Tax1065K1_V100

OFX / Types / Tax1065K1_V100

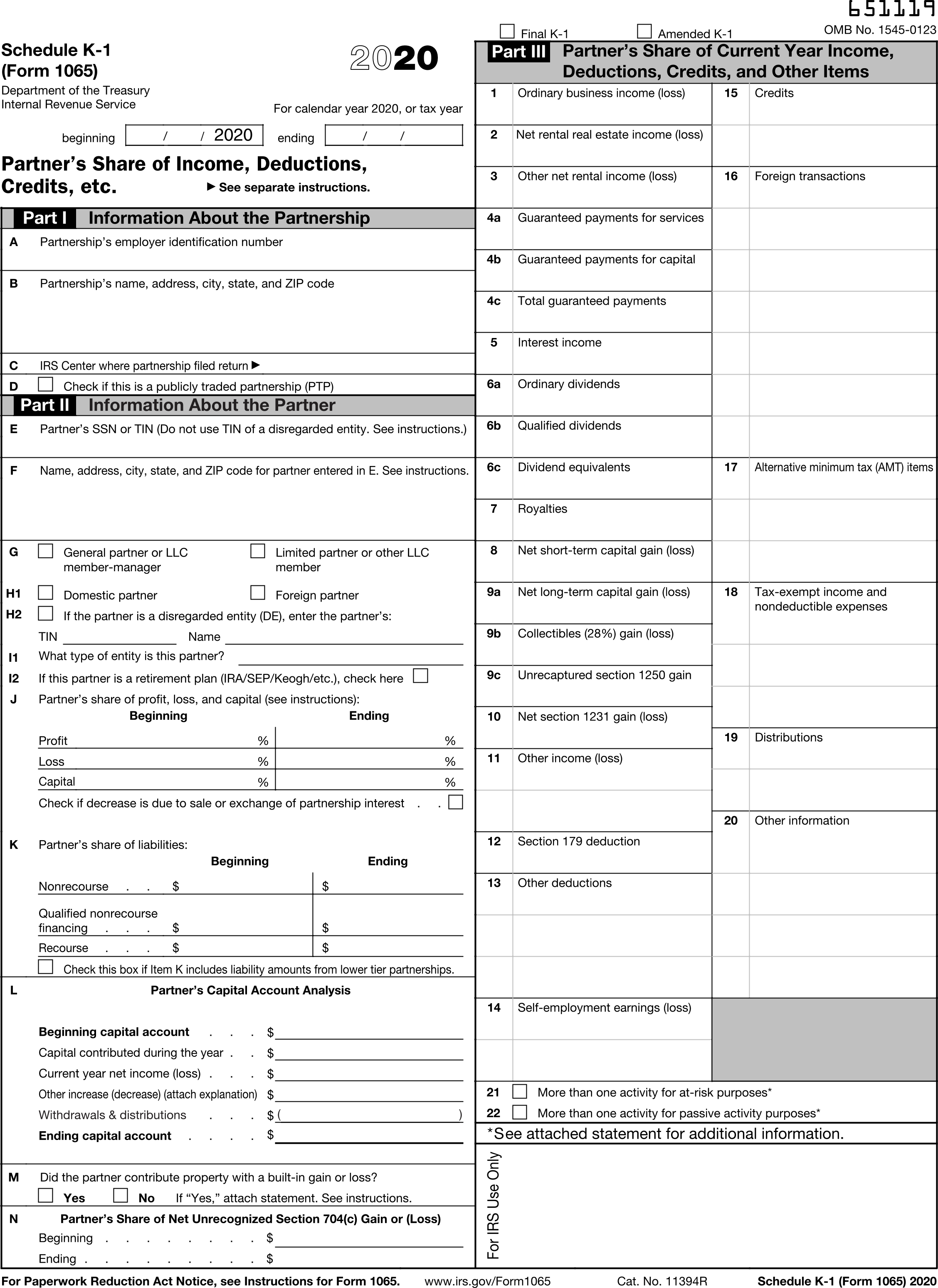

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | FINALK1 | BooleanType |

| 6 | AMENDEDK1 | BooleanType |

| 7 | PARTNERSHIPNAME | GenericNameType |

| 8 | PARTNERSHIPEIN | GenericNameType |

| 9 | PARTNERSHIPADDRESS | anonymous complex type |

| 10 | IRSCENTER | GenericNameType |

| 11 | PUBLICLYTRADEDPARTNERSHIP | BooleanType |

| 12 | PARTNERID | GenericNameType |

| 13 | PARTNERINFO | anonymous complex type |

| 14 | GENERALPARTNER | BooleanType |

| 15 | LIMITEDPARTNER | BooleanType |

| 16 | DOMESTICPARTNER | BooleanType |

| 17 | FOREIGNPARTNER | BooleanType |

| 18 | DISREGARDEDENTITY | BooleanType |

| 19 | DISREGARDEDENTITYTIN | GenericNameType |

| 20 | DISREGARDEDENTITYNAME | GenericNameType |

| 21 | PARTNERENTITYTYPE | GenericNameType |

| 22 | PARTNERISRETIREMENTPLAN | BooleanType |

| 23 | PARTNERSSHAREPROFITLOSSCAPITAL | anonymous complex type |

| 24 | PARTNERSHARELIAB | anonymous complex type |

| 25 | PARTNERSCAPITALACCT | anonymous complex type |

| 26 | PARTNERCONTRIBPROP | BooleanType |

| 27 | UNRECOGNIZEDSECTION704BEGIN | AmountType |

| 28 | UNRECOGNIZEDSECTION704END | AmountType |

| 29 | ORDINARYINCOME | AmountType |

