Tax1099INT_V100

OFX / Types / Tax1099INT_V100

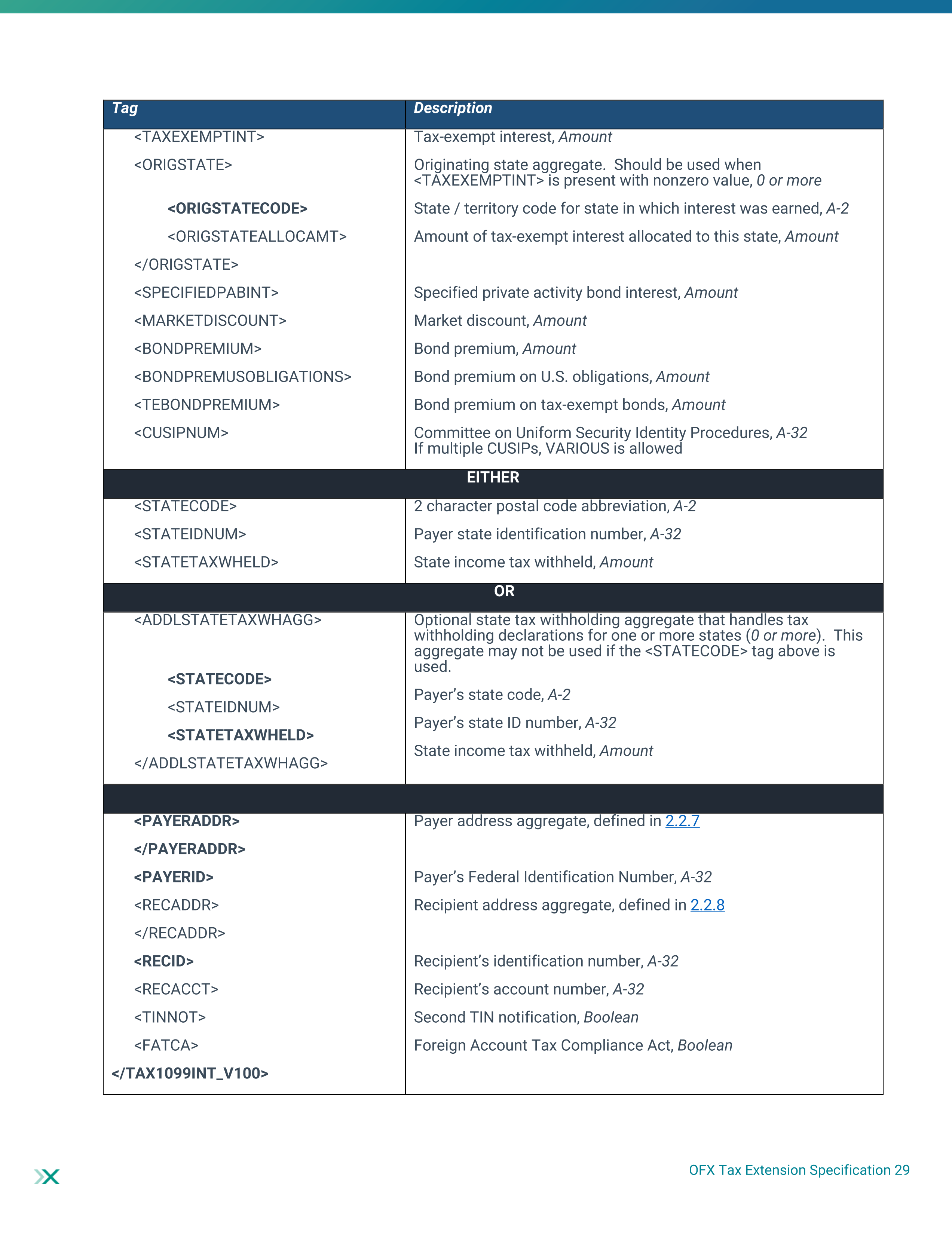

