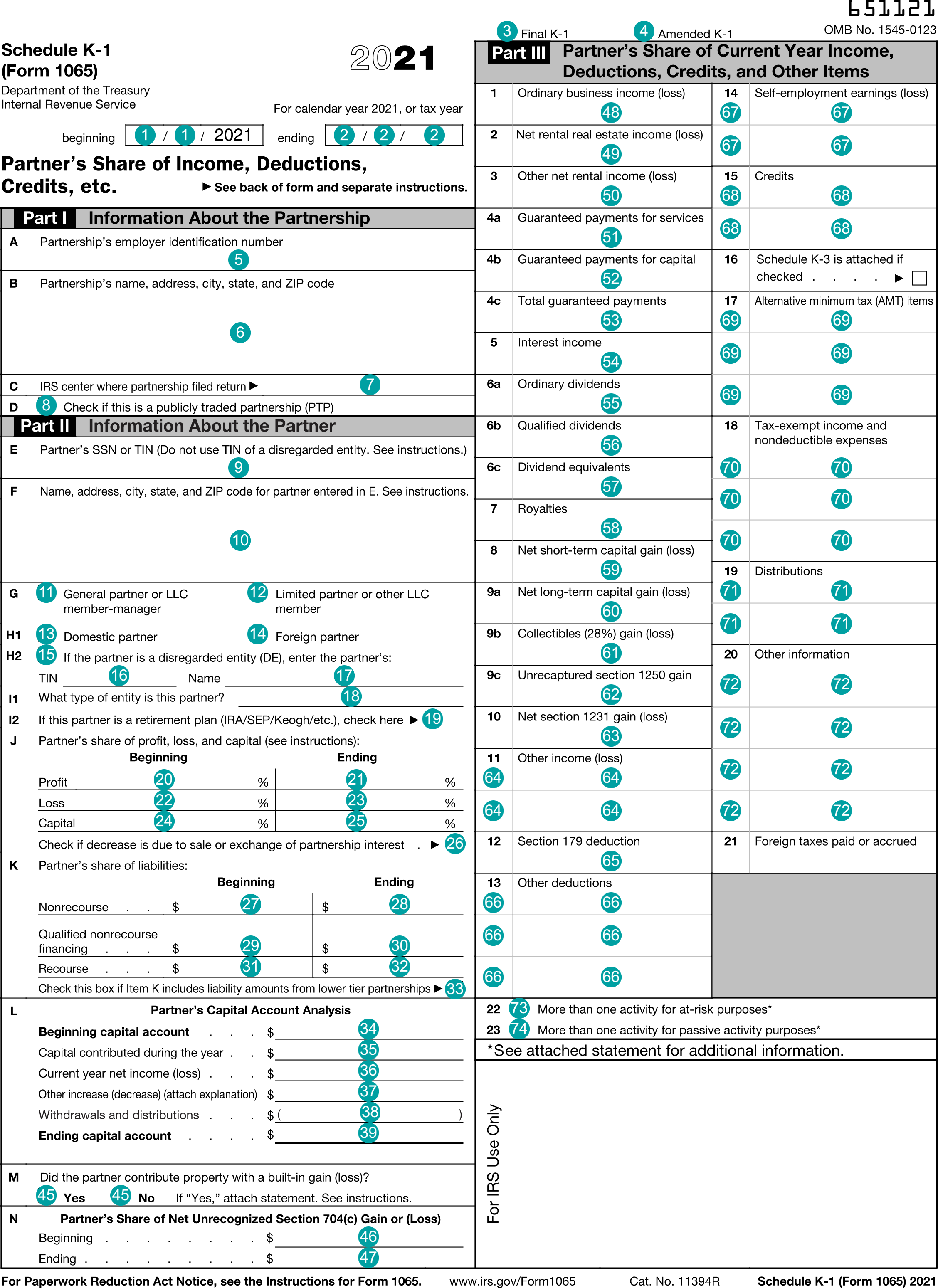

1065 K-1 : Partner's Share of Income, Deductions, Credits, etc.

FDX

FDX / Data Structures / Tax1065K1

Form 1065 K-1, Partner's Share of Income, Deductions, Credits, etc.