| 30 | NETRENTALREINCOME | AmountType |

| 31 | OTHERRENTALINCOME | AmountType |

| 32 | GUARANTEEDPAYMENTSERVICES | AmountType |

| 33 | GUARANTEEDPAYMENTCAPITAL | AmountType |

| 34 | GUARANTEDPAYMENT | AmountType |

| 35 | INTEREST | AmountType |

| 36 | ORDINARYDIVIDEND | AmountType |

| 37 | QUALIFIEDDIVIDEND | AmountType |

| 38 | ROYALTIES | AmountType |

| 39 | NETSTCAPITALGAIN | AmountType |

| 40 | NETLTCAPITALGAIN | AmountType |

| 41 | COLLECTIBLES | AmountType |

| 42 | UNRECAPSEC1250GAIN | AmountType |

| 43 | NETSEC1231GAIN | AmountType |

| 44 | OTHERINCOMELOSS | CodeAmountType |

| 45 | SEC179DEDUCT | AmountType |

| 46 | OTHERDEDUCTIONS | CodeAmountType |

| 47 | SELFEMPLOY | CodeAmountType |

| 48 | CREDITS | CodeAmountType |

| 49 | FOREIGNCOUNTRY | GenericNameType |

| 50 | FOREIGNTRANSACTIONS | CodeAmountType |

| 51 | AMTITEMS | CodeAmountType |

| 52 | TAXEXEMPT | CodeAmountType |

| 53 | DISTRIBUTIONS | CodeAmountType |

| 54 | OTHERINFO | CodeAmountType |

| 55 | DIVIDENDEQUIVALENTS | AmountType |

| 56 | FISCALYEARBEGIN | DateTimeType |

| 57 | FISCALYEAREND | DateTimeType |

| 58 | MULTIPLEATRISKACTIVITIES | BooleanType |

| 59 | MULTIPLEPASSIVEACTIVITIES | BooleanType |

Usages:

