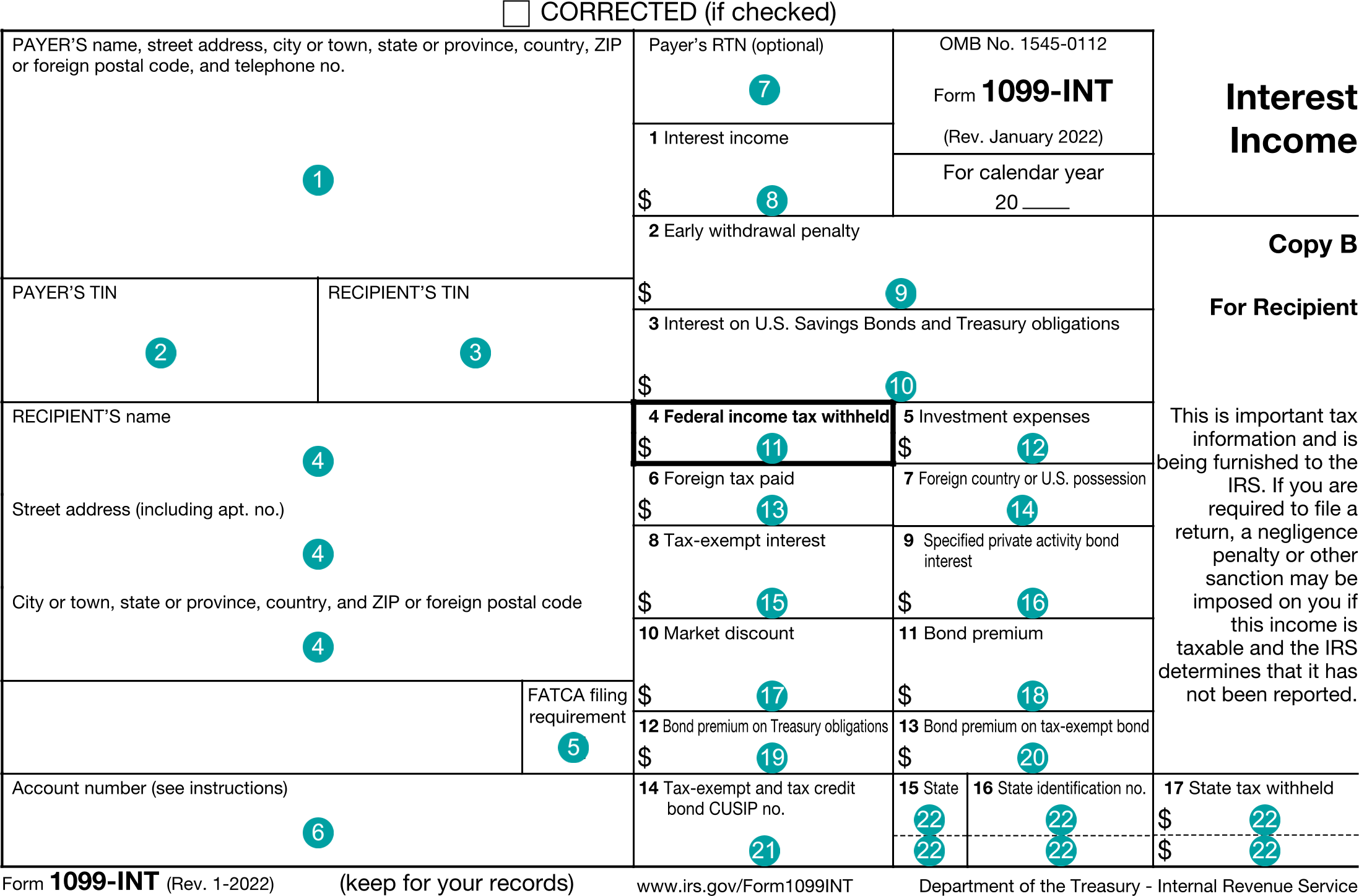

1099-INT : Interest Income

FDX

FDX / Data Structures / Tax1099Int

Form 1099-INT, Interest Income

Extends and inherits all fields from Tax

Tax1099Int Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | payerNameAddress | NameAddressPhone | Payer's name, address, and phone |

| 2 | payerTin | string | Payer's TIN |

| 3 | recipientTin | string | Recipient's TIN |

| 4 | recipientNameAddress | NameAddress | Recipient's name and address |

| 5 | foreignAccountTaxCompliance | boolean | FATCA filing requirement |

| 6 | accountNumber | string | Account number |

| 7 | payerRtn | string | Payer's RTN |

| 8 | interestIncome | number (double) | Box 1, Interest income |

| 9 | earlyWithdrawalPenalty | number (double) | Box 2, Early withdrawal penalty |