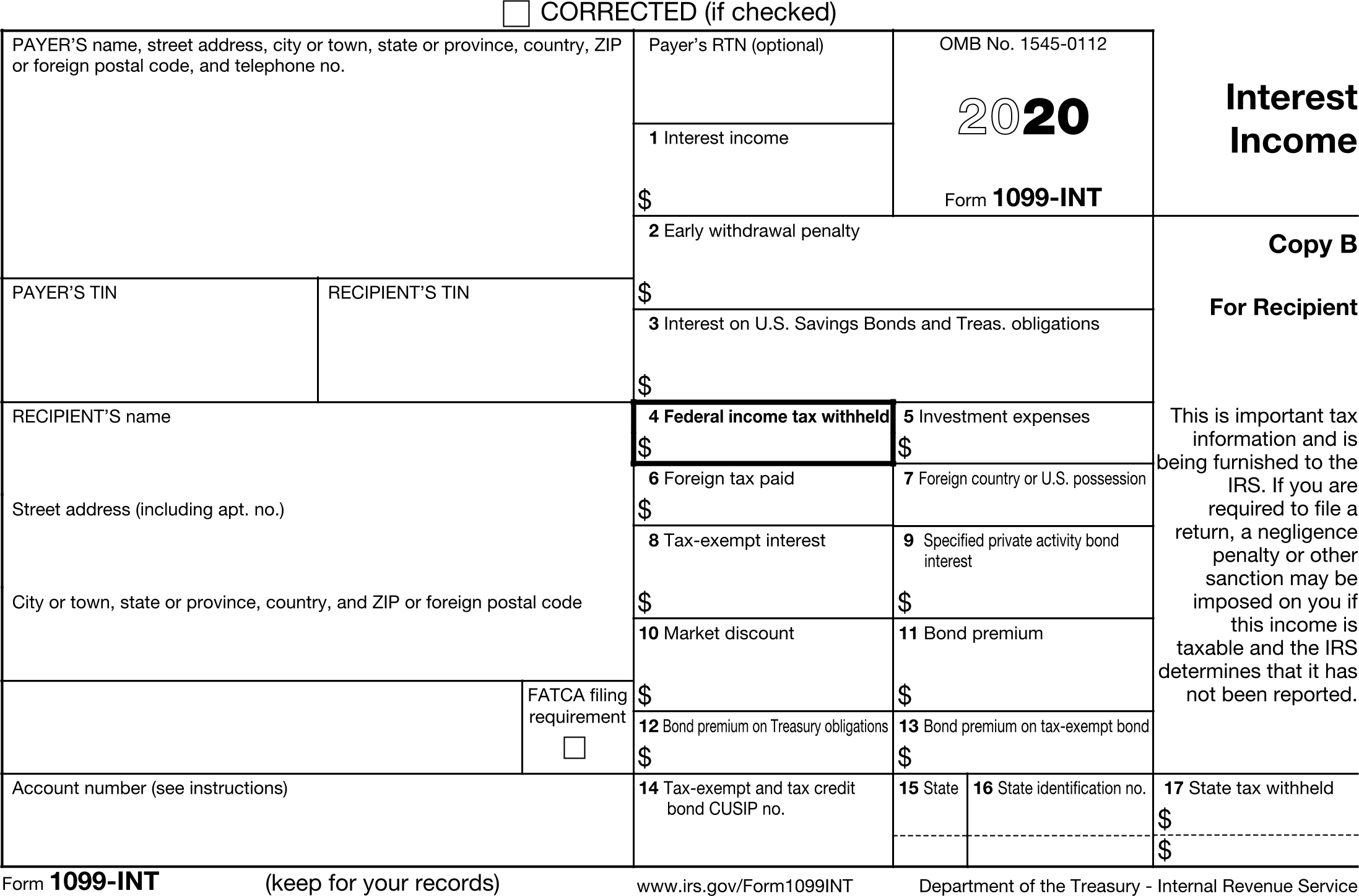

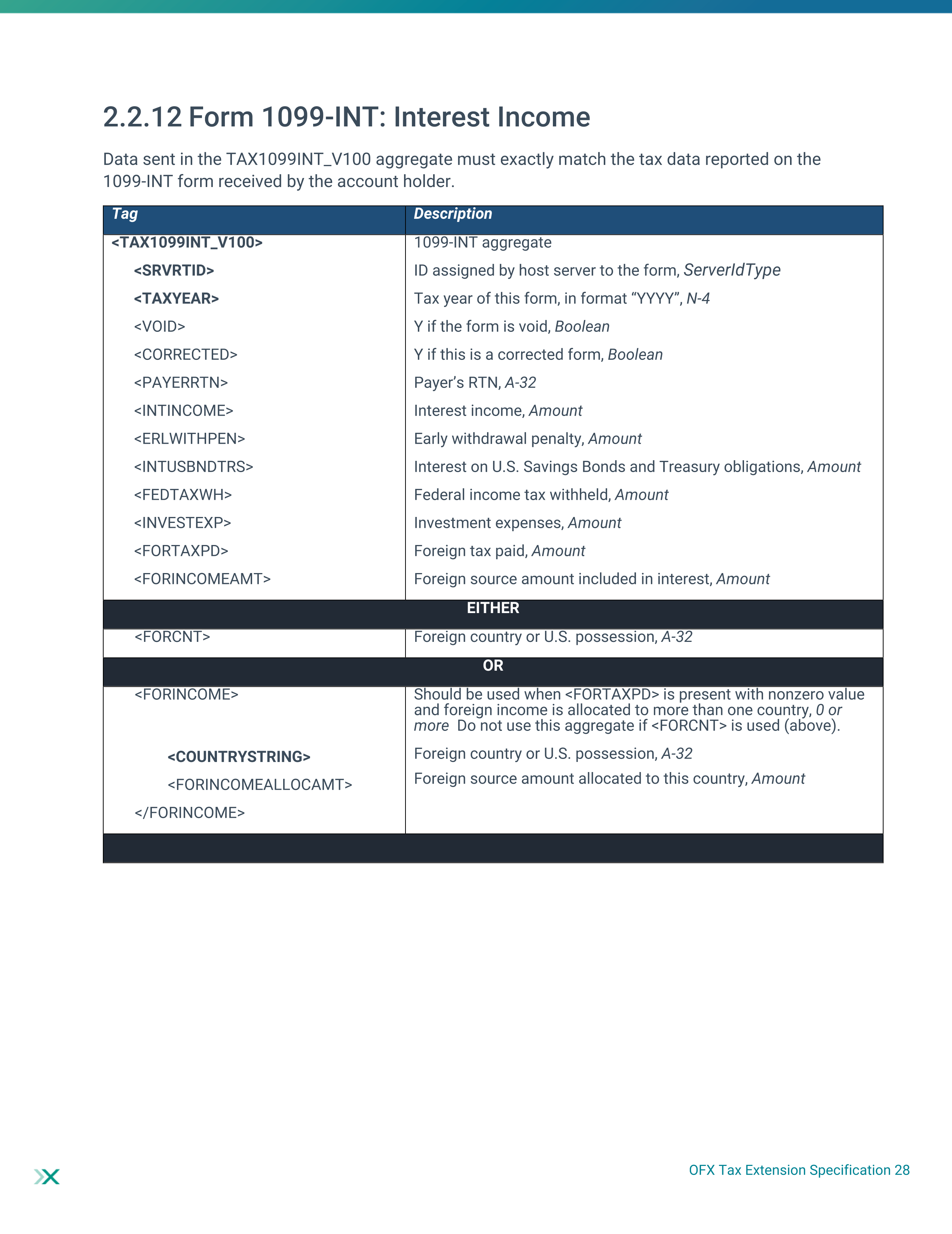

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | PAYERRTN | GenericNameType |