- TaxK1Response TAX1065K1_V100

XSD

<xsd:complexType name="Tax1065K1_V100"> <xsd:annotation> <xsd:documentation>The OFX element "TAX1065K1_V100" is of type "Tax1065K1_V100"</xsd:documentation> </xsd:annotation> <xsd:complexContent> <xsd:extension base="ofx:AbstractTaxFormK1"> <xsd:sequence> <xsd:element name="FINALK1" type="ofx:BooleanType" minOccurs="0"/> <xsd:element name="AMENDEDK1" type="ofx:BooleanType" minOccurs="0"/> <xsd:element name="PARTNERSHIPNAME" type="ofx:GenericNameType"> <xsd:annotation> <xsd:documentation>Name of Partnership</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PARTNERSHIPEIN" type="ofx:GenericNameType"> <xsd:annotation> <xsd:documentation>Fed ID#</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PARTNERSHIPADDRESS" minOccurs="0"> <xsd:annotation> <xsd:documentation> Partnership's address; Schedule K-1 Part I Line B </xsd:documentation> </xsd:annotation> <xsd:complexType> <xsd:sequence> <xsd:element name="ADDR1" type="ofx:AddressType"/> <xsd:element name="ADDR2" type="ofx:AddressType" minOccurs="0"/> <xsd:element name="ADDR3" type="ofx:AddressType" minOccurs="0"/> <xsd:element name="CITY" type="ofx:AddressType"/> <xsd:element name="STATE" type="ofx:StateType"/> <xsd:element name="POSTALCODE" type="ofx:ZipType" minOccurs="0"/> <xsd:element name="PHONE" type="ofx:PhoneType" minOccurs="0"/> </xsd:sequence> </xsd:complexType> </xsd:element> <xsd:element name="IRSCENTER" type="ofx:GenericNameType" minOccurs="0"/> <xsd:element name="PUBLICLYTRADEDPARTNERSHIP" type="ofx:BooleanType" minOccurs="0"/> <xsd:element name="PARTNERID" type="ofx:GenericNameType" minOccurs="0"/> <xsd:element name="PARTNERINFO" minOccurs="0"> <xsd:complexType> <xsd:sequence> <xsd:element name="NAME" type="ofx:GenericNameType"/> <xsd:element name="ADDR1" type="ofx:AddressType"/> <xsd:element name="ADDR2" type="ofx:AddressType" minOccurs="0"/> <xsd:element name="ADDR3" type="ofx:AddressType" minOccurs="0"/> <xsd:element name="CITY" type="ofx:AddressType"/> <xsd:element name="STATE" type="ofx:StateType"/> <xsd:element name="POSTALCODE" type="ofx:ZipType" minOccurs="0"/> <xsd:element name="PHONE" type="ofx:PhoneType" minOccurs="0"/> </xsd:sequence> </xsd:complexType> </xsd:element> <xsd:choice minOccurs="0"> <xsd:element name="GENERALPARTNER" type="ofx:BooleanType"/> <xsd:element name="LIMITEDPARTNER" type="ofx:BooleanType"/> </xsd:choice> <xsd:choice minOccurs="0"> <xsd:element name="DOMESTICPARTNER" type="ofx:BooleanType"/> <xsd:element name="FOREIGNPARTNER" type="ofx:BooleanType"/> </xsd:choice> <xsd:element name="DISREGARDEDENTITY" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box H2, Check if the partner is a disregarded entity (DE), and enter the partner's TIN and Name. TY19.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="DISREGARDEDENTITYTIN" type="ofx:GenericNameType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box H2, Disregarded entity partner's TIN. TY19.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="DISREGARDEDENTITYNAME" type="ofx:GenericNameType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box H2, Disregarded entity partner's Name. TY19.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PARTNERENTITYTYPE" type="ofx:GenericNameType" minOccurs="0"/> <xsd:element name="PARTNERISRETIREMENTPLAN" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation> Is the partner a retirement plan (IRA/SEP/Keogh/etc.) </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PARTNERSSHAREPROFITLOSSCAPITAL" minOccurs="0"> <xsd:annotation> <xsd:documentation> Partner's share of profit, loss, and capital </xsd:documentation> </xsd:annotation> <xsd:complexType> <xsd:sequence> <xsd:element name="PROFITBOY" type="ofx:AmountType"> <xsd:annotation> <xsd:documentation> Partner's share of profit beginning of year (percentage) </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PROFITEOY" type="ofx:AmountType"> <xsd:annotation> <xsd:documentation> Partner's share of profit end of year (percentage) </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="LOSSBOY" type="ofx:AmountType"> <xsd:annotation> <xsd:documentation> Partner's share of loss beginning of year (percentage) </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="LOSSEOY" type="ofx:AmountType"> <xsd:annotation> <xsd:documentation> Partner's share of loss end of year (percentage) </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="CAPITALBOY" type="ofx:AmountType"> <xsd:annotation> <xsd:documentation> Partner's share of capital beginning of year (percentage) </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="CAPITALEOY" type="ofx:AmountType"> <xsd:annotation> <xsd:documentation> Partner's share of capital end of year (percentage) </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="DECREASEDUETOSALEOREXCHANGE" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box J, Check if decrease is due to sale or exchange of partnership interest. TY19.