Extends and inherits all fields from Tax

Tax1065K1 Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | fiscalYearBegin | DateString | Fiscal year begin date |

| 2 | fiscalYearEnd | DateString | Fiscal year end data |

| 3 | finalK1 | boolean | Final K-1 |

| 4 | amendedK1 | boolean | Amended K-1 |

| 5 | partnershipTin | string | Box A, Partnership's employer identification number |

| 6 | partnershipNameAddress | NameAddress | Box D, Partnership's name, address, city, state, and ZIP code |

| 7 | irsCenter | string | Box C, IRS Center where partnership filed return |

| 8 | publiclyTraded | boolean | Box D, Check if this is a publicly traded partnership (PTP) |

| 9 | partnerTin | string | Box E, Partner's SSN or TIN |

| 10 | partnerNameAddress | NameAddress | Box F, Name, address, city, state, and ZIP code for partner entered in box E |

| 11 | generalPartner | boolean | Box G, General partner or LLC member-manager |

| 12 | limitedPartner | boolean | Box G, Limited partner or other LLC member |

| 13 | domestic | boolean | Box H1, Domestic partner |

| 14 | foreign | boolean | Box H1, Foreign partner |

| 15 | disregardedEntity | boolean | Box H2, Check if the partner is a disregarded entity (DE), and enter the partner's TIN and Name |

| 16 | disregardedEntityTin | string | Box H2, Disregarded entity partner's TIN |

| 17 | disregardedEntityName | string | Box H2, Disregarded entity partner's Name |

| 18 | entityType | string | Box I1, What type of entity is this partner? |

| 19 | retirementPlan | boolean | Box I2, If this partner is a retirement plan (IRA/SEP/Keogh/etc.), check here |

| 20 | profitShareBegin | number (double) | Box J, Partner's share of profit - beginning |

| 21 | profitShareEnd | number (double) | Box J, Partner's share of profit - ending |

| 22 | lossShareBegin | number (double) | Box J, Partner's share of loss - beginning |

| 23 | lossShareEnd | number (double) | Box J, Partner's share of loss - ending |

| 24 | capitalShareBegin | number (double) | Box J, Partner's share of capital - beginning |

| 25 | capitalShareEnd | number (double) | Box J, Partner's share of capital - ending |

| 26 | decreaseDueToSaleOrExchange | boolean | Box J, Check if decrease is due to sale or exchange of partnership interest |

| 27 | nonrecourseLiabilityShareBegin | number (double) | Box K, Partner's share of liabilities - beginning - nonrecourse |

| 28 | nonrecourseLiabilityShareEnd | number (double) | Box K, Partner's share of liabilities - ending - nonrecourse |

| 29 | qualifiedLiabilityShareBegin | number (double) | Box K, Partner's share of liabilities - beginning - qualified nonrecourse financing |

| 30 | qualifiedLiabilityShareEnd | number (double) | Box K, Partner's share of liabilities - ending - qualified nonrecourse financing |

| 31 | recourseLiabilityShareBegin | number (double) | Box K, Partner's share of liabilities - beginning - recourse |

| 32 | recourseLiabilityShareEnd | number (double) | Box K, Partner's share of liabilities - ending - recourse |

| 33 | includesLowerTierLiability | boolean | Box K, Check this box if item K includes liability amounts from lower tier partnerships |

| 34 | capitalAccountBegin | number (double) | Box L, Partner's capital account analysis - Beginning capital account |

| 35 | capitalAccountContributions | number (double) | Box L, Partner's capital account analysis - Capital contributed during the year |

| 36 | capitalAccountIncrease | number (double) | Box L, Partner's capital account analysis - Current year net income (loss) |

| 37 | capitalAccountOther | number (double) | Box L, Partner's capital account analysis - Other increase (decrease) |

| 38 | capitalAccountWithdrawals | number (double) | Box L, Partner's capital account analysis - Withdrawals & distributions |

| 39 | capitalAccountEnd | number (double) | Box L, Partner's capital account analysis - Ending capital account |

| 40 | bookTax | boolean | 2018 Box L, Tax basis (IRS removed 2019) |

| 41 | bookGaap | boolean | 2018 Box L, GAAP (IRS removed 2019) |

| 42 | book704b | boolean | 2018 Box L, Section 704(b) book (IRS removed 2019) |

| 43 | bookOther | boolean | 2018 Box L, Other (explain) (IRS removed 2019) |

| 44 | bookOtherExplain | string | 2018 Box L, Other (explain) (IRS removed 2019) |