| 6 | INTINCOME | AmountType |

| 7 | ERLWITHPEN | AmountType |

| 8 | INTUSBNDTRS | AmountType |

| 9 | FEDTAXWH | AmountType |

| 10 | INVESTEXP | AmountType |

| 11 | FORTAXPD | AmountType |

| 12 | FORINCOMEAMT | AmountType |

| 13 | FORCNT | GenericNameType |

| 14 | FORINCOME | ForeignIncomeAggregate |

| 15 | TAXEXEMPTINT | AmountType |

| 16 | ORIGSTATE | OriginatingStateAggregate |

| 17 | SPECIFIEDPABINT | AmountType |

| 18 | MARKETDISCOUNT | AmountType |

| 19 | BONDPREMIUM | AmountType |

| 20 | BONDPREMUSOBLIGATIONS | AmountType |

| 21 | TEBONDPREMIUM | AmountType |

| 22 | CUSIPNUM | CusipType |

| 23 | STATECODE | StateCodeType |

| 24 | STATEIDNUM | IdType |

| 25 | STATETAXWHELD | AmountType |

| 26 | ADDLSTATETAXWHAGG | AddlStateTaxWheldAggregate |

| 27 | PAYERADDR | PayerAddress |

| 28 | PAYERID | GenericNameType |

| 29 | RECADDR | RecipientAddress |

| 30 | RECID | IdType |

| 31 | RECACCT | GenericNameType |

| 32 | TINNOT | BooleanType |

| 33 | FATCA | BooleanType |

Usages:

- Tax1099Response TAX1099INT_V100

XSD

<xsd:complexType name="Tax1099INT_V100">

<xsd:annotation>

<xsd:documentation>

The OFX element "TAX1099INT_V100" is of type "Tax1099INT_V100"

</xsd:documentation>

</xsd:annotation>

<xsd:complexContent>

<xsd:extension base="ofx:AbstractTaxForm1099">

<xsd:sequence>

<xsd:element name="PAYERRTN" type="ofx:GenericNameType" minOccurs="0"/>

<xsd:element name="INTINCOME" type="ofx:AmountType" minOccurs="0"/>

<xsd:element name="ERLWITHPEN" type="ofx:AmountType" minOccurs="0"/>

<xsd:element name="INTUSBNDTRS" type="ofx:AmountType" minOccurs="0"/>

<xsd:element name="FEDTAXWH" type="ofx:AmountType" minOccurs="0"/>

<xsd:element name="INVESTEXP" type="ofx:AmountType" minOccurs="0"/>

<xsd:element name="FORTAXPD" type="ofx:AmountType" minOccurs="0"/>

<xsd:element name="FORINCOMEAMT" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>New TY18</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:choice>

<xsd:element name="FORCNT" type="ofx:GenericNameType" minOccurs="0"/>

<xsd:element name="FORINCOME" type="ofx:ForeignIncomeAggregate" minOccurs="0" maxOccurs="unbounded">

<xsd:annotation>

<xsd:documentation>New TY18</xsd:documentation>

</xsd:annotation>

</xsd:element>

</xsd:choice>

<xsd:element name="TAXEXEMPTINT" type="ofx:AmountType" minOccurs="0"/>

<xsd:element name="ORIGSTATE" type="ofx:OriginatingStateAggregate" minOccurs="0" maxOccurs="unbounded">

<xsd:annotation>

<xsd:documentation>New TY18</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="SPECIFIEDPABINT" type="ofx:AmountType" minOccurs="0"/>

<xsd:element name="MARKETDISCOUNT" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>NEW for TY14</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="BONDPREMIUM" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>NEW for TY14</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="BONDPREMUSOBLIGATIONS" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>new FOR ty16</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="TEBONDPREMIUM" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>NEW for TY15</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="CUSIPNUM" type="ofx:CusipType" minOccurs="0"/>

<xsd:choice>

<xsd:sequence>

<xsd:element name="STATECODE" type="ofx:StateCodeType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>2 DIGIT STATE CODE</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="STATEIDNUM" type="ofx:IdType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>PAYER STATE ID NUMBER</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="STATETAXWHELD" type="ofx:AmountType" minOccurs="0"/>

</xsd:sequence>

<xsd:element name="ADDLSTATETAXWHAGG" type="ofx:AddlStateTaxWheldAggregate" minOccurs="0" maxOccurs="unbounded"/>

</xsd:choice>

<xsd:element name="PAYERADDR" type="ofx:PayerAddress"/>

<xsd:element name="PAYERID" type="ofx:GenericNameType"/>

<xsd:element name="RECADDR" type="ofx:RecipientAddress" minOccurs="0"/>

<xsd:element name="RECID" type="ofx:IdType"/>

<xsd:element name="RECACCT" type="ofx:GenericNameType" minOccurs="0"/>

<xsd:element name="TINNOT" type="ofx:BooleanType" minOccurs="0"/>

<xsd:element name="FATCA" type="ofx:BooleanType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>FATCA filing requirement</xsd:documentation>