</xsd:documentation> </xsd:annotation> </xsd:element> </xsd:sequence> </xsd:complexType> </xsd:element> <xsd:element name="PARTNERSHARELIAB" minOccurs="0"> <xsd:complexType> <xsd:sequence> <xsd:element name="NONRECOURSELIABILITIESBOY" type="ofx:AmountType"> <xsd:annotation> <xsd:documentation> Partner's share of liability at beginning of year: NonRecourse. Cleanup TY19. </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="NONRECOURSELIABILITIES" type="ofx:AmountType"> <xsd:annotation> <xsd:documentation> Partner's share of liability at year end: NonRecourse </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="QUALNONRECOURSEFINANCEBOY" type="ofx:AmountType"> <xsd:annotation> <xsd:documentation> Partner's share of liability at beginning of year: Qualified NonRecourse Financing. Cleanup TY19. </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="QUALNONRECOURSEFINANCE" type="ofx:AmountType"> <xsd:annotation> <xsd:documentation> Partner's share of liability at year end: Qualified NonRecourse Financing </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="RECOURSEBOY" type="ofx:AmountType"> <xsd:annotation> <xsd:documentation> Partner's share of liability at beginning of year: Recourse. Cleanup TY19. </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="RECOURSE" type="ofx:AmountType"> <xsd:annotation> <xsd:documentation> Partner's share of liability at year end: Recourse </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="INCLUDESLOWERTIERLIABILITY" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box K, Check this box if item K includes liability amounts from lower tier partnerships. TY19.</xsd:documentation> </xsd:annotation> </xsd:element> </xsd:sequence> </xsd:complexType> </xsd:element> <xsd:element name="PARTNERSCAPITALACCT" minOccurs="0"> <xsd:annotation> <xsd:documentation> Partner's capital account analysis </xsd:documentation> </xsd:annotation> <xsd:complexType> <xsd:sequence> <xsd:element name="PRTNRBEGINNINGCAPITALACCT" type="ofx:AmountType"> <xsd:annotation> <xsd:documentation> Partner's capital account analysis: beginning capital account; Schedule K-1 Part II Line L </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PRTNRCAPCONTRIBUTEDDURINGYR" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation> Partner's capital account analysis: capital contributed during the year; Schedule K-1 Part II Line L </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PRTNRCURRENTYRINCRDECR" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation> Partner's capital account analysis: current year increase (decrease); Schedule K-1 Part II Line L </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PRTNROTHERINCRDECR" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box L, Partner's capital account analysis - Other increase (decrease). TY19.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PRTNRWITHDRAWANDDISTRIBUTION" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation> Partner's capital account analysis: Withdraws & Distributions; Schedule K-1 Part II Line L </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PRTNRENDINGCAPITALACCOUNT" type="ofx:AmountType"> <xsd:annotation> <xsd:documentation> Partner's capital account analysis: ending capital account; Schedule K-1 Part II Line L </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="TAXBASIS" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Tax basis; Schedule K-1 Part II Line L. IRS removed TY19.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="GAAP" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>GAAP; Schedule K-1 Part II Line L. IRS removed TY19.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="SECTION704BBOOK" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Section 704(b) book; Schedule K-1 Part II Line L. IRS removed TY19.