| 45 | builtInGain | boolean | Box M, Did the partner contribute property with a built-in gain or loss? - Yes |

| 46 | unrecognizedSection704Begin | number (double) | Box N, Partner's Share of Net Unrecognized Section 704(c) Gain or (Loss) - beginning |

| 47 | unrecognizedSection704End | number (double) | Box N, Partner's Share of Net Unrecognized Section 704(c) Gain or (Loss) - ending |

| 48 | ordinaryIncome | number (double) | Box 1, Ordinary business income (loss) |

| 49 | netRentalRealEstateIncome | number (double) | Box 2, Net rental real estate income (loss) |

| 50 | otherRentalIncome | number (double) | Box 3, Other net rental income (loss) |

| 51 | guaranteedPaymentServices | number (double) | Box 4a, Guaranteed payments for services |

| 52 | guaranteedPaymentCapital | number (double) | Box 4b, Guaranteed payments for capital |

| 53 | guaranteedPayment | number (double) | Box 4c, Total guaranteed payments |

| 54 | interestIncome | number (double) | Box 5, Interest income |

| 55 | ordinaryDividends | number (double) | Box 6a, Ordinary dividends |

| 56 | qualifiedDividends | number (double) | Box 6b, Qualified dividends |

| 57 | dividendEquivalents | number (double) | Box 6c, Dividend equivalents |

| 58 | royalties | number (double) | Box 7, Royalties |

| 59 | netShortTermGain | number (double) | Box 8, Net short-term capital gain (loss) |

| 60 | netLongTermGain | number (double) | Box 9a, Net long-term capital gain (loss) |

| 61 | collectiblesGain | number (double) | Box 9b, Collectibles (28%) gain (loss) |

| 62 | unrecaptured1250Gain | number (double) | Box 9c, Unrecaptured section 1250 gain |

| 63 | net1231Gain | number (double) | Box 10, Net section 1231 gain (loss) |

| 64 | otherIncome | Array of CodeAmount | Box 11, Other income |

| 65 | section179Deduction | number (double) | Box 12, Section 179 deduction |

| 66 | otherDeductions | Array of CodeAmount | Box 13, Other deductions |

| 67 | selfEmployment | Array of CodeAmount | Box 14, Self-employment earnings (loss) |

| 68 | credits | Array of CodeAmount | Box 15, Credits |

| 69 | scheduleK3 | boolean | Box 16, Schedule K-3 is attached |

| 70 | foreignCountry | string | Box 16, Foreign country. IRS deprecated 2021 and is now reported on Schedule K-3 |

| 71 | foreignTransactions | Array of CodeAmount | Box 16, Foreign transactions. IRS deprecated 2021 and is now reported on Schedule K-3 |

| 72 | amtItems | Array of CodeAmount | Box 17, Alternative minimum tax (AMT) items |

| 73 | taxExemptIncome | Array of CodeAmount | Box 18, Tax-exempt income and nondeductible expenses |

| 74 | distributions | Array of CodeAmount | Box 19, Distributions |

| 75 | otherInfo | Array of CodeAmount | Box 20, Other information |

| 76 | foreignTaxPaid | number (double) | Box 21, Foreign taxes paid or accrued |

| 77 | multipleAtRiskActivities | boolean | Box 22, More than one activity for at-risk purposes |

| 78 | multiplePassiveActivities | boolean | Box 23, More than one activity for passive activity purposes |

Tax1065K1 Usage:

- TaxData tax1065K1

OFX

OFX / Types / Tax1065K1_V100

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | FINALK1 | BooleanType |

| 6 | AMENDEDK1 | BooleanType |

| 7 | PARTNERSHIPNAME | GenericNameType |

| 8 | PARTNERSHIPEIN | GenericNameType |

| 9 | PARTNERSHIPADDRESS | anonymous complex type |

| 10 | IRSCENTER | GenericNameType |

| 11 | PUBLICLYTRADEDPARTNERSHIP | BooleanType |

| 12 | PARTNERID | GenericNameType |

| 13 | PARTNERINFO | anonymous complex type |

| 14 | GENERALPARTNER | BooleanType |

| 15 | LIMITEDPARTNER | BooleanType |

| 16 | DOMESTICPARTNER | BooleanType |

| 17 | FOREIGNPARTNER | BooleanType |

| 18 | DISREGARDEDENTITY | BooleanType |

| 19 | DISREGARDEDENTITYTIN | GenericNameType |

| 20 | DISREGARDEDENTITYNAME | GenericNameType |

| 21 | PARTNERENTITYTYPE | GenericNameType |

| 22 | PARTNERISRETIREMENTPLAN | BooleanType |

| 23 | PARTNERSSHAREPROFITLOSSCAPITAL | anonymous complex type |

| 24 | PARTNERSHARELIAB | anonymous complex type |

| 25 | PARTNERSCAPITALACCT | anonymous complex type |

| 26 | PARTNERCONTRIBPROP | BooleanType |

| 27 | UNRECOGNIZEDSECTION704BEGIN | AmountType |

| 28 | UNRECOGNIZEDSECTION704END | AmountType |

| 29 | ORDINARYINCOME | AmountType |

| 30 | NETRENTALREINCOME | AmountType |

| 31 | OTHERRENTALINCOME | AmountType |

| 32 | GUARANTEEDPAYMENTSERVICES | AmountType |

| 33 | GUARANTEEDPAYMENTCAPITAL | AmountType |

| 34 | GUARANTEDPAYMENT | AmountType |

| 35 | INTEREST | AmountType |

| 36 | ORDINARYDIVIDEND | AmountType |

| 37 | QUALIFIEDDIVIDEND | AmountType |

| 38 | ROYALTIES | AmountType |

| 39 | NETSTCAPITALGAIN | AmountType |

| 40 | NETLTCAPITALGAIN | AmountType |

| 41 | COLLECTIBLES | AmountType |

| 42 | UNRECAPSEC1250GAIN | AmountType |

| 43 | NETSEC1231GAIN | AmountType |

| 44 | OTHERINCOMELOSS | CodeAmountType |

| 45 | SEC179DEDUCT | AmountType |

| 46 | OTHERDEDUCTIONS | CodeAmountType |

| 47 | SELFEMPLOY | CodeAmountType |

| 48 | CREDITS | CodeAmountType |

| 49 | FOREIGNCOUNTRY | GenericNameType |

| 50 | FOREIGNTRANSACTIONS | CodeAmountType |

| 51 | AMTITEMS | CodeAmountType |

| 52 | TAXEXEMPT | CodeAmountType |

| 53 | DISTRIBUTIONS | CodeAmountType |

| 54 | OTHERINFO | CodeAmountType |

| 55 | DIVIDENDEQUIVALENTS | AmountType |

| 56 | FISCALYEARBEGIN | DateTimeType |

| 57 | FISCALYEAREND | DateTimeType |

| 58 | MULTIPLEATRISKACTIVITIES | BooleanType |

| 59 | MULTIPLEPASSIVEACTIVITIES | BooleanType |

Usages:

- TaxK1Response TAX1065K1_V100

FIRE

This form is not reported in the IRS FIRE system.

TXF

| Reference Number | Irs Form or Schedule | Description | Record Format | Sign |

|---|---|---|---|---|

| 447 | K-1 | Spouse | 0 | N/A |

| 446 | K-1 | Schedule K-1 Worksheet | 1 | + |

| 448 | K-1 | Ordinary income/loss | 1 | +/- |

| 449 | K-1 | Rental real est. inc/loss | 1 | +/- |

| 450 | K-1 | Other rental income/loss | 1 | +/- |

| 451 | K-1 | Interest income | 1 | + |

| 452 | K-1 | Dividends | 1 | + |

| 453 | K-1 | Net ST capital gain/loss | 1 | +/- |

| 454 | K-1 | Net LT capital gain/loss | 1 | +/- |

| 455 | K-1 | Guaranteed payments | 1 | + |

| 456 | K-1 | Net sec 1231 gain/loss | 1 | +/- |

| 527 | K-1 | Royalties | 1 | + |

| 528 | K-1 | Tax-exempt interest | 1 | + |

| 674 | K-1 | 28% rate gain(loss) | 1 | +/- |

| 675 | K-1 | Qualified 5-year gain | 1 | +/- |

| 676 | K-1 | Other Income (loss) | 1 | +/- |

| 679 | K-1 | Total Foreign Taxes | 1 | - |

| 457 | K-1 | Partnership or S corp name | 2 | N/A |