</xsd:annotation>

</xsd:element>

</xsd:sequence>

</xsd:extension>

</xsd:complexContent>

</xsd:complexType>

OFX XML

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>39210131000000</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>fiName</ORG>

<FID>fiId</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAX1099MSGSRSV1>

<TAX1099TRNRS>

<TRNUID>_GUID_</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAX1099RS>

<TAX1099INT_V100>

<TAXYEAR>2020</TAXYEAR>

<PAYERRTN>007007007</PAYERRTN>

<INTINCOME>1008.00</INTINCOME>

<ERLWITHPEN>2009.00</ERLWITHPEN>

<INTUSBNDTRS>3010.00</INTUSBNDTRS>

<FEDTAXWH>4011.00</FEDTAXWH>

<INVESTEXP>5012.00</INVESTEXP>

<FORTAXPD>6013.00</FORTAXPD>

<FORCNT>Canada</FORCNT>

<TAXEXEMPTINT>8015.00</TAXEXEMPTINT>

<SPECIFIEDPABINT>9016.00</SPECIFIEDPABINT>

<MARKETDISCOUNT>10017.00</MARKETDISCOUNT>

<BONDPREMIUM>11018.00</BONDPREMIUM>

<BONDPREMUSOBLIGATIONS>12019.00</BONDPREMUSOBLIGATIONS>

<TEBONDPREMIUM>13020.00</TEBONDPREMIUM>

<CUSIPNUM>CUSIP</CUSIPNUM>

<ADDLSTATETAXWHAGG>

<STATECODE>NY</STATECODE>

<STATEIDNUM>15-000022</STATEIDNUM>

<STATETAXWHELD>17022.00</STATETAXWHELD>

</ADDLSTATETAXWHAGG>

<PAYERADDR>

<PAYERNAME1>Financial Data Exchange</PAYERNAME1>

<ADDR1>12020 Sunrise Valley Dr</ADDR1>

<ADDR2>Suite 230</ADDR2>

<CITY>Prescott</CITY>

<STATE>VA</STATE>

<POSTALCODE>20191</POSTALCODE>

<PHONE>888-555-1212</PHONE>

</PAYERADDR>

<PAYERID>12-3456789</PAYERID>

<RECADDR>

<RECNAME1>Kris Q Public</RECNAME1>

<ADDR1>1 Main St</ADDR1>

<CITY>Melrose</CITY>

<STATE>NY</STATE>

<POSTALCODE>12121</POSTALCODE>

</RECADDR>

<RECID>xxx-xx-1234</RECID>

<RECACCT>111-5555555</RECACCT>

<FATCA>N</FATCA>

</TAX1099INT_V100>

</TAX1099RS>

</TAX1099TRNRS>

</TAX1099MSGSRSV1>

</OFX>

FDX JSON

{

"tax1099Int" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1099Int",

"payerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"payerTin" : "12-3456789",

"recipientTin" : "xxx-xx-1234",

"recipientNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q Public"

},

"foreignAccountTaxCompliance" : false,

"accountNumber" : "111-5555555",

"payerRtn" : "007007007",

"interestIncome" : 1008.0,

"earlyWithdrawalPenalty" : 2009.0,

"usBondInterest" : 3010.0,

"federalTaxWithheld" : 4011.0,

"investmentExpenses" : 5012.0,

"foreignTaxPaid" : 6013.0,

"foreignCountry" : "Canada",

"taxExemptInterest" : 8015.0,

"specifiedPabInterest" : 9016.0,

"marketDiscount" : 10017.0,

"bondPremium" : 11018.0,

"usBondPremium" : 12019.0,

"taxExemptBondPremium" : 13020.0,

"cusipNumber" : "CUSIP",

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 17022.0,

"state" : "NY",

"stateTaxId" : "15-000022"

} ]

}

}

OFX Tax Specification Page 28

OFX Tax Specification Page 29