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="OTHEREXPLAIN" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Other (explain); Schedule K-1 Part II Line L. IRS removed TY19.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="BOOKOTHEREXPLAIN" type="ofx:GenericDescriptionType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Explanation of the other method of accounting indicated by OTHEREXPLAIN. IRS removed TY19.</xsd:documentation> </xsd:annotation> </xsd:element> </xsd:sequence> </xsd:complexType> </xsd:element> <xsd:element name="PARTNERCONTRIBPROP" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation> Did the partner contribute property with a built-in gain or loss? </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="UNRECOGNIZEDSECTION704BEGIN" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box N, Partner's Share of Net Unrecognized Section 704(c) Gain or (Loss) - beginning. TY19.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="UNRECOGNIZEDSECTION704END" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box N, Partner's Share of Net Unrecognized Section 704(c) Gain or (Loss) - ending. TY19.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="ORDINARYINCOME" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="NETRENTALREINCOME" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="OTHERRENTALINCOME" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="GUARANTEEDPAYMENTSERVICES" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 4a, Guaranteed payments for services. TY19.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="GUARANTEEDPAYMENTCAPITAL" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 4b, Guaranteed payments for capital. TY19.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="GUARANTEDPAYMENT" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 4c, Total guaranteed payments.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="INTEREST" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="ORDINARYDIVIDEND" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="QUALIFIEDDIVIDEND" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="ROYALTIES" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="NETSTCAPITALGAIN" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="NETLTCAPITALGAIN" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="COLLECTIBLES" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="UNRECAPSEC1250GAIN" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="NETSEC1231GAIN" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="OTHERINCOMELOSS" type="ofx:CodeAmountType" minOccurs="0" maxOccurs="unbounded"/> <xsd:element name="SEC179DEDUCT" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="OTHERDEDUCTIONS" type="ofx:CodeAmountType" minOccurs="0" maxOccurs="unbounded"/> <xsd:element name="SELFEMPLOY" type="ofx:CodeAmountType" minOccurs="0" maxOccurs="unbounded"/> <xsd:element name="CREDITS" type="ofx:CodeAmountType" minOccurs="0" maxOccurs="unbounded"/> <xsd:element name="FOREIGNCOUNTRY" type="ofx:GenericNameType" minOccurs="0"/> <xsd:element name="FOREIGNTRANSACTIONS" type="ofx:CodeAmountType" minOccurs="0" maxOccurs="unbounded"/> <xsd:element name="AMTITEMS" type="ofx:CodeAmountType" minOccurs="0" maxOccurs="unbounded"/> <xsd:element name="TAXEXEMPT" type="ofx:CodeAmountType" minOccurs="0" maxOccurs="unbounded"/> <xsd:element name="DISTRIBUTIONS" type="ofx:CodeAmountType" minOccurs="0" maxOccurs="unbounded"/> <xsd:element name="OTHERINFO" type="ofx:CodeAmountType" minOccurs="0" maxOccurs="unbounded"/> <xsd:element name="DIVIDENDEQUIVALENTS" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Cleanup TY19.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="FISCALYEARBEGIN" type="ofx:DateTimeType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Cleanup TY19.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="FISCALYEAREND" type="ofx:DateTimeType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Cleanup TY19.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="MULTIPLEATRISKACTIVITIES" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 21, More than one activity for at-risk purposes. TY19.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="MULTIPLEPASSIVEACTIVITIES" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 22, More than one activity for passive activity purposes. TY19.</xsd:documentation> </xsd:annotation> </xsd:element> </xsd:sequence> </xsd:extension> </xsd:complexContent> </xsd:complexType>