| 10 | usBondInterest | number (double) | Box 3, Interest on U.S. Savings Bonds and Treasury obligations |

| 11 | federalTaxWithheld | number (double) | Box 4, Federal income tax withheld |

| 12 | investmentExpenses | number (double) | Box 5, Investment expenses |

| 13 | foreignTaxPaid | number (double) | Box 6, Foreign tax paid |

| 14 | foreignCountry | string | Box 7, Foreign country or U.S. possession |

| 15 | taxExemptInterest | number (double) | Box 8, Tax-exempt interest |

| 16 | specifiedPabInterest | number (double) | Box 9, Specified private activity bond interest |

| 17 | marketDiscount | number (double) | Box 10, Market discount |

| 18 | bondPremium | number (double) | Box 11, Bond premium |

| 19 | usBondPremium | number (double) | Box 12, Bond premium on Treasury obligations |

| 20 | taxExemptBondPremium | number (double) | Box 13, Bond premium on tax-exempt bond |

| 21 | cusipNumber | string | Box 14, Tax-exempt bond CUSIP no. |

| 22 | stateTaxWithholding | Array of StateTaxWithholding | Boxes 15-17, State tax withholding |

| 23 | foreignIncomes | Array of DescriptionAmount | Supplemental foreign income amount information (description is country) |

| 24 | stateTaxExemptIncome | Array of DescriptionAmount | Supplemental tax-exempt income by state (description is state) |

| 25 | secondTinNotice | boolean | Second TIN Notice |

Tax1099Int Usage:

- TaxData tax1099Int

OFX

OFX / Types / Tax1099INT_V100

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | PAYERRTN | GenericNameType |

| 6 | INTINCOME | AmountType |

| 7 | ERLWITHPEN | AmountType |

| 8 | INTUSBNDTRS | AmountType |

| 9 | FEDTAXWH | AmountType |

| 10 | INVESTEXP | AmountType |

| 11 | FORTAXPD | AmountType |

| 12 | FORINCOMEAMT | AmountType |

| 13 | FORCNT | GenericNameType |

| 14 | FORINCOME | ForeignIncomeAggregate |

| 15 | TAXEXEMPTINT | AmountType |

| 16 | ORIGSTATE | OriginatingStateAggregate |

| 17 | SPECIFIEDPABINT | AmountType |

| 18 | MARKETDISCOUNT | AmountType |

| 19 | BONDPREMIUM | AmountType |

| 20 | BONDPREMUSOBLIGATIONS | AmountType |

| 21 | TEBONDPREMIUM | AmountType |

| 22 | CUSIPNUM | CusipType |

| 23 | STATECODE | StateCodeType |

| 24 | STATEIDNUM | IdType |

| 25 | STATETAXWHELD | AmountType |

| 26 | ADDLSTATETAXWHAGG | AddlStateTaxWheldAggregate |

| 27 | PAYERADDR | PayerAddress |

| 28 | PAYERID | GenericNameType |

| 29 | RECADDR | RecipientAddress |

| 30 | RECID | IdType |

| 31 | RECACCT | GenericNameType |

| 32 | TINNOT | BooleanType |

| 33 | FATCA | BooleanType |

Usages:

- Tax1099Response TAX1099INT_V100

FIRE

Under Development

TXF

| Reference Number | Irs Form or Schedule | Description | Record Format | Sign |

|---|---|---|---|---|

| 285 | 1099-INT | Schedule B | 1 | + |

| 640 | 1099-INT | 1099 INT | 1 | + |

| 642 | 1099-INT | Foreign country, int | 2 | N/A |

| 287 | 1099-INT | Interest income | 3 | + |

| 288 | 1099-INT | US govt. interest | 3 | + |

| 289 | 1099-INT | State and mun. bond int. | 3 | + |

| 290 | 1099-INT | TE priv. act. bond int | 3 | + |

| 489 | 1099-INT | Interest inc., non-taxable | 3 | + |

| 490 | 1099-INT | Int inc., fed-tax, state-non | 3 | + |

| 491 | 1099-INT | Int inc., fed-non, state-tax | 3 | + |

| 492 | 1099-INT | Int inc., orig issue disc | 3 | + |

| 524 | 1099-INT | Seller financed mtge int. | 3 | + |

| 641 | 1099-INT | Foreign tax, int | 3 | - |

| 653 | 1099-INT | Intestment expense, int | 3 | - |