OFX XML

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>39210131000000</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>fiName</ORG>

<FID>fiId</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAXK1MSGSRSV1>

<TAXK1TRNRS>

<TRNUID>_GUID_</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAXK1RS>

<TAX1065K1_V100>

<TAXYEAR>2020</TAXYEAR>

<FINALK1>Y</FINALK1>

<PARTNERSHIPNAME>American People Corp.</PARTNERSHIPNAME>

<PARTNERSHIPEIN>12-3456789</PARTNERSHIPEIN>

<PARTNERSHIPADDRESS>

<ADDR1>1718-1/2 Oak Blvd</ADDR1>

<ADDR2>Suite 230</ADDR2>

<CITY>Austin</CITY>

<STATE>TX</STATE>

<POSTALCODE>78735</POSTALCODE>

</PARTNERSHIPADDRESS>

<IRSCENTER>Ogden</IRSCENTER>

<PUBLICLYTRADEDPARTNERSHIP>Y</PUBLICLYTRADEDPARTNERSHIP>

<PARTNERID>xxx-xx-1234</PARTNERID>

<PARTNERINFO>

<NAME>Kris Q. Public</NAME>

<ADDR1>1 Main St</ADDR1>

<CITY>Melrose</CITY>

<STATE>NY</STATE>

<POSTALCODE>12121</POSTALCODE>

</PARTNERINFO>

<GENERALPARTNER>Y</GENERALPARTNER>

<LIMITEDPARTNER>N</LIMITEDPARTNER>

<DOMESTICPARTNER>Y</DOMESTICPARTNER>

<FOREIGNPARTNER>N</FOREIGNPARTNER>

<DISREGARDEDENTITY>N</DISREGARDEDENTITY>

<PARTNERENTITYTYPE>LLC</PARTNERENTITYTYPE>

<PARTNERISRETIREMENTPLAN>N</PARTNERISRETIREMENTPLAN>

<PARTNERSSHAREPROFITLOSSCAPITAL>

<PROFITBOY>20.00</PROFITBOY>

<PROFITEOY>21.00</PROFITEOY>

<LOSSBOY>22.00</LOSSBOY>

<LOSSEOY>23.00</LOSSEOY>

<CAPITALBOY>24.00</CAPITALBOY>

<CAPITALEOY>25.00</CAPITALEOY>

</PARTNERSSHAREPROFITLOSSCAPITAL>

<PARTNERSHARELIAB>

<NONRECOURSELIABILITIESBOY>27.00</NONRECOURSELIABILITIESBOY>

<NONRECOURSELIABILITIES>28.00</NONRECOURSELIABILITIES>

<QUALNONRECOURSEFINANCEBOY>29.00</QUALNONRECOURSEFINANCEBOY>

<QUALNONRECOURSEFINANCE>30.00</QUALNONRECOURSEFINANCE>

<RECOURSEBOY>31.00</RECOURSEBOY>

<RECOURSE>32.00</RECOURSE>

</PARTNERSHARELIAB>

<PARTNERSCAPITALACCT>

<PRTNRBEGINNINGCAPITALACCT>134.00</PRTNRBEGINNINGCAPITALACCT>

<PRTNRCAPCONTRIBUTEDDURINGYR>135.00</PRTNRCAPCONTRIBUTEDDURINGYR>

<PRTNRCURRENTYRINCRDECR>136.00</PRTNRCURRENTYRINCRDECR>

<PRTNROTHERINCRDECR>137.00</PRTNROTHERINCRDECR>

<PRTNRWITHDRAWANDDISTRIBUTION>138.00</PRTNRWITHDRAWANDDISTRIBUTION>

<PRTNRENDINGCAPITALACCOUNT>139.00</PRTNRENDINGCAPITALACCOUNT>

</PARTNERSCAPITALACCT>

<PARTNERCONTRIBPROP>N</PARTNERCONTRIBPROP>

<UNRECOGNIZEDSECTION704BEGIN>246.00</UNRECOGNIZEDSECTION704BEGIN>

<UNRECOGNIZEDSECTION704END>247.00</UNRECOGNIZEDSECTION704END>

<ORDINARYINCOME>1048.00</ORDINARYINCOME>

<NETRENTALREINCOME>2049.00</NETRENTALREINCOME>

<OTHERRENTALINCOME>3050.00</OTHERRENTALINCOME>

<GUARANTEEDPAYMENTSERVICES>4252.00</GUARANTEEDPAYMENTSERVICES>

<GUARANTEEDPAYMENTCAPITAL>4353.00</GUARANTEEDPAYMENTCAPITAL>

<GUARANTEDPAYMENT>4151.00</GUARANTEDPAYMENT>

<INTEREST>5054.00</INTEREST>

<ORDINARYDIVIDEND>6155.00</ORDINARYDIVIDEND>

<QUALIFIEDDIVIDEND>6256.00</QUALIFIEDDIVIDEND>

<ROYALTIES>7058.00</ROYALTIES>

<NETSTCAPITALGAIN>8059.00</NETSTCAPITALGAIN>

<NETLTCAPITALGAIN>9160.00</NETLTCAPITALGAIN>

<COLLECTIBLES>9261.00</COLLECTIBLES>

<UNRECAPSEC1250GAIN>9362.00</UNRECAPSEC1250GAIN>

<NETSEC1231GAIN>10063.00</NETSEC1231GAIN>

<OTHERINCOMELOSS>

<K1CODE>I</K1CODE>

<AMOUNT>11064.00</AMOUNT>

</OTHERINCOMELOSS>

<SEC179DEDUCT>12065.00</SEC179DEDUCT>

<OTHERDEDUCTIONS>

<K1CODE>O</K1CODE>

<AMOUNT>13066.00</AMOUNT>

</OTHERDEDUCTIONS>

<SELFEMPLOY>

<K1CODE>S</K1CODE>

<AMOUNT>14067.00</AMOUNT>

</SELFEMPLOY>

<CREDITS>

<K1CODE>C</K1CODE>

<AMOUNT>15068.00</AMOUNT>

</CREDITS>

<FOREIGNCOUNTRY>Norway</FOREIGNCOUNTRY>

<FOREIGNTRANSACTIONS>

<K1CODE>B</K1CODE>

<AMOUNT>16070.00</AMOUNT>

</FOREIGNTRANSACTIONS>

<AMTITEMS>

<K1CODE>W</K1CODE>

<AMOUNT>17071.00</AMOUNT>

</AMTITEMS>

<TAXEXEMPT>

<K1CODE>X</K1CODE>

<AMOUNT>18072.00</AMOUNT>

</TAXEXEMPT>

<DISTRIBUTIONS>

<K1CODE>Y</K1CODE>

<AMOUNT>19073.00</AMOUNT>

</DISTRIBUTIONS>

<OTHERINFO>

<K1CODE>Z</K1CODE>

<AMOUNT>20074.00</AMOUNT>

</OTHERINFO>

<DIVIDENDEQUIVALENTS>6357.00</DIVIDENDEQUIVALENTS>

<FISCALYEARBEGIN>20200101</FISCALYEARBEGIN>

<FISCALYEAREND>20201231</FISCALYEAREND>

<MULTIPLEATRISKACTIVITIES>Y</MULTIPLEATRISKACTIVITIES>

<MULTIPLEPASSIVEACTIVITIES>N</MULTIPLEPASSIVEACTIVITIES>

</TAX1065K1_V100>

</TAXK1RS>

</TAXK1TRNRS>

</TAXK1MSGSRSV1>

</OFX>

FDX JSON

{

"tax1065K1" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1065K1",

"fiscalYearBegin" : "2020-01-01",

"fiscalYearEnd" : "2020-12-31",

"finalK1" : true,

"partnershipTin" : "12-3456789",

"partnershipNameAddress" : {

"line1" : "1718-1/2 Oak Blvd",

"line2" : "Suite 230",

"city" : "Austin",

"state" : "TX",

"postalCode" : "78735",

"name1" : "American People Corp."

},

"irsCenter" : "Ogden",

"publiclyTraded" : true,

"partnerTin" : "xxx-xx-1234",

"partnerNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"name1" : "Kris Q. Public"

},

"generalPartner" : true,

"limitedPartner" : false,

"domestic" : true,

"foreign" : false,

"disregardedEntity" : false,

"entityType" : "LLC",

"retirementPlan" : false,

"profitShareBegin" : 20.0,

"profitShareEnd" : 21.0,

"lossShareBegin" : 22.0,

"lossShareEnd" : 23.0,

"capitalShareBegin" : 24.0,

"capitalShareEnd" : 25.0,

"nonrecourseLiabilityShareBegin" : 27.0,

"nonrecourseLiabilityShareEnd" : 28.0,

"qualifiedLiabilityShareBegin" : 29.0,

"qualifiedLiabilityShareEnd" : 30.0,

"recourseLiabilityShareBegin" : 31.0,

"recourseLiabilityShareEnd" : 32.0,

"capitalAccountBegin" : 134.0,

"capitalAccountContributions" : 135.0,

"capitalAccountIncrease" : 136.0,

"capitalAccountOther" : 137.0,

"capitalAccountWithdrawals" : 138.0,

"capitalAccountEnd" : 139.0,

"builtInGain" : false,

"unrecognizedSection704Begin" : 246.0,

"unrecognizedSection704End" : 247.0,

"ordinaryIncome" : 1048.0,

"netRentalRealEstateIncome" : 2049.0,

"otherRentalIncome" : 3050.0,

"guaranteedPaymentServices" : 4252.0,

"guaranteedPaymentCapital" : 4353.0,

"guaranteedPayment" : 4151.0,

"interestIncome" : 5054.0,

"ordinaryDividends" : 6155.0,

"qualifiedDividends" : 6256.0,

"dividendEquivalents" : 6357.0,

"royalties" : 7058.0,

"netShortTermGain" : 8059.0,

"netLongTermGain" : 9160.0,

"collectiblesGain" : 9261.0,

"unrecaptured1250Gain" : 9362.0,

"net1231Gain" : 10063.0,

"otherIncome" : [ {

"code" : "I",

"amount" : 11064.0

} ],

"section179Deduction" : 12065.0,

"otherDeductions" : [ {

"code" : "O",

"amount" : 13066.0

} ],

"selfEmployment" : [ {

"code" : "S",

"amount" : 14067.0

} ],

"credits" : [ {

"code" : "C",

"amount" : 15068.0

} ],

"foreignCountry" : "Norway",

"foreignTransactions" : [ {

"code" : "B",

"amount" : 16070.0

} ],

"amtItems" : [ {

"code" : "W",

"amount" : 17071.0

} ],

"taxExemptIncome" : [ {

"code" : "X",

"amount" : 18072.0

} ],

"distributions" : [ {

"code" : "Y",

"amount" : 19073.0

} ],

"otherInfo" : [ {

"code" : "Z",

"amount" : 20074.0

} ],

"multipleAtRiskActivities" : true,

"multiplePassiveActivities" : false

}

}